Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

All information about the Discover Cashback Debit Account, Ally Spending Account, Capital One 360 Checking Account and Betterment was collected independently by Slickdeals and has not been reviewed by the issuer.

Key Takeaways:

- The easiest bank accounts to open require low minimum deposits and can be opened online in just a few minutes with some personal information, like proof of identification and mailing address.

- We picked accounts with no monthly fees (or easy-to-waive fees) and perks like getting paid up to two days early, high APYs, waived ATM fees and strong overdraft protection.

- Accounts like SoFi Checking and Savings, Discover Cashback Debit Account, Ally Spending Account, and Betterment Checking are accounts that we consider to be some of the easiest bank accounts to open online.

Opening a bank account used to be a chore. You’d have to scrounge up a bunch of documents, schlep yourself down to a branch, fill out a paper application and wait. Online banks make this process a lot easier and quicker. Many charge fewer fees and offer higher rates, too.

That said, you’ll still need to jump through a few hoops. Federal law requires all banks to verify your identity to make sure you’re a legitimate customer. At a minimum, you’ll need to provide your name, date of birth, address and taxpayer ID number, but some banks require more information.

If you’re looking for a smoother start-up experience, here are the easiest bank accounts to open online.

Easiest Bank Accounts to Open Online

| Account | Time To Apply | Monthly Fee | Minimum Opening Deposit | Learn More |

|---|---|---|---|---|

|

Member FDIC |

A few minutes |

$0 |

None |

Open Account |

|

|

A few minutes |

$12 with options to waive

Chase Total Checking customers can have their monthly maintenance fee waived by receiving direct deposits totaling $500 or more in new money each monthly statement period, maintaining a daily balance of at least $1,500 at the beginning of each day, or maintaining an average beginning day balance of $5,000 or more in any combination of linked qualifying Chase checking, savings and other accounts |

None |

Open Account |

|

|

A few minutes |

$0 |

None |

Open Account |

|

|

5 minutes |

$0 |

None |

Open Account |

|

|

5 minutes |

$0 |

None |

Open Account |

|

|

A few minutes |

$0 |

None |

Open Account |

|

|

About 5 minutes |

$0 | $10 | Open Account |

|

|

5 minutes |

$0 |

None |

Open Account |

Methodology

To put together our list of the easiest bank accounts to open online, Slickdeals’ editors reviewed many online banks, brick-and-mortar banks and credit unions. We considered several criteria to determine the best options for our readers, including these factors:

- Quick and easy application process: The entire process of opening an account and identity verification can be completed online in less than five minutes.

- Lack of fees: The account has few or no recurring fees, or offers ways to waive them.

- Low or no opening deposit: The account either doesn’t require a minimum opening balance to get started, or the amount is relatively low.

- FDIC insurance: Since these are all deposit accounts, having standard FDIC insurance is a must.

- Perks and features: We also considered helpful features that can enhance your banking experience, such as mobile banking tools, the ability to earn interest, customer service and more.

SoFi® Checking and Savings

- Our Rating 5/5 How our ratings work

- APY0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

- Minimum

Deposit RequiredN/A -

Intro Bonus

$50-$300Expires January 31, 2026

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. SoFi members with Eligible Direct Deposit can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.80% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings boasts an impressive APY of up to 3.80% on savings balances for customers who set up direct deposit or who deposit at least $5,000 each month. Alternatively, customers can also unlock the top rate by paying the monthly SoFi Plus Subscription Fee. This account also offers 0.50% APY on checking balances. There are no monthly maintenance fees, and new customers can even earn a generous signup bonus worth up to $300. If you don’t care about physical bank locations, this is a great option.

Overview

SoFi Checking and Savings features remarkably strong interest rates for customers who meet one of several requirements, such as receiving recurring monthly direct deposit or depositing $5,000+ every 30 days. This account also doesn’t have any maintenance fees, overdraft fees or non-sufficient funds fees. To top it off, new customers can earn a signup bonus worth up to $300.

