Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

If you're looking for a new bank, it's important to research and compare multiple options before you make a decision. U.S. Bank® offers a variety of banking products and services, though it may only make sense if you live near one of the financial institution's branches and prefer in-person service.

If you're thinking about opening an account with U.S. Bank, here's everything you need to know before you get start

U.S. Bank Overview

U.S. Bank can trace its roots back to 1863 in Cincinnati when the First National Bank of Cincinnati was chartered. Now, the bank is headquartered in Minneapolis and operates in 13 countries.

The bank has more than 2,000 physical branches across 26 states. However, it offers its banking products in all 50 states and is one of the largest banks in the U.S. in terms of assets.

U.S. Bank offers checking, savings and other deposit accounts, as well as credit cards, loans, lines of credit, investment services, retirement services and business accoun

U.S. Bank Checking Accounts

U.S. Bank offers two checking accounts, both of which are relatively straightforward in their feat

U.S. Bank Smartly® Checking Account (Member FDIC)

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4/5 How our ratings work

- Minimum

Deposit Required$25 -

Intro Bonus

Up to $450Expires September 26, 2024

Earn up to $450 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through September 26, 2024. Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm. Member FDIC.

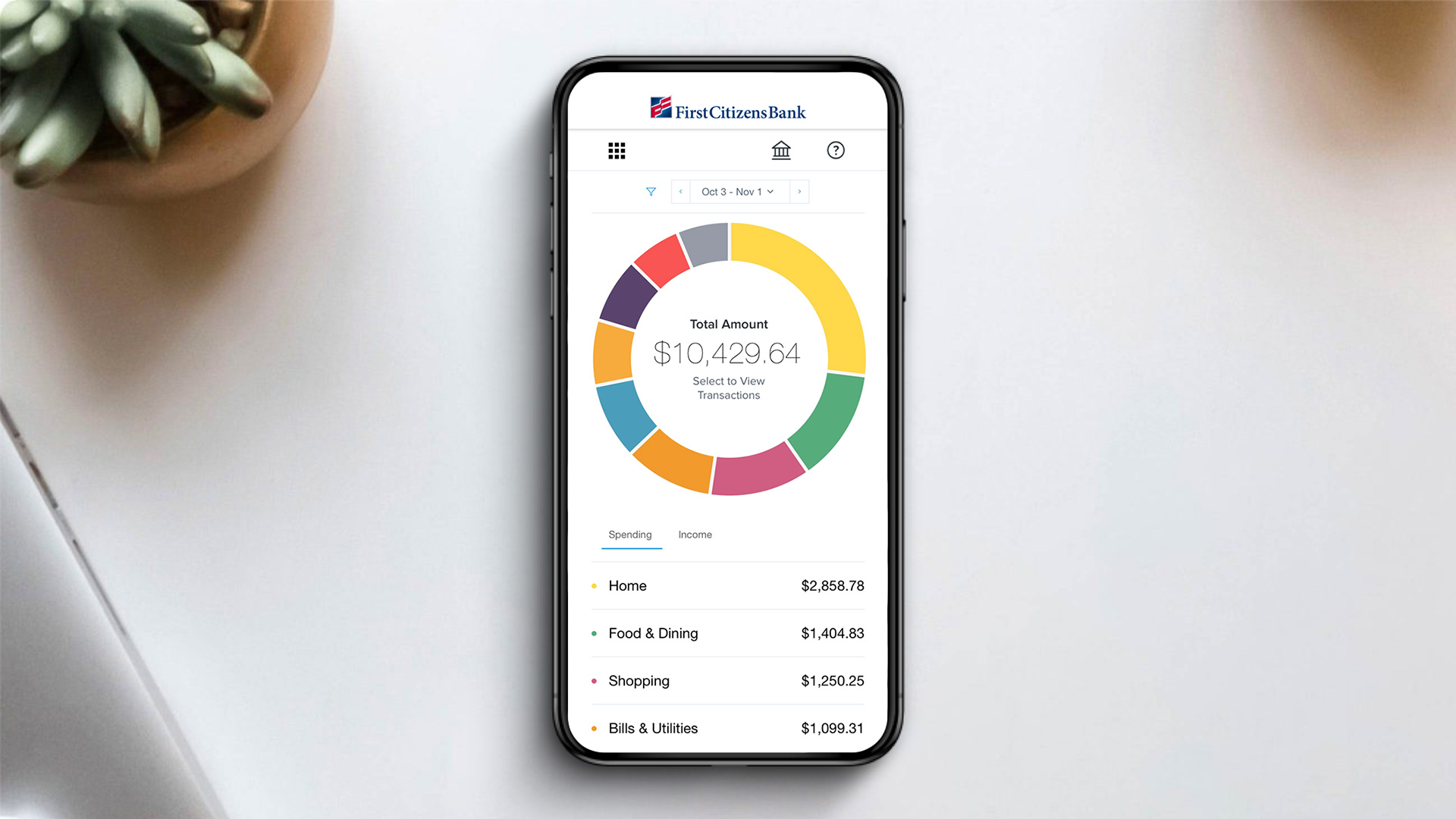

U.S. Bank's Smartly® Checking Account is a pretty standard checking account; customers get access to handy features such as personalized financial insights, automated budgeting and and access to U.S. Bank Smart Rewards. While this account features a $6.95 monthly service fee, there are multiple ways to get it waived.

Most people considering a U.S. Bank checking account would consider this option the better fit. Here's what you'll get.

Fees

The account charges a $6.95 monthly fee, but you can get it waived if you meet one of the following criteria:

- You're a member of the military

- You're 24 and younger or 65 and older

- You have a combined number of direct deposits totaling $1,000 or more each month

- You maintain an average account balance of at least $1,500

- You have an eligible U.S. Bank credit card

- You qualify for the Primary, Plus, Premium or Pinnacle tier in the Smart Rewards™ program

The bank doesn't charge an ATM transaction fee at U.S. Bank ATMs or surcharge fees in the MoneyPass® network, though you may be charged fees by the MoneyPass ATM owner. The bank also offers no-fee overdraft protection through a linked eligible account and may waive the fee if you overdraw by less than $50 or qualify for the Overdraft Fee Forgiven program.

