Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

You will face many decisions when you join your life together with a marriage partner. One of the most important choices you’ll need to make, at least from a financial standpoint, is whether to combine bank accounts after you get married.

As with many financial decisions, there are pros and cons to sharing bank accounts with your spouse. It’s important to consider these details along with the unique aspects of your relationship before you decide if opening joint bank accounts with your partner is the right fit for your relationsh

How Do Joint Bank Accounts Work?

A joint bank account is a deposit account, like a checking or savings account, that you and another person open together at a bank or credit union. When you open a joint bank account with a spouse, both you and your partner share equal ownership of the account.

Both owners of a joint bank account have the ability to make deposits or withdraw funds without approval from the other account holder. Therefore, you should only consider opening a shared bank account if you have a committed, trusting relationship with the other pers

Pros and Cons of Joint Bank Accounts

There are potential benefits and drawbacks to combining bank accounts with your partner when you get married. Here are some pros and cons of having a joint bank account with a spouse that you should consider in advance.

Pros

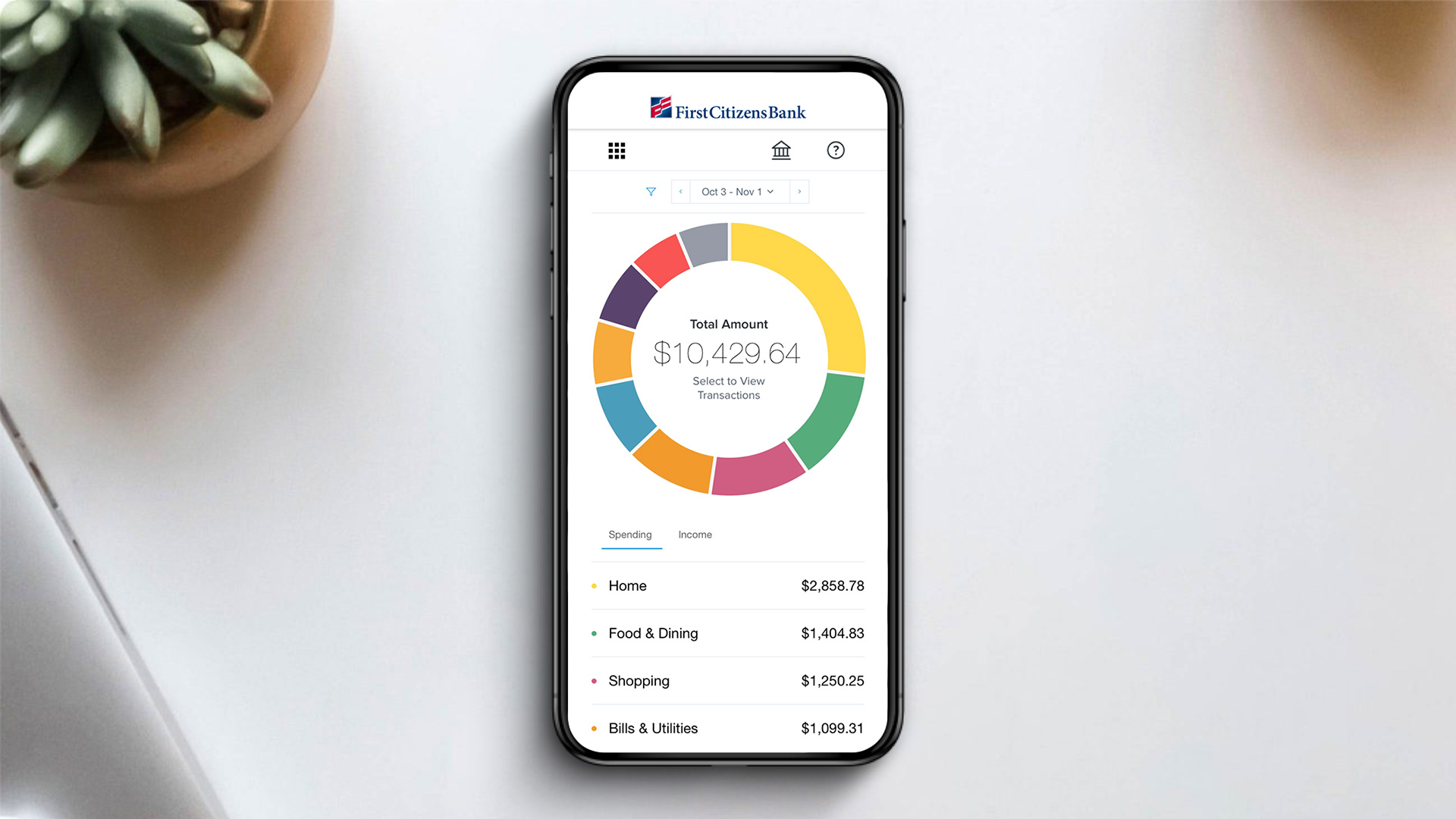

- Financial Transparency: Combined bank accounts can provide accountability and transparency for couples.

