Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

In the past, checking accounts have rarely been something special. But in recent years, financial institutions like Betterment have emerged, making it easier and cheaper to do your everyday banking. The online-only institution's Betterment Checking is a fee-free checking account without some of the constraints of traditional accounts. You'll also get the chance to earn cash back with select merchants. Betterment also offers a high-yield savings account and a handful of investment options.

Here's everything you need to know about Betterment and how to decide whether it's right place to store your money.

About Betterment

Betterment LLC is a financial services company that began as a robo-advisor in 2008. Robo-advisors use algorithms to manage investor portfolios at a fraction of the cost of a hands-on manager. Other robo-advisors include Wealthfront, Stash, Ellevest and many more. In recent years, the company has branched out to offer banking products, including the Betterment Checking account and Cash Reserve account.

Betterment isn't a bank, so it provides its banking products through nbkc bank (member FDIC). It also doesn't offer a lot of the services you can get from brick-and-mortar banks and credit unions. However, Betterment's banking products are solid, especially for people who want to escape the fees that are so common with traditional deposit accounts.

Related Article

Related Article

Here Are the Top 10 Safest U.S. Banks in 2024

Betterment Checking Account

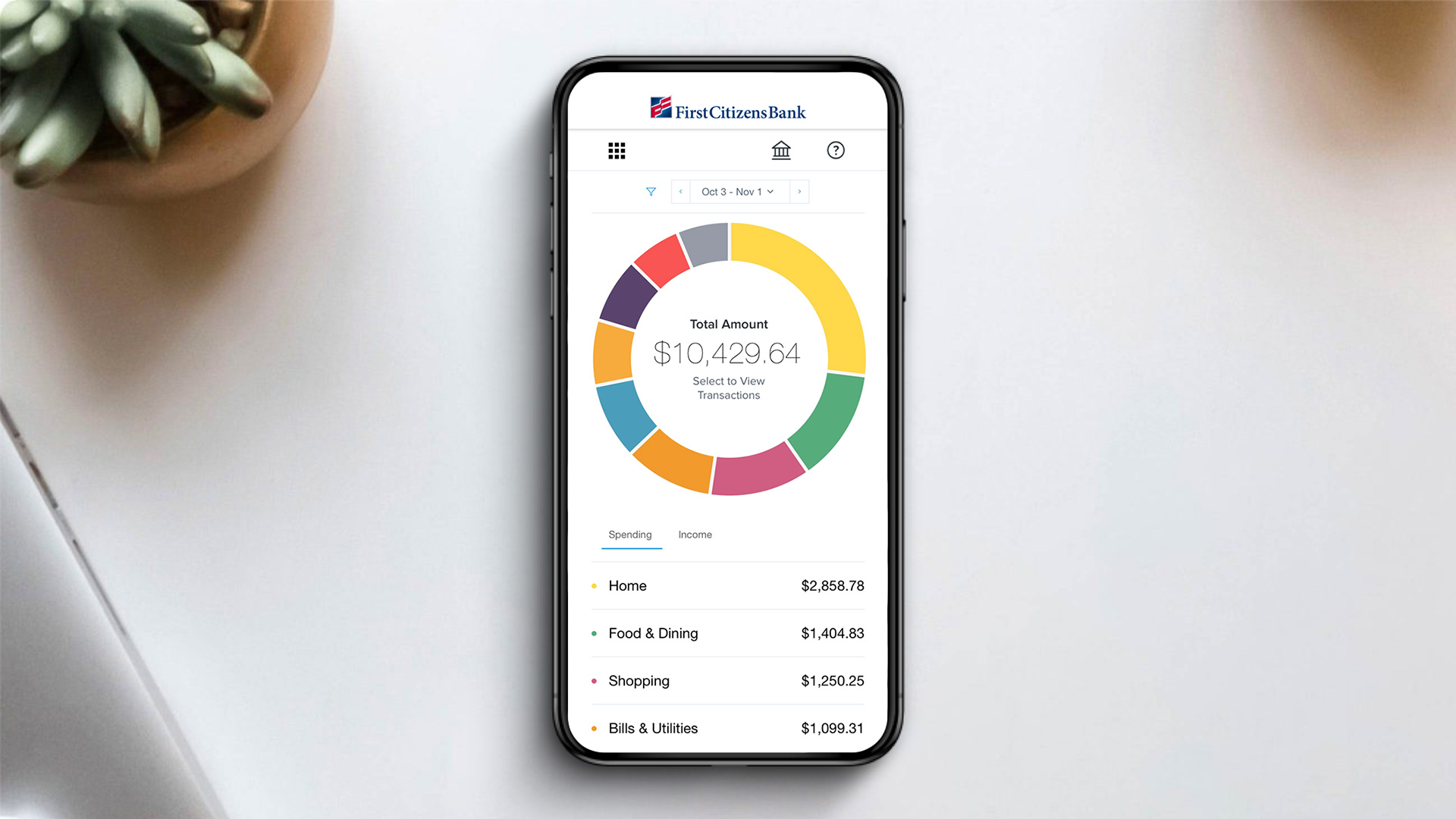

The Betterment Checking account is the financial institution's only checking account, so you won't get a lot of choices like with other banks. But the perks of no fees and cash back can be incredibly appealing to some consumers. Here's what you need to know.

