Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

If you’re a freelancer, self-employed worker or independent contractor, your taxes might be more work than you realized. In addition, taxes are ever-changing, so the rules and guidelines for self-employed folks might be a bit—here’s what you need to know.

Who Is an Independent Contractor?

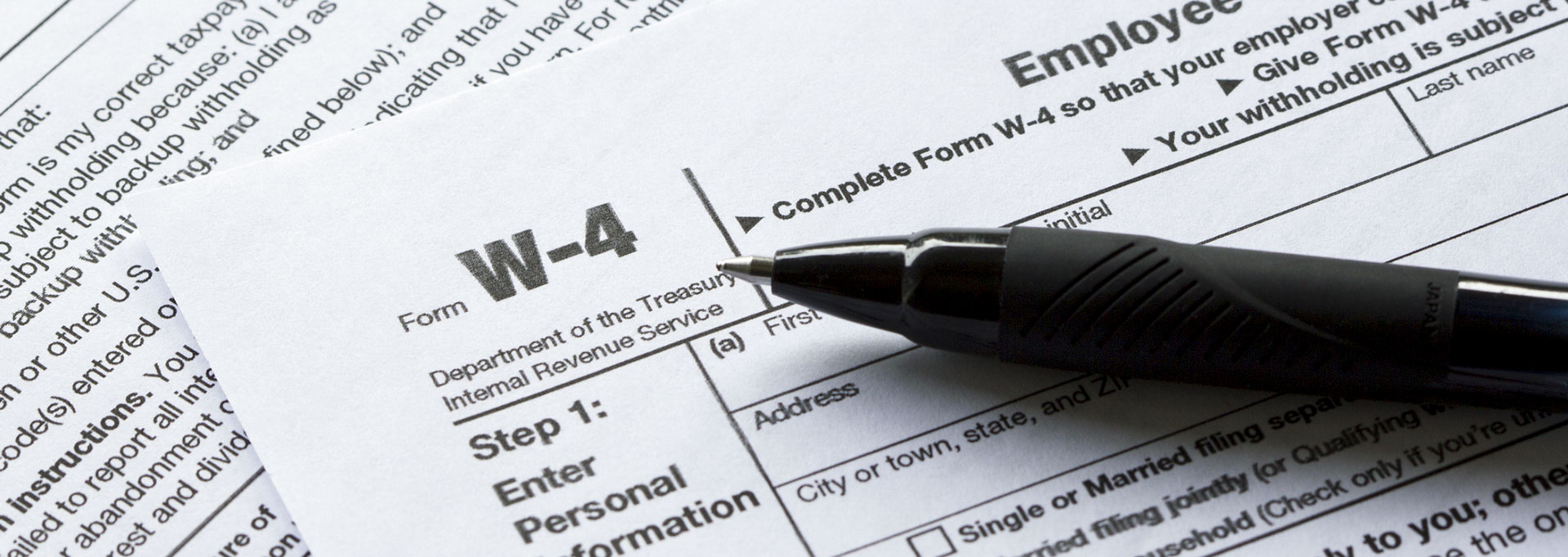

While employees typically get a W-2 and have withholdings on paychecks, independent contractors don’t. Instead, they complete a W-9 and receive payment for the total amount of the project. Then, the contractor pays out the taxes they owe at tax time. Here are some general guidelines on how an independent contractor is defined by the IRS.

How much you pay in taxes depends on how you’re classified. If you’re an independent contractor, you’ll know by the type of tax form you completed—a W-9. This is for all self-employed folks and those classified as a sole proprietor, LLC or S-Corporation.

Related Article

Related Article

9 Best and Cheapest Online Tax Services in April 2024

How to Pay Taxes as an Independent Contractor

Most independent contractors pay federal estimated quarterly taxes four times a year. You should make estimated quarterly taxes if you expect to owe more than $1,000 in income tax (even with credits and other withholdings).

The final estimated quarterly taxes are always due at the beginning of the next year. It’s also important to remember that you’re paying an estimate, not the exact amount you owe.

TurboTax

- Our Rating 4.5/5 How our ratings work Read the review

TurboTax shines when it comes to customers who have more complex tax returns. The Deluxe option helps maximize tax deductions and credits, while Premium covers investments—including cryptocurrency and and stock activity—and rental properties. Plus, you can easily import your investment income automatically with TurboTax.

Overview

Regardless of how complex your tax return is, you’ll likely be able to find a TurboTax service that meets your needs. TurboTax offers several pricing tiers, including the TurboTax Free Edition (Disclaimer: ~37% of taxpayers qualify for TurboTax Free Edition. Form 1040 + limited credits only), as well as premium tiers geared toward more complicated returns. There’s even a full-service edition for anyone who’s worried about filling out their tax return incorrectly.

