Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

H&R Block

- Our Rating 4.5/5 How our ratings work

Straightforward and easy-to file tax prep that comes with accuracy and maximum refund guarantees, H&R Block can also handle complex tax needs. Additional support is available from brick-and-mortar locations if needed. Even those opting for the free tier can enjoy robust features, including state filings at no additional cost.

Simple, Intuitive Tax Filing With Many Support Options

Not only is H&R Block one of the oldest tax preparation providers, but it’s also one of the most trusted, completing more than 800 million tax returns since its inception.

H&R Block’s online software offers several options for those planning to do their own taxes, from simple returns to more complex tax situations. The company also offers support from tax pros and in-person help at its local offices. Here’s a look at H&R Block’s online software, its features, pricing and who it’s best for.

Pros

- Multiple packages to fit most tax needs

- 24/7 customer support

- Option to work with a tax professional online or in person

- Free version available (with state included)

- Simple navigation & software interface

- Ability to upload tax documents

Cons

- More expensive than some competitors

- Extra fee for state tax filing

- Expensive add-ons

H&R Block at a Glance

|

Price |

Free Online: $0 federal + $0 per state |

|

Guarantees |

Maximum refund guarantee |

|

W-2 + Prior Year Import |

Yes |

|

Audit Support |

Free analysis to gauge the situation or audit support for a fee |

|

Access to Tax Experts |

Phone, chat and AI support plus expert help with paid tiers |

Pricing

Similar to other online tax services, H&R Block offers several packages at different price points to fit varied tax needs.

There are

H&R Block Products & Pricing

| Tier | SUMMARY | FEDERAL | STATE |

|---|---|---|---|

|

Free Online |

|

$0 |

$0 |

|

Deluxe |

|

$44 (sale) |

$49 |

|

Premium |

|

$68 (sale) |

$49 |

|

Self-Employed |

|

$92 (sale) |

$49 |

Features & Capabilities

H&

It also provides access to a host of useful features for preparing your taxes. Some unique features are available for all users, while others may require an extra fee. Here's a look at some of H&R Block's most promising features.

Peace of Mind Extended Service Plan

With the Peace of Mind service plan, customers receive pro

Second Look Review

If you filed your own taxes or hired someone else to do it the prev

H&R Block reviews for missing education and other credits, and checks your filing status to determine if filing differently would've earned you a larger return. If you're eligible for money money, H&R Block will refile an amended return on your behalf for free.

Related Article

Related Article

9 Best and Cheapest Online Tax Services in July 2024

Tax Pro Go

Tax Pro

H&R Block even allows you to request the same tax pro each year if you find one you like working with and knows your situation. You can also drop off your documents at a local office or sit down with a tax professional who will prepare your return.

Tax Identity Shield

H&R Block's Tax Id

Expat Services

If you're a U.S. citizen living outside of America, you likely need to file expat taxes with the IRS annually. H&R Block's expat services provide tax support for U.S. citizens living overseas. There are options to file online or through an H&R Block tax advisor. Expat online services st

