Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

As someone who’s been working since before I could drive, taxes have become a part of everyday life. I never felt comfortable filing my own taxes, though. It seemed intimidating. I didn’t want to mess anything up and have the IRS come looking for me. While my fears weren’t very rational, many people share similar thoughts, which meant going through a local tax professional to file.

According to a recent survey by the National Society of Accountants, the average cost of professional tax preparation is about $220, which is typical for a 1040 tax form with itemized deductions and a state tax return. Today, with online tax software more popular than ever, it’s not a huge ordeal to tackle your own taxes. Based on my years of experience working with tax software, here are the best online tax services I’ve found.

Summary of Best Tax Software:

- Best Value: TaxSlayer

- Best Simple Returns: Jackson Hewitt

- Best for Complex Returns: TurboTax

- Best Accuracy Guarantee: TaxAct

- Best for Live Support: H&R Block

- Best Free Option: FreeTaxUSA

- Best Free Audit Support: Cash App Taxes

- Best for Experienced Tax Filers: Liberty Tax

- Honorable Mention: e-file.com

Comparing Tax Software Costs

| Tax Service | Regular Price | Sale Price | Free Version? |

|---|---|---|---|

|

TaxSlayer |

$0-$67.95 |

$0-$54.36 federal Use code SAVE20 at checkout with this link for 20% off** |

Yes, basic 1040 for federal* |

|

Jackson Hewitt |

$25 flat fee |

N/A |

No |

|

TurboTax |

$0-$129 federal |

N/A |

Yes, with TurboTax Free Edition (Disclaimer: ~37% of taxpayers qualify for TurboTax Free Edition. Form 1040 + limited credits only) |

|

TaxAct |

$0-$99.99 federal |

N/A |

Yes, basic 1040 for federal |

|

H&R Block |

$0-$115 federal |

$0-$92 federal Save 20% off select online tax prep products through 4/15/24 |

Yes, basic 1040 for federal and state |

|

FreeTaxUSA |

$0 federal |

N/A |

Yes, all federal returns |

|

Cash App Taxes |

Free |

N/A |

Yes, basic 1040 for federal and state |

|

Liberty Tax |

$55.95-$95.95 federal |

$45.95-$85.95 federal |

No |

|

e-file.com |

$0-$49.99 federal (regular price) |

$0-$37.49 federal With code 25OFF |

Yes, basic federal return |

*Simply Free includes one free federal return. Simply Free may also include a free state return at certain times during the tax season, or may be free depending on any applicable coupons, discounts, or promotions. Simply Free is only available for those with a basic 1040. To qualify you must meet other eligibility requirements; offer may change or end at any time without notice. Less than the majority of U.S. taxpayers may qualify.

**20% off your federal tax return. Offer is valid on federal tax returns e-filed by April 15, 2024, at 11:59 p.m. ET. Only valid for new or first time TaxSlayer users only. Promotion code must be entered at checkout. Offer is not applicable to state tax returns or additional products. Offer is valid for one-time use only and cannot be combined with any other coupons, promotions, discounts, or offers. Offer is nontransferable, cannot be sold or otherwise bartered, and is not applicable to previous purchases or returns.

1. Best Value: TaxSlayer

Pricing (on sale $0-$54.36):

- Simply Free: $0*

- Military: $0, plus state

- Classic: $30.36 (regular $37.95), plus state

- Premium: $46.36 (regular $57.95), plus state

- Self-Employed: $54.36 (regular $67.95), plus state

*Simply Free includes one free federal return. Simply Free may also include a free state return at certain times during the tax season, or may be free depending on any applicable coupons, discounts, or promotions. Simply Free is only available for those with a basic 1040. To qualify you must meet other eligibility requirements; offer may change or end at any time without notice. Less than the majority of U.S. taxpayers may qualify.

Supported tax forms: All tax situations

Notable features:

- Free federal tax return filing

- Free active military federal filing

- Free tax tools

- Well-liked mobile app

Why we like it: For those looking for more bang for their buck, TaxSlayer is our choice for overall value in tax software. Its easy-to-use interface makes filing online a breeze. TaxSlayer's free version handles most simple federal tax situations. The Classic version adds access to credit, deductions and all income types. Premium takes it a step further with live chat support and priority phone and email support as well. TaxSlayer also allows active members of the military to file federal returns for free. This includes all tax situations and forms.

