Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

TaxAct

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

TaxAct has a robust accuracy and refund maximum guarantee that eclipses most competitors. Its no-frills tax service is easy to use and simple to navigate. It really shines with its Xpert Assist help service, which allows filers across all tiers to consult a tax expert, though the service now comes with a fee.

Straightforward Tax Solutions for the Budget-Conscious

TaxAct is one of the most popular online tax software companies, and for good reason. While its user interface is relatively simple compared to some other tax services, confident filers may appreciate its straightforward, no-frills presentation style.

With TaxAct, users gain access to a wealth of tools and support options. These reasons, along with its $100k Accuracy Guarantee, make TaxAct one of the best online tax services around.

Pros

- Maximum refund and accuracy guarantee

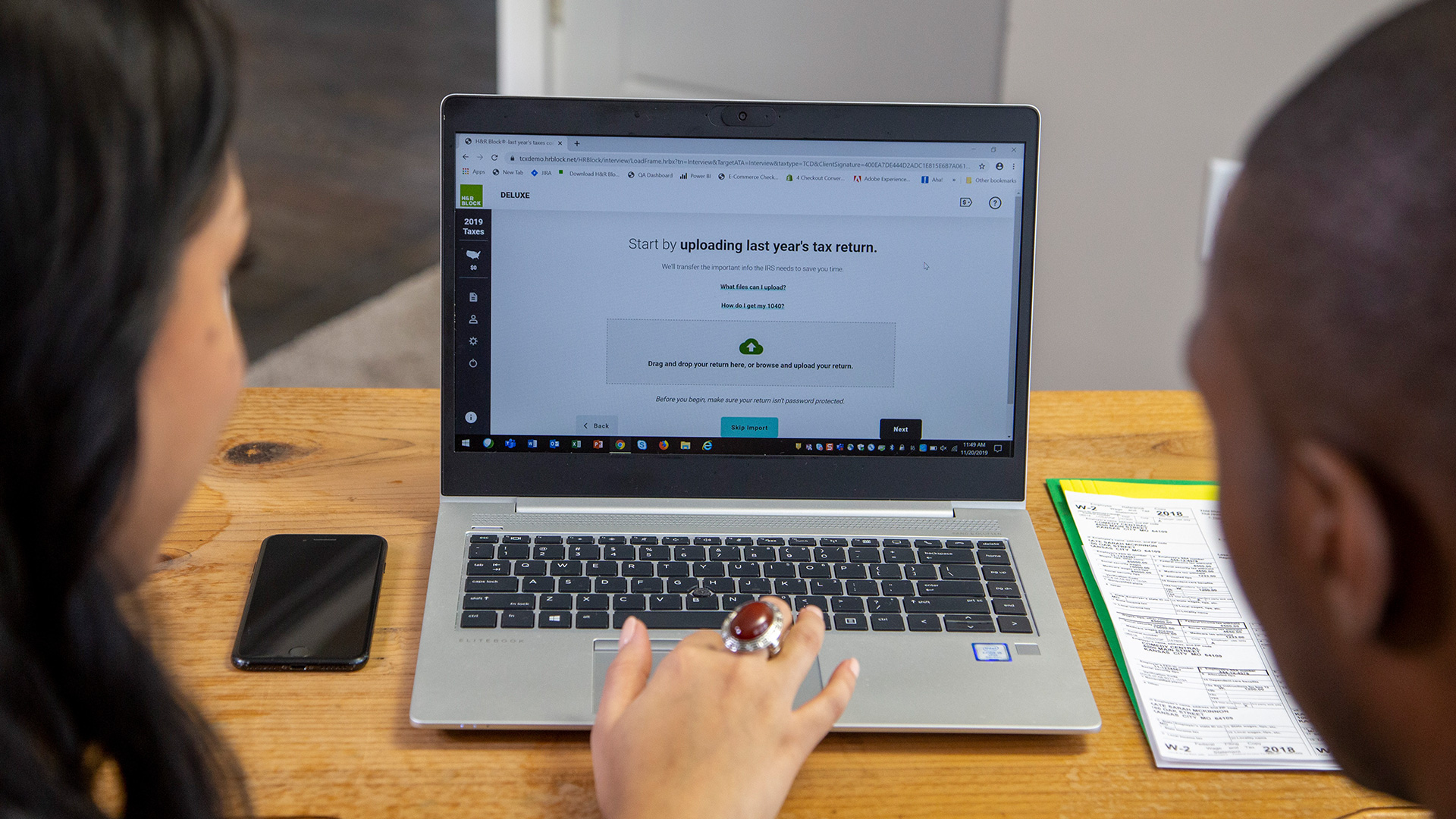

- Ability to import previous returns from other online tax softwares

Cons

- No free state return filing

- Live tax help from an expert now has a fee

TaxAct at a Glance

|

Price |

|

|

Guarantees |

|

|

W-2 + Prior Year Import |

|

|

Audit Support |

|

|

Access to Tax Experts |

|

Products and Pricing

Pricing varies per version and is subject to change.