Pros

- Accounts with monthly direct deposit earn interest

- No minimum opening balance or minimum monthly balance

- No maintenance fees, non-sufficient fund fees or overdraft fees

- Access to Allpoint’s worldwide ATM network

- Get paid up to two days early

Cons

- No physical branch locations

SoFi® began in 2011 as a private student loan lender and has since expanded to offer many different types of products—including online checking and savings accounts. Customers can access its large, nationwide ATM network5, but SoFi does not have physical branches. In total, the company claims to work with over 5.2 million people through its various financial products.

Features

- Frequent sign-up bonus offers

- Savings rates notably higher than national average

- Access to the SoFi member benefits program

- Get paid up to two days earlier via early direct deposits6

- Deposits may be FDIC insured up to $3 million4

- No monthly fees, overdraft fees or minimum balance requirements3

How to Open an Account

You can open an account in two different ways:

- Online: Click “Open an account” on SoFi’s banking page.

- Mobile app: Download the mobile app and follow the prompts to open an account.

Information Needed

- Name

- Contact information

- Employment status & income

- Citizenship status

- Social Security number

- Other info if needed to verify your identification

Chase Total Checking® Account

- Our Rating 4/5 How our ratings work

- APYN/A

- Minimum

Deposit RequiredN/A -

Intro Bonus

$300Expires July 16, 2025

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities

Chase Total Checking® is among the best entry-level accounts. It typically offers new customers a sign-up bonus, and it’s fairly simple to waive the $12 monthly fee. However, it's worth noting that it doesn’t offer many valuable features or benefits and it’s not an interest-bearing checking account.

Overview

Chase Total Checking® is a basic checking account that doesn’t offer many premium features. However, if you can easily meet the qualifications required for the new account bonus (and to waive its monthly fee), it’s a good option for those who want an entry-level account.

Pros

- No minimum opening balance

- Multiple ways to waive monthly fee

- Access to nationwide Chase branches and ATM network

Cons

- Monthly maintenance fee

- Account does not earn interest

Chase is the largest bank in the U.S., and with thousands of branches and ATMs, there’s likely one near most customers. But Chase also has a robust online presence, including a highly rated mobile app that lets users send and receive money, use budgeting tools and more. The bank also offers a wide range of other products, from checking and savings accounts to credit cards and loans, so if you're looking to grow into other account types, Chase could be a good fit.

Plus, you can typically open an account online, such as Chase Total Checking®, in a few minutes as long as you have your ID and other contact information handy.

Features

- No minimum balance required

- Monthly fee can be waived

- Huge branch and ATM footprint across U.S.

- Online bill pay and other mobile banking tools

- Many account types, credit cards and loans also available

How to Open an Account

In most cases, you can open a Chase account online in a few minutes:

- Online: Find the account you want and click “Open Account.”

- Mobile app: First enroll at chase.com; then you can download the mobile app and sign in to get started.

Information Needed

- Name

- Contact information

- Social Security number or ITIN

- Driver's license state ID

- Proof of address, like a current utility bill

UFB Direct Portfolio Savings Account

- Our Rating 5/5 How our ratings work

- APY4.01%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate.

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

The UFB Direct Portfolio Savings Account has a solid interest rate of 4.01% APY. Plus, there are no monthly fees and no minimum balance to open.

Overview

With one of the strongest high-yield savings interest rates on the market, as well as no monthly fees or minimum opening deposit, UFB Direct’s Portfolio Savings Account is an extremely attractive package.

Pros

- Strong interest rate

- No maintenance fees or minimum monthly balances

- Free complimentary ATM card

- Mobile app and SMS banking

Cons

- No signup bonus

UFB Direct is a division of Axos Bank, which began life as Bank of Internet back in the year 2000. Headquartered in San Diego, California, UFB is an online-only bank that offers a few banking products, like its high-yield savings account, as well as mortgages. UFB deposit accounts are FDIC insured up to the legal limits through its partnership with Axos Bank.