Customers can prepare and file online or through TaxSlayer’s sleek mobile app. Download the app to set up tax return status notifications and other updates. TaxSlayer guarantees you’ll get the maximum return possible, as well as 100% accuracy. You will be hard-pressed to find a better value than what’s offered by TaxSlayer.

Related Article

Related Article

3 Things to Know Before Paying for a Tax Preparation Service

2. Best for Simple Returns: Jackson Hewitt

Pricing: $25 for federal and unlimited state

Supported tax forms: All tax situations

Notable features:

- Flat fee for online filing

- One of the oldest tax services in America

- Offers help at brick-and-mortar office locations and at Walmart stores

- Also provides online filing

Why we like it: Jackson Hewitt's online tax prep service recently reinvented itself by providing customers a flat fee of $25 to file both state and federal taxes, "no matter what." While it doesn't offer a free filing option, Jackson Hewitt has easy pricing that includes perks such as live chat support.

The service makes it easy to download your W-2, and there is a 100% accuracy guarantee. The step-by-step process keeps it simple, perfect for those just starting to DIY taxes online.

3. Best for Complex Returns: TurboTax

Pricing ($0-$129):

- TurboTax Free Edition: $0 (Disclaimer: ~37% of taxpayers qualify for TurboTax Free Edition. Form 1040 + limited credits only)

- TurboTax Deluxe: $69, plus state

- TurboTax Premium: $129, plus state

- TurboTax Deluxe State: $64 per state

- TurboTax Premium State: $64 per state

- TurboTax Free Edition State: $0 (~37% of taxpayers qualify. Form 1040 + limited credits only.)

Supported tax forms: All tax situations

Notable features:

- File for free with TurboTax Free Edition (Disclaimer: ~37% of taxpayers qualify for TurboTax Free Edition. Form 1040 + limited credits only)

- Free tax tools

- Packages for complex returns

Why we like it: TurboTax is one of the most recognizable online tax software companies in America. They’ve been providing service online for a long time, and it shows. Filing your taxes is simple with TurboTax, which allows you to snap a photo of your W-2 using a mobile app. TurboTax Free Edition includes free federal and state filing (*disclaimer: ~37% of taxpayers qualify for TurboTax Free Edition. Form 1040 + limited credits only).

TurboTax shines with customers who have complex tax returns. TurboTax Deluxe helps maximize tax deductions and credits, while the TurboTax Premium includes investments, rental properties, cryptocurrency, plus freelancer and self-employed needs. And you can easily import your investment income automatically with TurboTax.

Note for Return Users

TurboTax previously offered a Premier package for investors and a Self-Employed option, but these have since merged into the new Premium offering. The Premium pricing is a bit lower than the old Self-Employed package, which came in at $129 at our last check, but it’s similar to the old Premier package cost and generally offers the same functionality.

Before you file, TurboTax always runs a comprehensive review of your return, ensuring nothing gets missed. For complete and quality service, TurboTax has you covered.

Once you've received your tax return, you might want to consider using your extra cash to earn a new bank account bonus.

4. Best Accuracy Guarantee: TaxAct

Pricing ($0-$99.99):

- Simple Returns: $0, plus state

- Deluxe: $49.99, plus state

- Premier: $79.99, plus state

- Self-Employed: $99.99, plus state

- State: $39.99-$59.99 per state

Supported tax forms: All tax situations

Notable features:

- Free federal tax and state return filing

- Tax experts through TaxAct Xpert Assist (for a fee)

- $100K Accuracy Guarantee

Why we like it: TaxAct has you covered, no matter your tax situation. The free version includes simple returns, and the premium offerings are designed for those with more complex tax situations, from credits and deductions to investments and rental properties. There’s even a self-employed version for freelancers and independent contractors.