TaxAct Products & Pricing

| Tier | Summary | Federal | State |

|---|---|---|---|

|

$0 |

$39.99 |

|

|

$49.99 |

$59.99 |

|

|

$79.99 |

$59.99 |

|

|

$99.99 |

$59.99 |

Free Edition

For simple returns, turn to TaxAct’s Free Edition. It’s fre

- Standard deduction

- Earned income credit

- Child tax credit

- Tuition and fees deduction

The free version allows you to upload last year’s return to save time. It walks customers through their returns by asking simple questions. TaxAct does most of the work, but several support options exist if you need extra help. If your tax situation isn’t complicated, take advantage of TaxAct’s Free Edition instead of paying for premium services.

Related Article

Related Article

9 Best and Cheapest Online Tax Services

Deluxe Edition

For a little more flexibility with your return, TaxAct's Deluxe Edition might be a better option. It offers everything that comes with the free version, but also covers most t

- Itemized deductions

- Child and dependents care

- Adoption credits

- Student loan interest

- Mortgage interest

- Real estate taxes

- HSAs

Keep in mind that you get all the benefits of the Free Edition as well.

Premier Edition

For more comprehensive support and access to all pe

- Invest

ments and investment income expenses - R

ental properties - R

oyalty and Schedule K-1 inc ome - Foreign bank and financial accounts

Self-Employed Edition

TaxAct also has a version of its software specifically for people who are self-employed. This includes small business owners, freelancers, independent contractors and other entrepreneurs. TaxAct's Self-Employed Edition helps customers easily report inco

TaxAct Self-Employed users also have access to t

Other TaxAct Editions

Besides the versions already mentioned, TaxAct also has options for b

Features

TaxAct offers several options that are standard with online tax services, like:

- Imports of last year’s return

- PDF import of a return prepared by a different software provider

- W-2 import

- Tax calculators

- Information on the latest tax laws

TaxAct goes beyond that, though, with other features that most customers will appreciate.

Xpert Assist: For a fee, get unlimited assistance from live tax experts to ask unlimited questions to file confidently. They’ll even give your taxes a quick review before you file. - Donation Assistant: This useful tool helps calculate the resale value of donated items to charitable or non-profit organizations, which will help maximize your deduction.

- Alerts: TaxAct inspects every return, looking for any errors or omissions that increase your chances of being audited. It also looks for tax savings missed when you filled out your tax return.

- Real-Time Refund Status: As you work through your return on TaxAct, it automatically updates your refund amount so you can see what you’re getting back.

- Automatic State Return Transfer: TaxAct automatically transfers information from your federal return to your state forms to save time.

- ProTips: Quick, easy-to-digest bits of information while you’re filing that help improve your tax outcome and financial wellness.

- My TaxPlan: After you file your taxes, TaxAct gives you complimentary advice on ways to boost next year's refund with a customized tax plan.

Refund Options

TaxAct customers have a variety of options for receiving tax refunds. Direct deposit to a b

Related Article

Related Article

3 Things to Know Before Paying for a Tax Preparation Service

TaxAct Support

TaxAct comes with a Help Center to answer more common tax questions. Technical and account support is available by phone.

Phone support is available all year, with extended hours during tax season. Here’s a breakdown of its phone support, which is available

January 2, 2024-April 7, 2024:

- Monday-Friday: 8 a.m.-9 p.m. CT

- Saturday and Sunday: 9 a.m.-6 p.m. CT

Support hour exceptions:

- April 8-12, 2024: 8 a.m.–10 p.m. CT

- April 13 and 14, 2024: 9 a.m.–8 p.m.

