Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

All information about the Chase Freedom Flex was collected independently by Slickdeals and has not been reviewed by the issuer.

Chase Ultimate Rewards is widely regarded as one of the most versatile credit card reward loyalty programs. Select Chase cards earn Ultimate Rewards points, which can be redeemed in numerous ways. Chase also partners with more than a dozen airline and hotel loyalty rewards partners, and transferring your Ultimate Rewards points can make your point redemptions more valuable.

In addition to transferring points to a travel partner, cardholders can also transfer or combine points into another eligible Chase card, or to other individuals with an eligible account. My wife and I have multiple Chase cards that earn Ultimate Rewards, which we’ve used to fund several family vacations and getaways over the years. We've booked travel through Chase but frequently pool our points and transfer them to our favorite transfer partners.

Keep reading to learn how to transfer Chase points to partners or other accounts and how to maximize your Ultimate Rewards points.

- How to transfer to travel partners

- How to combine or transfer to your other Chase accounts

- How to transfer to someone else's Chase account

What Are My Chase Points Worth?

Chase points are generally worth one cent each but can hold more value depending on the card and how the points are redeemed. For example, points earned with Chase Sapphire Reserve® are worth 50% more when redeemed for travel booked through the Chase rewards portal, while points from the Chase Sapphire Preferred® Card are worth 25% more in the travel portal.

Points transfer to all airline and hotel partners at a 1:1 ratio, meaning one Chase point is worth one point with the partner program. That means 10,000 Chase points transferred to Marriott Bonvoy are worth 10,000 points in Bonvoy, and 1,500 points transferred to Southwest Rapid Rewards, Singapore Airlines KrisFlyer, or Emirates Skywards are also worth 1,500 miles in their respective programs.

Which loyalty programs are Chase transfer partners? Check out the current list of partners below:

Chase Airline Partners

- Aer Lingus AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Flying Blue (Air France/KLM)

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Chase Hotel Partners

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

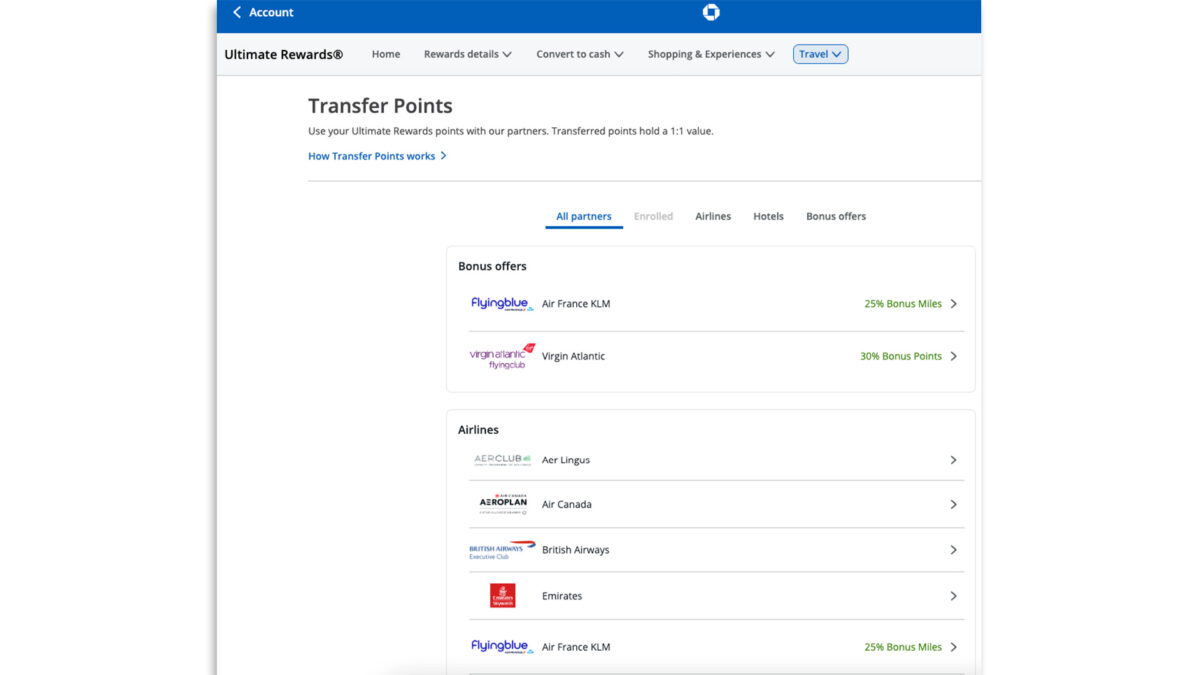

Chase points transfer at a 1:1 ratio, but that doesn't necessarily mean they hold the same value within each partner program. Sometimes, Chase partners have bonus offers for additional bonus rewards with transfers.