Xpert Assist Is No Longer Free

Of note this year is that TaxAct’s previously free Xpert Assist service, which provides access to real tax pros, now comes with a fee if you want to use it. It’s still a useful feature, but it’s worth knowing going in that will cost you at least $59.99, depending on the tier you choose.

You can’t talk about TaxAct without mentioning its $100K Accuracy Guarantee. Most online tax software services have guarantees, but not to this extent. TaxAct guarantees their software is 100% accurate and will calculate the maximum possible refund for customers. If there’s an error in the tax software that causes you to receive a smaller refund or larger tax liability than you get from another tax service, TaxAct will pay you the difference, up to $100,000. You’ll also receive any fees paid to TaxAct for filing services.

If you're audited by the IRS and end up paying penalties or interest because of a software error, TaxAct reimburses penalties and most audit costs, up to $100,000, plus TaxAct software fees. Certain limitations apply, but it’s great to know that TaxAct stands behind their product like this.

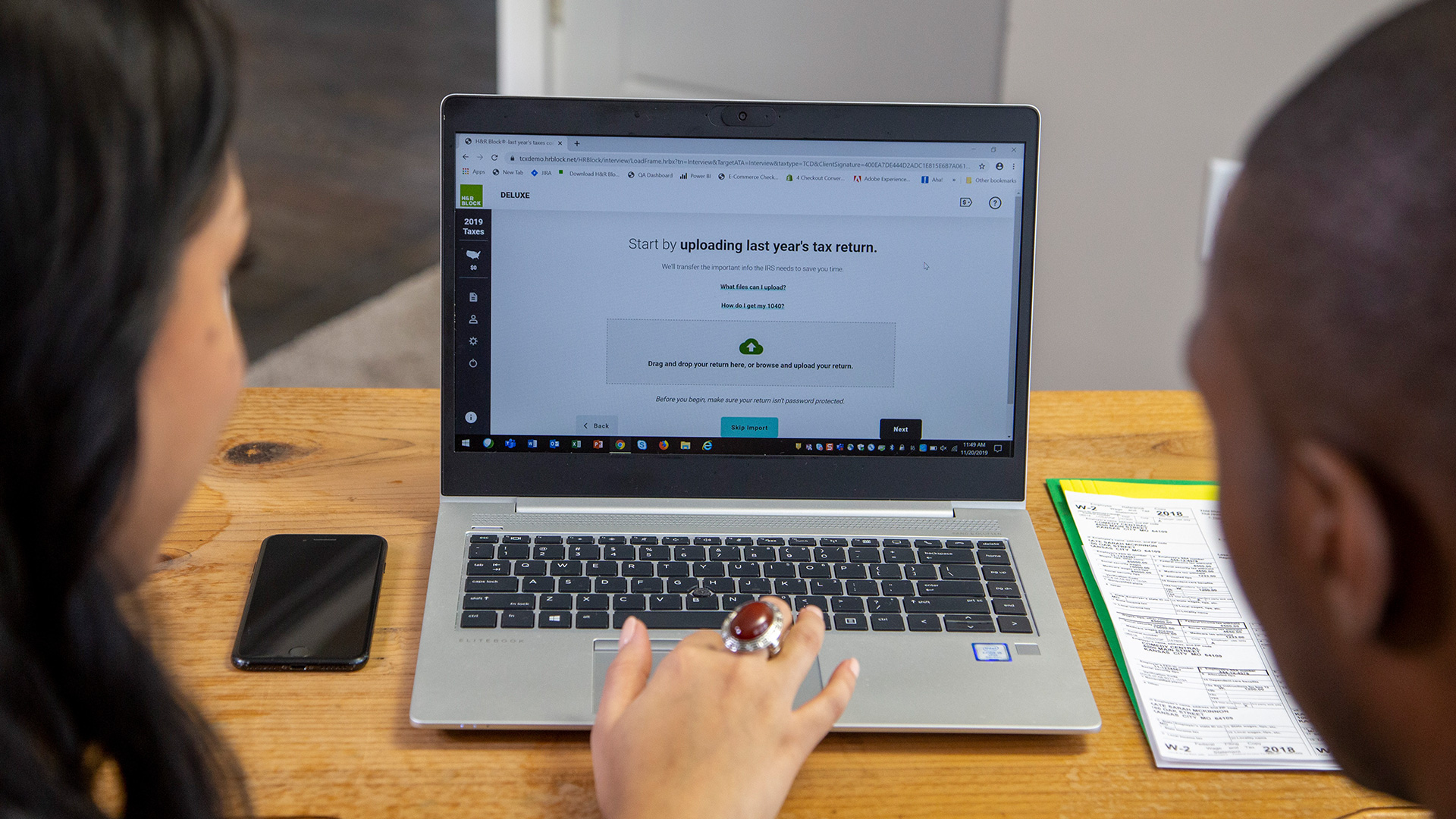

5. Best for Live Support: H&R Block

Pricing ($0-$92):

- Simple Returns: $0

- Deluxe: $44 (regular $55)

- Premium: $68 (regular $85)

- Self-Employed: $92 (regular $115)

- State: $49 per state ($0 for simple returns)

Supported tax forms: All tax situations

Notable features:

- Free federal and state filing

- Free tax tools

- Live help with Online Assist

- Online and in-person options

Why we like it: H&R Block is one of the oldest tax preparation services, founded in 1955. Over the past 60+ years, it’s developed into a world leader in the industry. Besides visiting a local H&R Block tax professional, you can also file your return online. With several options and price points, H&R Block has a good fit for most people.

On top of free and Premium tax filing services, customers can receive online support through Online Assist from a tax specialist, such as a tax expert, enrolled agent or a CPA. Online Assist is available as an add-on—for a fee—to every filing option, but it’s perfect for people who need extra help as they work through their tax return.

6. Best Free Option: FreeTaxUSA

Pricing ($0-$14.99):

- Federal: $0

- Form 1099: $0, plus state

- Deluxe Edition: $7.99, plus state

- State: $14.99 for each state

Supported tax forms: All common tax forms and many less-used tax forms