- April 15, 2024: 8 a.m.–12 a.m. CT

All TaxAct editions also include live chat support, along with

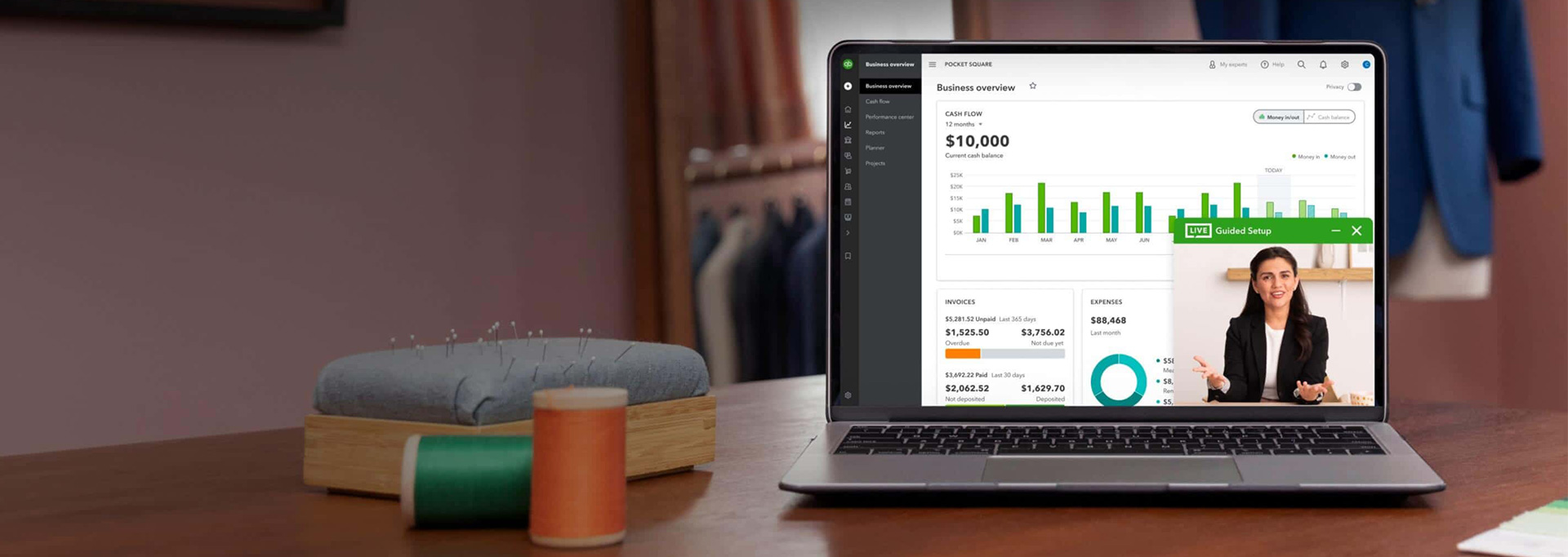

TaxAct Xpert Assist

A standout support option available through

TaxAct Xpert Assist allows you to connect one-on-one with a tax expert when you need it and share your screen so it's easy to talk through your questions. Not all tax prep services offer this type of service, so it's worth considering if you think you could benefit from a little extra support.

Is TaxAct Secure?

TaxAct takes security seriously and has several measures in place to protect customers’ information and tax returns. Security measures include:

- Complex password requirements

- Account authentication

- Device verification

- SSL encryption

TaxAct’s website also features security tips and resources to keep customers safe. TaxAct partners with the IRS and state agencies to ensure it uses the latest security protocols.

TaxAct and Audits

Nobody wants to face an audit, so it's essential to find a tax solution that provides support should it happen to you. TaxAct offers some audit support in the form of answers within its knowledge base, but it also partners with a company called Prote

ProtectionPlus comes with three years of coverage for your return and includes:

- Assistance with federal and state audits

- Contact with the IRS or State on your behalf

- Preparation of correspondence on your behalf

- Tax fraud assistance

You can enroll in this premium audit service during the TaxAct filing process.

TaxAct Guarantees

One of TaxAct’s strongest features is its guarantees. TaxAct has two guarantees in place that stand out compared to its competitors:

- $100k Accuracy and Maximum Refund Guarantee: TaxAct guarantees its software is

100% accurate and will calcu late the maximum refund for your return. If an error occurs that leads to a smaller refund or larger tax liability than you receive using another tax prep software, TaxAct will pay the difference in your refund or liability, up to $100,000 and refund your software fees. - Satisfaction Guarantee: Customers

who aren’t satisfied with their TaxAct product can simply discontinue using the pr oduct before billing occurs. Unfortunately, there is no option for refunds after printing or e-filing a tax return.

Bottom Line

TaxAct's competitive prices make it a smart option for budget-conscious people who want a simple DIY online tax solution.

Those with more complex needs or who could benefit from extra support can pay an additional fee to use TaxAct's Xpert Assist servi

Ready to File Your Taxes? Start Here