Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Lili is a fintech company that offers a variety of products and services for small businesses. Freelancers, independent contractors and other small business owners can manage their banking, submit invoices to clients, track and manage expenses, optimize their tax returns and more.

If you're just starting a business or you're looking for an inexpensive way to bank and manage your company's finances as well as your personal finances, it's definitely worth it to check out Lili to determine if it's the right fit for you.

In this Lili review, you'll get a full picture of what the bank offers and how to determine if it's a good choice for your business.

About Lili

Lili was founded in 2018 by Lilac Bar David and Liran Zelkha with the mission to empower freelancers by providing tools and resources to manage their businesses in one place.

It's important to note that while Lili offers a bank account, it's not technically a bank but a financial technology company. Lili partners with Choice Financial Group, which is FDIC-insured, to provide its banking services.

The bank account is mobile-only, which means that Lili doesn't have any brick-and-mortar branches. You also can't access your account via a desktop browser. The Lili app is available for Android and iOS.

Lili Bank Account Review

The Lili banking account offers a variety of tools that freelancers and other small business owners can use to make the most of their finances in one place. Here's what you need to know about the bank account's fees and features.

Account Fees

The Lili bank account has no account fees, which means no monthly fees, no overdraft fees, no foreign transaction fees and no in-network ATM fees. With more than 38,000 MoneyPass® ATMs around the country, you can locate them in the Lili app.

If you take a withdrawal from a non-MoneyPass ATM, there's a $2.50 fee within the U.S. and a $5 fee abroad.

There are also no minimum balance requirements with the fee-free account, which can be the case with other business bank accounts.

Unfortunately, there's no way to make either domestic or international wire transfers.

Checking Account

The Lili Checking Account does a lot more than just help you keep track of your income and expenses. Here are some other tools and features you'll enjoy from your all-in-one business bank account:

- Expense management: You can quickly categorize each of your transactions with the Lili mobile app. You'll also get reports and insights to help you evaluate your spending habits.

- Receive payments: You can easily connect your payment apps, including Venmo, PayPal and Cash App, to transfer money into your account in seconds. You can also set up direct deposit and receive payments up to two days early.

- Link accounts: You can link your Lili bank account to external accounts, making it easy to transfer money between your business and personal banks.

- Push notifications: Users can sign up to receive push notifications every time money comes in or goes out of the account.

- Cash deposits: It can be difficult to make cash deposits with an online-only bank, but Lili makes it possible through partnerships with more than 90,000 retailers, including Walmart, CVS, Walgreens, 7-Eleven® and more. Just keep in mind that you can only deposit up to $1,000 per 24-hour period, up to a maximum of $9,000 per month. Additionally, some retailers may have lower limits, and you may be charged a fee of up to $4.95 by the retailer to complete the transaction.

Tax Optimizer

Taxes can be daunting for sole proprietors, single-member LLCs and S corporations alike, so it's nice to see a business bank account that offers some tax tools. Here's what you'll get:

- Write-Off Tracker: It's generally best to avoid mixing business and personal expenses in the same account, but with this tool, you can easily categorize personal and business expenses with the swipe of your finger.

- Tax Bucket: The last thing you want is to forget to save up for estimated taxes. With the Tax Bucket tool, you can automatically set aside a percentage of all your income for tax payments.

- Receipt Scanner: Lili Checking Account users can upload a picture or PDF of each receipt, so they don't have to worry about keeping a paper copy in case of an IRS audit.

- Pre-filled Schedule C: At the end of the year, you can get a pre-filled 1040 Schedule C form that you can use to file your own taxes or share with your tax accountant.

- Expense reports: You'll get access to both quarterly and annual expense reports, giving you a summary of your company's spending so you have a good idea of where you stand financially.

How to Pay Taxes as a Freelancer

Automatic Savings

Lili doesn't offer a separate savings account, but you can set up sub-accounts for emergency savings. You can also set up automatic weekly transfers based on how much you want to save each day.

For example, if you want to set aside $5 per day in your emergency savings, the Lili banking app will automatically transfer $35 each week. There's a maximum of $10 per day, and you can withdraw the money at any time.

Lili Pro Features

You can take advantage of most of the Lili banking app's features with the fee-free version of the checking account. However, you'll also be able to enjoy interest on your savings, cash back with your debit card and more if you upgrade to the Lili Pro tier.

Here's a breakdown of what you'll get with Lili Pro:

- Savings account interest: When you set up an emergency bucket sub-account, you'll earn 1.5% APY on your balance, turning it into a high-yield savings account.

- Debit cash rewards: When you use your Lili debit card at participating merchants, you'll receive cash back on each purchase. Unfortunately, Lili doesn't disclose a list of participating merchants or the rewards rates on its website.

- BalanceUp overdraft protection: In addition to charging no overdraft fees, Lili also covers up to $200 in overdrafts on your Visa® Debit Business Card when you opt-in for the BalanceUp feature.

