Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Online banks have changed the game for the banking industry, making it easier and more convenient to manage your money while also providing a lot more value than traditional banks and even credit unions.

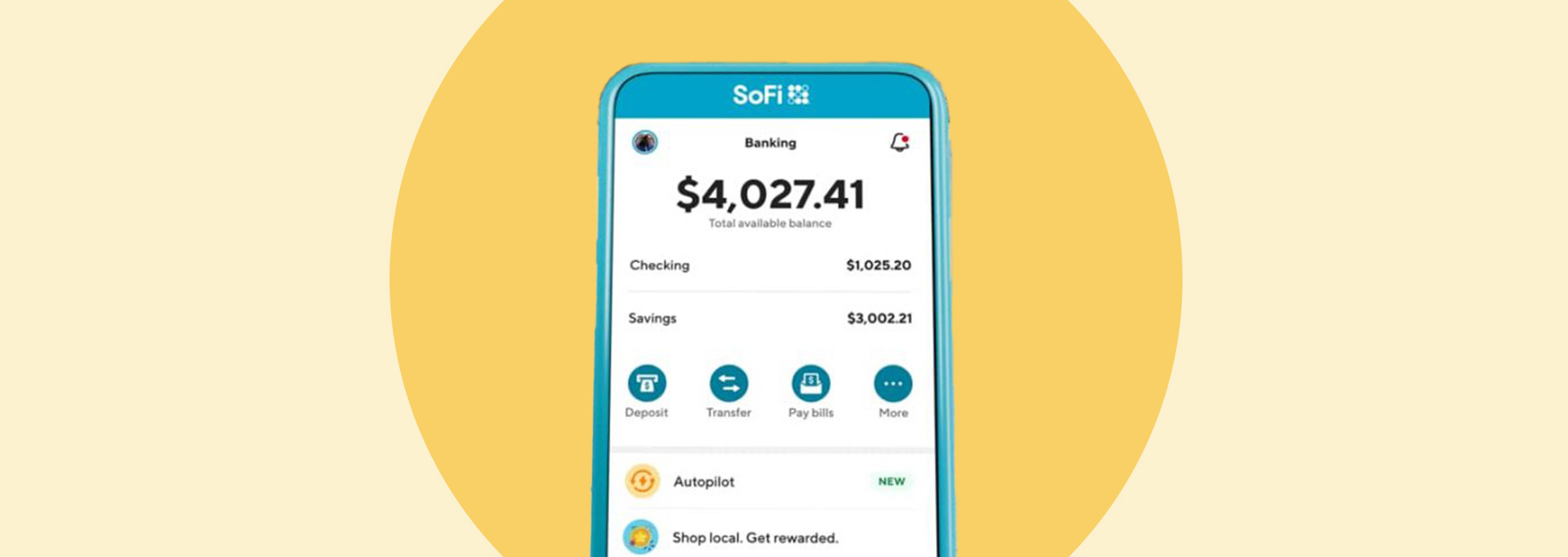

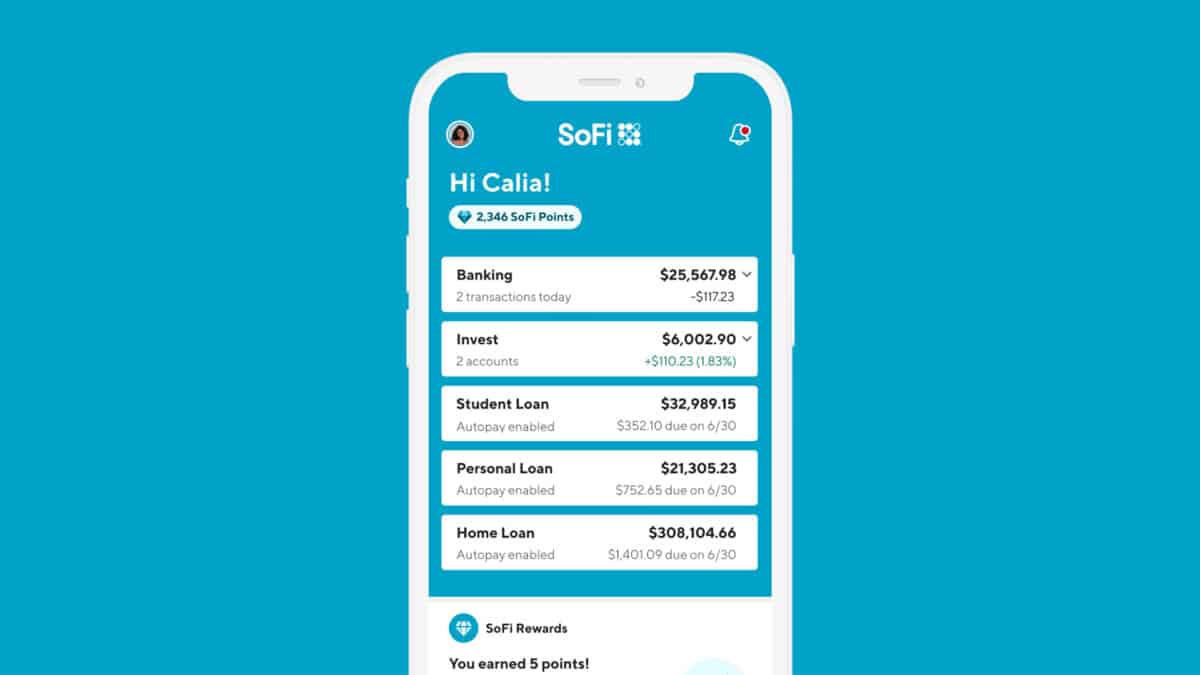

The SoFi Checking and Savings account is no exception. In addition to a signup bonus for new customers, the account offers a lot of valuable features, including early direct deposit6, savings vaults, additional FDIC insurance coverage4 and a high yield on your deposits.

However, there are some drawbacks to using a purely digital bank account, and depending on what features you're looking for, you may be able to find a better option elsewhere. Here's what you need to know about the SoFi Checking and Savings account to determine if it's right for you.

SoFi Checking and Savings

- Our Rating 5/5 How our ratings work

- APY0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

- Minimum

Deposit RequiredN/A -

Intro Bonus

$50-$300Expires December 31, 2024

See full terms and disclosures at sofi.com/banking. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/24. SoFi members with Direct Deposit can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the 4.60% APY for savings (including Vaults). Members without Direct Deposit will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings boasts an impressive APY of up to 4.60% on savings balances for customers who set up direct deposit, or who deposit at least $5,000 each month. This account also offers 0.50% APY on checking balances. There are no monthly maintenance fees, and new customers can even earn a generous signup bonus worth up to $300. If you don’t care about physical bank locations, this is a great option.

Overview

SoFi Checking and Savings features remarkably strong interest rates for customers who receive recurring monthly direct deposit, or who deposit $5,000+ every 30 days. This account also doesn’t have any maintenance fees, overdraft fees or non-sufficient funds fees. To top it off, new customers can earn a signup bonus worth up to $300.