There's a minimum opening deposit requirement of

Features

The account offers a lot of basic banking features, as well as some unique ones, including:

- Account alerts and reminders

- Automated budgeting

- Zelle® payments

- Mobile check deposits

- Automated bill pay

- Personalized financial insights

- Financial goal setting

- Zero-liability fraud protect

ion

Recommended Bank Bonuses

| Bank Account | Intro Bonus | Minimum Deposit | Learn More |

|---|---|---|---|

|

Member FDIC |

$50-$300Expires December 31, 2024

See full terms and disclosures at sofi.com/banking. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/24. SoFi members with Direct Deposit can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the 4.60% APY for savings (including Vaults). Members without Direct Deposit will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

N/A | Open Account |

|

|

$300Expires October 16, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

N/A | Open Account |

Axos Rewards Checking Account |

Up to $500Expires July 31, 2024

Cash in on up to a $500 bonus† and up to 3.30% APY* with a new Rewards Checking account. Just use promo code RC500 before July 31. |

N/A |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

|

$300Expires October 17, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

N/A | Open Account |

Safe Debit Account

If you're looking for an account for your teenager, this option may be worthwhile. Adults can also open this account, although there are better checking account options without a fee.

Fees

The account charges a $4.95 monthly service fee that cannot be waived. However, it doesn't charge overdraft fees. You just can't withdraw money from your account or use your debit card until you bring your account back into a positive ba

Features

The account comes with a debit card, but you won't get access to paper checks. Other features include:

- Mobile check deposit

- Bill pay

- Access to your VantageScore® credit score

- Discounts on money orders

You can open an account with a $25 minimum opening depo

U.S. Bank Savings and Money Market Accounts

U.S. Bank only offers one savings account, but it also offers two money market accounts, which can give you the best of both worlds with some checking and savings account features. Here's what you'll g

Differences Between a Savings and Checking Account

Standard Savings Account

With a deposit of $25, you can get started with the Standard Savings account. Unfortunately, its APY is a measly 0.01%, making it far less appealing than high-yield savings accou

