Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Whether you want to send money internationally to support a family member, pay an employee who lives in a different country or fund an overseas investment venture, there are several money platforms to choose from. A global bank may seem like the obvious choice, but some banks charge $50 for international wire transfers.

Fortunately, there are cheaper platforms you can use to send money internationally. To help with your search, we compiled a list of money transfer platforms below. The best option for you varies depending on the country you're sending funds to, how much you're sending, and your desired transfer speed.

Best International Money Transfer Services

| Platform | Transfer Fees | Transfer Speed |

|---|---|---|

|

MoneyGram |

Starts at $1.99 per transfer |

Within few minutes |

|

WesternUnion |

Starts at $1.99 per transfer |

Few minutes up to 5 days |

|

Wise |

Starts at 0.43% of the amount sent |

Instant to up to two days or longer |

|

Xoom by PayPal |

From $0 to $5.99 on average, or higher for some countries

|

Few minutes to a few days |

We chose four options for sending money internationally based on transfer speed, fees and available payment methods.

Important: Even though some of the companies below offer low or no upfront fees, they generally charge exchange rate markups to earn a profit. Put simply, this means the exchange rate given to you is typically lower than the market exchange rate. You can find current market exchange rates for some currencies on the Federal Reserve’s website and other places like Bloomberg and Yahoo Finance.

MoneyGram

MoneyGram offers digital and in-person money transfers. It has over 430,000 locations across the world. The company provides fast transfer speeds—many transfers arrive within minutes but could take longer depending on where your recipient lives and the transfer method.

- How to use it: To send an online transfer, you must sign up for a MoneyGram account. You can make a transfer on its website or using their mobile app.

- Coverage: More than 200 countries and territories.

- Fees: Starting at $1.99 per transfer. MoneyGram’s transfer fees vary widely based on your transfer amount, payment type and pickup location.

- Transfer speed: Most transfers are instant but may take longer, depending on the destination and payment method.

- Transfer limits: For most countries, you can send up to $10,000 per online transfer. Cannot exceed $10,000 each month.

- Payment options: Credit card, debit card or bank transfer.

Explore the Best Bank Bonuses Currently Available

Visit the Marketplace

Western Union

Western Union hosts over 500,000 cash pickup locations across the globe to support in-person international money transfers. You can also transfer money digitally to your recipient’s bank account, mobile wallet or to their nearest Western Union location, depending on where you’re sending the money.

- How to use it: Visit a nearby location to set up an account or create one on Western Union’s website if you prefer digital transfers. In addition, you can download the app from the App Store or Google Play.

- Coverage: Over 200 countries.

- Fees: Starts at $1.99 per transfer, but fees vary widely depending on where your recipient lives and the payment method. The fee for using a credit card is much higher than paying via debit or bank transfer.

- Transfer speed: As early as the same day if using a credit card, debit or bank transfer.

- Transfer limits: Transfer maximums vary widely by country. For example, as of this writing, the maximum amount you can send to Jamaica is around $6,492, while the limit is $50,000 for transfers to India.

- Payment options: Credit card, debit card or bank transfer. The available payment method varies depending on where you’re sending money.

Wise

Wise, formerly TransferWise, is a UK-based fintech company that offers international transfers with low upfront costs. The transfer speed for sending money via credit or debit card usually takes a few minutes, but bank transfers may take up to five business days.

- How to use it: Register for a Wise account online or via the app, which is available on the APP Store and Google Play.

- Coverage: Over 60 countries.

- Fees: Varies but generally less than 1% of the transfer amount for banking transfers.

- Transfer speed: When you pay by card, transfer speed is generally instant but may take longer for bank transfers.

- Transfer limits: Up to $1.6 million USD for international wire transfers.

- Payment options: Credit card, debit card, bank transfer, wire transfer, Apple Pay and Google Pay