Pros

- Accounts with monthly direct deposit earn interest

- No minimum opening balance or minimum monthly balance

- No maintenance fees, non-sufficient fund fees or overdraft fees

- Access to Allpoint’s worldwide ATM network

- Get paid up to two days early

Cons

- No physical branch locations

The SoFi Checking and Savings account offers several valuable features for people who prefer a digital banking experience. New customers can earn up to $3001 when opening an account, enjoy other cash-back offers, and get some extra help tracking and achieving various savings g

Pros

- Generous signup bonus

- No fees

- Rewards with select merchants

- High APY on deposits

Cons

- No free cash deposits

- No physical branches

- Can't open either account individually

SoFi Checking and Savings: Main Benefits and Features

If you're considering a SoFi Checking and Savings account, here are some of the headline perks you'll get.

Bonuses

New account holders can earn a signup bonus of up to $3001 when they open an account and receive one or more direct deposits totaling $1,000 or more within 25 calendar days.

If you receive between $1,000 and $4,999.99 in direct deposits during that period, you'll earn a $50 bonus. If your total is $5,000 or more, you'll receive the full $300. You'll receive the bonus within seven business days after the end of the promotional peri

High Yield

When you set up direct deposit or deposit a minimum of $5,000 into the account every 30 days, you'll also earn a solid 4.60% annual percentage yield (APY)2 on your savings balances and 0.50% APY on your checking balance.

If you don't meet either of those requirements, however, you'll earn just 1.20% APY on your savings balances and 0.50% APY on your checking ba

Savings Features

In addition to a high interest rate on your balances, SoFi® allows you to create up to 20 vaults for individual savings goals.

