Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

QuickBooks® Online

- Our Rating 5/5 How our ratings work

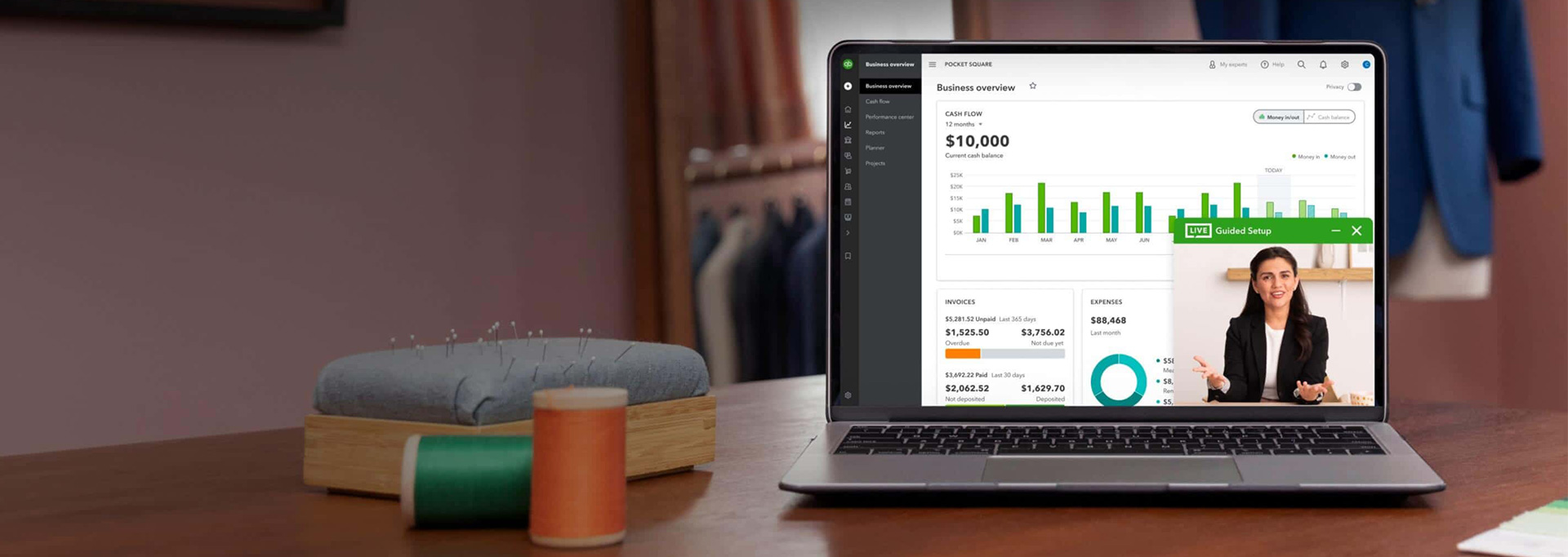

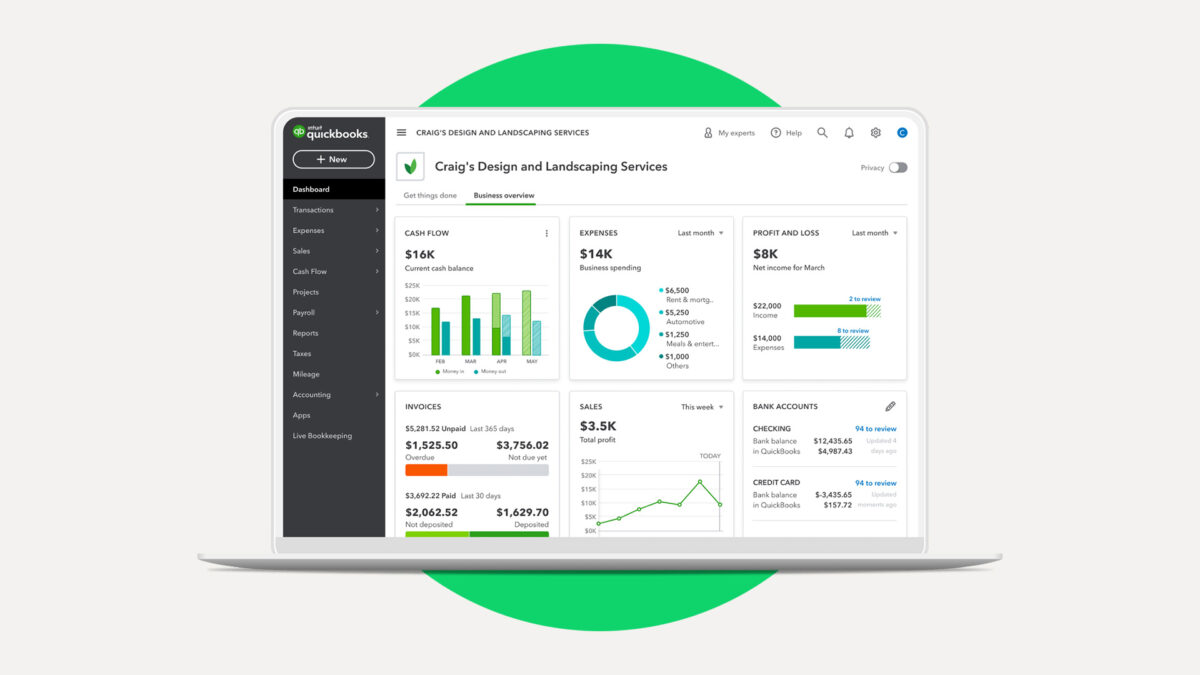

Quickbooks Online has been a leading name in accounting software for decades. It offers a wide variety of features designed to meet the needs of both large and small businesses. While new users may experience some difficulty with learning how to use Quickbooks, we were impressed with the level of customer support offered. With Quickbooks Online, it's easy to scale your bookkeeping as your business grows, since it offers tiered packages for companies of all sizes.

A Favorite Among Accounting Professionals

Intuit’s QuickBooks® Online is one of the most widely-used accounting software programs for small businesses. With five different plans, including one for freelancers and independent contractors, the software provides features for businesses of all sizes and industries.

That said, QuickBooks Online does have a bit of a learning curve compared to other accounting software options, and it can be pricey, especially if you decide to add payroll services to your package. Here’s everything you need to know about QuickBooks Online and how to decide if it’s right for you.

Pros

- Robust, comprehensive feature set

- Access to assistance, from guided setup to ongoing support

- Access to Intuit's virtual bookkeeping service for an additional fee

- Easy integration with other business software, tools and accounts

Cons

