Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

CIT Bank Savings Connect Account

- Our Rating 4.5/5 How our ratings work

- APY3.90%

Annual Percentage Yield is accurate as of June 11, 2025. Interest rates for the Savings Connect account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 - Intro Bonus N/A

CIT Bank's Savings Connect account is one of our top picks for high-yield savings accounts. Featuring a competitive flat APY on all balances, it can go head-to-head with most of the top savings accounts available. What's more, you don't have to do anything special to earn this high interest rate; many similar accounts (including some offered by CIT) only offer their highest interest rates to customers who complete certain requirements.

Earn High Interest Rates With No Monthly Fees

The CIT Bank Savings Connect account could be a solid solution if you’re looking for a high-yield savings account with an impressive APY and easy-to-use online banking services.

With a current APY (annual percentage yield) of 3.90%, the savings account offers some of the most competitive rates currently available among high-yield savings accounts. Plus, you can enjoy the convenience and security of an FDIC-insured savings account from CIT (a division of First Citizens Bank) with zero monthly service fees.

Pros

- Competitive APY

- No monthly service fee

- Free electronic bank transfers to checking accounts (even if it isn't a CIT checking account)

Cons

- No fee-free ATM network

- Minimum opening deposit required

Features

The CIT Bank Savings Connect account offers its customers a savings APY that's 9x higher than the national average. This generous APY makes the high-yield savings account a great place to stash away a fund for emergencies, holiday spending, down payment, vacations, wedding planning or any other short-term savings goal.