You can squeeze more value from your Chase points by finding sweet spots for flights and accommodations within partner programs. Many of our family trips are domestic, so we generally move points to Southwest or United, but you can find great transfer options with almost every transfer partner. Plus, many of Chase's airline partners belong to airline alliances, giving you even more options for booking award flights.

Related Article

Related Article

10 Ways to Redeem 60,000 Chase Ultimate Rewards Points for Travel

How to Transfer Chase Points to Travel Partners

The process to transfer Chase Ultimate Rewards points to one of the card issuer's travel partners is straightforward and should only take a few minutes to complete.

Here are the steps to transfer Chase points to travel partners.

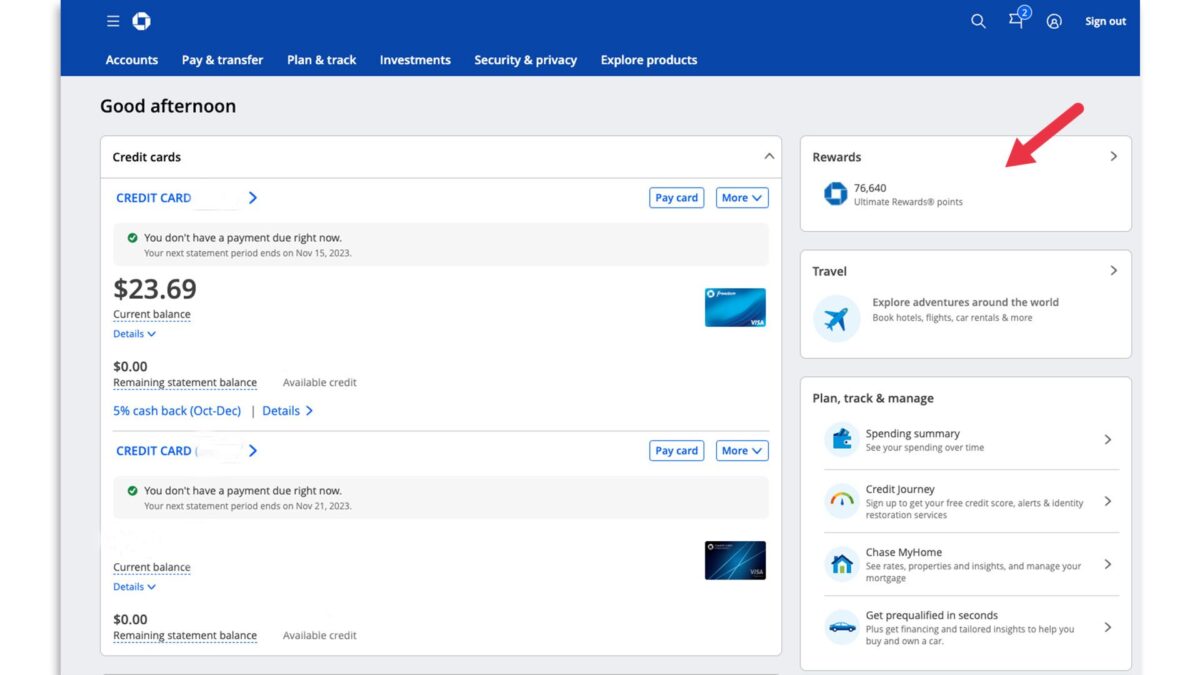

1. Log into your Chase account and go to the rewards portal.

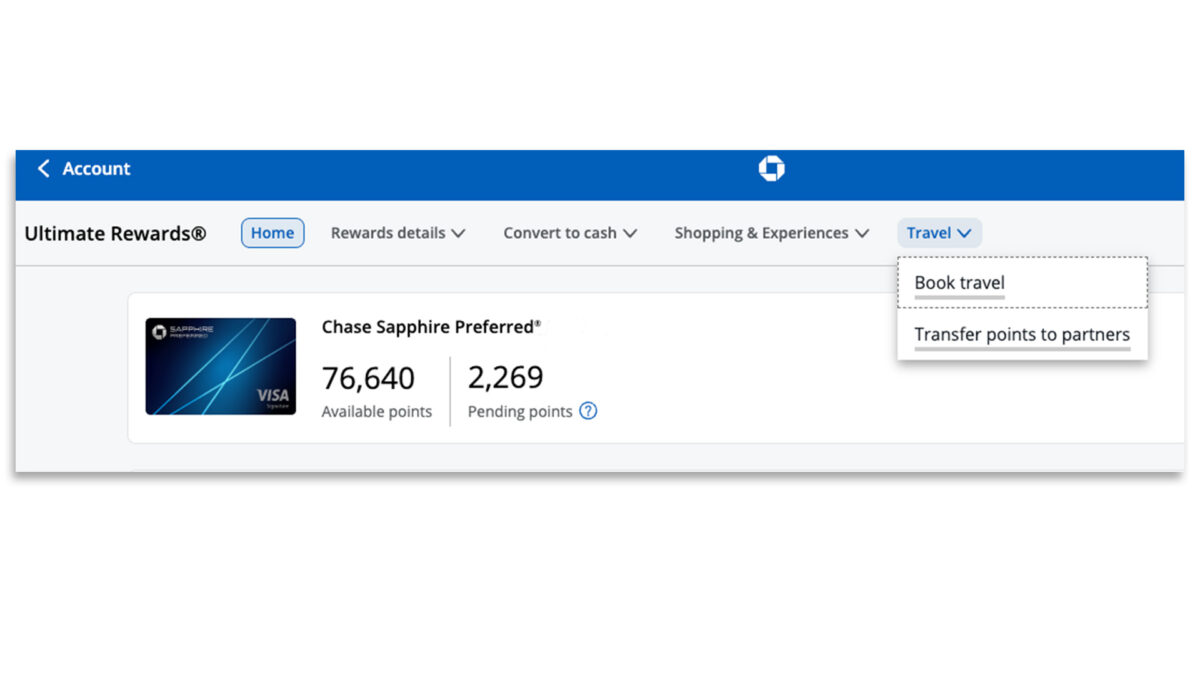

2. Click "Travel" in the dropdown menu at the top. Choose "Transfer points to partners."

3. Select the loyalty partner program to which you want to transfer your Chase points.

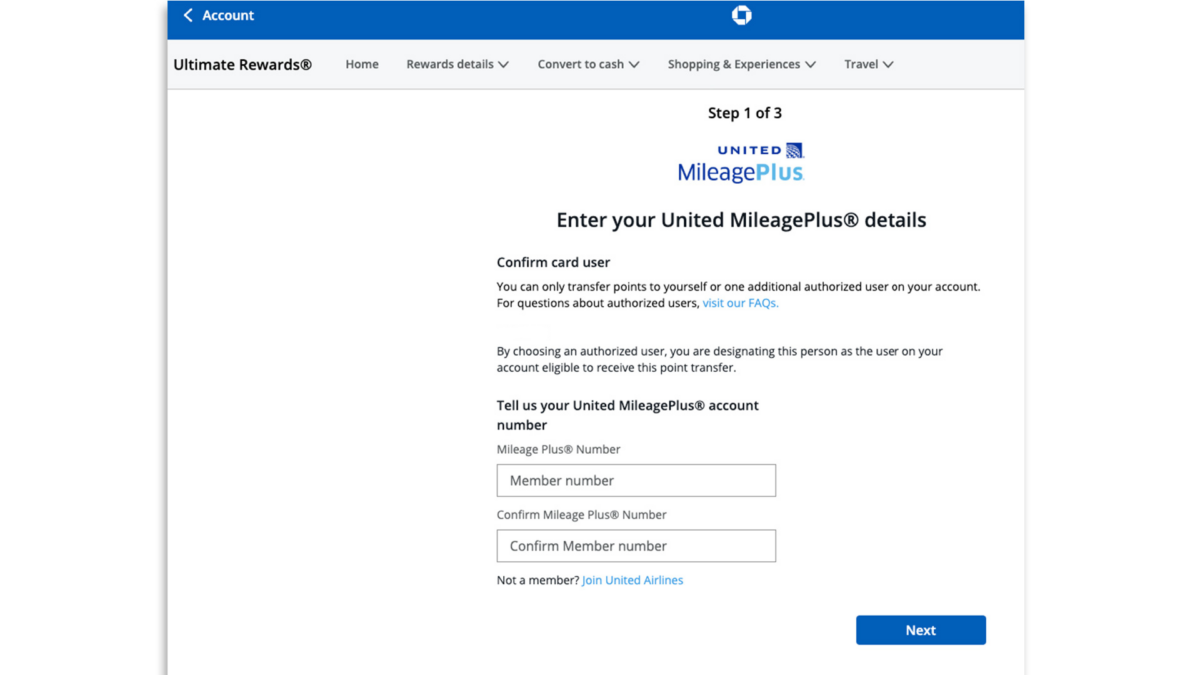

4. Link your account to the loyalty partner program by entering the required account information.

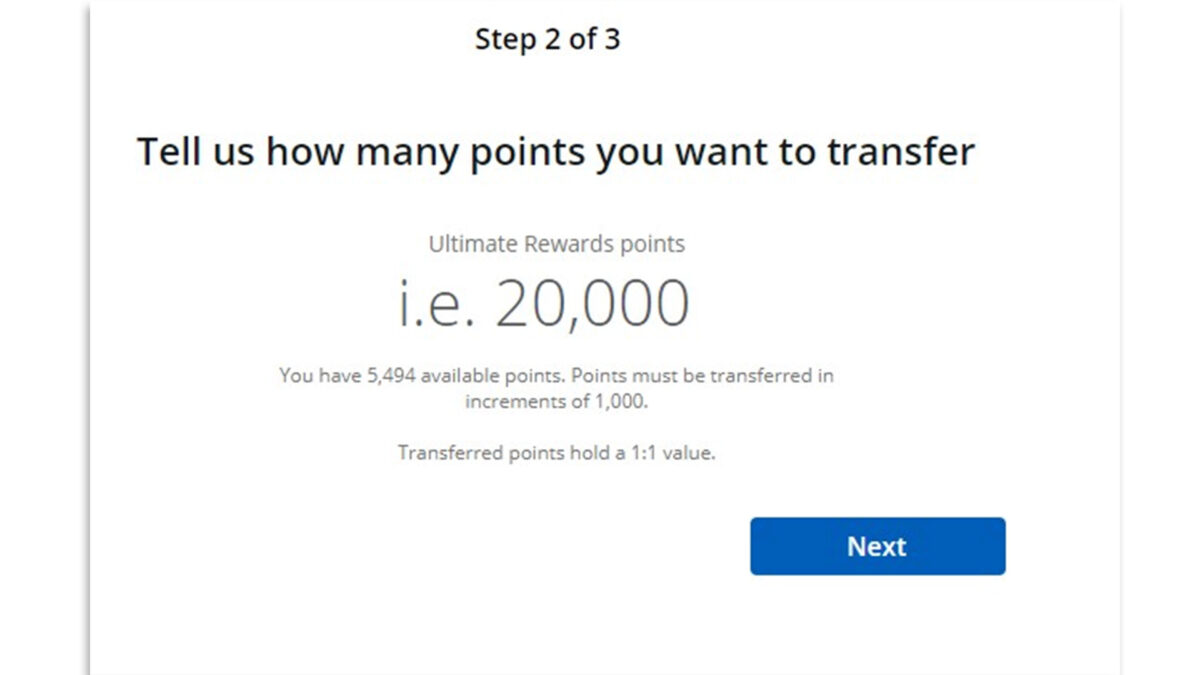

5. Enter the number of points you want to transfer. Transfers start at 1,000 points and are only transferrable in increments of 1,000.

6. Confirm your transfer and click "Submit."

The name on your Chase account must match the name on the transfer partner loyalty account. Chase typically processes transfer requests by the next business day but sometimes takes up to seven business days to complete. Factor the possible delay into your travel booking plans.

It's always a good idea to double-check award availability with the partner airline or hotel before transferring points. There's no way to cancel or request a refund once the points have been transferred.

Cardholders can also call the number on the back of their Chase card or visit a local Chase branch to transfer points to travel partners.

