Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Wells Fargo is a nati

Wells Fargo CD Rates

| CD Term | APY | Relationship APY |

|---|---|---|

|

7 months (special) |

4.75% |

5.01% |

|

3 months |

4.50% |

4.51% |

|

6 months |

2.50% |

2.51% |

|

1 year |

1.50% |

1.51% |

Note: Wells Fargo CD rates vary based on location.

Wells Fargo's s

Wells Fargo do

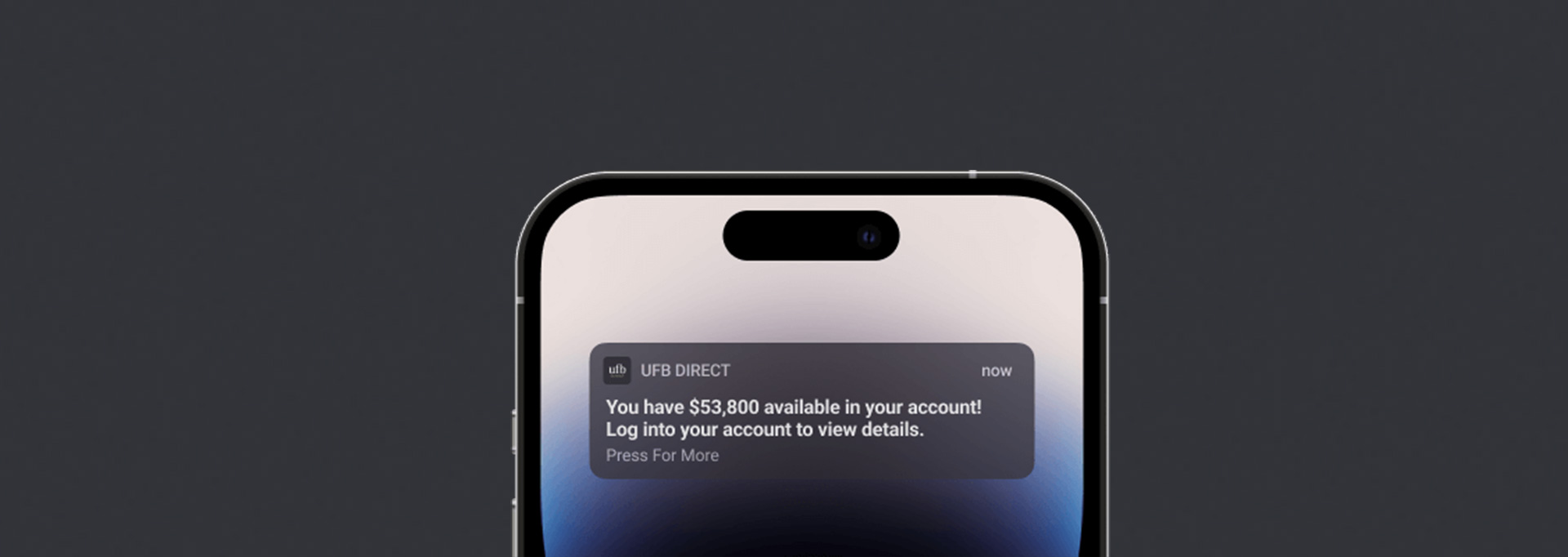

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.30%

*Annual Percentage Yield (APY) is variable and is accurate as of 6/10/2025. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.66%

Earn up to 4.66% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

4.00%

Earn 4.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of June 11, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Pros and Cons of Wells Fargo CDs

Pros

- High-yield interest rates

- Relationship rate benefits

Cons

- High minimum opening deposit

- No CDs longer than 12 months unless you visit a branch

- Highest interest tiers require balances of $100,000 or more

Wells Fargo CD Overview

- Minimum deposit: $2

,500 for standard CDs; $5,0 00 for special CDs - Interest: Compou

nded daily and credited m onthly - CD ter

ms: Four options ranging from three m onths to one year - Monthly fees: N

one

Wells Fargo offers short-ter

The minimum to open a stan

Funding options for a Wells Fargo CD in

- Electronic transfers from an existing Wells Fargo account

- Electronic transfer from an external bank

- Mailed check

- Money order

Deposits to Wells Fa

Related Article

Related Article

U.S. Bank Bonus Offers: Up to $1,000 for Opening New Accounts

Interest Disbursement

Interest compou

Early Withdrawal

CDs typically offer hi

Early withdrawal penalties:

- Terms le

ss than three months: One mo nth's interest - Three to 1

2 months: Three mont hs' interest - Thirteen to

24 months: Six month s' interest - More than 2

4 months: Twelve month s' interest

Explore the Best Checking Accounts

Visit the Marketplace

Relationship Benefits

Some banks offer exclusive benefits and pe

Wells Fargo offers slightly higher

Related Article

Related Article

8 Easiest Bank Accounts You Can Open Online Instantly (2025)

How Wells Fargo CD Rates Compare

- National banks aren't typically known for competitive rates, but Wells Fargo CDs offer decent APY on select CD terms.

- Rates often beat the national average, according to the FDIC.

- Wells Fargo rates may exceed some big banks and online banks on select terms.

- If you're already banking through Wells Fargo,

you may be eligible for higher relationship rates with a qualifying linked bank account.

While there's a lot to like about Wells Fargo CDs, the bank offers limited terms online, all 12

Alternatives to Wells Fargo CDs

Like most financial products, it's best to research available options before committing. Shop around to find the best CD rates and terms to maximize your savings based on your needs.

If you're looking for other CDs with comparable or higher APYs, here are some CD offerings to consider.

Recommended CD Accounts

| Account | 1-Year APY | 3-Year APY | 5-Year APY | Learn More |

|---|---|---|---|---|

CIT Bank Term Certificates of Deposit |

0.30%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice |

0.40%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice |

0.50%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

|

4.00% | 4.00% | 3.50% | Open CD |

|

|

4.10% | 3.65% | 3.60% | Open CD |

|

|

4.10% | 3.50% | 3.40% | Open CD |

Quontic Bank Certificates of Deposit |

4.00% | 3.25% | 3.00% |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

Bottom Line

Wells Fargo offers com

FAQs

-

Yes, Wells Fargo CDs are FDIC insured up to $250,000 per depositor, per ownership type, in the event of a bank failure.

-

You can open a Wells Fargo CD online through the bank's website or in person at a Wells Fargo branch location. You must be at least 18 to apply for a CD and have a qualifying government-issued photo ID, a Social Security number or Individual Taxpayer Identification Number, and a U.S. home address.

-

You can fund a new CD through another Wells Fargo account, an electronic transfer from another bank or financial institution, or by mailing a check or money order to the bank.

-

If you withdraw funds from your Wells Fargo CD before the end of your CD term, Wells Fargo will charge an early withdrawal penalty of up to 12 months' worth of interest based on your term length.