Features

- Very competitive APY on savings account

- No monthly fees

- No minimum balance requirement

- Free debit card with account

- Online customer service tools

- Also offers mortgages

How to Open an Account

You can typically open a UFB Direct account in just a few minutes:

- Online: Navigate to the account you want and click “Open Account.”

- Mobile app: Download the mobile app and tap on “Open a New Account.”

Information Needed

- Social Security number

- Driver’s license or State ID

- U.S. cellphone number

- U.S. address (not a P.O. Box)

- Citizenship or resident alien status

- Email address

U.S. Bank Smartly® Checking Account (Member FDIC)

- Our Rating 4/5 How our ratings work

- Minimum

Deposit Required$25 -

Intro Bonus

Up to $400Expires July 31, 2025

Earn up to $400 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through July 31, 2025. Member FDIC. Offer may not be available if you are an existing U.S. Bank customer or live outside of the U.S. Bank footprint.

If you're interested in opening a checking account with U.S. Bank, the Bank Smartly Checking Account is likely the one you'll be most interested in. This account includes a wealth of standard banking features, such as mobile check deposits and automated bill pay. While the Bank Smartly Checking Account features a $12 monthly fee, it's relatively easy to waive, and you only need $25 to open an account.

Overview

The U.S. Bank Smartly® Checking Account is a pretty standard checking account; customers get access to handy features such as personalized financial insights, automated budgeting and access to U.S. Bank Smart Rewards®. While this account features a $12 monthly service fee, there are multiple ways to get it waived.

Pros

- Frequently offers valuable welcome offer

- No surcharge fees at MoneyPass® Network ATMs

- Monthly fee is waivable

Cons

- Monthly fee

- Account not available nationwide

U.S. Bank (Member FDIC) traces its roots back to the late 1800s and has a large presence across the country, providing around 2,000 branches in just under 30 states and thousands of ATMs to its customers. Along with its robust in-person footprint, the bank provides convenient digital banking tools that make opening an account online easy. U.S. Bank offers a wide range of consumer and business banking products, including checking and savings accounts, plus loans, investment accounts and more.

Features

- Mobile check deposits

- Automated bill pay

- Zelle® payments

- Account alerts

- Automated budgeting

- Personalized financial insights

- Financial goal setting

- Zero-liability fraud protection

How to Open an Account

- Online: Click or tap the apply button and follow the prompts to open an account, typically in five minutes or less.

- Mobile app: If you already have an account with U.S. Bank, log into the app, navigate to “explore accounts and offers” and find the account you want to open. Tap the “open an account” button and follow the instructions.

Information Needed

- Contact information

- Social Security number

- Valid, government-issued photo ID

Axos Essential Checking Account

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4/5 How our ratings work

- APYN/A

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

If you're in the market for an entry-level checking account, Axos Essential Checking is a solid option. With this account, you'll never be charged a monthly maintenance fee, overdraft fee, NSF fee or no bill pay fee. While it lacks many of the features seen in more premium accounts, Direct Deposit Express - which allows you to receive your paycheck up to two days early - is an excellent perk.

Overview

Axos Essential Checking ticks off the majority of the boxes we expect for a standard checking account, with a few extra benefits thrown in for good measure. This account doesn’t charge a monthly maintenance fee, overdraft fee, NSF fee or bill pay fee. Plus, its Direct Deposit Express feature can give you access to your paycheck up to two days early.

Pros

- Virtually no fees

- Free Visa Debit Card

- Receive your paycheck up to two days early with Direct Deposit Express

Cons

- No physical branch locations

Axos Bank is a California-based bank with a long history. Beginning as Bank of Internet, the bank rebranded to Axos Bank in 2018. The company technically has a few branches in California but is by-and-large an online bank that offers a range of checking and savings products for both personal and business uses, along with mortgages and personal loans.

Features

- No monthly maintenance fees

- Decent APY on savings account

- No overdraft fees on most accounts

- 24/7 customer service

- Offers other banking products, including personal loans and business accounts

How to Open an Account

- Online: Find the account you want to open and click on “Get Started”

- Mobile app: From a browser window, select the account you want and tap “Open an Account” or download the mobile app and follow the prompts.

