Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Cash App Taxes is one of many tax services that can help you file your fed

What Is Cash App Taxes?

Cash App Taxes (formerly Credit Karma Taxes) is now in its third year of offering free tax filing and continues to have the super-efficient product model Credit Karma Taxes was known for.

Here are some notable features of Cash App Taxes:

- Free state and federal returns filing: If you DIY your taxes, you can file state and federal returns for free. Cash App Taxes can help you prep and file the most

common tax forms and schedules without paying a cent. - Basic support for

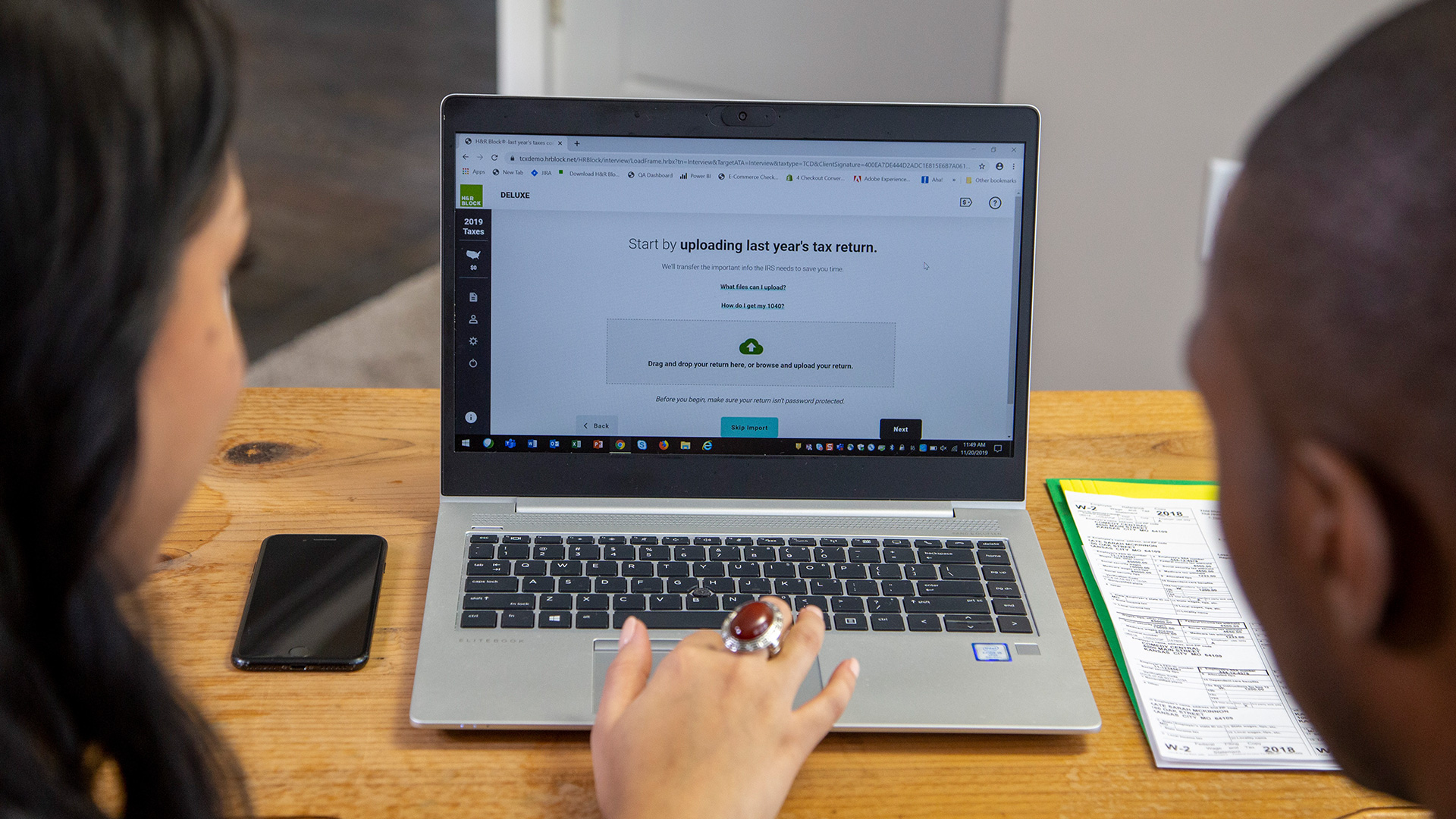

standard or ite mized deductions: The free online filing service can also help you determine what deductions you qualify for and whether you should opt for a standard or itemized return. - Import from other tax filing services: If you've

used H&R Block, TurboTax or TaxAct in the past to file taxes, Cash App Taxes gives you the ability to import last year's data and personal information.

