Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

SoFi Checking and Savings

- Our Rating 5/5 How our ratings work Read the review

- APY0.50% - 4.60%

Customers earn 4.60% APY on savings balances when they set up recurring monthly direct deposit of their paycheck or benefits provider via ACH deposit. Alternatively, deposit at least $5,000 each month to earn 4.60% APY on your savings balance. Checking balances earn 0.50% APY

- Minimum

Deposit RequiredN/A -

Intro Bonus

$50-$300Expires June 30, 2024

New customers can earn a $300 bonus for opening a new SoFi Checking and Savings account and receiving a total of $5,000+ in qualifying direct deposits within the specified evaluation period; receive $1,000 - $4,999 in qualifying direct deposits to earn a $50 bonus.

SoFi Checking and Savings boasts an impressive 4.60% APY on savings balances for customers who set up direct deposit, or who deposit at least $5,000 each month. This account also offers 0.50% APY on checking balances. There are no monthly maintenance fees, and new customers can even earn a generous signup bonus worth up to $300. If you don’t care about physical bank locations, this is a great option.

SoFi Checking and Savings has a lot to offer, including no monthly maintenance or overdraft fees, fee-free ATM access to a wide network nationwide and early direct deposit up to two days early. But it also comes with one big benefit—you can earn up to 4.60% APY on your savings balance, as well as 0.50% APY on your checking balance. New customers can also currently earn a generous sign-up bonus worth up to $300 just for opening a new SoFi Checking and Savings account and receiving qualifying direct deposits.

Bonus Offer: Up to $300

It's pretty common for banks to offer a welcome bonus when you sign up and meet certain requirements, and the SoFi Checking and Savings account is no different.

New customers can currently earn a one-time bonus of up to $300 when they open a new SoFi Checking and Savings account before June 30, 2024.

SoFi Checking and Savings Bonus Tiers

| Total Qualifying Direct Deposits | Cash Bonus |

|---|---|

|

$1,000 – $4,999.99 |

$50 |

|

$5,000+ |

$300 |

To qualify for the $300 SoFi Checking and Savings bonus:

- Open a new SoFi Checking and Savings Account.

- Receive at least $1,000 in qualifying direct deposits within a 25-day "Evaluation Period," which begins the day your first qualifying direct deposit is received.

- Hit the minimum requirement to earn a $50 cash bonus.

- Reach the next tier to earn you a $300 bonus.

Once you meet the direct deposit requirement, you'll receive your bonus within seven business days after the Evaluation Period.

While we've seen larger bonuses tied to this account in the past—a SoFi $300 bonus was available for much of 2022, for example—the interest rate on savings balances is higher than it was during previous promotions, which helps make up for the slightly lower cash payout.

If you're looking a new account with a higher sign-up bonus, there are several banks that have more enticing bank account bonus offers.

Recommended Bank Bonuses

| Bank Account | Intro Bonus | Minimum Deposit | Learn More |

|---|---|---|---|

|

|

Up to $700Expires June 27, 2024

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC. Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm. |

$25 | Open Account |

|

|

$50-$300Expires June 30, 2024

New customers can earn a $300 bonus for opening a new SoFi Checking and Savings account and receiving a total of $5,000+ in qualifying direct deposits within the specified evaluation period; receive $1,000 - $4,999 in qualifying direct deposits to earn a $50 bonus. |

N/A | Open Account |

|

|

$300Expires July 24, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

N/A | Open Account |

|

|

$300Expires July 22, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

N/A | Open Account |

SoFi Direct Deposit Bonus Fine Print

- Deadline to open an account: To be eligible for the bonus, you'll need to open an account by June 30, 2024.

- Qualifying direct deposit: The deposit must come from your employer, payroll or benefits provider—such as a paycheck or government-issued benefits check.

- Bonuses are reported as taxable income: This bonus, like many bank bonuses, is considered miscellaneous income for tax purposes. You may receive a Form 1099-MISC (or Form 1042-S, if applicable) at the start of tax season, and you'll need to claim that income on your tax return, but the value of the bonus tends to outweigh the tax bill.