Information Needed

- Social Security number

- Driver’s license or State ID

- U.S. cellphone number

- U.S. address (not a P.O. Box)

- Citizenship or resident alien status

- Email address

Discover Cashback Debit Account

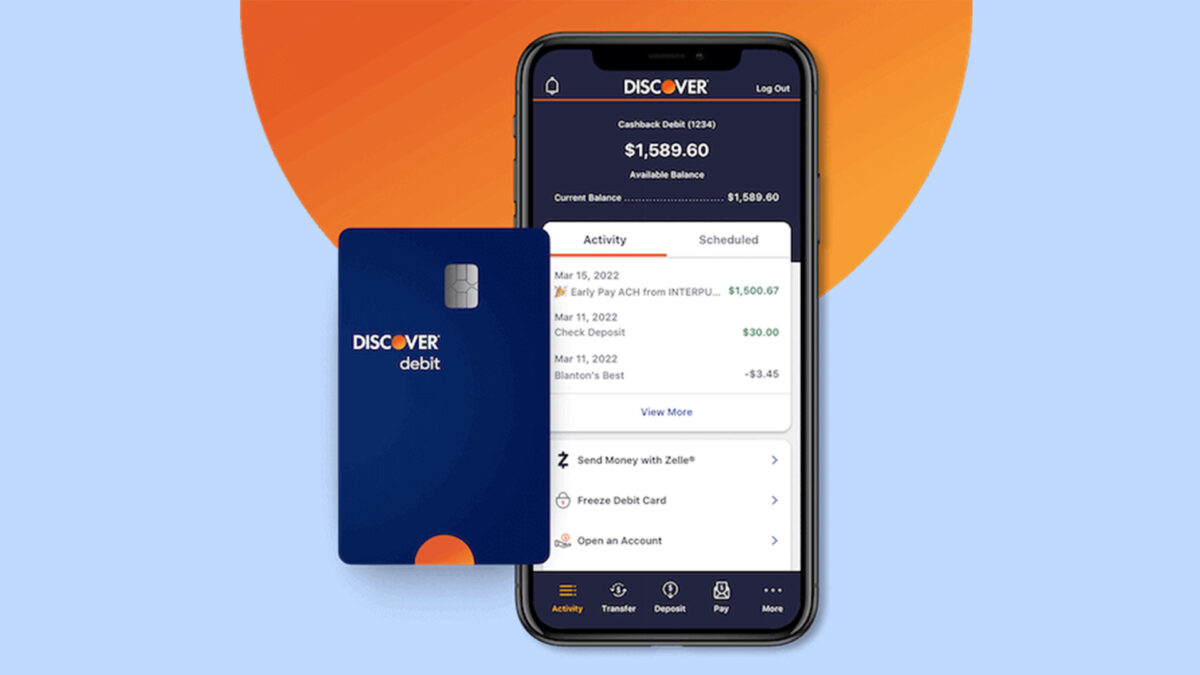

The bank better known for its credit cards also offers online banking—and it’s surprisingly good. The online bank is becoming more popular, and it’s a particularly good choice if you’re already using a Discover credit card (or if you want to) because you can streamline your finances by keeping everything with the same bank.

Features

- 24/7 customer service

- Frequent sign-up bonuses

- Get paid two days earlier via direct deposits

- No monthly fees or minimum balance requirements

- Savings account rates nearly 10X higher than average

- Full-service banking includes credit cards, personal loans and bank accounts

- High rankings for mobile app and overall customer satisfaction by J.D. Power

- 1% cash back on up to $3,000 in purchases per month from checking account

How to Open an Account

Discover offers a few ways to open an account:

- Online: Look for “Open an Account” buttons scattered around the site.

- Mobile app: If you already have an account, you can open a new account type by logging into the app.

- Over the phone: 1-800-347-7000, available anytime.