Read the reviewPros

- A product for every tax situation, both simple and more complex

- TurboTax Premium includes investments and rental properties

- A comprehensive review of your return, ensuring nothing gets missed

Cons

- Some products are more expensive than competitors

- Pricing for specific packages can be hard to find at a glance

Important Tax Deadlines

The 2024 quarterly estimated tax deadlines for independent contractors are:

- 1st quarter: April 15, 2024

- 2nd quarter: June 17, 2023

- 3rd quarter: September 16, 2023

- 4th quarter: January 15, 2025

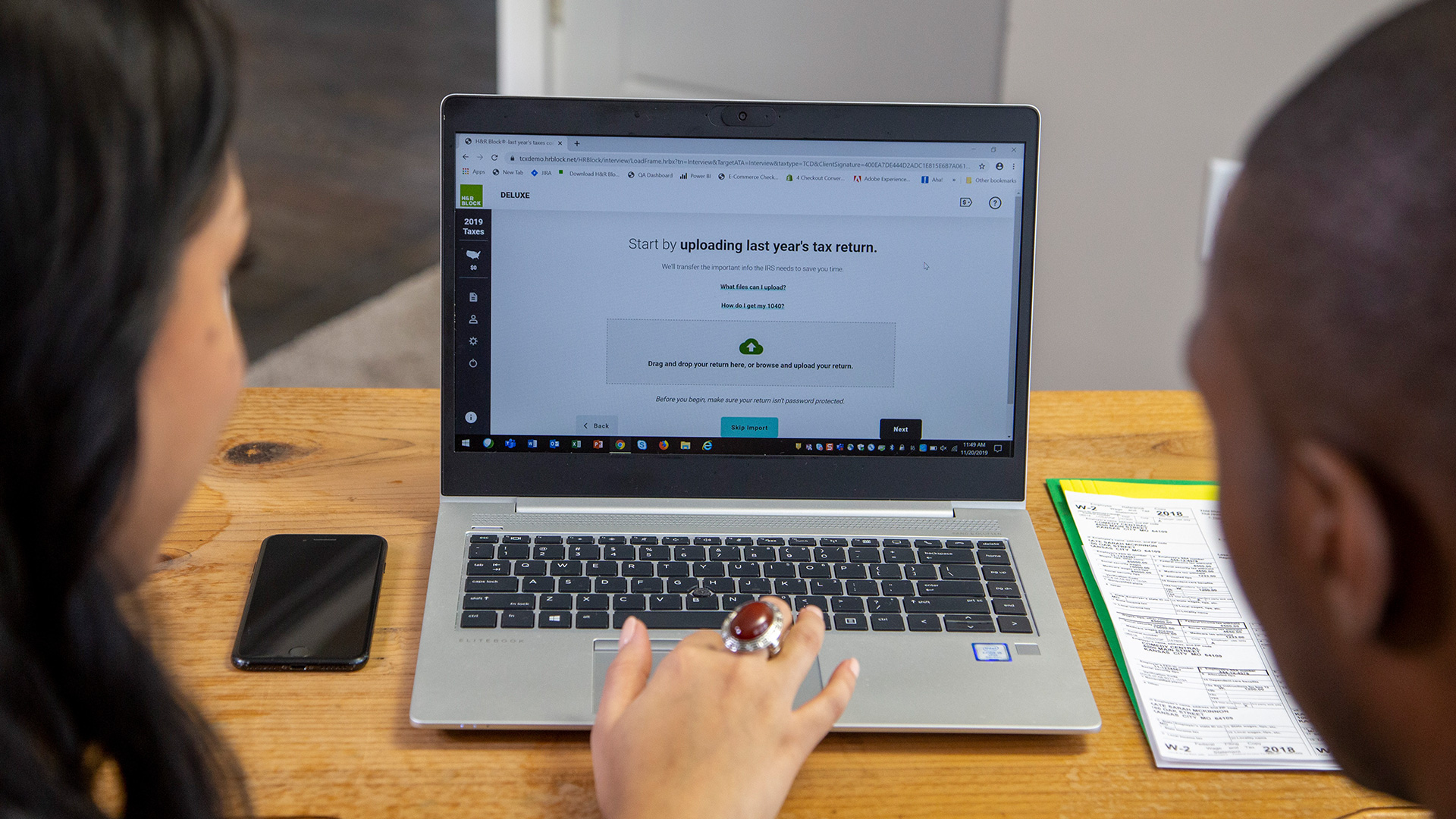

H&R Block for Small Business

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work Read the review

H&R Block for small business offers a wide range of services for small business owners, including freelancers and contractors. This flexibility means more business owners may be able to benefit from H&R Block’s tax products and services.

Overview

Business owners have a lot of flexibility when using H&R Block for small business. H&R Block’s tax preparation software can be used to file independently online, or with the help of a tax professional. If users decide to work with a professional, they have the option to meet in person or virtually—or drop off files at an office. In addition to tax preparation, H&R Block also offers small businesses bookkeeping, business formation and payroll services that help with tax payments and reporting obligations throughout the year.

Read the reviewPros

- 100% satisfaction guarantee with desktop tax software (before filing)

- Flexible options for DIY and professional tax help

- E-file up to five federal returns with desktop software

- Free audit support with desktop software

- Add-on audit protection available when working with tax pros

Cons

- Additional fees for an extended download time frame

- No live tax help with desktop software

- Additional fee to e-file state tax return with desktop software

- Additional fee for Business Tax Audit Support when working with a tax pro

How to Estimate Your Taxes

The estimated taxes you'll pay is based on reporting your self-employment income. You’ll file a Schedule C form with your personal tax return detailing your business profits and losses. To calculate the self-employment taxes, you’ll use the Schedule SE form.

