Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Axos Bank® recently increased the interest rate earned with Axos Rewards Checking to an eye-watering 3.30%. These days, it's not too hard to find a checking account that earns interest, but it is rare to find one that offers APYs that rival the best savings accounts on the market.

Generally, checking accounts are used as everyday spending accounts for making purchases and paying bills. Since funds are expected to flow in and out of checking accounts regularly, they typically don't earn much interest. As of February 21, 2023, the FDIC lists the national average rate for interest checking accounts as just 0.06%, which is substantially lower than what Axos is offering.

Axos Rewards Checking Account

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 5/5 How our ratings work

- APYUp to 3.30%

Earn up to 3.30% APY for completing qualifying activities.

- Minimum

Deposit RequiredN/A -

Intro Bonus

Up to $500Expires July 31, 2024

Cash in on up to a $500 bonus† and up to 3.30% APY* with a new Rewards Checking account. Just use promo code RC500 before July 31.

Axos Bank Rewards Checking gives customers the chance to earn up to a 3.30% APY on their deposits with no monthly fees. These are all terrific features for a checking account, but Axos is digital-only, so if you deal with cash regularly it’s probably not the best fit for you.

Overview

While it takes a bit of work to unlock the maximum interest rate, Axos Rewards Checking customers can potentially earn an impressive 3.30% APY. This account also does not include any monthly fees.

Pros

- Strong APY compared to similar accounts

- No monthly maintenance fee or monthly minimum balance

- No overdraft or non-sufficient fund fees

- Unlimited domestic ATM fee reimbursements

Cons

- Several qualifying activities required to earn maximum interest

- No physical branch locations

While the current Axos Rewards Checking interest rate should turn heads, customers don't receive the maximum APY by default when they open an account. Instead, Axos Rewards Checking earns tiered interest; customers can boost the rate earned by meeting several monthly account requirements.

Achieving all of the requirements necessary to earn the highest APY may be difficult for some customers, depending on your banking habits and whether you use other Axos Bank services. But even if you don't qualify for the highest rate, you can still earn a competitive APY by meeting some of the account requirements.

How to Earn 3.30% APY With Axos Rewards Checking

Right now, Axos Bank offers up to 3.30% APY on its Axos Rewards Checking account. Customers must meet five qualifying account requirements to earn Axos' highest interest rate.

First, customers must set up and receive monthly direct deposits totaling $1,500 or more. Completing the account's direct deposit requirement earns 0.40% APY and is a requirement to unlock the other four interest qualif

Once you've met the monthly requirement to earn the initial 0.40% APY, accountholders can earn higher rates by completing the following tasks:

| Activity | APY Earned |

|---|---|

|

Make a total of ten Axos debit card transactions per month ($3 minimum per transaction) |

0.30% |

|

Maintain an average daily balance of $2,500 per month in an Axos Invest Managed Portfolios account |

1.00% |

|

Maintain an average daily balance of $2,500 per month in an Axos Invest Self-Directed Trading account |

1.00% |

|

Make your full monthly Axos Bank consumer loan payment using your Rewards Checking account |

0.60% |

Combine the four activities above with qualifying direct deposits each month and you'll earn 3.30% A

Can You Still Earn Competitive Rates if You Don’t Meet All of the Requirements?

Not all customers will qualify to earn the full APY Axos Bank offers. To do so requires having some type of loan through the bank as well as a managed investment account and self-directed trading account. Plus, you'll need to meet balance requirements for those accounts each month to earn the qualifying rate.

The good news is that you can still earn high, competitive rates if you only meet some of the qualifying requirements. Let's look at some scenarios where you would still qualify for a high APY.

Let's start strictly within the banking portion of the qualifying activities. You must receive $1,500 total or more in monthly direct deposits to unlock any of the other qualifying tasks. If you can meet the direct deposit requirement and sign up for Personal Finance Manager through Axos, you will earn 0.70% APY on your account balance each mont

Personal Finance Manager is a digital tool that syncs with all of your external financial accounts, outside of the Axos ecosphere, to give you a 360-degree view of your finances in one spot. If you're not comfortable with linking other accounts to Axos, you can instead make ten qualifying debit card transactions each month to earn the same APY.

- Qualifying direct deposits totaling $1,500 or more: 0.40%

- Qualifying debit card transactions or Personal Finance Manager: 0.30%

- Total interest rate earned: 0.70% AP

Y

The highest interest rate boosts are tied to Axos' investing accounts. You can potentially earn a 1.00% APY increase through the bank's managed or self-directed investment accounts. Not all customers are going to open both types of accounts. If you started with a self-directed trading account and met monthly balance requirements, you would add an additional 1.00% APY to your total. Along with meeting both banking requirements, you would earn 1.70% APY.