- Plans are relatively expensive compared to competitors; in some cases, freelancers and independent contractors can get by with free alternatives

- Limited account users for lower-tier plans; only the highest tier plan allows for more than 5 users

- Steep learning curve; new users may need some time to learn all the tips and tricks

Highlights

- QuickBooks Online offers a wide range of features for sm

all and medium businesses across five plans . - The software program can have a steep learning curve, but most tiers (excluding Self-Employed) include free guided setup.

- The software maker, Intuit, also offers add-ons, including tim

e tracking, payroll management, payment processing and virtual bo okkeeping. - QuickBooks Online can be c

ostly compared to competitors, so it's crucial that you consider both the benefits and drawbacks before you sign up.

About QuickBooks Online

QuickBooks was first introduced as a desktop version and quickly became the most popular bookkeeping software among small- and medium-sized businesses. In 2

With QuickBo

Because the QuickBooks Online software can be difficult to navigate at first for uninitiated customers, Intuit offers free guided setup on all plans except the Self-Employed version or during a free trial.

Currently, all plans are 5

QuickBooks Online Plans

| Plan | Monthly Cost |

|---|---|

|

Self-Employed |

$15 |

|

Simple Start |

$30 |

|

Essentials |

$55 |

|

Plus |

$85 |

|

Advanced |

$200 |

QuickBooks Online Self-Employed

The least expensive of the five tiers, QuickBooks Online Self-Employed, is designed specifically for free