Fees

While most savings accounts don't come with a monthly fee, this one charges $4 per month unless you meet one of the following requirements:

- Maintain a minimum daily balance of at least $300

- Have an average monthly collected balance of $1,000 or more

- Hold the account jointly with a minor 12 or younger

- Open a U.S. Bank Smartly® Checking account and enroll in the Smart Rewards® Primary tier or higher

There's no ATM fee if you access your funds at a U.S. Bank ATM, and there's no U.S. Bank surcharge at MoneyPass ATMs. You can also get fee-free overdraft protection if you link an eligible U.S. Bank acco

Features

True to its name, the Standard Savings account features are what you can expect from most traditional savings accounts:

- Recurring savings transfers

- Account alerts

- Electronic stateme

nts

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Elite Money Market Account

Money market accounts can be a good alternative to traditional savings accounts, and with the Elite Money Market Account, you can earn up to 4.50% APY. New accounts and existing accounts that are less than 30 days old can qualify for this premium APY with a $25,000 deposit.

Note that this offer is only available to customers who reside within the U.S. Bank footprint: AZ, AR, CA, CO, ID, IL, IN, IA, KS, KY, MN, MO, MT, NE, NV, NM, NC, ND, OH, OR, SD, TN, UT, WA, WI and WY.

Fees

The account charges a $10 monthly fee unless you maintain a minimum daily ledger balance of $10,000 or when you open a U.S. Bank Smartly® Checking account and enroll in the Smart Rewards® Primary tier. Additionally, you'll need to deposit at least $100 when you open the account. However, you'll pay no fees at U.S. Bank ATMs, and you can get fee-free overdraft protection if you link an eligible U.S. Bank acc

Features

The account offers a lot of standard features, including:

- Custom account alerts

- Check-writing privileges

- Electronic statements

- Mobile and online ba

nki ng

Explore the Best Money Market Accounts

Visit the Marketplace

Retirement Money Market Account

If you have an individual retirement account with U.S. Bank, you can also open a Retirement Money Market account to keep some of your retirement funds in a risk-free environment. The account offers tiered interest rates with no other special features.

You can open the account with a $100 deposit or with a $25 automatic monthly deposit. There's no monthly maintenanc

U.S. Bank Certificates of Deposit

U.S. Bank offers four types of certificates of deposit (CDs) from which you can choose.

Note: U.S. Bank CDs are available in AZ, AR, CA, CO, ID, IL, IN, IA, KS, KY, MN, MO, MT, NE, NV, NM, NC, ND, OH, OR, SD, TN, UT, WA, WI, WY, FL, GA, NC, TX and NY. Rates vary by state and zip code.

Here's a summary of each option:

| APY | Terms | Minimum Deposit | Notable Features | |

|---|---|---|---|---|

|

Standard CD |

Up to 0.25% |

1 – 60 months |

$500 |

N/A |

|

CD Special |

Up to 4.95% |

7 – 19 months |

$1,000 |

Competitive rates |

|

Step Up CD |

0.35% |

28 months |

$1,000 |

Interest rate increases every seven months |

|

Trade UP CD |

0.10% or 0.40% |

30 or 60 months |

$1,000 |

Can request a one-time rate increase if rates go up |

U.S. Bank Business Checking Accounts

If you're interested in moving your company's funds over to U.S. Bank., you'll have several different checking account options to choose from. Deciding which account is best for your business will likely depend on your company's size and how many free transactions and cash deposits you'll require each month.

To help with your decision-making process, here's a breakdown of what each account type offers:

U.S. Bank Silver Business Checking Account Package

If your business doesn't generate many bank transactions, the U.S. Bank Silver Business Checking Account Package might be a good fit.

U.S. Bank Silver Business Checking Account

- Our Rating 4.5/5 How our ratings work

- APYN/A

- Minimum

Deposit Required$100 -

Intro Bonus

Up to $800Expires September 16, 2024

Earn up to a $800 bonus when you open a new, eligible U.S. Bank business checking account online with promo code Q3AFL24 and complete qualifying activities, subject to certain terms and limitations. Offer valid through September 16, 2024. Member FDIC.