Related Article

Related Article

9 Best and Cheapest Online Tax Services in July 2024

How to Use Cash App Taxes

Here's how to use Cash App Taxes:

- Download Cash App

- Create an account

- Import your prior year's tax information

- Fill out your current tax year data

- File and submit your returns

Cash App Taxes imports your tax information from the year prior. Once you upload your 1040 form, the app will pull your adjusted gross income and personal data from the form.

Quick Tip

After downloading Cash App, you can file your taxes from your phone or computer at cash.app/taxes.

You can al

- Itemizing deductions and filling out your 1040

- Submitting payment

- Setting up direct deposit for your tax refund or post-dating a direct

deposit of taxes you owe

Related Article

Related Article

TurboTax Review: Get a 100% Accuracy Guarantee

Pros and Cons of Cash App Taxes

Pros

- File for free

- Get your tax refund early

- Maximum refund guarantee

- Free audit defense

Cons

- Need to use the mobile app

- Limited customer support

- Can’t file foreign or multiple state returns

Pros

Here are the main benefits of using Cash App Taxes:

- File for free: The major draw of using Cash App Taxes is that you can file your state and federal returns for free. Plus, you won't be pressed to purchase any expensive add-ons.

- Get your tax refund early: You can receive your refund up to

six days quicker because you can receive direct deposits within the software as soon as they're received. Sign up for direct deposit, and they’ll drop a max of $25,000 in to your account per direct deposit and up to $50,000 within a 24-hour period. - Maximum refund guarantee: Say

you origi nally filed your federal tax return through Cash App Taxes. Then, you file an amended federal tax return through another tax filing service. Cash App Taxes will refund you up to $100 of the difference if you owe less on your taxes or get a larger return through the other tax filing service. - Free audit defense: Should you be flagged for a potential audit, Cash App Taxes will connect you

with a qualified case manager to help you gather documents for your case, draft written correspondence to tax authorities on your part and respond to inquiries.

Cons

Now, let's take a look at some of the disadvantages of Cash App Taxes:

- Need to use the mobile app: While

you can prepar e and file your taxes on your computer, you need to download the Cash App Taxes app to log in or create an account. After that, you can hop back onto your computer to continue the process. This isn’t a major deal, but it could dissuade app-weary folks. - Limited customer support: Since Cash App Taxes is entirely free, there's limited customer support. Plus, unlike some of its competitors, there's no option to work with a tax professional.

- Can't file foreign or multiple state returns: Currently, mul

tiple state returns, part-year state filings or foreign-earned income ar en't supported.

Related Article

Related Article

TaxAct vs. TaxSlayer: How Do They Compare?

Cash App Taxes vs. the Competition

While all tax preparation services help you prepare and file your return, they’re not all created equal. Here’s how a few tax filing services compare.

H&R Block

- Our Rating 4.5/5 How our ratings work

Straightforward and easy-to file tax prep that comes with accuracy and maximum refund guarantees, H&R Block can also handle complex tax needs. Additional support is available from brick-and-mortar locations if needed. Even those opting for the free tier can enjoy robust features, including state filings at no additional cost.

Whereas Cash App Taxes is a 100% free tax filing service, you can also file a simple return (For

TurboTax

- Our Rating 4.5/5 How our ratings work

TurboTax shines when it comes to customers who have more complex tax returns. The Deluxe option helps maximize tax deductions and credits, while Premium covers investments—including cryptocurrency and and stock activity—and rental properties. Plus, you can easily import your investment income automatically with TurboTax.

Similar to H&R Block, TurboTax has

TaxAct

- Our Rating 4.5/5 How our ratings work

TaxAct has a robust accuracy and refund maximum guarantee that eclipses most competitors. Its no-frills tax service is easy to use and simple to navigate. It really shines with its Xpert Assist help service, which allows filers across all tiers to consult a tax expert, though the service now comes with a fee.

TaxAct offers free filing on fed

Who Is Cash App Taxes Best for?

Cash App Taxes is best for those who want a relatively simple way to file state and federal taxes without needing to pay for a tax preparation service or tax professional. This

- Nine-to-fivers (aka those with W-2 tax forms)

- Business owners

- Freelancers, gig economy workers and self-employed folks

If you are disabled, have student loans or are a retiree, the tax filing service might also be a good fit for you.

Cash App Taxes is not

- Live and work in multiple states

- Need to file multiple state returns

- Need to file a part-year state return

- Need professional support for complicated tax situations

Cash App Taxes could be a solid choice if you're comfortable going fully DIY or looking for an option to file your taxes for free without needing to

FAQs

-

Yes. Should you get dinged with a penalty or interest from the tax authorities due to a calculation error made by Cash App Taxes, you'll get reimbursed up to $1,000 through gift cards.

-

You can file both your federal and state returns for free through Cash App. There are no upsells or pricey add-ons.

-

Yes. You need to create an account or log in via the app. Once you've logged in, you can prep and file your taxes from either your computer or smartphone.

-

Cash App Taxes complies with the IRS's privacy, security and business requirements. Cash App uses security measures such as 128-bit encryption, two-factor authentication and an on-site security team.