Information Needed

- Name

- Address

- Social Security number

- Proof of identity if Discover needs to verify anything in more detail

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.30%

*Annual Percentage Yield (APY) is variable and is accurate as of 6/10/2025. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.66%

Earn up to 4.66% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

4.00%

Earn 4.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of June 11, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

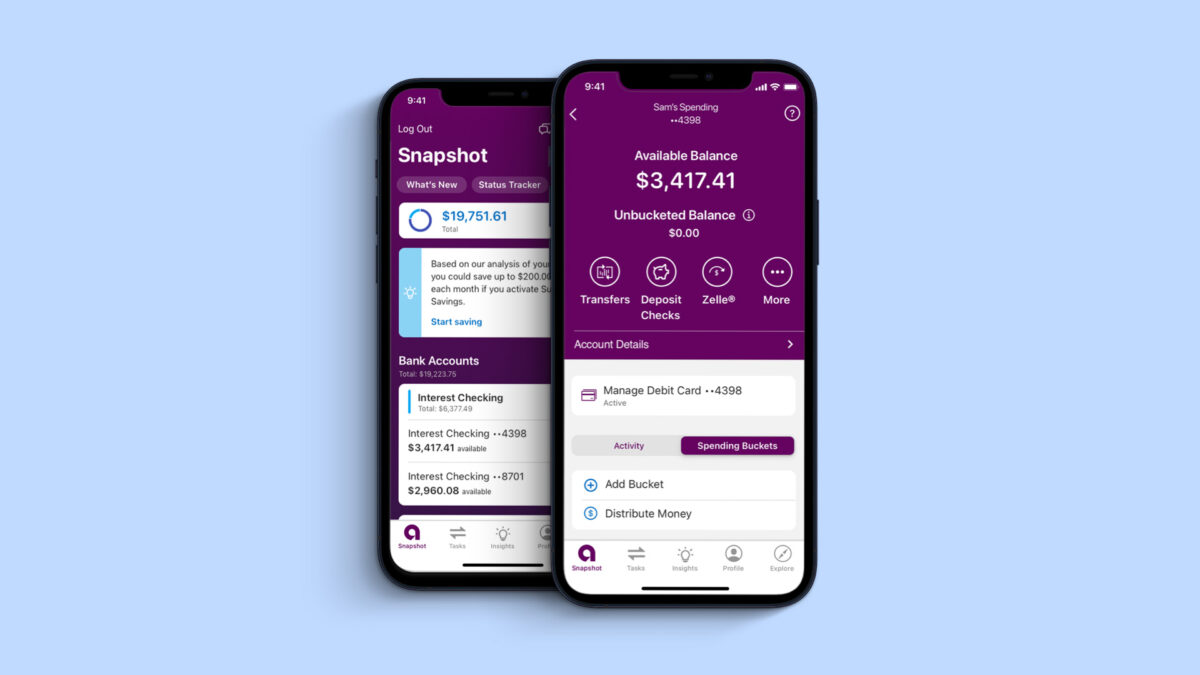

Ally Spending Account

Ally launched in the 1920s as a division of General Motors, offering financing for people to buy cars. It still offers auto loans, but Ally has since expanded and rebranded into Ally Bank, one of the most popular online banks available. According to the company, it has over 11 million customers. Ally offers interest checking, online savings and money market accounts.

Features

- Customer support via online chat and phone

- Savings rates almost 10X higher than average

- Get paid two days earlier via direct deposits

- $10 monthly refund for third-party ATM fees

- No monthly fees, overdraft fees or minimum balance requirements

- High rankings for overall customer satisfaction by J.D. Power

- Full-service banking includes checking, savings, auto loans, personal loans and investments

How to Open an Account

You can open an account at Ally in just a few minutes in a few different ways:

- Online: Look for the “Open New Account” links on the webpage of the account want to open.

- Mobile app: You can open a new account through the mobile app if you’re already an existing customer.

- Over the phone: Call 1-877-247-2559, available 24/7.