Notable features:

- Free federal tax filing

Why we like it: FreeTaxUSA is an online tax preparation software for federal and state returns. Federal returns are free to file, and all tax situations are covered, including filing jointly, homeownership, itemized deductions, dependents, investments and more. Self-employed tax filings are free as well.

This free online tax service also allows you to import last year’s return from another service, like TurboTax, H&R Block, or TaxAct. Plus, FreeTaxUSA guarantees to get you the maximum refund with 100% accuracy. Customers receive support in the form of a searchable help section and email support. If you opt for the Deluxe Edition, you’ll receive chat support, as well as unlimited amended returns.

The real draw is Audit Defense, which, for $19.99, supplies support from audit specialists if you find yourself subject to an IRS audit. With this service, audit experts will communicate with the IRS on your behalf and can provide up to $1 million in services.

7. Best Free Audit Support: Cash App Taxes

Pricing: $0

Supported tax forms: All common tax forms

Notable features:

- Free federal tax return and state return filing

- Audit defense

Why we like it: Cash App Taxes (formerly Credit Karma Tax) is an online tax service offering free federal and state filings for most common tax situations. The free service supports several filing statuses, including:

- Single

- Married filing jointly

- Married filing separately

- Qualifying widower with dependent child

- Head of household

Cash App Taxes also supports some forms for self-employment tax situations, like 1040 schedule C, schedule E and schedule SE. If you filed with Credit Karma Tax in previous years, don't worry—the rebranded Cash App Taxes will still let you access those returns.

You can estimate their refunds before formally doing their taxes, and you can get your refund a few days days faster when you deposit it into a free Cash App account. Cash App Taxes stands behind its free service with a guarantee of 100% accuracy and says you will receive the maximum refund possible.

However, customer service for Cash App Taxes is limited to email support through its website. This tax software also features free audit support for those who qualify. Audit support includes features like reviewing documents, consultations, written correspondence with tax authorities and attendance at conferences or hearings on your behalf.