If you're in the market for a basic business checking account, you'd do well to consider U.S. Bank's Silver Business Checking. This account carries no monthly maintenance fee, and features an alluring sign-up offer for new customers who complete qualifying transactions. While the free cash deposit limit is relatively low, it should be enough to accommodate businesses that don't generate many monthly banking transactions.

Fees

U.S. Bank doesn't charge a monthly maintenance fee on its Silver Business Checking account. The account allows up to 125 free transactions per statement cycle. Additional transactions beyond this limit cost $0.50 each.

U.S. Bank doesn't charge an ATM transaction fee at U.S. Bank ATMs or MoneyPass® network ATMs, but you may be charged fees by Non-U.S. Bank ATM owners.

There is a $5 monthly charge for customers who opt to receive a paper statement.

Features

As U.S. Bank's lowest tier business checking account, Silver Business Checking offers basic features like:

- A U.S. Bank Visa® debit card

- 125 free transactions per statement cycle

- $2,500 of free cash deposits or 25 free cash transactions, whichever comes first, per statement cycle

- 50% discount on first check order, up to $50

- Online bill pay

- Mobile check deposit

- Check fraud prevention

- Zelle® payments

There's a minimum deposit requirement of $100 to open an account.

U.S. Bank Gold Business Checking Account Package

U.S. Bank Gold Business Checking is geared towards businesses with moderate banking needs. The checking account offers more free transactions and deposits than Silver Business Checking. It's only one of two business checking accounts with an interest-bearing option.

U.S. Bank Gold Business Checking Account

- Our Rating 4.5/5 How our ratings work

- APY0.01%

Earn 0.01% APY on balances of $20,000 or greater.

- Minimum

Deposit Required$100 -

Intro Bonus

Up to $800Expires September 16, 2024

Earn up to a $800 bonus when you open a new, eligible U.S. Bank business checking account online with promo code Q3AFL24 and complete qualifying activities, subject to certain terms and limitations. Offer valid through September 16, 2024. Member FDIC.

Assuming you can meet the requirements to waive its monthly fee, the U.S. Bank Gold Business Checking account is a strong option for mid-size businesses. This account offers considerably more free transactions than U.S. Bank's Silver Business Checking account and gives customers the chance to earn 0.01% APY on balances of $20,000 or more.

Fees

This business checking account charges a $20 monthly maintenance fee, but you can get it waived if you meet one of the following criteria:

- Have a U.S. Bank Payment Solutions Merchant Account

- $10,000 average collected checking balance or $25,000 average collected checking balance on interest-bearing option

- $20,000 in combined average collected deposit balances or $50,000 in combined average collected balance on interest-bearing option

- $50,000 combined average collected business deposits and outstanding business credit balances

The account allows up to 300 free transactions per statement cycle. Additional transactions beyond this limit cost $0.45 each.

U.S. Bank doesn't charge an ATM transaction fee at U.S. Bank ATMs or MoneyPass® network ATMs, but you may be charged fees by Non-U.S. Bank ATM owners.

There's a minimum deposit requirement of $100 to open an account.

Features

Gold Business Checking is a step up from the Silver account offering and offers access to additional benefits, including:

- A U.S. Bank Visa® debit card

- 300 free transactions per statement cycle

- $10,000 of free cash deposits or 100 free cash transactions, whichever comes first, per statement cycle

- 50% discount on first check order, up to $100

- Online bill pay

- Mobile check deposit

- Check fraud prevention

- Zelle® payments

- Free monthly paper statements

U.S. Bank Platinum Business Checking Account Package

U.S. Bank Platinum Business Checking is geared towards businesses operating with larger account balances and generating significant transactions each month.

U.S. Bank Platinum Business Checking Account

- Our Rating 4.5/5 How our ratings work

- APYN/A

- Minimum

Deposit Required$100 -

Intro Bonus

Up to $800Expires September 16, 2024

Earn up to a $800 bonus when you open a new, eligible U.S. Bank business checking account online with promo code Q3AFL24 and complete qualifying activities, subject to certain terms and limitations. Offer valid through September 16, 2024. Member FDIC.