Information Needed

- Name

- Social Security or tax ID number

- Residential address

- Legal name

- Birth date

- Other info if Ally needs more to verify your identity

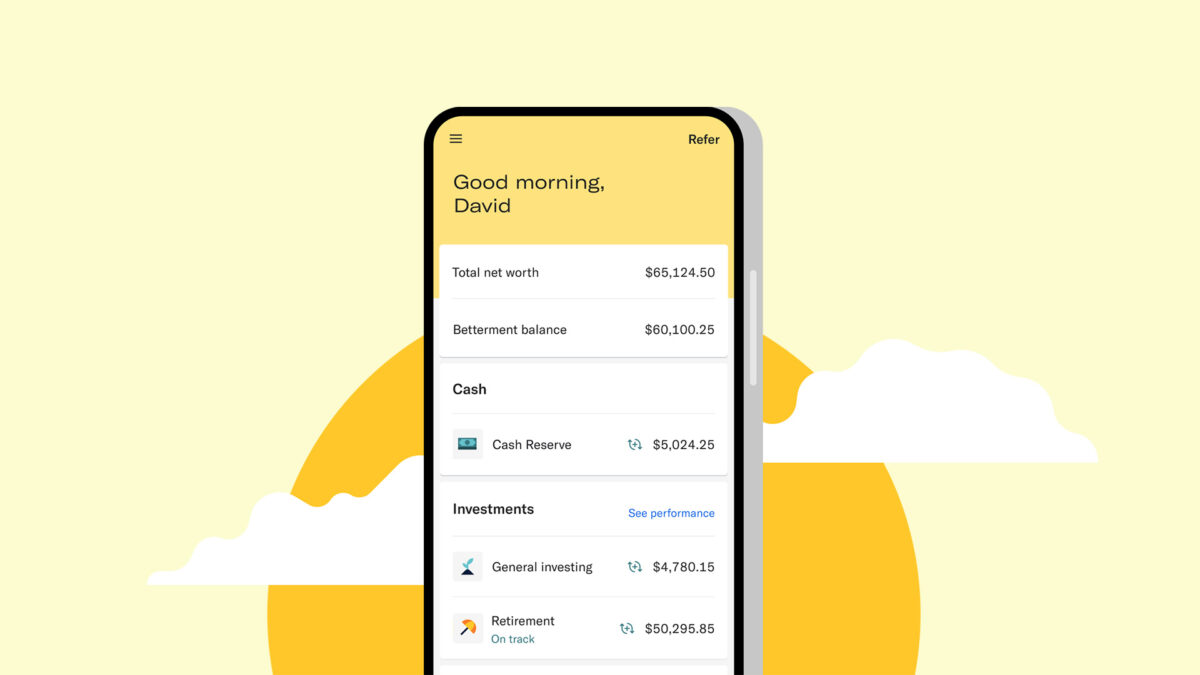

Betterment Checking

Betterment LLC is a financial services company that started back in 2008 as a robo-advisor. The company now offers a wider range of financial products, including its Checking account, which is FDIC insured up to $250,000 per depositor through nbkc bank. This account also offers cash back on transactions with select merchants and you won’t face monthly fees or minimum balance requirements.

Features

- Cash back with select merchants

- No monthly fee

- No minimum balance fee or requirement

- FDIC insurance on deposit accounts

- Contactless payments

How to Open an Account

- Online: Go to the account you want to open and click or tap “Get started.”

- Mobile app: If you already have a Betterment account, log in to the app and tap on "Add goal/account” to get started.

Information Needed

- Permanent U.S. address

- Social Security number or ITIN

- Checking account from a U.S. bank

Key Smart Checking®

- Our Rating 4/5 How our ratings work

- Minimum

Deposit Required$10 -

Intro Bonus

$300Expires October 17, 2025

Earn $300 after qualified activities until 10.17.25 with the no-monthly-maintenance-fee Key Smart Checking®. Geographic restrictions apply and account opening is subject to approval. Offer is available in these states: AK, CO, CT, ID, IN, ME, MA, MI, NY, OH, OR, PA, UT, VT, WA

Key Smart Checking® is ideal for those who want a simple, entry-level checking account with some nice-to-have features, including no monthly maintenance fees, overdraft protection, and access to a wide network of fee-free ATMs.