How to Combine or Transfer Points to Your Other Chase Accounts

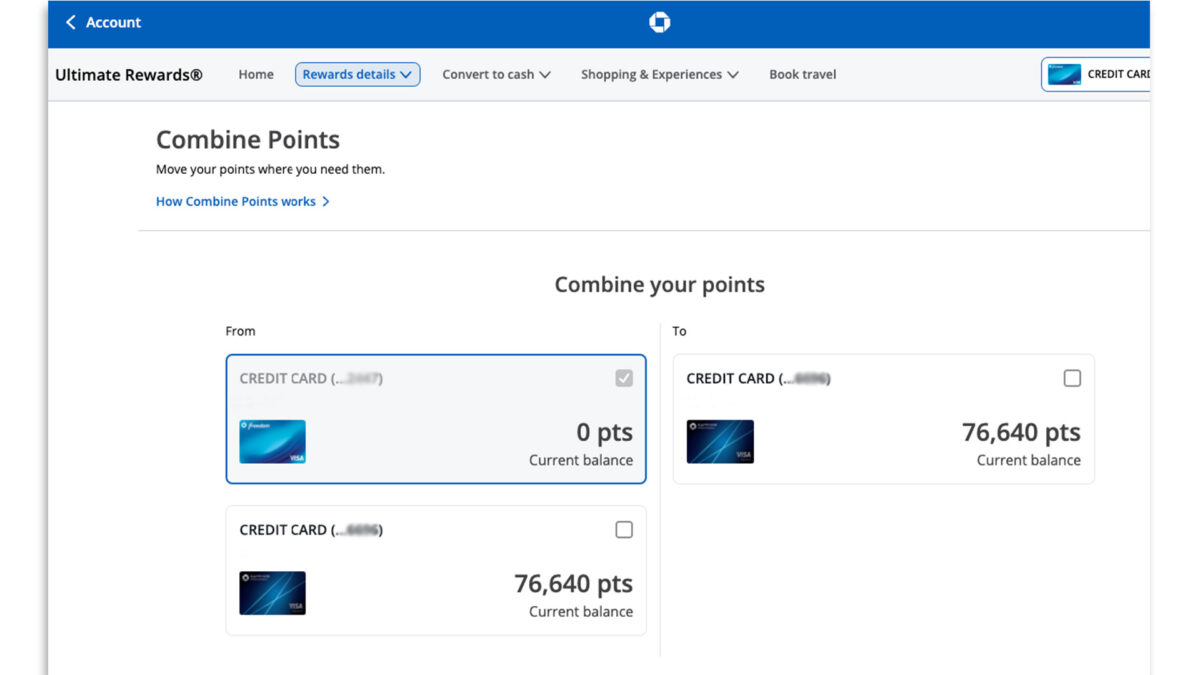

Besides transferring points to travel partners, you can also transfer points to other eligible Chase Ultimate Rewards accounts. If you have multiple cards that earn Chase Ultimate Rewards, you can pool your points under one account at any time to maximize redemption opportunities. You can also combine your Chase points with members of your household or other eligible account holders.

You can transfer points from one Ultimate Rewards account to another easily online.