Related Article

Related Article

Best Credit Cards for TSA PreCheck and Global Entry Reimbursement

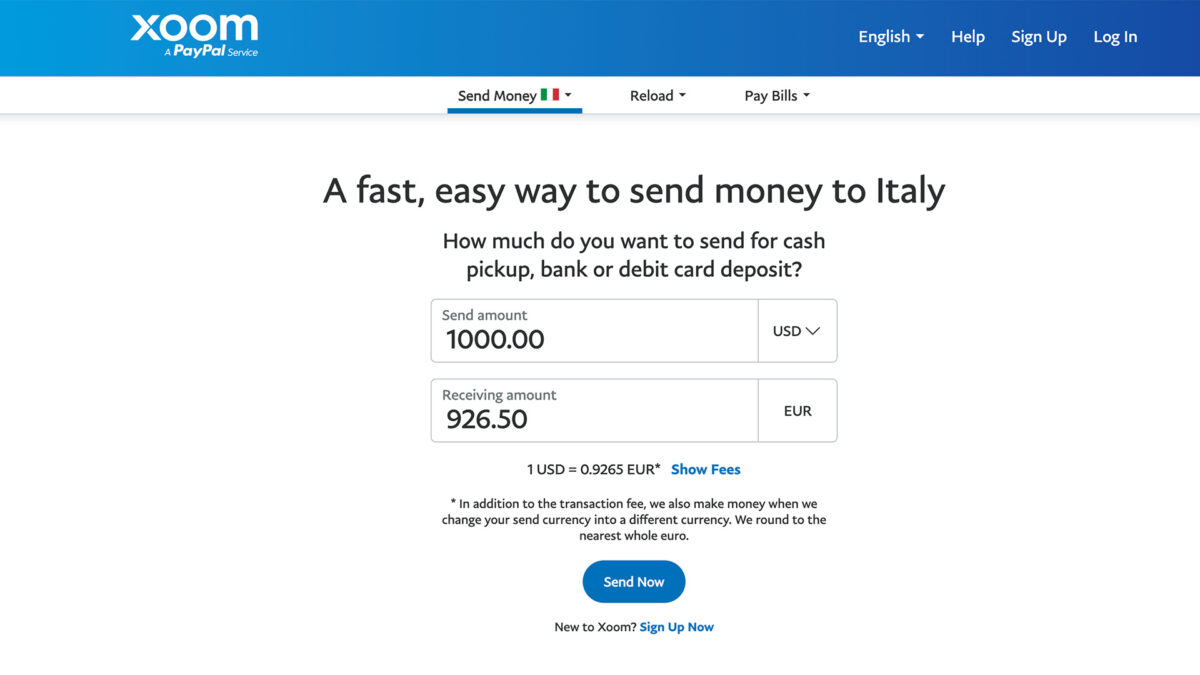

Xoom by PayPal

Xoom, a PayPal company, is a service that has fast international transfers, and in most cases, funds are delivered in just a few minutes. It also offers low fees on mobile wallet transfers when you pay with a bank or PayPal account—generally from $0 to $5.99 or higher, depending on where you’re sending funds.

- How to use it: Create a Xoom account to make transfers through Xoom’s website or via the Xoom app (available in the App Store or Google Play).

- Coverage: Over 160 countries.

- Fees: Upfront fees typically range from $0 to $5.99 or higher, depending on the amount you’re sending, the transfer method and the delivery destination.

- Transfer speed: As fast as a few minutes, but up to a few days.

- Transfer limits: $50,000 daily limit and $60,000 monthly limit for U.S. residents.

- Payment options: Bank transfer, debit card, credit card and PayPal

Tips on Sending Money Internationally

The best platform for sending money abroad depends on various factors, such as where the recipient lives, how much you want to send them, and how fast you want the funds to arrive. Here are some tips to help you find the service that meets your needs at the cheapest price.

- Comparison shop. To find the best deal for the country you need to send money to, compare fees from several transfer platforms.

- Exchange rate markups. Also, pay attention to the exchange rate of each service. The higher the exchange rate markup, the less money your recipient will receive in their currency.

- Transaction limits. Select a service with limits that meet your needs, especially if you need to send large amounts of money in one transaction.

- Try to avoid paying with a credit card. Some issuers may charge a cash advance fee that makes sending money using a credit card more expensive than other transfer methods, like using a debit card or bank transfer.

- Check transfer speeds. Delivery times (transfer times) vary widely based on your chosen platform and the country where the recipient lives. Expedited transfers may also come with a higher fee.

- Track your transfer. After completing the transfer, keep track of the delivery status to ensure it arrives and contact the recipient to confirm it went to the right person.

Related Article

Related Article

8 Easiest Bank Accounts You Can Open Online Instantly (2025)

Frequently Asked Questions

-

Transfer speeds vary based on the transfer service you use. While some money transfer platforms offer instantaneous transfers, it may take up to a few days or longer, depending on the transfer method and the platform you choose.

-

No, Zelle only works with U.S. banks, so you can only send money to someone with a U.S. bank account.

-

PayPal allows consumers to send money to banks and other platforms to recipients in over 200 countries through its international transfer service, Xoom. You can also transfer money through Zoom for a cash pickup at one of its partner locations or have cash delivered to the recipient's front door.

-

You can only send money through the Apple Pay app to people in the U.S. However, some platforms like Wise allow you to pay for transfers with cash from your Apple Pay account.

-

Venmo only allows you to send cash to someone who resides in the U.S.