Overview

Key Smart Checking® is a no-frills checking account that offers convenience and simplicity. There are no monthly maintenance fees, no minimum balance requirements and no ATM fees when you use their network of 40,000+ ATMs nationwide. If you live near a branch and value in-person banking, this entry-level account can be a good choice.

Pros

- No monthly maintenance fees

- No minimum balance requirements

- Overdraft protection

- Free access to 40,000 KeyBank and Allpoint® ATMs nationwide

- Get eligible direct deposits up to two days early

- No transaction requirements

Cons

- Not available nationwide

- Branches located only in select states

- Out-of-network ATM fees apply

With branch footprints across 15 states and over 1,000 full-service branches, KeyBank is an award-winning bank that offers a wide range of consumer and commercial banking services. You can find checking, savings, CDs, investment and lending products conveniently under one roof at KeyBank.

KeyBank's Key Smart Checking® is a no-monthly-maintenance-fee account that can be opened in five minutes or less. Plus, you only need $10 to open an account.

Features

- No monthly maintenance fees

- Free access to 40,000+ KeyBank and Allpoint® ATMs nationwide

- Overdraft protection

- No minimum balance requirements

- Early Pay - You could get paid up to 2 days sooner

How to Open an Account

Opening a Key Smart Checking® account is easy and takes less than five minutes.

- Online: Eligible applicants* can apply directly on their website.

- In person: Visit your nearest location and meet with a bank representative to open an account.

You'll need to provide your Social Security Number or Taxpayer Identification Number and a valid form of identification, along with basic personal information such as your name and contact information when opening a new account.

* To open an account online, you must be 18 years of age or older, a U.S. citizen, opening an individual account and a resident of AK, CO, CT, ID, IN, ME, MA, MI, NY, OH, OR, PA, UT, VT or WA