1. Log into your Chase account and go to the rewards portal.

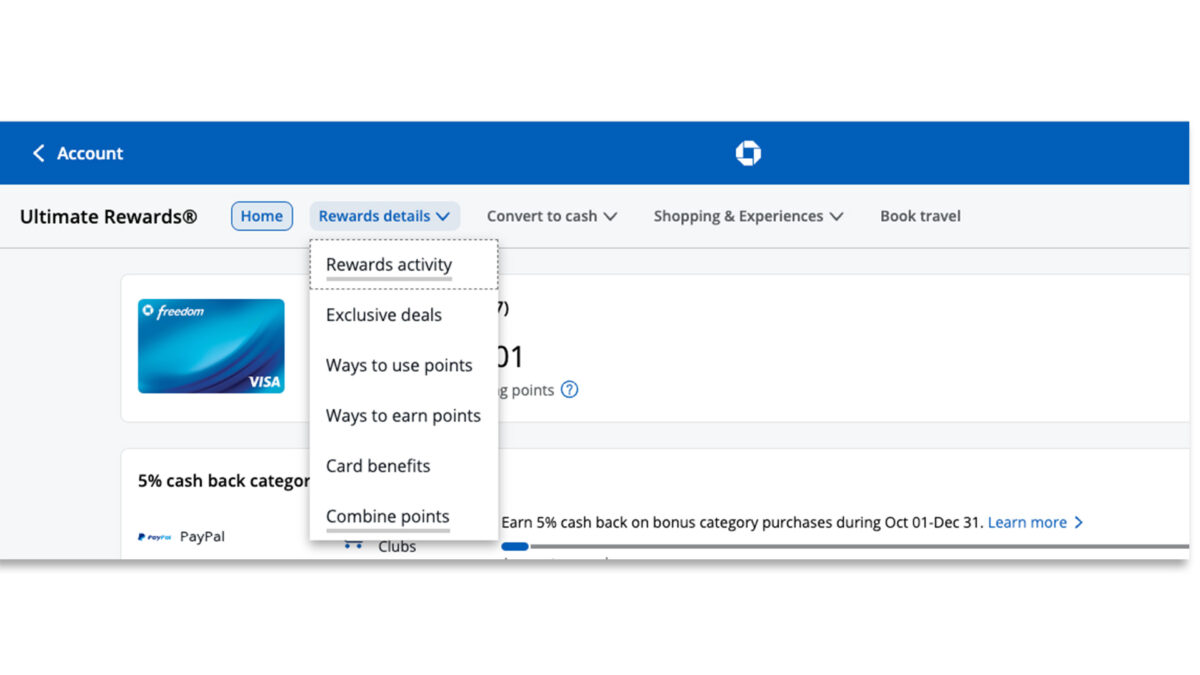

2. Click "Rewards details" in the top menu. Select "Combine points."

3. Choose the card account to which you want to transfer points.

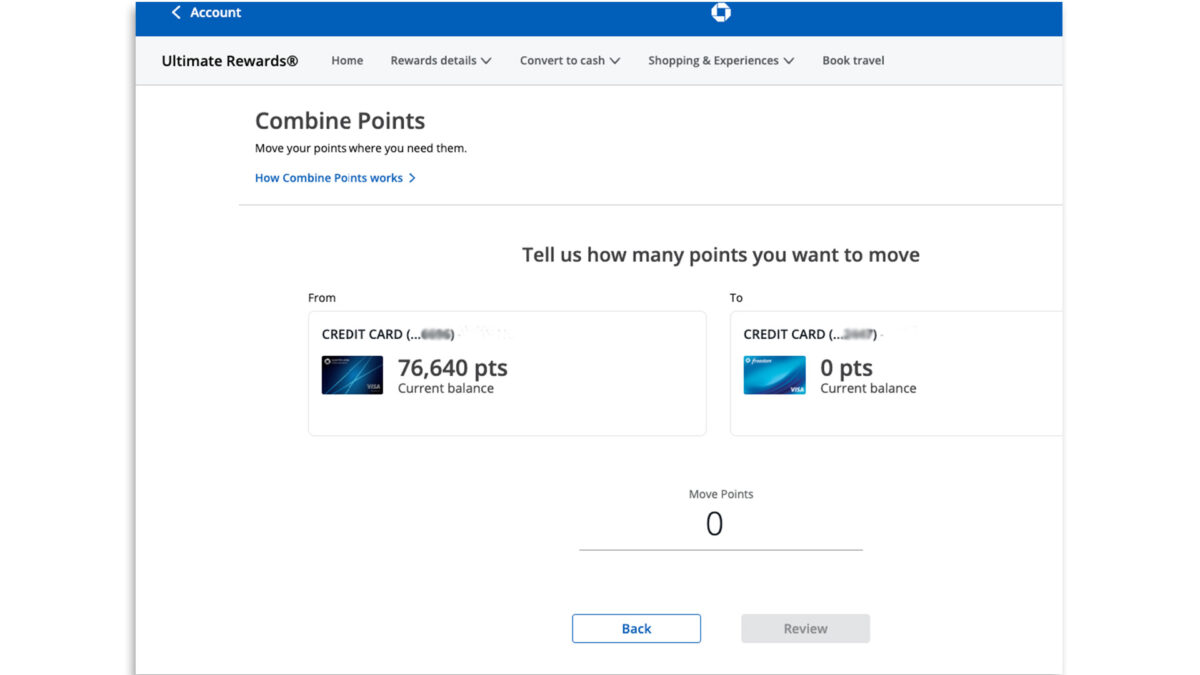

4. Enter the number of points you want to transfer. Unlike transfers to travel partners, there are no restrictions on the number of points you can transfer.

5. Review transfer details and select "Submit" to complete the process.

The points you transfer are accessible immediately under the new account. Transfers are final and not reversible. However, if you accidentally transferred points to the wrong account or want to move them back, you can initiate a new transfer back to the original card account or another eligible account.