Features and Benefits

In addition to some of the standard features you can expect from a checking account, such as mobile check deposit, direct deposit and paper checks, you'll also get a few other impressive benefits.

Cash Back

Betterment is far from the only checking account that offers cash back when you use your debit card, but it may give you higher rewards rates on some purchases compared with the competition.

You'll earn cash back with select merchants on both in-store and online transactions. Based on examples on Betterment's website, rates can go as high as 5%, or potentially even higher. You'll typically get the cash back the next day, but it can take up to 90 days.

The only drawback is that you won't earn rewards on every purchase like you can with some debit cards. You'll be able to view which cash-back offers are available through the Earn Rewards section of your Betterment account, which you can find in the mobile app.

Unfortunately, Betterment Checking is not an interest-bearing account, but that may not matter if you're using the debit card enough to rack up cash-back rewards.

Recommended Bank Bonuses

| Bank Account | Intro Bonus | Minimum Deposit | Learn More |

|---|---|---|---|

|

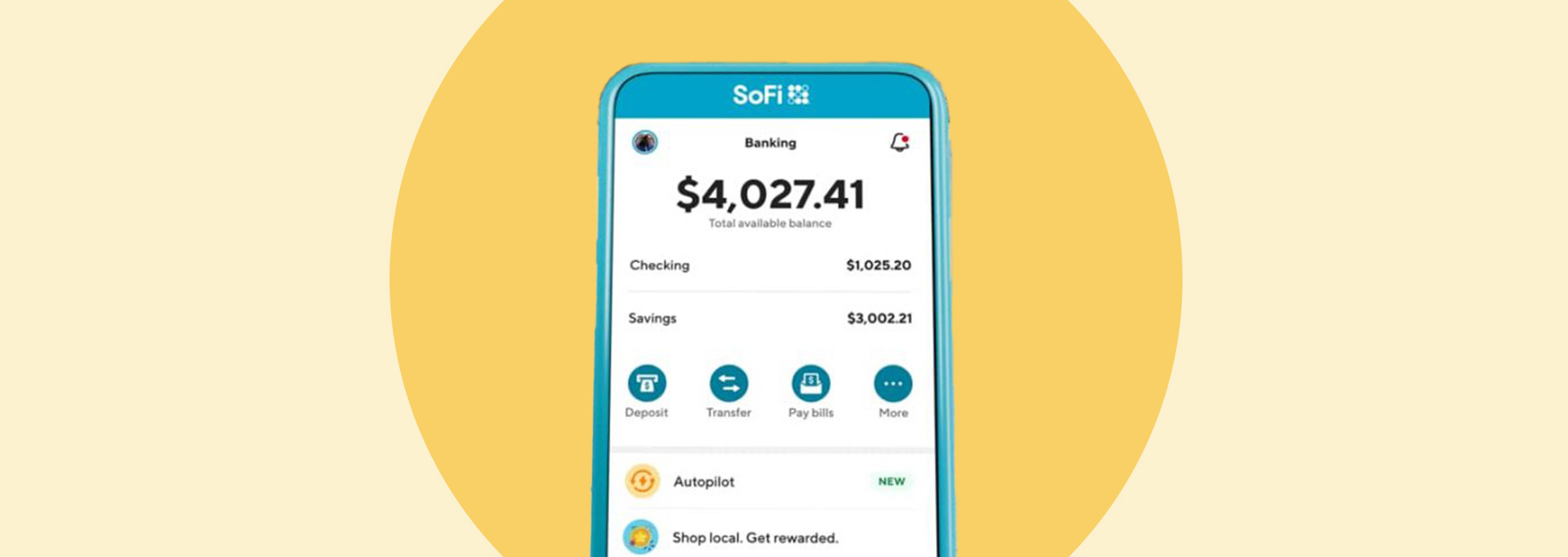

Member FDIC |

$50-$300Expires December 31, 2024

See full terms and disclosures at sofi.com/banking. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/24. SoFi members with Direct Deposit can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the 4.60% APY for savings (including Vaults). Members without Direct Deposit will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

N/A | Open Account |

|

|

$300Expires October 16, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

N/A | Open Account |

Axos Rewards Checking Account |

Up to $500Expires July 31, 2024

Cash in on up to a $500 bonus† and up to 3.30% APY* with a new Rewards Checking account. Just use promo code RC500 before July 31. |

N/A |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

|

$300Expires October 17, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

N/A | Open Account |

FDIC Insurance

Because Betterment isn't a bank, you may be concerned that your deposits won't be insured. But because nbkc bank is a member FDIC, your money will be FDIC insured up to $250,000.