You can name each vault and define your target amount, then track your progress with a progress percentage display. You can also set up recurring transfers from your savings account to individual vaults, and automatically transfer a portion of your paychecks to individual vaults.

Additionally, you can set up a roundup feature, which rounds up every purchase you make with your debit card to the nearest dollar, transferring the difference to a vault of your choice. That said, you can't use roundups for more than one va

Overdraft Protection and Coverage

While those two sound like the same, they work a little differently, and SoFi offers both:

- Overdraft protection6: When you enable this feature, SoFi will pull money from your savings account anytime you overdraw your checking account using any type of transaction.

- Overdraft coverage7: If you don't have enough cash in your savings account to cover a debit card purchase, SoFi will spot you up to $50.

In both cases, SoFi doesn't charge a fee in the event that you overdraw your account. However, you must receive a minimum of $1,000 in monthly direct deposits to qualify for overdraft covera

FDIC Insurance Coverage

The maximum FDIC insurance coverage you can get with most banks is $250,000 per depositor, per ownership category. But if you have more than that, SoFi can spread your money across a network of banks, increasing your maximum coverage up to $2 mill

Other Benefits

- Early direct deposit: Like many online banks, SoFi can make your paychecks available up to two days early6 once you set up direct depos

it. - ATM access: You'll have access to more than 55,000 fee-free ATMs in the Allpoint® Networ

k. 5 - Cash deposits: Unlike many online banks, SoFi allows customers to make cash deposits at local retailers through the Green Dot® Network. That said, there is a fee of up to $4.95 per deposit, and there are limits of $500 per transaction, $1,000 per day, $3,000 per week and $5,000 per mo

nth.

Fees

The SoFi Checking and Savings account doesn't charge any account fees3 or service charges. It doesn't even charge a fee when you use an out-of-network ATM, but you will be subject to a third-party fee from the ATM ow

Who Should Open a SoFi Checking and Savings Account?

SoFi packs a lot of value into its free bank account. In particular, you may consider opening an account if any of the following describe your situation:

- You want a signup bonus: If you receive enough direct deposits to qualify for the account's maximum signup bonus, it's an easy one to earn. Even if you can't meet the $5,000 requirement, a lower bonus is better than what most bank accounts offer (which is nothing).

- You have multiple savings goals: SoFi's vault feature makes it easy to work toward several savings goals at once without needing to open multiple savings accounts.

- You primarily use a debit card: There are other debit cards that offer rewards on all of your purchases, but if you like the idea of earning up to 15% back with local merchants, the SoFi Checking and Savings account is worth considering.

- You're fee-averse: Most online bank accounts don't charge a monthly fee, but the SoFi Checking and Savings account is unique in that it doesn't charge any fees at all.

- You want more flexibility with deposits: If you generally prefer a digital banking experience but want the option to deposit cash now and then, other banks may not offer that featur

e.

SoFi Checking and Savings Account: Up to $300 Bonus Offer

Who Shouldn't Open a SoFi Checking and Savings Account?

While the account offers some clear and valuable features, there are some situations where it might not make sense:

- You want a bank with physical branches: If you regularly deposit cash into your bank account or you generally prefer in-person service, you'll want to open an account with a traditional bank or credit union.