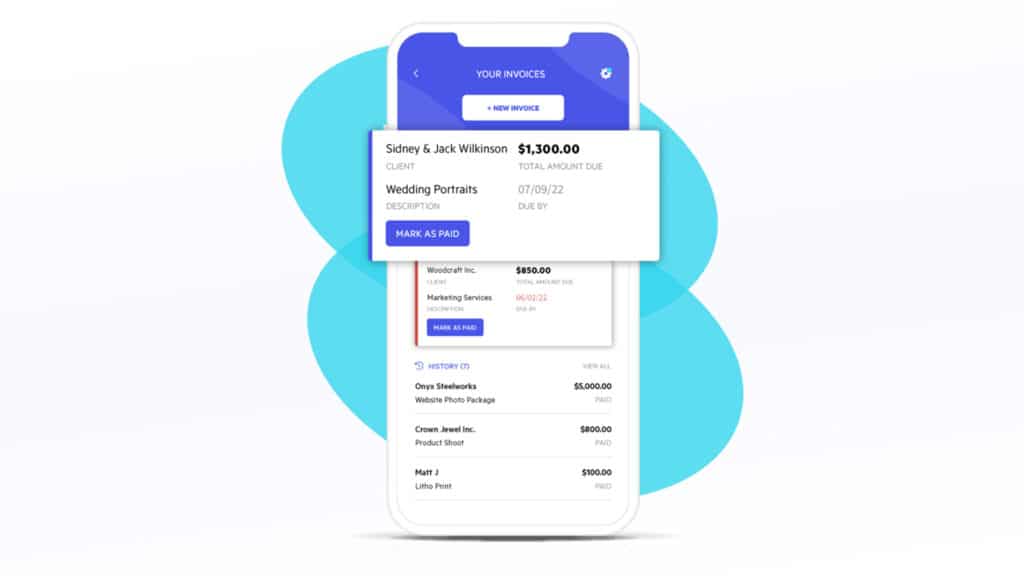

- Invoicing: Users can create custom invoices tailored to their business needs and clients and track those invoices until they are paid. They can also send reminders and issue corrections if needed. You can also receive payments directly through the Lili app — it accepts debit and credit cards, ACH transfers, Venmo, Cash App, PayPal, check deposits and cash. Keep in mind, though, that you'll need to integrate Stripe to receive debit and credit card payments, as well as ACH transfers, which may result in third-party fees with each transaction.

- Split categorization: Being able to swipe left or right to signify business versus personal expenses is a helpful tool, but with Lili Pro, you'll also be able to split transactions into each, if necessary.

- Higher transfer limits: With the basic Lili account, you can only transfer up to $500 per day and up to $2,000 per month to your external accounts. With Lili Pro, you can transfer up to $1,000 per day and $5,000 per month to your external accounts. In either case, though, there's a two-transfer monthly limit.

- Higher check deposits: If you make a lot of mobile check deposits, there's a $2,000 limit per check for basic users. Additionally, you're limited to $2,500 per day and $6,000 per month. With Lili Pro, you can deposit up to $5,000 per check, $5,000 per day and $50,000 per month.

Lili Pro costs $9 per month, but you can try it out for free for 30 days.

Is a Lili Account Right for You? Pros and Cons to Consider

The Lili account offers a lot of value, but there are some serious drawbacks to consider before you open an account.

Pros

- Versatile tools: If you sign up for Lili Pro, you could feasibly manage all your business expenses, invoicing and payments in one place rather than dealing with multiple platforms.

- Low fees: If you stick with the basic plan, you'll get no monthly fees, no overdraft fees and no other account fees. What's more, you don't have to maintain minimum balance requirements to avoid account fees. You can also easily skip ATM fees by avoiding out-of-network ATMs with the mobile app's MoneyPass ATM locator. Even if you sign up for Lili Pro, a $9 monthly fee is low compared to other options.

- Rewards and interest: If you sign up for Lili Pro, you'll enjoy interest on your emergency savings and rewards on eligible debit card purchases. Depending on how you make it work, you could easily make up for the monthly fees with your cash-back rewards and interest earnings.

Cons

- Limited fee-free features: Most of what sets Lili apart from other business bank accounts is reserved for Lili Pro users. If you want a fee-free bank account with interest and rewards, the LendingClub Tailored Checking account may be a good alternative with its low balance requirement.

- Low transfer and mobile check deposit limits: If you want to use Lili for all your personal and business banking needs, you may not need to worry about external account transfer limits. But if you want to separate your personal and business expenses, those limits could be a deal-breaker. The same goes if you regularly receive checks as payment and would regularly reach the check deposit limit.

- Some features are limited: Not only can you not send or receive wire transfers, but you also can't get a checkbook, open a joint account or obtain more than one debit card for a partner or employees.

- Mobile-only: If you prefer in-person service or you'd prefer to have both mobile and desktop access, you'll be disappointed.

Lili Review: The Bottom Line

Lili's primary goal is to make it easier to mix your business and personal expenses so you don't need to deal with multiple accounts. But depending on how you bank, the account's features may be too limited for your needs, or at least create an unnecessary inconvenience in your life.

The Lili banking app offers a lot of value to sole proprietors, single-member LLCs and other small business owners who work as freelancers and independent contractors. However, there are some clear drawbacks and caveats to consider before deciding that it's right for you.

Because most of the best features are reserved for Lili Pro members, consider it only if you're willing to pay the monthly fee to get those tools and resources. Additionally, it's important to determine whether the account's limits on external account transfers and mobile check deposits would affect you. The last thing you want is to be unable to access your money in the way you want.

You'll also want to consider how no access to checkbooks, wire transfers, joint accounts and some of the other omissions might impact you or your business.

While Lili has a great value proposition, its drawbacks may make it less appealing for some. As with any business financial product, it's important to shop around and compare multiple options before settling on one. Consider which features are the most important and research top business checking accounts to find the best one for you.