If your business regularly deals with enough cash to make the most of the higher free transaction limit (and to easily waive the monthly fee) you'll likely find a lot to like about the U.S. Bank Platinum Business Checking account. In addition to offering a host of features meant to assist larger businesses, this account features the same $100 minimum opening deposit requirement and valuable sign-up offer as seen in U.S. Bank's Gold and Silver Business Checking packages.

Fees

Platinum Business Checking charges a $30 monthly maintenance fee, but you can get it waived if you meet one of the following criteria:

- $25,000 average collected checking balance

- $75,000 combined average collected business deposits and outstanding business credit balances

The business checking account allows up to 500 free transactions per statement cycle. Additional transactions beyond this limit cost $0.40 each.

U.S. Bank doesn't charge an ATM transaction fee at U.S. Bank ATMs or MoneyPass® network ATMs, but you may be charged fees by Non-U.S. Bank ATM owners.

There's a minimum deposit requirement of $100 to open an account.

Features

Platinum Business Checking offers more transactions and deposits than the previous two checking package tiers. Account features include:

- A U.S. Bank Visa® debit card

- 500 free transactions per statement cycle

- $20,000 of free cash deposits or 200 free cash transactions, whichever comes first, per statement cycle

- 50% discount on first check order, up to $100

- Free front and back check images on account statements

- Online bill pay

- Mobile check deposit

- Check fraud prevention

- Zelle® payments

- Free monthly paper statements

Other Financial Products

If you like to have all of your finances under one proverbial roof, U.S. Bank offers a variety of other products and services you can take advantage of. Here's a summary of what's available.

Lending

- Credit cards

- Personal loans

- Personal lines of credit

- Mortgage loans

- Auto loan

s

Investing

- Investment management

- Wealth planning

- Trusts and estates

- Insurance

- Charitable givin

g

Business

- Business savings accounts

- Business credit cards

- Business loans

- Business lines of credit

- Merchant services

- Cash management

- Payroll services

- Legal servi

ces

U.S. Bank Pros and Cons

As you research and compare your banking options, it's important to consider both the benefits and drawbacks of each choice. Here's our assessment of U.S. Bank.

Pros

- Physical presence: While the bank only has branches in roughly half of all states, if you live in one of those states and prefer in-person banking services, that may be enough to consider this bank.

- Light on fees: U.S. Bank charges fees on most of its bank accounts but it doesn't take a lot to get them waived. Even if you can't, the fees are relatively low compared to other major banks.

- Diverse products and services: If you want to manage your entire financial life with one financial institution, U.S. Bank makes that easy with its suite of financial products.

Cons

- Lack of options: Many other major banks offer a variety of checking and savings accounts, making it easier to get one that's tailored to your needs. With U.S. Bank, there's only one checking account that most people would consider and only one savings account option.

- Low interest rates: While you can get a competitive rate with the bank's special CD, all other savings products offer rock-bottom rates that won't net you much. Even with the Elite Money Market account, the promotional rate is still a limited-time offer.

- Small footprint: Despite being an international bank, U.S. Bank only has branches in 26 states. If you live in a state where it doesn't have physical locations, your options for in-person service and fee-free ATM withdrawals may be extremely limited.

U.S. Bank Customer Satisfaction

In the J.D. Power 2022 National Banking Satisfaction Study, U.S. Bank was ranked fifth out of nine major financial institutions, with a rating just above the industry average. In the J.D. Power 2022 Banking Mobile App Satisfaction Study, the bank ranked seventh out of ni

Bottom Line: Is U.S. Bank Right for You?

U.S. Bank offers a lot of standard features on its bank accounts but compared to the best checking and savings accounts available today, the bank's offerings fall short. Even if you prefer a bank with physical branches, other banks like Chase and Bank of America may offer a wider selection of products and better access to in-person services.

Additionally, the bank doesn't have the best satisfaction ratings, so you may get a better overall experience with another financial institution.

As with any financial decision, it's important to take your time to shop around and compare multiple options to determine which one is best suited for you and your needs. With each bank, consider the products and services it offers, as well as the fees, features, access to cash and other factors that are important to y