Don't forget that in addition to federal taxes, you may need to pay state taxes. Check with the tax authorities in your local area for more information. If you’re an LLC or an S-Corp, you’ll file business tax returns rather than additional paperwork to your personal returns.

6 Best Banks for Small Businesses

What Can You Write Off as an Independent Contractor?

Calculating your taxes is based on your income, filing status (married versus single, for example), and deductions (standard versus itemized). The calculation also considers if you qualify for tax credits and deductions, which can lower how much you owe. For salaried W-2 employees, these deductions and credits might mean they get more money back. For self-employed workers who haven’t made tax payments throughout the year, you might still owe money on your taxes, but these credits and deductions can reduce how much you owe.

Self-employed workers have the advantage of claiming business deductions. You may qualify for some of them, including:

- Home office deductions: This is the cost of your home workspace that you use exclusively for work as an independent contractor. You can deduct this space whether you rent or own, and while you’re going off the honor system, it’s a good idea to have precise measurements in case you get audited. If you own your home, you can also deduct a portion of your mortgage interest, homeowners insurance and more.

- Utility deductions: Aside from claiming a portion of your home utilities (if you own your home), you can also deduct phone and internet usage on your taxes. You could deduct the whole expense if you can prove the line is both ordinary and necessary. It’s not easy to do this if you use the line for business and personal use, so if you have a second phone line devoted entirely to business use, you can deduct all of that.

- Insurance premiums deductions: If you have insurance through the Marketplace or otherwise pay for premiums, you can deduct health, dental, vision and other health-related premium costs. You can do this for yourself and your dependents if they don’t have their own insurance.

- Other deductions: Depending on your work, you might also qualify for deductions on meals, travel, costs associated with your business (like startup costs, advertising, business insurance) and retirement plan contributions.

Check with a qualified tax professional if you have questions about a specific deduction on your taxes.

TaxSlayer

- Our Rating 4.5/5 How our ratings work Read the review

Regardless of which tier you opt for, TaxSlayer offers users an incredible amount of value for a relatively affordable price. Featuring a free federal version meant for simple tax situations, as well as a Classic tier that includes access to additional deductions, credits and forms and a Premium tier that comes with robust customer support functionality, you'll likely be able to find a service offered by TaxSlayer that satisfies your needs. Plus, active military members can file their federal returns for free with TaxSlayer.

Overview

TaxSlayer offers several tiers of service, ranging from a free federal version that’s best for simple tax situations to a premium tier that includes live chat support, as well as priority phone and email support. While not everyone qualifies for TaxSlayer’s free edition, pricing on all of TaxSlayer’s tiers compares favorably to its top competitors’ prices.

Simply Free includes one free federal return. Simply Free may also include a free state return at certain times during the tax season, or may be free depending on any applicable coupons, discounts, or promotions. Simply Free is only available for those with a basic 1040. To qualify you must meet other eligibility requirements; offer may change or end at any time without notice. Less than the majority of U.S. taxpayers may qualify.

Read the reviewPros

- Premium tiers are relatively affordable compared to competing products

- Free version available for some users

- Free federal returns for active-duty military members

Cons

- Some tax credit forms not available in free version

- Free version not available to high-income users

The Bottom Line

Handling your taxes as a self-employed worker or independent contractor can feel like a lot of work, and sometimes it is. If you need help, consider hiring a tax professional to help you throughout the year—not just in April—so they can set you up for the most success with the least amount of extra cash coming out of your pocket. Tax laws frequently change, so doing it right the first time is vital to ensure you’re in line with the IRS.

Related Article

Related Article

3 Things to Know Before Paying for a Tax Preparation Service

FAQs

-

Self-employed workers are on the hook for the self-employment tax (15.3%) and income taxes. You pay an estimate, not an exact amount, so to be safe, you may want to set aside anywhere from 25% or more of your income for taxes. This might seem like a lot, but it’s better to have enough to cover your taxes rather than scrambling if the IRS finds out you owe more than you originally said you did.

-

When you’re working for someone else, both you and your employer pay taxes on your earnings. You don’t see as much money taken out since your employer handles a portion of it for you. When you work for yourself, you’re paying both employer and employee taxes.

-

Businesses can't withhold taxes from an independent contractor. They can only withhold taxes from salaried employees.

-

The best way to reduce how much you owe on your taxes is to take advantage of all the deductions you’re eligible for. If you think you’ll save more by itemizing deductions instead of taking the standard deduction, you could owe less and pocket more once you file your tax return.

In most cases, as an independent contractor or sole proprietor, you probably won’t get a tax refund. But if you’re a small business owner, that could be the difference in getting a refund versus owing money to the IRS. Consider examining which business classification is best for you to get the most back in your tax refund or not owe as much if you have to pay.