Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

H&R Block for Small Business

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

H&R Block for small business offers a wide range of services for small business owners, including freelancers and contractors. This flexibility means more business owners may be able to benefit from H&R Block’s tax products and services.

Accommodating Tax Solutions for Small Businesses

Managing taxes, bookkeeping and payroll can be daunting. That’s why many entrepreneurs and freelancers turn to companies like H&R Block® for support. Getting help from reputable online tax services or a tax professional can make tedious and often confusing financial tasks easier to manage.

A key benefit of working with H&R Block is the flexibility it offers. You can purchase software to file your own taxes, get in-person or virtual support with taxes and payroll, or opt for many other year-round business financial services. Here are some of the tax, bookkeeping and payroll options available through H&R Block for small businesses.

Pros

- 100% satisfaction guarantee with desktop tax software (before filing)

- Flexible options for DIY and professional tax help

- E-file up to five federal returns with desktop software

- Free audit support with desktop software

- Add-on audit protection available when working with tax pros

Cons

- Additional fees for an extended download time frame

- No live tax help with desktop software

- Additional fee to e-file state tax return with desktop software

- Additional fee for Business Tax Audit Support when working with a tax pro

H&R Block Small Business Services Overview

|

Price |

Self-Employed online: $92 (sale) $115 (regular) federal + $49 per state |

|

Guarantees |

Maximum refund guarantee |

|

W-2 + Prior Year Import |

Yes |

|

Audit Support |

Basic support to understand next steps (online filing) |

|

Access to Tax Experts |

On-demand expert help with online filing |

|

Other Services |

Bookkeeping |

Get a 20% Discount When You File Online With H&R Block

File your taxes today and receive 20% off select online tax prep products at hrblock.com. Offer is valid through April 15, 2024.

H&R

- Tax return preparation: Business owners can use H&R Block tax preparation software or work with tax professionals to prepare business tax returns. Several tax preparation options are available, with varying prices and features.

- Bookkeeping: You can elect this standalone service to help your small business stay on top of tax obligations throughout the year.

- Payroll services: This is also a standalone service that can help business owners manage payroll and stay compliant and organized for tax time.

- Business formation services: H&R Block can help you select the right business structure, such as S corporation or limited liability company, to set up your venture for success and help you save on taxes.

Related Article

Related Article

9 Best and Cheapest Online Tax Services

Tax Preparation Services

As a small business owner, there are two ways H&R Block can help prepare your business tax return. You can use the company’s software to prepare your tax return (deskto

H&R Block Small Business Tax Products & Pricing

| Tier | SUMMARY | FEDERAL | STATE |

|---|---|---|---|

|

Self-Employed Online |

|

$115 (sale price: $92) |

$45 |

|

Premium & Business Software |

|

$99 |

1 state included |

|

Tax professional |

|

$203+ depending on services |

Included |

File Online

Eligible small business owners (e.g., freelancers, contractors and other self-employed individuals) can also prepare their business tax returns online with H&R Block. The cost for this service depends on whether you want access to a ta

- Deluxe: This is a good option for those who have multiple income streams and are looking for some help from a tax expert.

- Premium: This product is designed with investors in mind and also offer guidance for rental property owners

- Self-Employed: Those who own their own business and want to do things like claim small business expenses can benefit from this tier.

An additional

Tax Software

H&R Block’s Premium & Business tax software may be a good fit for small business owners who want a user-friendly option to file tax returns and other tax forms (like W-2s and 1099s) themselves. The so

One state is included with the federal price, but itt will cost an addition

If, for some reason, you don’t like the tax software, you can submit a request before you file and receive a

Related Article

Related Article

Tax Deadlines and Extended Filing Deadlines in 2024

Work With a Tax Professional

Some small business owners prefer to work with a tax professional when it comes to filing annual tax returns. If your business is an S Corporation, C Corporation, Partnership, or you are self employed, H&R Block offers three ways to work with a tax

- Meet in person

- Virtual tax preparation

- Drop off files at an office

Tax preparation costs for the three options above sta

You also have the option to add Business Tax Audit Support protection to your tax ret

