Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

If you want to save money on fees or earn higher interest rates from your financial institution, you'll find that online banks often outshine traditional brick-and-mortar banking solutions. Yet, in light of recent bank failures and general economic uncertainty, it’s understandable if you have concerns about where you keep your money. In fact, you may wonder if online banks are safe.

The good news is that online banks are just as safe as traditional banks as long as they are insured by the FDIC and take strong security precautions. Here are some tips on how to choose a safe online bank.

Are Online Banks Safe?

Yes, the vast majority of online banks are safe because most have FDIC insurance and take stringent security measures to protect their systems and your funds. However, before depositing money in an online bank, check that it has FDIC insurance on the account type you’re interested in. You can also check the bank’s FAQs or talk to customer service to learn what online security measures and privacy protections the bank uses.

What Is an Online Bank?

An online bank is a financial institution that does not have any physical branches customers can visit. Instead, the bank provides all of its services over the internet, using websites and mobile apps. As an online bank customer, you typically manage your accounts, deposits and withdrawals through your phone, tablet or computer.

Many online banks let you access your cash through ATMs, either for free or for a small fee, depending on the terms of your account. And just like traditional bank accounts, you may be able to access the money in your bank account via a debit card or checks, based on the type of account you open.

Related Article

Related Article

Here Are the Top 10 Safest U.S. Banks in 2024

How Online Banks Keep Your Money and Information Safe

Banks can take different approaches to keeping your money and information safe. So, if you’re looking for a safe online bank, keep an eye out for those that have strong safety measures in place, such as the following.

FDIC Insurance

No matter what type of bank you’re considering, make sure it’s a member of the Federal Deposit Insurance Corporation (FDIC). FDIC insurance ensures that your deposits are protected for up to at least $250,000 (per ownership category) in case of bank failure.

Quick Tip

Note that FDIC insurance only covers deposit accounts (like checking and savings). It doesn’t protect investments and some other types of accounts.

Multifactor Authentication

Another sign of a safe online back is one that has a login process that requires at least two-factor authentication. A multistep login process may require you to enter a password and a security code or PIN to log in to your account, making it harder for hackers to access your bank account without your knowledge.

Encryption

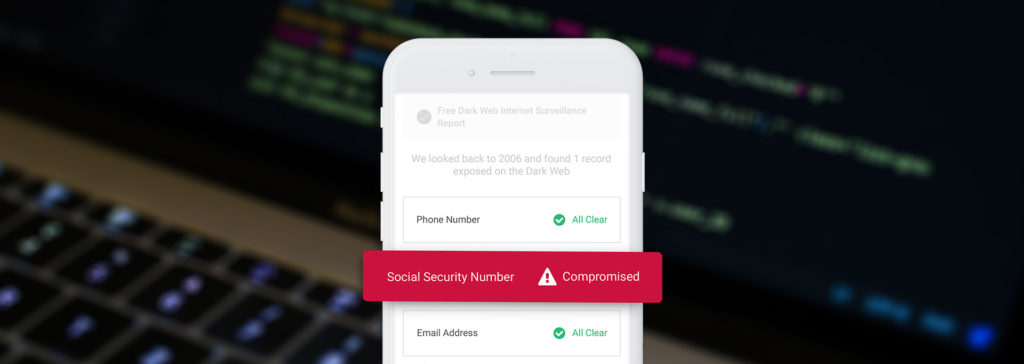

No matter what type of bank or credit union you use, data breaches and identity theft are more common threats than they were in years past. More than 422 million Americans were the victims of data compromises in 2022 alone, according to the Identity Theft Resource Center.

While you can’t keep your personal and financial information totally safe from people with bad intentions, it’s wise to choose an online bank that does everything in its power to protect you. One way to accomplish this goal is to choose a bank that uses at least 256-bit Advanced Encryption Standard (commonly called AES-256 encryption) to secure your information.

Related Article

Related Article

Free Experian Dark Web Scan Uncovers Identity Theft Before It Gets Serious

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.05%

*Annual Percentage Yield (APY) is variable and is accurate as of 10/18/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

4.57%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.30%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.30% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 10/8/2024. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

4.70%

Earn 4.70% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of September 25, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Benefits of Online Banks

Depending on your banking needs and preferences, online banks have numerous benefits. Here are some of the top perks that online banks may offer.

Lower Fees

Online banks don’t have the same overhead costs as traditional financial institutions. That means they’re able to pass along some of that savings to their customers, so online banks often charge low fees (or no fees) for deposit accounts. If landing a free checking account or another type of deposit account with no bank fees matters to you, online banks may be one of the first places you want to look.

Higher APYs

Online bank accounts frequently feature higher annual percentage yields (APYs) than what you’ll find with traditional brick-and-mortar banks. If you’re looking to earn more interest on your savings, you may be able to find some of the best high-yield savings account rates, best CD rates, best money market account rates, and more with online banks.