8. Best for Experienced Tax Filers: Liberty Tax

Pricing ($45.95-$85.95):

- Basic (Simple Returns): $45.95 (regular $55.95), plus state

- Deluxe: $65.95 (regular $75.95), plus state

- Premium (Self Employed): $85.95 (regular $95.95), plus state

- State: $36.95 for each state

Supported tax forms: Form 1040, 4562, 8829, 4136, 4684, 4835, 8839, 8853, Schedule A, B, C, E, F, K-1

Notable features:

- Can import past tax returns from competitors

- Free double-check service (in person)

Why we like it: Liberty Tax is known for its in-person tax help, with over 2,500 locations across the U.S. They also offer online tax software for customers who want to DIY their taxes from home. Liberty’s website if full of free resources, like withholding and mileage calculators, income tax tables and other helpful tools.

With a price point of $45.95, you can find better bargains than Liberty’s Basic version for simple returns through other companies on this list. If you’re an experienced tax filer, though, Liberty Tax is a solid choice. There’s not a lot of hand-holding with Liberty or extra support features you may find with other top online tax software. If you know what you’re doing, you won’t miss those features. Plus, you always have the option to hand off your tax return to your local Liberty Tax branch if you get in a bind.

9. Honorable Mention: e-file.com

Pricing ($0-$37.49):

- Simple Returns: $0, plus state

- Deluxe Plus: $20.99 (regular $27.99), plus state

- Premium Plus: $37.49 (regular $49.99), plus state

- State: $24.75 per state

Supported tax forms: All tax situations

Notable features:

- Simple federal returns

- Expert support via email

Why we like it: e-file is worth considering if you’re shopping around for an online tax preparer that offers lower cost deluxe and premium features for more complicated returns.

If you’re one of millions of Americans who will file a simple return this year, then you’re better off using a service that allows truly free filing. Online tax preparers like FreeTaxUSA or H&R Block’s Free Edition allow people with dependents, HSA and student loan interest to file both federal and state for free. While e-file does offer free federal filing, its so-called Free edition charges $22.49 state tax returns.

Which Tax Preparation Service Is Right for You?

With the help of online tax software preparation services, like those mentioned above, you can file your own taxes like a pro. Many services allow you free account access to start, only paying once you actually file. Why not take advantage of the convenience and support found with online tax software? You’ll gain a better understanding of the entire tax filing process and save money at the same time.

FAQs

-

Most of the tax services listed above offer free e-filing services for at least simple federal tax returns. Cash App Taxes, H&R Block and TaxAct also offer free state filings in some tax situations.

-

Cash App Taxes offers free audit support services for members who have their tax returns audited. Services are provided through a partnership with audit specialists Tax Protection Plus. The program offers free support like consultations, document review and collection, written correspondence with taxing authorities and representation at any conferences or hearings with taxing authorities.

-

The best free tax filing service depends on your tax situation and specific needs. Almost all of the tax services on our list offering some form of free tax filing. Cash App Taxes is the only option listed that includes free audit support. Review each service’s features and supported forms the find the right one for you.

-

If you don’t have experience filing your own taxes or have a more complicated tax situation, it might be worth it to pay a tax prep service to do your taxes. Many online tax services have created filing processes that are easy to understand and use for most people. One option is to try filling out your tax return through one of these inexpensive programs and if you get stuck, then turn to someone else for help. In some cases, you can pay for premium support through online tax services.

-

Free tax filings are usually limited to more common tax situations. If you have a more complicated tax situation, there’s a good chance you’ll need to pay to file your federal and state taxes. Qualifications vary from one tax service to the next. Take time to research all of the free tax filing options to determine your eligibility.

-

Small business owners should examine their specific tax needs to determine if using the cheapest tax service makes sense. If your business falls in the realm of self-employment, it could be a smart move. It’s more important, though, to find a tax service that covers your tax situation and offers extra services beneficial to a business.

-

If you hire someone else to do your taxes, they could be liable if they make mistakes that result in an audit. If you use an online tax service, do your homework to find out who is responsible if there are mistakes made. Many of the services listed above come with accuracy guarantees. Ultimately, it’s up to you to go over your return before it’s filed to ensure accuracy.

-

Both are designed to help people prepare their own taxes and offer additional assistance from CPAs for a cost. However, tax preparation software is downloaded to a device; whereas an online tax preparation service is completed entirely on your internet browser.