Related Article

Related Article

U.S. Bank Bonus Offers: Up to $800 for Opening New Accounts

APY: Earn Up to 4.60%

SoFi Checking and Savings isn't a high-yield savings account, but it offers a much higher APY than the majority of checking accounts—and also many savings accounts on the market.

You won't have to jump through a lot of hoops to earn the highest APY. All you have to do is set up monthly direct deposits of your paycheck or government-issued benefits. You won't even have to receive a minimum direct deposit amount to earn the increased APY. If you don't receive monthly direct deposits, you can still earn the top savings rate by depositing $5,000 or more each month.

You can earn a 4.60% APY interest rate on your SoFi savings account in one of two ways:

- Monthly direct deposit: Set up a recurring monthly direct deposit of your paycheck or benefits provider via ACH deposit.

- Qualifying deposits: SoFi defines qualifying direct deposits as transactions made from an enrolled member’s employer, payroll or benefits provider via ACH deposit. There's no minimum deposit required for this method.

- Deposit $5,000 each month: If you don't receive direct deposit, you can still earn the top interest rate by adding $5,000 or more in qualifying deposits every 30 days. This includes funds you add to both your checking and savings accounts.

- Qualifying deposits: In this case, qualifying deposits include ACH deposits, inbound wire transfers, cash or check deposits, peer-to-peer transfers such as PayPal or Venmo, instant funding to your SoFi Bank debit card and push payments to your SoFi Bank debit card.

While it's nice to have multiple ways to earn the top interest rate, the direct deposit method is a little more straightforward, only because there's no minimum deposit requirement. Regardless if you get a $100 or $4,000 direct deposit from your employer each month, you'll earn 4.60% APY on your savings.

What APY Do You Earn if You Don't Qualify for 4.60%?

If you don't meet any of the requirements to earn 4.60% APY, your APY will be a healthy 1.20% APY on your savings balance, which is still higher than rates offered by many traditional banks. Plus, you earn 0.50% APY on checking balances, regardless of whether you set up direct deposit.

Benefits of SoFi Checking and Savings

Until recently, SoFi was not officially a bank—although customer deposits were FDIC insured. SoFi became an online bank in 2022 and can now offer traditional banking products. If you opened a SoFi Money account prior to the firm's incorporation as a bank, don't worry—you'll keep your benefits until your spending account is converted to the new Checking and Savings product.

