Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

The Chase Sapphire Preferred® (Rates and Fees) offers a valuable blend of travel benefits with a relatively low annual fee of $95. If you're a new cardholder or thinking of getting the Sapphire Preferred soon, here are a few things you can do to maximize the card's value and unlock its full potential.

Chase Sapphire Preferred®

- Our Rating 5/5 How our ratings work

- APR19.99% - 28.24% (Variable)

- Annual Fee$95

-

Sign Up Bonus

100,000Chase Ultimate Rewards Points

Earn 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,300 (100,000 Chase Ultimate Rewards Points * 0.023 base)

The Chase Sapphire Preferred Card is one of the gold standards for earning travel rewards. It has a generous sign-up bonus and you can earn points on travel and dining expenses. The card does have an annual fee, but you can continue earning points through bonus categories and an anniversary points boost.

Overview

The Chase Sapphire Preferred is pretty flexible as it lets you transfer rewards points into miles or points several airlines and hotel programs. You can take advantage of strong transfer partners such as United, Southwest, Singapore Airlines, Virgin Atlantic and Hyatt. Similarly, you can book any reservation you want through the Chase Travel℠ portal. Although the card might not be ideal for the most frequent travelers, it has a built-in upgrade path, so when it’s time to level up your travel rewards game, you won’t have to start from scratch.

Pros

- Points are easily transferable to airlines and hotel partners

- Accelerated earnings on dining, travel & household purchases

- Excellent travel and purchase protections

- No foreign transaction fees

Cons

- Not ideal for the highest spenders

- $95 annual fee

1. Earn the Sign-Up Bonus

The Chase Sapphire Preferred features an incredibly generous sign-up bonus: Earn 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

To help ensure I met the requirement for the bonus, I moved all of my regular spending over to my new card. Since I have a large family, I'm able to do this with just my normal spending habits. The Chase Sapphire Preferred® earns bonus rates in specific categories, which can help you earn even more points while pursuing the sign-up bonus.

2. Use the $50 Annual Hotel Credit

The Chase Sapphire Preferred features a $50 annual statement credit on hotel stays booked through the Chase Travel℠ portal with the card. The credit is available each account anniversary year and will be applied automatically to your account after your booking.

While I usually prefer to book hotel accommodations directly, the hotel credit can be a great way to save and can help offset more than half of the annual fee alone.

3. Activate Your DashPass Membership

Like several other Chase cards that offer additional partner benefits, the Chase Sapphire Preferred comes with a complimentary DashPass membership for DoorDash and Caviar for at least a year (must activate by December 31, 2027). This membership normally costs $9.99 per month and includes benefits such as $0 delivery fees and lower service fees on eligible orders.

As someone who orders food delivery at least once a week, the complimentary DashPass perk is convenient and a great way to save on overall fees.

Related Article

Related Article

5 Best Credit Cards for Restaurant and Dining Rewards

4. Book a Trip Through the Portal

All travel booked through the Chase portal earns you 5x points per dollar spent, which can help you earn points even faster for your upcoming travel plans.

When you've earned enough points, redeem them through the Chase Travel℠ portal where they are worth 25% more. You can use the portal to book flights, hotels, rental cars, activities and experiences and even cruises using points. Whenever it's time to book travel, I almost always search the Chase portal, even if I'm planning on booking direct. You never know when you'll find a deal.

If you have another Chase card like the Chase Freedom Unlimited® (Rates and Fees), you can pair it with the Sapphire Preferred to get even more value out of your Chase points.

Related Article

Related Article

10 Ways to Redeem 100,000 Chase Ultimate Rewards Points for Travel

5. Transfer Points to a Travel Partner

The Chase Sapphire Preferred® card includes entry into Chase Ultimate Rewards, one of the most versatile and coveted loyalty rewards programs for credit cards. One of my favorite perks of the card is the ability to redeem points in multiple ways, including when you transfer them to Chase travel partners. Currently, you can transfer points at a 1:1 ratio to 11 airlines and three hotel partners.

I've transferred points to Southwest Airlines, United Airlines, JetBlue, IHG, Marriott and Hyatt. Always check availability and costs before you transfer your points, as you can't move points back to Chase once they've been transferred.

6. Earn Rewards on Your Spending

Enjoy elevated rewards on select spending categories with the Chase Sapphire Preferred. Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

Having multiple spending categories earning different rates can sometimes be a chore to track, but the rewards can add up quickly.

7. Set Up Autopay

Paying your full balance each month helps you avoid expensive interest charges. Whether you pay off your card each month or carry a balance, do yourself a favor and set up automatic payments. I make it a point to pay off my card most months, but I still set up auto payments for the minimum payment amount to avoid late fees. It also protects my credit score since payment history accounts for 35% of FICO credit scores, more than any other factor.