- Qualifying direct deposits totaling $1,500 or more: 0.40%

- Qualifying debit card transactions or Personal Finance Manager: 0.30%

- Qualifying Axos investment account with an average daily balance of $2,500: 1.00%

- Total interest rate earned: 1.70% AP

Y

Perhaps you use another bank or brokerage firm for your investments. You could still boost your interest rate by taking out a loan through Axos Bank and using your checking account as the payment method for monthly loan payments.

- Qualifying direct deposits totaling $1,500 or more: 0.40%

- Qualifying debit card transactions or Personal Finance Manager: 0.30%

- Qualifying Axos loan payment made with Rewards Checking account: 0.60%

- Total interest rate earned: 1.30% A

PY

How Does Axos Rewards Checking Compare?

Axos Rewards Checking is as solid as it comes for an online checking account. The account only requires a N/A initial deposit to open and carries no monthly maintenance fees, overdraft fees or non-sufficient fund fees. Plus, you can withdraw cash at almost any ATM thanks to Axos Bank's unlimited domestic ATM fee reimbursements. Even without earning interest, Axos Rewards Checking offers a solid base as an everyday spending account for those comfortable banking digitally.

Compare Checking Accounts

-

Axos Rewards Checking Account

-

Chase Total Checking® Account

-

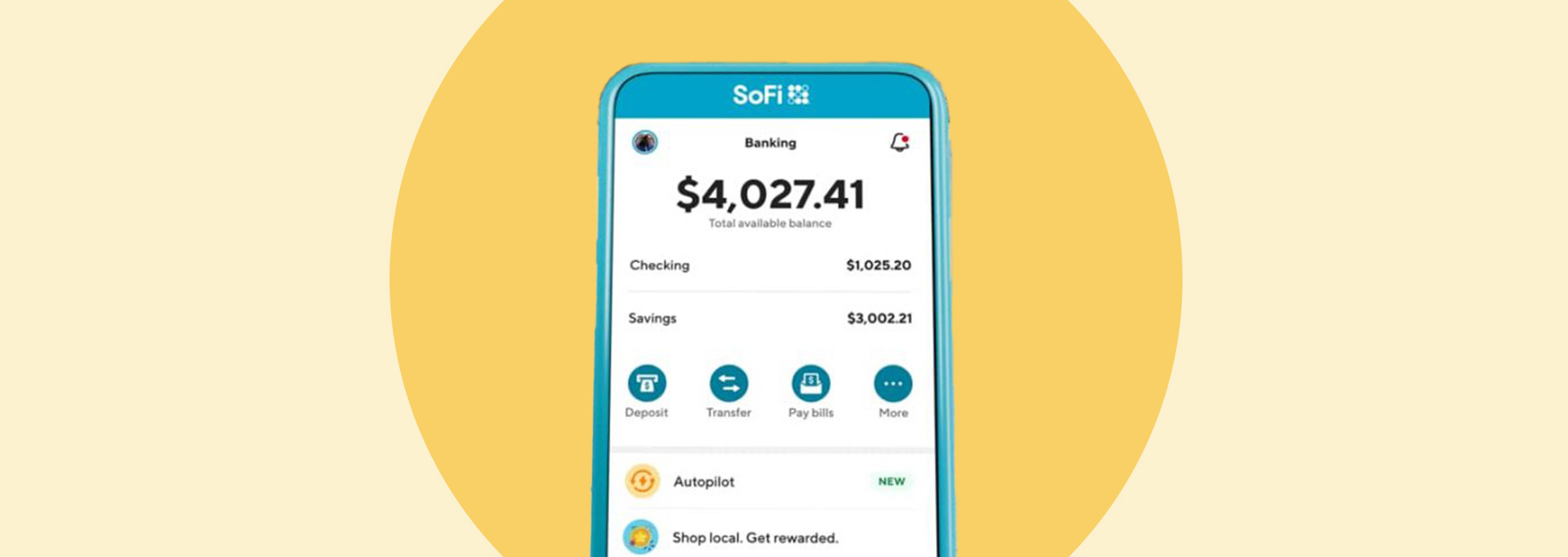

SoFi® Checking and Savings

If you're a current Axos customer and either have an investment account or loan (or both) through the online bank, there's no reason not to sign up for a Rewards Checking account. It might be a good option for individuals who are planning to apply for a mortgage, personal or auto loan soon and qualify for competitive loan rates through Axos.

Axos Rewards Checking still earns a competitive interest rate if you only meet the account's banking requirements to earn 0.30% or 0.70% APY. It's not as eye-catching as its highest APY tier, but you'll still earn more than with many checking accounts.

Ready to open an Axos Rewards Checking account? Start here.

Checking account balances often fluctuate, so the amount you'll earn will depend on your account balance and how much money goes in and out of the account at any given time. Pairing Rewards Checking with a high-yield savings account can maximize your savings even more, giving you the best of both worl