- Import an

d track yo ur income and expenses - Capture and

organize receipts Estimate quarterly tax payments- Bas

ic rep orts, including year-by-year summaries of work activity - Tra

ck mil es

If you also want to do your taxes with TurboTax®, you can upgrade to the

Finally, you can upgrade to the

Related Article

Related Article

TurboTax Review: Get a 100% Accuracy Guarantee

QuickBooks Online Simple Start

If you're just starting out or your small business is still in its early stages of growth, you may consider the Simple Start plan, which costs $3

- Maximi

ze tax dedu ctions - Customize invo

ices and accept payments from clients an d customers - Create c

ustom estimates, which can b e converted into invoices - Track s

ales and calculate sales tax - Manag

e 1099 con tractors - Con

nect o ne online sales channel - Foreca

st cash fl ow

QuickBooks Online Essentials

At $5

- Recurring invo

ice billing and ven dor payments - Trac

k bill st atus - Detaile

d reports, including sales, accounts receivable, and acc ounts payable - Time tr

acking for you and your e mployees - Conn

ect th ree online sales channels

Also, unlike the lower-tier plans, Essentials allows up to thre

Explore the Best Business Checking Accounts

Visit the Marketplace

QuickBooks Online Plus

As your business grows, so will your need for a more detailed analysis of your financials and forecasting. With QuickBooks Online Plus, which cos

- Profitability tracking

for individual projects, including user-friendly dashbo ards and detailed reports - Inventory tra

cking, including alerts when it's low - More specific budg

eting, inventory, and c lass reports - Connect all online sales channels

With the Plus plan, you can add up to five use

QuickBooks Online Advanced

The most expensive QuickBooks Online tier, the Advanced plan, is designed for me

- Seamless data transfer be

tween QuickBooks and Excel for better insights and analytics - Integrate premium app

s, including LeanLaw, HubSpot, DocuSsign®, Bill.com, Salesforce, Centage, and m ore - On-de

mand training to make the most of the software - Data ba

ckups and restoration services - Unlimite

d chart of accounts and e ntries - Employee ex

pense tracking and man agement - Cust

omized access for u sers - A dedic

ated account team at Intuit - Work

flow auto mation - Cust

o m reports - Class an

d location tracki ng for revenue

Business owners can add u

QuickBooks Online Add-Ons

In addition to the five pricing tiers, Intuit offers s

Payroll

QuickBooks offers three payroll tiers, ranging from $4

Here's what you'll get with each tier:

| Payroll Core | Payroll Premium | Payroll Elite | |

|---|---|---|---|

|

Cost |

$45 plus $5 per employee per month |

$75 plus $8 per employee per month |

$125 plus $10 per employee per month |

|

Features |

|

|

|

Time Tracking

QuickBooks Online offers t

- Premium - $20 plus $8 per user per month

- Elite - $40 plus $10 per user per month

Both tiers allow business owners to keep track of their employe

Additionally, the Elite tier provides proj

Payments

As previously mentioned, some of the QuickBooks Online plans allo

| Transaction | Fee |

|---|---|

|

ACH bank payments |

1% ($10 maximum) |

|

Credit or debit card through an invoice |

2.9% plus $0.25 |

|

Credit or debit card via a card reader |

2.4% plus $0.25 |

|

Credit or debit card keyed |

3.4% plus $0.25 |

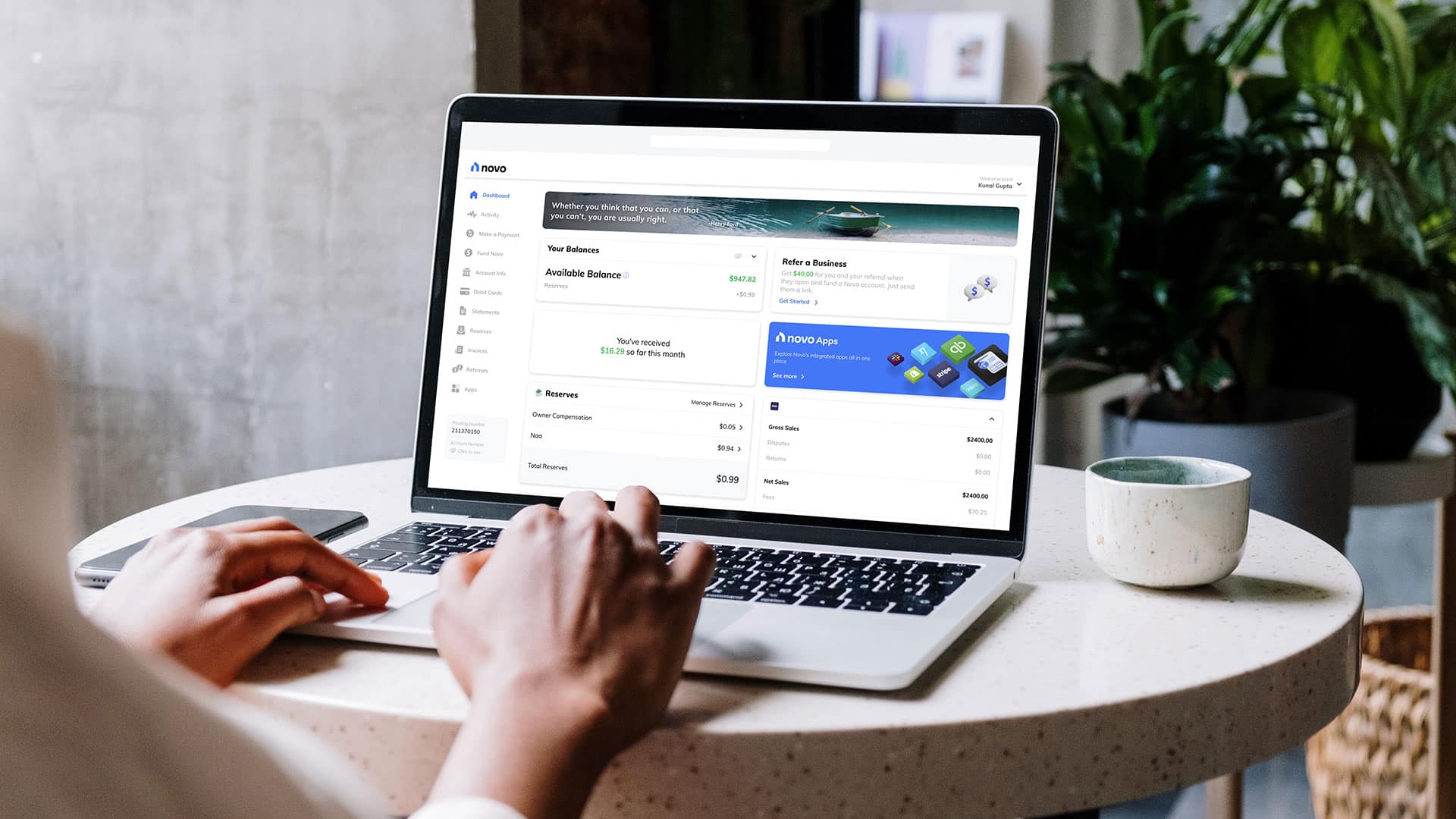

Virtual Bookkeeping

If you're not comfortable managing your business finances, you can enlist th

You'll then get ongoing support, so you don't h

That said, it doesn't include finan

Drawbacks

Overall, QuickBooks Online offers an immense amount of value, as well as more than enough features to handle the average business's accounting needs. However, as with any tool or service you. can use to manage your business finances, there are some instances where it may not be the best choice for what you're trying to accomplish.

- Plans are Relatively Expensive: Compared to some of its competitors, QuickBooks Online can be expensive, particularly for smaller businesses that only need basic reporting, invoicing, and bookkeeping software. In some cases, freelancers and independent contractors can get what they need for free.

- Limited Account Users on Lower-Tier Plans: Unless you shell out for the highest-tier plan, the largest number of users you can have at a time is five, and the cheapest plan doesn't allow for multiple users at all.

- Potentially Steep Learning Curve: You don't have to be an accounting whiz to understand QuickBooks Online, but it can take some time to get set up and to learn all the tips and tricks to maximizing the program's features — even with help from an Intuit expert.

The Bottom Line: Is QuickBooks Online Right for You?

Before you make a decision about your bookkeeping software, it's importan

Ready to give QuickBooks a try? Start here.

Then, compare pricing and plans across multiple providers to determine the best fit for you. If you're already working with an acco