Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

If you're like most people, you probably don't give your banking relationship much thought on a day-to-day basis. Yet many Americans may not be happy with their banks—according to a 2023 J.D. Power retail banking study, the number of customers with more than $10,000 at their primary bank has declined to 28% from 44% a year prior, meaning some people are moving their money to better fit their needs.

Switching from one bank or credit union to another can be a headache. But the payoff could be worth it —especially if it saves you money or helps you earn more interest. Below are four signs it's time to switch banks and some suggestions on how to choose the best bank for your lifestyle.

1. You’re Not Getting the Highest Interest Available

Not all banks are the same where interest rates are concerned. As of April 2024, the Federal Deposit Insurance Corporation (FDIC) reports that the average national deposit rate banks offered customers on savings accounts was just 0.46%. However, the best high-yield savings accounts feature annual percentage yields (APYs) over 10 times higher than average—some exceeding 4.50% or even 5.00% at the time of this writing.

If your bank isn't offering you competitive interest rates on your balances, it may be time to look at opening accounts elsewhere. The key to earning the highest interest possible might be to open multiple bank accounts. Just be sure you have a plan to manage multiple bank accounts wisely so you don't run into potential problems.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

2. The Fees Are Adding Up

Some banks offer customers the chance to avoid bank account fees by meeting certain criteria each month. Yet there are also free checking accounts (and other types of deposit accounts) with no fees and no hoops you have to jump through either. If you decide to change bank accounts to avoid recurring monthly fees, just remember to close your bank account after you make your move. Otherwise, you may continue to incur monthly maintenance fees on your original bank account despite transferring your money elsewhere.

3. Your Bank Isn’t Keeping Up With the Times

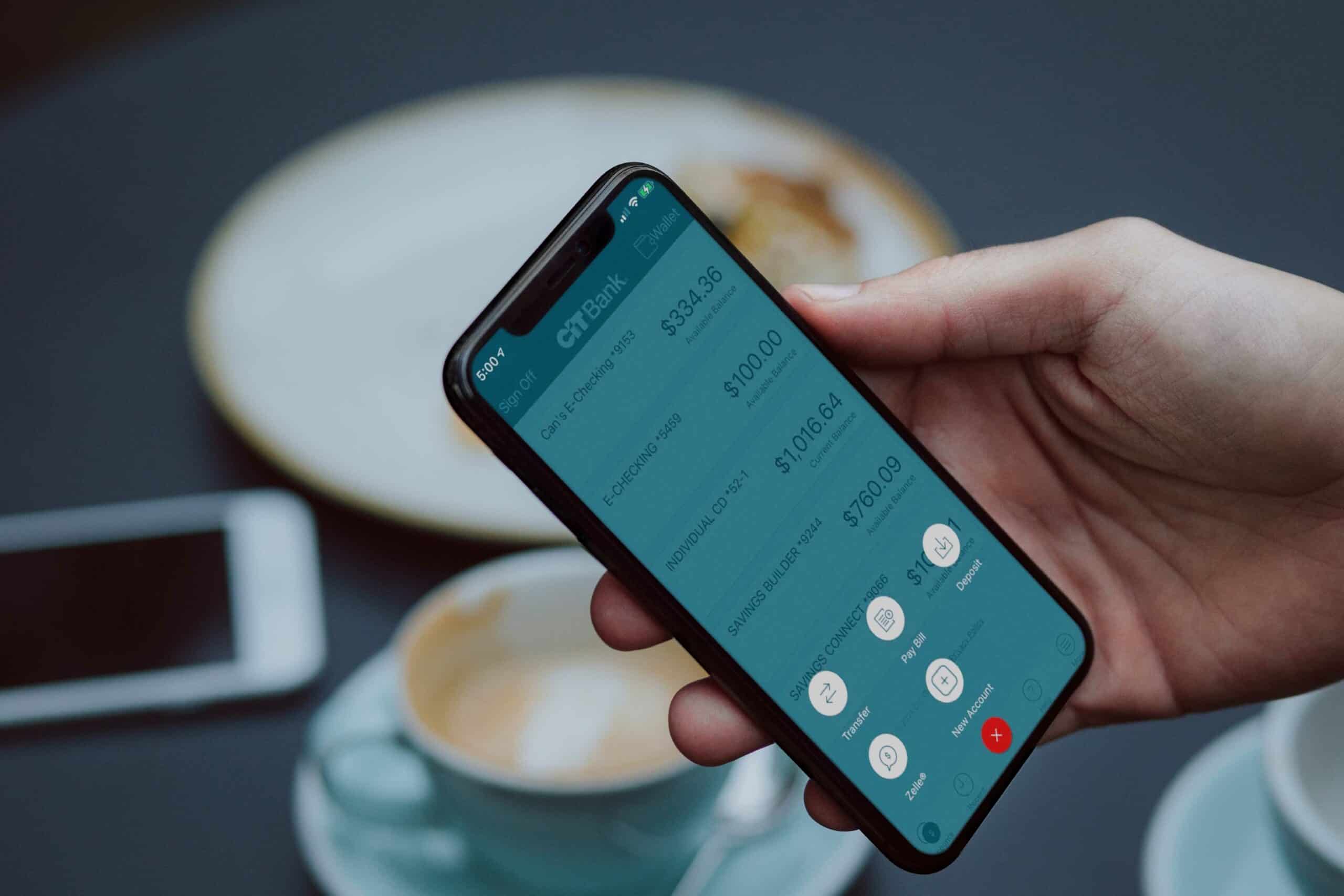

Many banks provide online services and mobile apps that can make banking more convenient for their customers. Yet some banks outperform others in this area. What's more, smaller financial institutions might not be equipped to keep up with the times when it comes to digital upgrades.

Make an honest assessment about whether your bank lacks features that are available elsewhere, such as mobile deposit and online transfer capabilities, online budgeting tools and other useful technology. If you find that your bank doesn't measure up where current technology is concerned, it might be time to see what other financial institutions (especially the best online banks) have to offer in this department.

4. You Want More In-Person Banking Options

Online banks don't have the same overhead that banks with brick-and-mortar branches have to factor into their budgets. As a result, they often pass those savings along to their customers in the form of higher interest rates on deposit accounts and lower fees.

Despite this benefit, some people need or prefer in-person banking options. If you deposit a lot of cash, for example, you may need a bank with physical branches. Or you might just like face-to-face customer service where financial transactions are concerned.

Over time, however, some bank branches close or relocate. According to data reported by the FDIC, there are fewer than 4,200 commercial banks in the United States as of 2022. That number is down from roughly twice that amount—8,300—in the year 2000. If your bank has closed or doesn't have enough branches to meet your needs anymore, it might be time to shop around for an alternative.

How to Choose the Best Bank

If you're unhappy with your current banking relationship, your best bet is to ask yourself some questions about the services and products you would like to find in an ideal bank or credit union:

- Do you want to earn a high APY on your savings account, checking account, CD or money market account?

- Are you looking for deposit accounts that charge no fees or limited fees?

- Is the ability to do business in person (in your local area and beyond) important to you?

- Do you prefer a bank that also offers financing products (e.g., loans, credit cards or lines of credit)?

Explore the Best Checking Accounts

Visit the Marketplace

Whatever your banking priorities may be, shop around and search for banks and credit unions that can meet your specific needs. You'll find that the "perfect" financial institution doesn't exist. Yet it may be quite possible to find a bank or credit union that matches the priorities you have added to your banking wish list.