You can still pay off your balance or make multiple payments if you set up autopay.

8. Create a Calendar Reminder for the Annual Fee

Chase Sapphire Preferred’s $95 annual fee is affordable compared to some travel rewards cards, especially when considering the valuable benefits it offers. Because the card offers a sign-up bonus, the Sapphire Preferred card's potential value is highest in year one.

Therefore it’s important to add a recurring reminder or calendar notification before the annual fee hits each year. When the reminder pops up, use it as a chance to review how much value you received from the card over the past year, which features or benefits you used and determine whether keeping the card is worth it before the fee hits your account.

Recommended No-Annual-Fee Credit Cards

| Credit Card | Intro Bonus | Rewards Rate | Learn More |

|---|---|---|---|

|

|

$200Cash Bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. |

2%Cashback

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, a special travel offer, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/25. |

Apply Now Rates & Fees |

|

|

$250Cash Bonus

Limited Time Intro Offer: Earn a $250 Bonus after you spend $500 on purchases in your first 3 months from account opening |

1.5% - 5%Cashback

Enjoy 5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases |

Apply Now Rates and Fees |

|

|

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

Apply Now Rates & Fees |

9. Monitor Your Credit Score

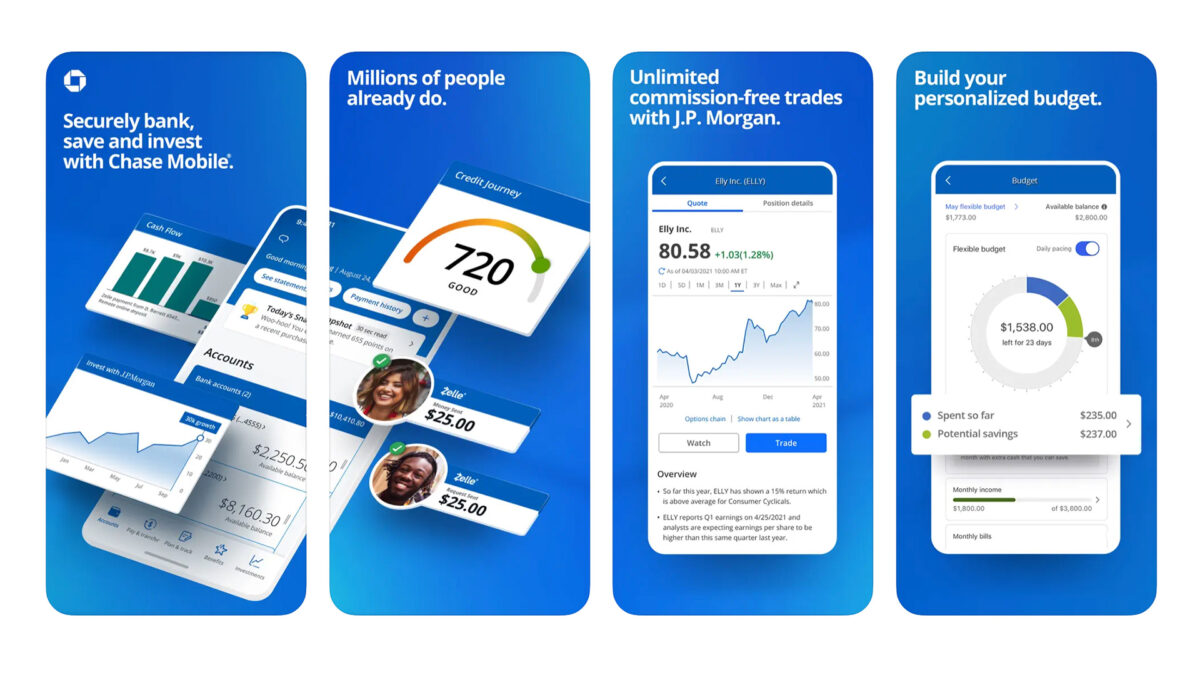

Chase offers free credit score monitoring through Chase Credit Journey. You don't need a Chase account to use the free service, but cardholders can access Credit Journey through the mobile app. Credit Journey allows you to check your credit score at any time, get advice on improving your score and access identity protection tools.

Keeping tabs on your credit health is always a good idea, and the free service through the Chase app makes it even easier for cardholders.

Unlock Your Card's Full Potential

Like any credit card, the Chase Sapphire Preferred is most valuable when you know how to leverage its many benefits and perks. With a manageable $95 annual fee, it's not difficult to recoup the cost. Plus, Chase Ultimate Rewards points don't expire as long as your account is in good standing, so you can save up for larger redemptions or use them immediately.

Ready to Apply? Start here.

.