Best Online Banks of 2025

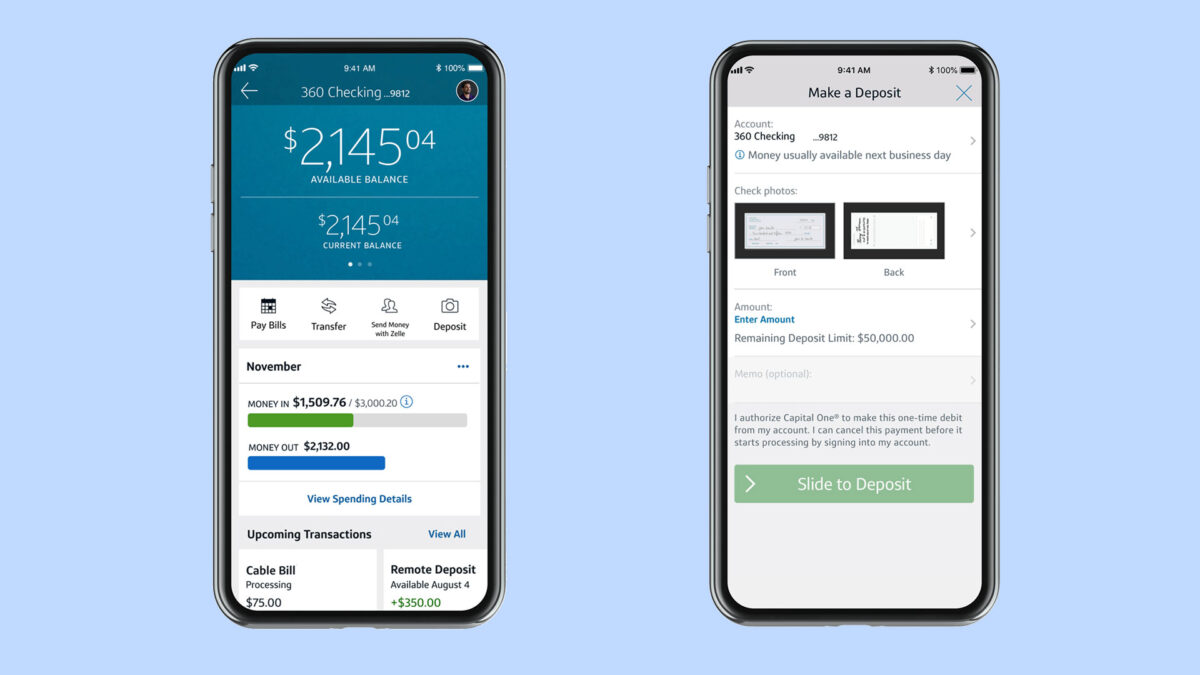

Capital One 360 Checking Account

Despite being the ninth-largest bank in the U.S., Capital One operates mostly as an online bank, with just a few scattered in-person locations. Capital One offers a wide range of products, including checking, savings and CDs you can access from just about anywhere. It’s another good choice if you’re looking to consolidate all of your accounts into one online bank with minimum hassle.

Features

- Get paid two days earlier via direct deposits

- Savings rates nearly 10X higher than average

- More than 50 hybrid cafe-bank branch locations around the county

- No monthly fees, overdraft fees or minimum balance requirements

- High rankings for mobile app and overall customer satisfaction by J.D. Power

How to Open an Account

Capital One claims that it only takes about five minutes to open an account, though the process is slightly more involved than with some of the other online banks on this list. You can open a Capital One bank account in a couple of ways:

- Online: Click the “Open Account” button on the page for the account type you’d like to open.

- In person: If you live near one of its branch locations, you can open an account right there.

Information Needed

- Social Security number

- Two forms of ID

- Proof of address

Related Article

Related Article

5 High-Yield Savings Accounts With Over 5.00% APY

Frequently Asked Questions

-

Opening an account online with banks such as Ally Bank, Discover Bank or Chime generally only takes a few minutes. However, the easiest bank accounts to open online typically follow the same process, so there isn’t any one bank that’s definitively better than the others. Some banks will take additional steps to verify your identity, such as asking for a photo ID, which could lengthen the process a bit.

-

No, most banks require some proof of identification before you can open an account. This can include a photo ID, Social Security number, or passport.

-

You can start using an online bank account as soon as your application is approved and the account is open. Most online banks do this automatically unless there’s a delay in verifying your identity. Keep in mind that it usually takes a couple of days for transfers to be made into your account.

-

You may not be able to open a bank account online if the bank can’t verify your identity. This might happen if you’re not a U.S. citizen with a taxpayer ID or you don’t have proof of your address. In some cases, you could also be denied a bank account if you’ve mismanaged accounts in the past, such as not paying back overdraft fees.

SoFi Disclosures

1. Up to $300 Bonus Tiered Disclosure

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. SoFi members with Eligible Direct Deposit can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.80% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

2. APY disclosures

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

3. Fee Policy

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee

for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Checking & Savings Fee Sheet for details at

sofi.com/legal/banking-fees/.

4. Additional FDIC Insurance

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per depositor per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $3M through participation in the program. See full terms at SoFi.com/banking/fdic/sidpterms. See list of participating banks at SoFi.com/banking/fdic/participatingbanks.

5. ATM Access

We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third-party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

6. Early Access to Direct Deposit Funds

Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

7. Overdraft Coverage

Overdraft Coverage is limited to $50 on debit card purchases only and is an account benefit available to customers with Eligible Direct Deposits of $1,000 or more during the current 30-day Evaluation Period as determined by SoFi Bank, N.A. The 30-Day Evaluation Period refers to the “Start Date” and “End Date” set forth on the APY Details page of your account, which comprises a period of 30 calendar days (the “30-Day Evaluation Period”). You can access the APY Details page at any time by logging into your SoFi account on the SoFi mobile app or SoFi website and selecting either (i) Banking > Savings > Current APY or (ii) Banking > Checking > Current APY. Members with a prior history of non-repayment of negative balances are ineligible for Overdraft Coverage.