Combining Chase points is especially valuable if you have one of the following Chase Ultimate Rewards cards that earn cash back:

These cash-back cards have limited redemptions and value, but you can gain flexibility and increase the value of points earned with these Chase cards by transferring your points to a premium Chase card like Sapphire Reserve, Sapphire Preferred or Ink Business Preferred®.

How to Transfer Points to Someone Else's Chase Account

Chase allows you to combine Ultimate Rewards points with select individuals who also have a card that earns Chase Ultimate Rewards. Transfers are limited to members of your household. If you have an eligible business card, you can combine points with the business owner.

The process to transfer points to another person's account is the same once you've linked the accounts.

- Link your accounts.

- If you haven't combined Chase points with the other cardholder before, you must call Chase support at the number on the back of your card. Let the support representative know you would like to transfer points with another eligible cardholder. You will need the name and credit card number of the account holder. The name provided must match the name on their card.

- Log into your Ultimate Rewards account online. Choose the Ultimate Rewards card you want to transfer points from.

- Choose "Rewards details" from the menu at the top. Use the dropdown menu to select "Combine points."

- Choose the card account to which you want to transfer points.

- Enter the number of points you want to transfer.

- Review the transfer and select "Submit" to complete the transaction.

Recommended Credit Cards

| Credit Card | Rewards Rate | Annual Fee | Bonus Offer | Learn More |

|---|---|---|---|---|

|

|

1x- 5xPoints

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. |

$95 |

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base) |

Apply Now |

|

|

1x - 2xPoints

Receive 3,000 anniversary points each year. Enjoy benefits including 2X points on local transit and commuting, including rideshare, 2X points on internet, cable, and phone services; select streaming, 2 EarlyBird Check-In® each year, 10,000 Companion Pass® qualifying points boost each year, and more. |

$69 |

30,000Southwest Rapid Rewards Points

Earn Companion Pass® plus 30,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. Dollar Equivalent: |

Apply Now |

|

|

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

$0 |

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

Apply Now Rates & Fees |

|

|

2%Cashback

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, a special travel offer, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/25. |

$0 |

$200Cash Bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. |

Apply Now Rates & Fees |

Tips to Maximize Your Chase Points

By being strategic with your Chase Ultimate Rewards cards, you can maximize earning opportunities and redemptions.

To earn the most Chase points:

- Consider your spending habits: When choosing a Chase card, look for cards that earn bonus rates in categories you frequently spend money.

- Try to meet the bonus spending requirements: Many Chase cards come with generous sign-up bonuses. Earning a lucrative bonus is the quickest way to boost your points balance.

The more points you earn, the more points you'll have available to redeem.

To maximize the value of points earned:

- Choose the best redemption option for your needs.

- Pool your points to score larger redemptions.

- Consider your travel preferences when booking travel through Chase or transferring points to a travel partner. Where you live may dictate which airport and airlines you use. If you have elite status with a particular airline or hotel, redeeming points within those brands may provide additional value.

- Verify award availability before transferring points to a partner airline or hotel. Allow extra time for points to arrive in the partner account in case the transfer process is delayed.

Use Chase's Flexibility To Your Advantage

Chase Ultimate Rewards is one of the most versatile credit card rewards programs. Cardholders have seemingly endless options for redeeming points. Redemptions within the program are great, but often, the highest values are attained by transferring your points to a Chase travel partner.

Pair Chase cards together that earn Ultimate Rewards points for more earning power and to increase their value. Consider building the Chase Trifecta to maximize your points even further. At the same time, remember that you don't always have to squeeze every last drop of value out of your points. They are yours to redeem as you want, and what other cardholders value may not be the same as you. Our family has redeemed Chase points several times, including for redemptions that others may not consider, but it worked for us.

See Which Credit Cards Offer BonusesBest Credit Card Bonuses

Visit the Marketplace

Frequently Asked Questions

-

Chase points are transferable to eligible members of your household with a Chase card that earns Ultimate Rewards.

-

Cardholders with an eligible Chase business card can transfer points to the business owner's card account.

-

Generally, you'll get more value redeeming points through a Chase travel transfer partner than cash-back redemptions. The best option, though, depends on your needs at the time.

-

American Airlines is not a Chase Ultimate Rewards transfer partner. Chase points don't transfer directly to the American Airlines AAdvantage program. However, you can use Chase points for American Airlines flights indirectly by transferring points to British Airways and Iberia, which are partners of American Airlines through the OneWorld Alliance.