Contactless Payments

The Betterment Checking debit card has a tap-to-pay feature, which allows you to make purchases by tapping your card to a contactless-enabled card reader instead of swiping or inserting it.

This process provides the maximum security for a point-of-sale transaction and it processes more quickly than using your card's chip.

No-Fee Joint Accounts

Betterment listened to its customers and is now offering joint checking accounts. Not only do Betterment Joint Checking accounts have the same features as individual checking accounts (such as no fees), but each user will also receive one Visa® debit card for shared expenses between accounts.

Betterment users are only allowed up to two checking accounts, but you can chose between individual and joint accounts depending on your needs.

Cellphone Protection Is No Longer Available

Betterment previously offered cellphone protection when users paid their phone bills using their Betterment Visa® Debit Card or a Betterment Checking account. Unfortunately, some users have reported this service was discontinued at the beginning of 2023.

Cellphone protection has become a popular benefit among credit card issuers, but it hasn't taken off with checking accounts yet—which is what made this feature so special for customers when it was available.

No Account Fees

A lot of online bank accounts highlight that they have no hidden fees. But what that really means is that while they don't charge some of the common bank account fees, like monthly fees and in-network ATM fees, they may still charge other fees you'll find buried in the terms and conditions of the account paperwork.

With Betterment Checking, though, it truly doesn't charge any fees. That means no monthly fees, no overdraft fees, no ATM fees and more. There's also no minimum balance requirement.

ATM Access

Betterment Checking doesn't have its own ATM network, which is common with most banks and credit unions. Instead, the financial institution reimburses all ATM fees so you don't have to worry about searching for in-network ATMs wherever you are—just use the closest one, and you're good.

No Foreign Transaction Fees

In addition to that, Betterment Checking also reimburses the foreign transaction fee that Visa® charges on all purchases you make abroad—this fee is typically 1% of the transaction amount.

Account Access

As with most online banks, Betterment does not offer services at brick-and-mortar locations. Instead, you have access to your Betterment Checking account through the mobile app, ATMs, a secure website and other third-party payment apps.

Mobile App

The Betterment app provides everything you need to manage your account. That includes checking balances and transactions, making transfers, using mobile check deposits and more.

You can also connect your account to Zelle®, Venmo, Cash App and more for peer-to-peer payments.

Locations

Betterment is an online-only, mobile-first financial institution. This means there are no brick-and-mortar locations where you can get in-person service on your account. If this is a deal-breaker for you, you'll be better off with an account from a different bank.

But if you're not concerned about doing all of your banking online, it's a solid product.

Betterment Cash Reserve Account

If you're considering a Betterment Checking account, it may also be worth opening a Betterment Cash Reserve account. The Cash Reserve account is a high-yield savings account that offers an above average APY of 4.75%, which is more than 10 times higher than the average rate of 0.46% on a traditional savings account, according to April 2024 data reported by the FDIC.

You'll also get up to $2 million in FDIC insurance because Betterment may hold your cash in up to eight program banks, each providing $250,000 in coverage. Plus, there's no minimum balance requirement to earn the APY.

Related Article

Related Article

Best High-Yield Savings Accounts (July 2024)

Other Financial Products

Currently, Betterment offers the checking account, Cash Reserve and a few investment accounts. On the investment side of things, you can open a retirement account or a robo-advisor account.

Fees on Betterment's investment accounts are relatively low compared with other brokerage firms. However, keep in mind that a robo-advisor doesn't give the investor control over exactly where their money is invested—you'll simply provide Betterment with some information about you, and it will create a portfolio with those details.

Is Betterment Right for You?

Betterment offers a lot of benefits, especially for people who love online banking. You'll have access to fee-free checking with the potential to earn cash rewards, a decent savings account and a few investment account options, including IRAs. If you don't mind the lack of in-person service and are comfortable with online banking, Betterment could be a great choice for your funds.

If you prefer face-to-face customer service or access to a wider range of banking products, you might want to shop around and compare your options.