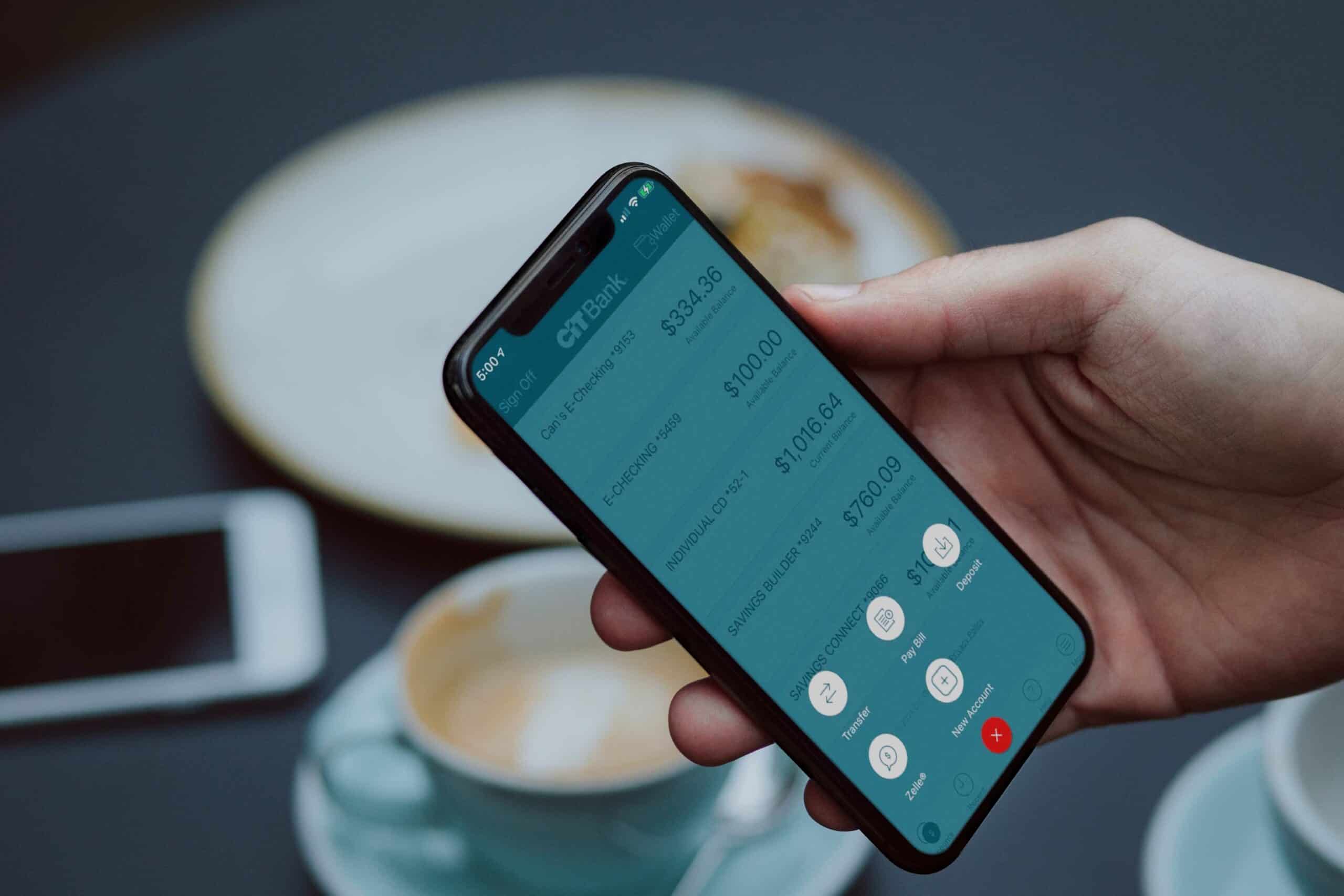

On top of the attractive interest rate, the CIT Bank Savings Connect account also comes with convenient remote deposit capabilities, online banking and a user-friendly mobile app.

CIT Bank is a member of the Federal Deposit Insurance Corporation. Your deposit accounts with CIT Bank are insured for up to $250,000 per depositor for each ownership category.

APY

CIT Bank Savings Connect customers can enjoy a solid 3.90% APY on the funds they tuck away in their savings account. Unlike some other high-yield savings accounts on the market, you don't have to meet a lot of criteria to earn that elevated interest rate.

Fees

With the CIT Bank Savings Connect account, you don't have to worry much about fees: There are zero monthly service fees with this linked online account combination. Some other banks charge monthly fees, and if you want to avoid paying them, you might have to jump through hoops, like having a certain number of direct deposits or a minimum average daily balance to qualify for a waiver.

The only fees the bank charges with the Savings Connect account are:

- Outgoing wire fees: $10 (waived if you have a balance of $25,000 or more)

- Returned deposit fees: $10

So, if you avoid sending outgoing wire transfers and having returned deposits, you shouldn't have to worry about paying any bank fees.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.30%

*Annual Percentage Yield (APY) is variable and is accurate as of 6/10/2025. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.66%

Earn up to 4.66% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

4.00%

Earn 4.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of June 11, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Minimum Deposits and Maximum Withdrawals

When you open a new CIT Bank Savings Connect account, you'll need to make a minimum deposit of at least $100. However, the online bank does not have any physical branches. As a result, you will need to make your opening deposit in one of the following ways:

- Electronic transfer

- Wire transfer

- Mail a check

Accessing Your Funds

There are several convenient ways to withdraw funds from your savings account when you need them. Here are a few options:

- Electronic bank transfers: These are free of charge between your Savings Connect account and your checking account, even if you hold a checking account with another bank.

- Wire transfers: You can schedule wire transfers for a $10 fee (or free of charge if your account has a balance of $25,000 or more).

- Check: You can request a check in the mail from your savings account.

Other CIT Bank Accounts

While the CIT Bank Savings Connect is a great option, it's not the only account the bank offers. If you're in the market for an account to grow your savings, here are some other accounts to consider:

| Bank Account | APY | Minimum Deposit | Monthly maintenance fee | Learn More |

|---|---|---|---|---|

|

|

4.00%

Earn 4.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of June 11, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 | $0 | Open Account |

|

|

3.90%

Annual Percentage Yield is accurate as of June 11, 2025. Interest rates for the Savings Connect account are variable and subject to change at any time without notice. |

$100 | $0 | Open Account |

CIT Bank Savings Builder Account |

Up to 1.00%

Earn 1.00% APY by maintaining a balance of $25,000 or more, or by receiving a single deposit of $100 or more each month. Annual Percentage Yield is accurate as of September 22, 2022. Interest rates for the Savings Builder account are variable and subject to change at any time without notice. |

$100 | $0 |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

How to Open an Account

It's easy to open a CIT Bank Savings Connect account. The bank says the three-step process takes about 10 minutes to complete online:

- Fill out an application with information like your name, address, email, phone number, Social Security number, date of birth and citizenship status.

- Once your application is accepted, fund your accounts with at least $100 to open a Savings Connect account via electronic transfer, wire transfer or by mailing in a check from another bank.

- The bank will send you a confirmation email once it accepts your application and receives your initial deposit.

- Then you can set up your online banking profile and mobile app to start using your account.

Ready to open a CIT Bank Savings Connect Account? Start here.