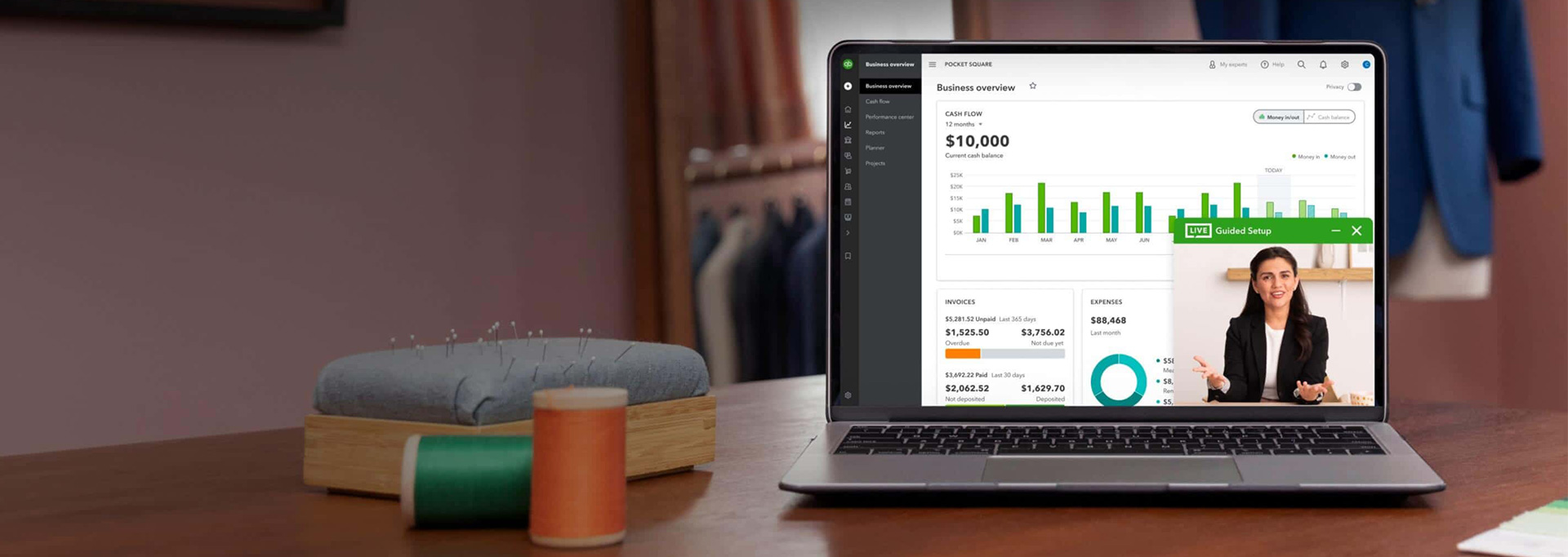

Bookkeeping Services

Bookkeeping services, like those from Block Advisors by H&R Block, can help small business owners manage business cash flow (both revenue and expenses), forecast business financials, stay on top of tax obligations, and more. According to H&R Block, its full-service bookkeeping fees could cos

Related Article

Related Article

5 Best Business Bank Account Bonuses and Promotions (2025)

Pricing

The cost of small business bookkeeping services with Block Advisors by H&R Block varies based on the types of services you

- Self-service, $39 per month: Basic income and expense management you do yourself.

- Full-service, $175 per month: Get a dedicated accountant, yearly books review and more.

- Premium: $299 per month: Everything in Full-Service plus more tracking and inventory tools, estimates, charts and more.

Both the full-service and premium bookkeeping options offer on-d

Block Advisors by H&R Block offers a free 30-minute consultation to discuss the differences between the company’s two bookkeeping options. You can use the free consultation to see if either is right for your business.

Payroll Services

As a small business owner, your tax responsibilities to the state and federal government are more than a once-a-year occurrence. Depending on your business structure and whether you have employees (including yourself), you may have to file tax reports and pay tax withholdings on a quarterly and monthly basis—including payroll tax filings. (Even freelancers have to pay taxes.)

Block Advisors by H&R Block offers back-office support for payroll services that can help free up time for small business owners and make sure they remain compliant. The service is available

6 Best Banks for Small Businesses

Pricing

As with Block Advisors by H&R Block’s other services, the cost of payroll services varies based on your business’

- Basic, $59 per month: Dedicated accountant, standard reporting and good for self-employed folks.

- Plus, $79 per month + $10 per employee: Offers year-end W-2s and 1099s, provides detailed reports, makes paying contracts easier.

- Premium, $140 per month + $10 per employee: Provides benefits of Plus, along with workers' comp and retirement benefits services.

A free consultation is available. You can set up an appointment to talk to a specialist and find out if the service is a good fit for your business. Just keep in mind that specialists are sales representatives. So it’s wise to do your own research before making a final decision.

Business Formation Services

H&R Block now also offers business formation services to help small businesses pick the right business structure for their needs. Common business structures include limited liability company, S corporation, C corporation and nonprofit. Each has its own pros and cons, as well as tax implications. H&R Block can guide you toward the best choice for your specific business scenario.

Pricing

Business formation through Block Advisors starts at

Recommended Business Credit Cards

| Credit Card | Rewards Rate | Annual Fee | Intro Bonus | Learn More |

|---|---|---|---|---|

|

|

1.5%Cashback

Earn unlimited 1.5% cash back on every purchase made for your business. The advertised rewards type is cash back, but it’s important to note that you’re technically earning Chase Ultimate Rewards points (which can then be converted to cash back). |

$0 |

$750Cash Bonus

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. |

Apply Now |

|

|

1% - 5%Cashback

Earn 5% cash back on your first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. It also offers you 2% cash back on your first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. |

$0 |

$750Cash Bonus

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening |

Apply Now |

|

|

1x - 3xPoints

Earn 3 points per $1 spent on Southwest® purchases. Earn 2 points per $1 spent on Rapid Rewards® hotel and car rental partners. Earn 2 points per $1 spent on local transit and commuting, including rideshare. Earn 1 point per $1 spent on all other purchases. |

$99 |

60,000Southwest Rapid Rewards Points

Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open. Dollar Equivalent: $840 (60,000 Southwest Rapid Rewards Points * 0.014 base) |

Apply Now |

|

|

1x - 3xPoints

Earn 3x points on the first $150,000 of combined spending in a number of key business categories |

$95

This fee includes extra cards for authorized users, such as employees, at no additional charge. |

90,000Chase Ultimate Rewards Points

Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,070 (90,000 Chase Ultimate Rewards Points * 0.023 base) |

Apply Now |

Is H&R Block for Small Business Right for Your Tax Needs?

H&R Block for small business offers a wide range of services for small business owners, including freelancers and contractors. This flexibility means more business owners may be able to benefit from H&R Block’s tax products and services.

Nonetheless, it’s always wise to shop around and compare multiple options before you make your final decision. With fee-based tax preparation services in particular, you may want to consider the average cost of getting your taxes done and see how H&R Block’s fees compare.