- Simplified Budgeting: When you combine finances in a single account, household budgeting may be easier to navigate.

- Combined Savings: Saving money toward joint goals can be easier when you and a spouse share a savings account.

- Maintain Access: If one spouse becomes sick, injured, or passes away, keeping your funds in a joint account should make sure that you (or your spouse) have full access to the other person’s money in times of crisis.

- Avoid Fees: You may be able to avoid monthly bank fees at certain financial institutions by maintaining a minimum balance in your checking or savings account—a task that might be easier when you’re combining your finances with another person.

Cons

- Potential for Abuse: An untrustworthy partner could take advantage of combined bank accounts to manipulate or abuse their spouse.

- Arguments Could Arise: One of the most common subjects that couples argue about is money, especially when partners have different spending styles. Maintaining some financial independence through separate accounts might be preferable if joint accounts lead to frequent arguments about how the other person spends their money.

- No Creditor Protection: Does your spouse have premarital debts? If paying those bills ever becomes a struggle, creditors might be able to target the funds in a joint bank account (including cash you deposited) for your spouse’s delinquent debts.

- Lack of Privacy: Although financial transparency is important in a marriage, there are times when you might want to make discrete purchases (such as a surprise gift). Shared bank accounts can make such situations challenging.

- Difficult to Separate: In the event of a divorce, separating finances can be trickier when you combine bank accounts. It’s too easy for one person to drain the funds out of a joint bank account and leave their former spouse broke and brokenhearted in the process.

How to Combine Finances

If you and your partner decide that merging your finances into joint bank accounts is the right move for your situation, here are some of the basic steps you may want to follow.

1. Shop Around for the Right Accounts

When you decide to share bank accounts with a spouse, it’s a good opportunity to compare the different types of deposit accounts that are available from a variety of banks, online banks, and credit unions. As you shop around, you can make a list of features and benefits that matter most to you and your spouse in a financial institution.

For example, the two of you might prioritize finding a bank that offers a cash or points-based bonus when you open a new account. On the other hand, you might focus on finding a bank that offers the best rates on high-yield savings accounts, money market accounts, or certificates of deposit to help you reach your savings objectives. (Note: There’s nothing wrong with opening accounts at multiple financial institutions to accomplish your go

2. Switch Direct Deposits and Recurring Bills to the Joint Account

After you open your joint checking account, you can schedule direct deposits and recurring bills to come out of the shared checking account. This should simplify the budgeting process moving forward and could make it easier to manage joint finances out of a single checking acc

3. Schedule Frequent Money Dates

Even after you combine your bank accounts, you and your spouse may maintain separate credit cards, investment accounts, cash spending money, and more. Therefore, it’s important to set up regular “money dates” to discuss your overall financial goals and the progress you’re making toward those objectives togeth

Related Article

Related Article

9 Money Moves to Set Your Finances on the Right Path: An End of Year Financial Checklist

When to Keep Separate Bank Accounts

The idea that every couple has to combine bank accounts when they get married is outdated. Some couples thrive with completely separate bank accounts. Others prefer a hybrid approach where both spouses keep their own checking and savings accounts while also opening additional shared deposit accounts to split certain bills and joint savings goals.

If either you or your spouse has premarital debt or savings, separate bank accounts after marriage could make sense. Furthermore, some couples prefer to maintain financial independence—especially those who might have experienced a difficult breakup in the past. Remember, even if you have individual bank accounts, you can still maintain financial transparency with a trustworthy partner and schedule frequent money discussions to accomplish joint financial goals together as a team.

In the end, you should choose a financial arrangement with which both you and your spouse feel comfortable. Whether you opt to combine bank accounts, keep your finances separate, or try an approach that’s somewhere in between, open and honest communication is key when it comes to sharing your financial life with another pe