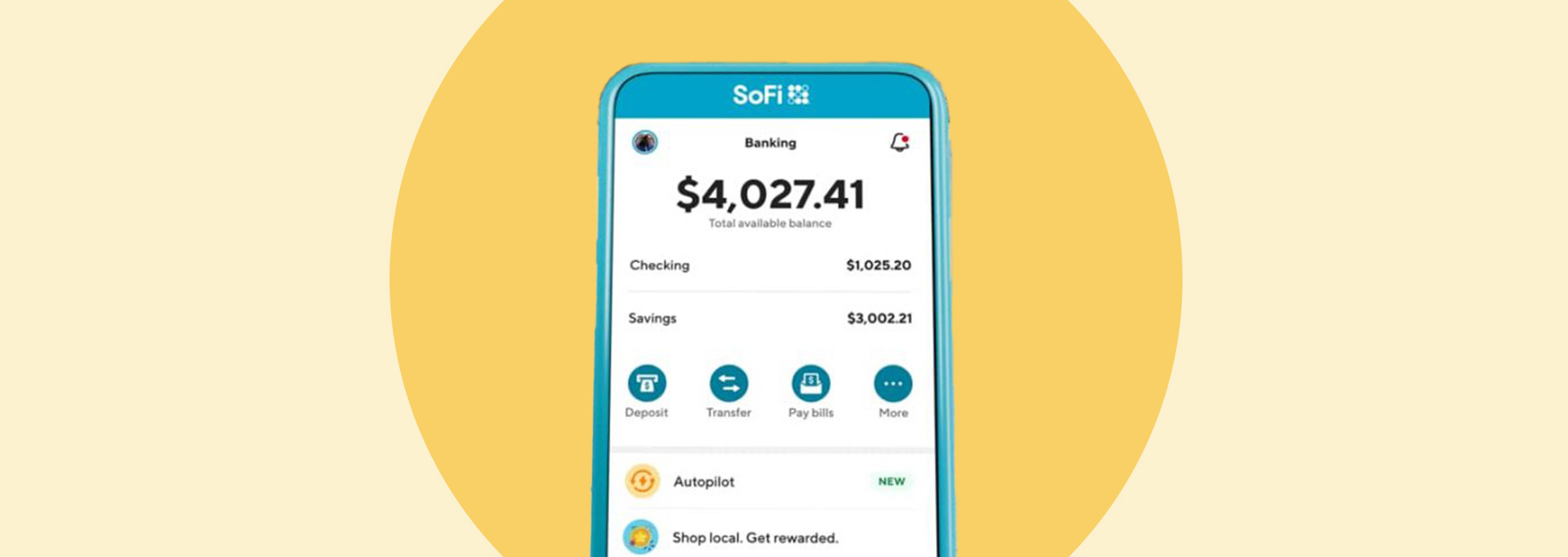

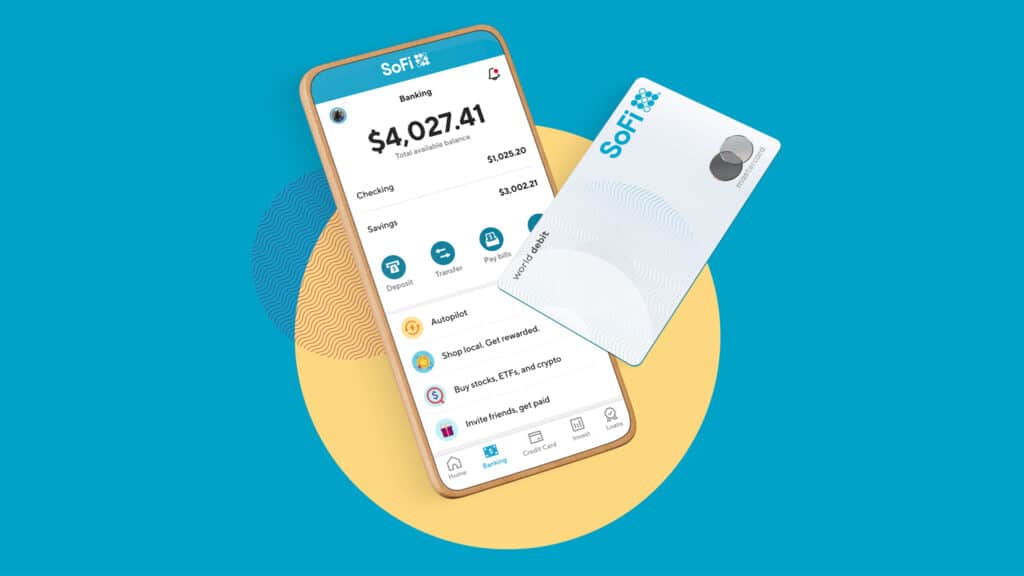

- SoFi Checking and Savings Work Together: One thing to know is that you have to open both a checking account and savings account; you can't do solely one or the other. But remember, everyone who opens this account can get 0.50% APY on checking balances and 4.60% APY on savings with direct deposit or monthly deposits of at least $5,000.

- No Account Fees: You won't need to worry about overdraft fees, monthly fees or punitive fees for not meeting a minimum balance requirement. Plus, you'll have fee-free access to the Allpoint ATM network, which operates 55,000 cash points nationwide. Still, if you use a non-network ATM, you will incur third-party fees.

- Get Paid Up to Two Days Early: When you set up direct deposit, you'll receive your paycheck up to two days earlier. This is based on the timing of when SoFi receives notice of impending payment from your employer or depositor. It's typically up to two days before the scheduled payment date, but your mileage may vary.

Useful Banking Tools

The SoFi Checking and Savings also comes with several useful tools to help you manage your finances.

- Vaults: SoFi Savings Vaults are extensions of your account, where you can earmark funds for certain goals. You can create up to 20 Vaults, and there are no fees or minimum balance requirements.

- Roundups: Every purchase you make with your debit card is rounded up to the nearest dollar. The difference is automatically transferred to one of your Vaults, which you can dedicate for that savings. Saving a few cents every time you swipe your card may not sound like a lot, but it can add up over time.