Convenience

Many online banks have highly rated mobile apps that make it easy to deposit checks, transfer funds, manage your cash and send money to others 24/7. The ability to handle all of your banking needs with a few swipes on your smartphone can be far less time-consuming than a visit to your local bank branch.

Related Article

Related Article

4 Warning Signs You Need to Get a New Bank Account

Downsides of Online Banks

Despite the convenience and other perks of online banks, they have their drawbacks as well. Here are some potential downsides to consider.

No In-Person Service

Every now and then you’ll find an online bank that has one or a handful of branches, but it’s very rare. That means all your services and communications are handled online. If you prefer to walk into a branch and ask a question, deposit or check or manage other bank business in person, you might be better off with a brick-and-mortar bank.

Harder to Deposit Cash

If you tend to have a lot of cash you need to deposit regularly, you could find it harder to work with an online bank. You might be able to mail it in, but that’s just not practical in most cases, especially when you could deposit it in person at a traditional bank. If all or most of your incoming funds are checks that can be handled with mobile deposit or direct deposit, an online bank could make sense, but those with lots of cash may find it easier to deal with in-person banking.

Fewer ATMs

Another downside of some online banks is that you might have access to fewer ATMs. Many online banks partner with large ATM networks to mitigate this problem, but in some cases you end up paying a fee just to withdraw cash or there might not be an ATM nearby. Many traditional banks have large ATM networks that often don’t charge fees—but it depends on the bank, so if you plan to use ATMs a lot, definitely check the fine print.

Fewer Banking Products

Online banks tend to do a few things really well. They often have high-yield savings accounts, top-notch digital services and mobile apps, and streamlined online customer service via email or chat. But they don’t always have the wide range of banking products you’ll find at big traditional banks. If you want a lot of banking products under one roof—say checking, savings and investment accounts, and potentially even a mortgage or loan—you might want to stick with a traditional bank.

Best Online Banks of 2024

How to Stay Safe With Online Banking

Online banking is very common these days, and it can be relatively safe when you take a few precautions and look for certain features. Here are some tips to help you stay safe when banking online.

Pick a Bank With Tight Security

When vetting banks, look for one that has modern security features in place, which could include encryption systems, security breach protocols, fraud monitoring, firewalls and more. These are fairly common at banks now, but it’s always good to look into what protections are in place before you stash your cash there.

Create Strong Passwords

Set up a unique password for your account, and use a mix of numbers, letters and characters that are hard to guess. Don’t share your passwords or write them down. And avoid using common words or public information, like your pet's or child’s name that could be easily predicted.

Use Multifactor Authentication

Also take advantage of other protections, like two-factor or multifactor authentication processes. This is another layer of protection you can set up for account access to verify your identity and stop hackers. It could be a code that gets texted to your phone when you log in, your fingerprint or even a verification requirement through a third-party app. Check what multifactor options the bank has to make your account extra secure.

Don’t Bank in Public

If possible, don’t do your banking on public computers where your sensitive information could be seen easily or systems might be more vulnerable. If you need to log in to your account on your phone or tablet on the go, try to find private places to do so and avoid using public Wi-Fi, which may be less secure.

SoFi Checking and Savings Account: Up to $300 Bonus Offer

Is Online Banking Right for You?

If you’re savvy with technology and value convenience, online banking may be right for you. Online banks are typically safe as long as they use industry-standard security measures and have FDIC insurance. And the ease of accessing your accounts anytime online is a real perk for many. But before you sign on the dotted line, do a little research to ensure the bank you pick has protections in place against fraud, hacking and identity theft.

On the other hand, if you prefer in-person service, walking into a neighborhood branch or exploring a wider range of banking products under one roof, you might want to stay at a traditional brick-and-mortar bank. If you want the best of both worlds—say a high-yield savings account at an online bank and a straightforward checking account at your neighborhood branch—there’s no reason not to explore both options.

FAQs

-

No, not all online banks are FDIC insured, but it is very rare to find a bank without FDIC insurance. Always check if any bank has FDIC insurance before you deposit your funds.

-

It’s generally just as safe to bank online or with an app on your phone or tablet. The key is to make sure you’re using a private device and private Wi-Fi, which are both less vulnerable to cyberattacks. Using your personal devices also makes it less likely you’ll accidentally share or save your login credentials on a public network or computer.

-

If your online bank account is hacked, the bank will typically return all or most of your funds to you, but it’s crucial you report the unauthorized withdrawal right away. If you wait too long, your liability might go up, which means you could get less of your money back. It can also be a long process, so you might not get your funds back immediately.

-

To know if your online bank is safe, check if it has FDIC insurance by using the FDIC bank search tool.

You can also read the bank’s FAQs or fine print, or contact customer service to ask about security measures like hacker prevention, fraud protections, firewalls and two-factor authentication.