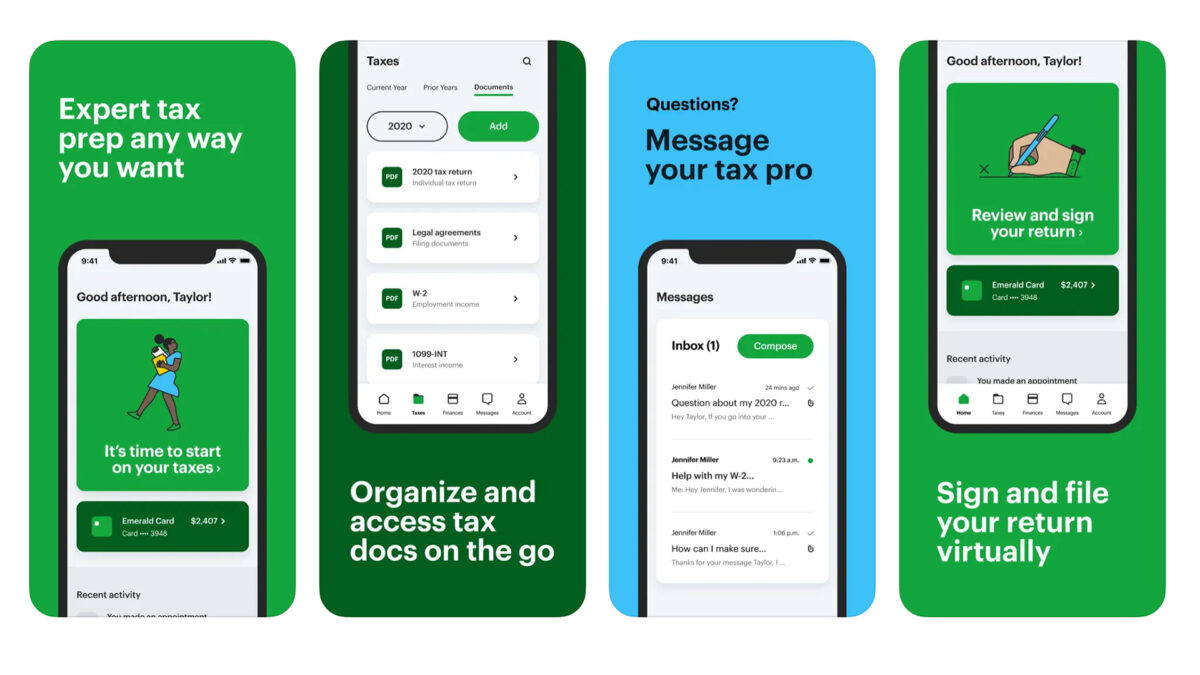

Mobile App

H&R Block customers can tackle their tax returns digitally through the My

Online Tax Help

Tax Pro Review

Tax Pro Review is another add-on feature. With the service, an H&R Block tax profes

Tax Tools

Whether you're well versed in DIY tax preparation or a novice, H&R Block provides several free tools to help you along as you prepare your tax returns. Tax tools include calculators, tax reform information, checklists, and a knowledge database.

H&R Block Support

H&R Block provides live phone and chat support with all of its tax preparation packages except the free version, along with the new AI Tax Assist chat option, which some may find useful. There are also support features available through the company's mobile app.

If you prefer in-person help, you can make an appointment with one of its many offices nationwide. As mentioned above, H&R Block offers several supplementary services that include more prominent customer support services for an additional fee.

Related Article

Related Article

3 Things to Know Before Paying for a Tax Preparation Service

Auditing Services

H&R Block tax pros are well-versed in federal and state taxes if you run into an issue with the IRS. If you receive a notice from the IRS, H&R Block provides a free analysis to gauge the situation. You'll receive upfront pricing for additional audit services based on your situation, such as if you need auditing defense and representation before the IRS.

How Does H&R Block Stack Up to Competitors?

H&R Block offers an easy-to-use solution to DIY tax preparation. With several packages to choose from, it's ideal for individuals who want to file taxes on their own, but have the option of help from a tax professional. Most packages includes chat and phone support and an array of tax tools for added convenience. It's also a good choice for students and people with simple tax returns.

Although H&R Block is comparable to many competitors, you can find cheaper DIY tax software options. H&R Block has a number of add-ons to support more complex tax situations, but these add-ons can drive up the cost of doing your taxes. If you have a more complex tax situation, there are other tax software packages that you can consider for less.

Related Article

Related Article

TaxAct vs. TaxSlayer: How Do They Compare?

Is H&R Block Worth It?

H&R Block offers several filing options for your DIY tax needs, so the user-friendly software could be the ticket for filing taxes this year. If you need extra help, H&R Block offers additional support packages and in-person help from tax professionals as a backup.

While it's not the cheapest online tax software, H&R Block tax packages have handy tools to make tax filing a breeze. However, it may not be the best option if you are already familiar with another software or are looking for a budget-friendly solution for complex tax situations.

FAQs

-

H&R Block's online tax software is a great choice for new DIY tax filers who need step-by-step help walking through their tax return. There's also an option of free filing for simple returns. H&R Block may not be the best option for cheap tax returns compared to some of its competitors.

-

According to H&R Block, if you're using H&R Block Tax Pro Review, you can expect your return to be reviewed within three days.

-

H&R Block guarantees transparency with its pricing. Whether it's one of the company's tax preparation packages or one of its add-on services, H&R Block provides pricing before you sign up or pay.

-

H&R Block guarantees 100% accuracy and reimburses you for any IRS penalties and interest if it makes errors on your tax return.