- Money transfers: The app lets you transfer money to anyone, similar to Venmo or Cash App. If they're a SoFi member, they'll receive the funds instantly. If not, they'll receive the cash within two to three business days after they submit their bank account information to get the funds.

- Mobile deposit: While you can't deposit cash into a SoFi account super easily, you can deposit checks via the mobile app.

Account Fees

While a big benefit of SoFi Checking and Savings is that you don't have to worry about account fees, such as a monthly servicing fee, that doesn't mean SoFi Checking and Savings is completely fee free.

Here are some fees to watch out for with this account:

- Out-of-network ATM fees: You'll be charged a fee by the ATM owner, and SoFi won't reimburse that fee like some online banks do.

- Foreign currency conversion fee: You pay 0.2% if you use your debit card to make a purchase or ATM withdrawal in a foreign currency.

Alternatives to SoFi Checking and Savings

If you're not quite sure that a SoFi Checking and Savings is the right choice for you, here are a few alternatives to consider:

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.25%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

|

0.50% - 4.60%

Customers earn 4.60% APY on savings balances when they set up recurring monthly direct deposit of their paycheck or benefits provider via ACH deposit. Alternatively, deposit at least $5,000 each month to earn 4.60% APY on your savings balance. Checking balances earn 0.50% APY |

No minimum deposit |

Open Account |

|

|

5.05%

Earn 5.05% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

|

|

4.65%

Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Savings Connect account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

How to Maximize SoFi Checking and Savings

SoFi Checking and Savings offers a lot of features you can't get with a traditional checking or savings account. And because it's partnered with SoFi Invest, it makes it easier to transfer funds between its banking and investment accounts, if that's something you want to do.

Here's how to maximize the value you can get from SoFi Checking and Savings:

- Read the fine print on the sign-up bonus to make sure you receive the full amount.

- Meet the monthly requirements to qualify for the higher APY.

- Check your mobile app regularly for the latest limited-time cash-back offers.

- Take advantage of your Vaults to establish and track savings goals.

- Turn on the Roundup feature so you can save every time you use your debit card.

SoFi Checking and Savings Referral Bonus: $75

Once you become a SoFi member, you can use the app to send referral links to friends or family to also open an account. If they use your unique referral link to open an account, then fund it with $10 or more via qualifying transfers within 14 days, you will receive a $75 referral bonus and the referee will get $25. Referral requirements change from time to time, so it's best to check the most current details in the SoFi app.

How to get the referral bonus link:

- Log into your account using the app to access your unique referral link.

- Look for the "Invite friends" button (or tile) on your SoFi Checking and Savings home screen.

- Click on the button to generate referral links for friends via a prepopulated SMS, email or social media post.

Terms and conditions apply.

Is a SoFi Checking and Savings Account Right for You?

SoFi isn't right for everyone. If you like in-person service or deal with a lot of cash, using SoFi may be more trouble than it's worth. But if you don't use cash regularly and prefer an online banking setup, it's one of the better banking options out there. Plus, the bonus for new account holders gives you a great excuse to test drive membership.

That said, take some time to compare SoFi Checking and Savings with checking accounts and high-yield savings accounts, and compare rates and other features to find the right fit for you.

Ready to Open a SoFi Checking and Savings Account? Start Here

FAQs

-

You can earn the SoFi Checking and Savings referral bonus when you share a unique referral code with friends and family and they open a new account and make a deposit of $10 or more within 14 days of account opening. Referral requirements may change from time to time, so it's best to check the most current details in the SoFi app.

The deposit must be made via an ACH transfer or via "Instant Transfer" from a debit card—Venmo, PayPal, Apple Cash and other P2P transfer platforms are ineligible to earn the referral bonus. Referral bonuses are not available to residents of a few states or to SoFi employees.

-

When you set up a Vault, purchases made with a SoFi debit card are automatically rounded up to the nearest dollar and deposited into the Vault. For example, if you spend $2.75 on a cup of coffee, SoFi debits your account $3 and deposits the extra $0.25 into your Vault. Periodically, SoFi offers roundup bonuses where members can earn an additional cash just for using the roundup feature.

Featured photo courtesy of SoFi