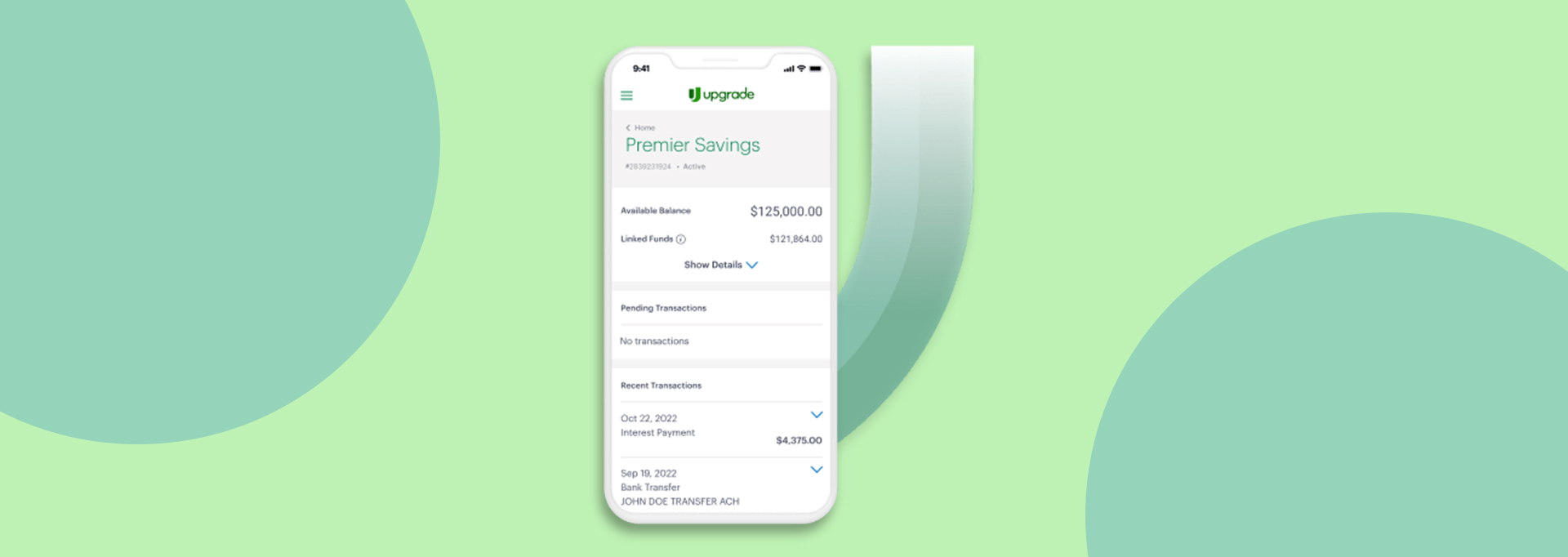

- You want a higher return on your savings: While the yield on the SoFi Checking and Savings account is high, it can't quite compete with the very best high-yield savings accounts that over over 5% APY. Just keep in mind that some banks that offer high-yield savings accounts don't offer a companion checking account.

- You don't want to use SoFi as your primary bank: In some cases, it can make sense to bank with multiple financial institutions, primarily if the bank you have a checking account with doesn't offer a high-yield savings account. With SoFi, however, you can't maximize the savings benefits without using the checking account as your primary money management account.

The Bottom Line

The SoFi Checking and Savings account can be a great option for someone who wants an online bank account with various opportunities to earn cash back along with a solid interest rate. It's also worth considering if you want to track individual savings goals without needing to open multiple savings accounts.

Ready to on an account? Start here.

But as with any online-only bank, SoFi may not be a good option if you want access to physical branches. If you're focused on an individual feature, such as savings account yield, everyday debit card rewards or ATM fee rebates, be sure to shop around and compare the account with several other online bank accounts to find the best fit.

Related Article

Related Article

Best High-Yield Savings Accounts (July 2024)

Disclosures

1. Up to $300 Bonus Tiered Disclosure

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus when they set up Direct Deposit of at least $1,000 during the Direct Deposit Bonus Period. Cash bonus will be based on the total amount of Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/24. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC.

SoFi members with Direct Deposit can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the 4.60% APY for savings (including Vaults). Members without Direct Deposit will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

2. APY disclosures

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

3. Fee Policy

Our account fee policy is subject to change at any time.

4. Additional FDIC Insurance (must be bolded)

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $2M through participation in the program. See full terms at SoFi.com/banking/fdic/terms See list of participating banks at SoFi.com/banking/fdic/receivingbanks

5. ATM Access

We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third-party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

6. Early Access to Direct Deposit Funds

Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

7. Overdraft Coverage

Overdraft Coverage is limited to $50 on debit card purchases only and is an account benefit available to customers with direct deposits of $1,000 or more during the current 30-day Evaluation Period as determined by SoFi Bank, N.A. The 30-Day Evaluation Period refers to the “Start Date” and “End Date” set forth on the APY Details page of your account, which comprises a period of 30 calendar days (the “30-Day Evaluation Period”). You can access the APY Details page at any time by logging into your SoFi account on the SoFi mobile app or SoFi website and selecting either (i) Banking > Savings > Current APY or (ii) Banking > Checking > Current APY. Members with a prior history of non-repayment of negative balances are ineligible for Overdraft Coverage.