Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

When you find yourself short on checks, your first stop is often the bank for a restock. Some banks are gracious enough to offer free checks. But many other financial institutions charge an extra fee for new checkbook orders — we found pricing ranging from three cents to 20 cents or more per check (or about $20 per book).

Such prices are pretty steep, considering how often (or not) you use checks these days. Here are some excellent resources for scoring discount or cheap checks, but keep in mind that prices will vary depending on how many checks you order, the design you choose, and your shipping speed.

7 Places to Get Free (or Discounted) Checks

| Option | Cheapest price | Price per check |

|---|---|---|

|

$0 |

$0 |

|

|

$20.45 for 4 packs of 100 single checks for Executive members |

$0.05 |

|

|

$15.33 for 2 packs of 240 single checks for Sam’s Club members |

$0.03 |

|

|

$17.03 for 2 packs of 120 single checks |

$0.07 |

|

|

$1.95 for 1 pack of 60 single checks |

$0.03 |

|

|

$5.25 for 1 pack of 25 single checks |

$0.21 |

|

|

$4.95 for 1 pack of 100 single checks |

$0.05 |

Fee-Free Banks

Not all banks charge for checks. If you don’t have a compelling reason to stick with your current bank, jumping ship to a new financial institution can mean free checks for life. Many banks that offer free checks also charge fewer fees in other areas, such as waiving monthly maintenance fees or not for charging overdrafts.

If you’re willing to bank online (you’re here right now, aren't you?), you can find dozens of options for customer-friendly online banks offering free checks. Here are a few good options:

- Ally Bank offers $10 in ATM fee reimbursements every month and unlimited free basic checks for those with a checking account. Pair it with their high-yield savings account for even more financial benefit.

- Discover Bank has fee-free checking accounts that are good enough to rival their credit cards. Check orders are always free, and you earn 1% cash back on up to $3,000 in debit card purchases per month. Its high APY on its savings account is pretty competitive, too.

- SoFi Checking and Savings accounts come with free checks, fee-free ATM access5, no-fee overdraft coverage7 and the ability to access your paycheck up to 2 days early6. Plus, you can earn a nice bonus as a new customer when you complete the required activities.

SoFi® Checking and Savings

- Our Rating 5/5 How our ratings work

- APY0.50% - 3.30%

SoFi members with Eligible Direct Deposit can earn 3.30% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.30% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

- Minimum

Deposit RequiredN/A -

Intro Bonus

$50 or $300Expires December 31, 2026

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. SoFi members with Eligible Direct Deposit can earn 3.30% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.30% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings boasts an impressive APY of up to 3.30% on savings balances for customers who set up direct deposit or who deposit at least $5,000 each month. Alternatively, customers can also unlock the top rate by paying the monthly SoFi Plus Subscription Fee. This account also offers 0.50% APY on checking balances. There are no monthly maintenance fees, and new customers can even earn a generous signup bonus of $50 or $300. If you don’t care about physical bank locations, this is a great option.

Overview

SoFi Checking and Savings features remarkably strong interest rates for customers who meet one of several requirements, such as receiving recurring monthly direct deposit or depositing $5,000+ every 31 days. This account also doesn’t have any maintenance fees or non-sufficient funds fees. To top it off, new customers can earn a signup bonus worth $50 or $300.

Pros

- Accounts with monthly direct deposit earn interest

- No minimum opening balance or minimum monthly balance

- No maintenance fees, non-sufficient fund fees or overdraft fees

- Access to Allpoint’s worldwide ATM network

- Get paid up to two days early

Cons

- No physical branch locations

Costco

Costco is always a premier way to save money with its lower prices and frequent sales. Plus, Costco members are eligible to buy discount checks.

Costco partners with Harland Clarke to offer a variety of checks with different designs and security features. Executive members get an additional 20% discount on orders. A basic set of Blue Safety Checks costs $20.45 for a four-pack of 100 checkbooks (for Executive members) or $25.56 (for Gold Star members).

Sam’s Club

Warehouse retailer, Sam’s Club, also offers discount checks to members — and countless other deals. Unlike Costco, a higher-tier membership won’t score you any additional savings on checks, so Sam’s Club could be a more affordable option if you’re looking for a warehouse membership.

Walmart

Walmart, America’s largest retailer, offers a discount check printing service without membership requirements, but it can take up to 12 business days to receive your order.

Due to the sensitive nature of checks, you’ll need to have the checks shipped to your home rather than to a store; however, shipping is free. If you have a credit card offering extra rewards on Walmart purchases, consider bundling your check order with something else to rack up extra points.

Super Value Checks

Super Value Checks offers three categories of checks: Super Saver Checks, Every Day Value Checks, and Premier Discount Checks. Its Super Saver Checks ($1.95 for a book of 60 checks) are among the cheapest checks online, but shipping can take up to two weeks. The company charges for shipping, so you may want to consider ordering in bulk to keep the cost-per-check low.

Checks In The Mail

The aptly named Checks In The Mail offers over 200 check designs in various colors. Its regular prices are kind of steep, but keep an eye out for coupon codes that can help you save. You can often find codes such as 20% off your order or other deals for new customers.

As of this writing, the company advertises a 20% off Welcome Offer for business and animal-themed checks as well as a New Customer Offer featuring free shipping on a premium checkbook for $6.49.

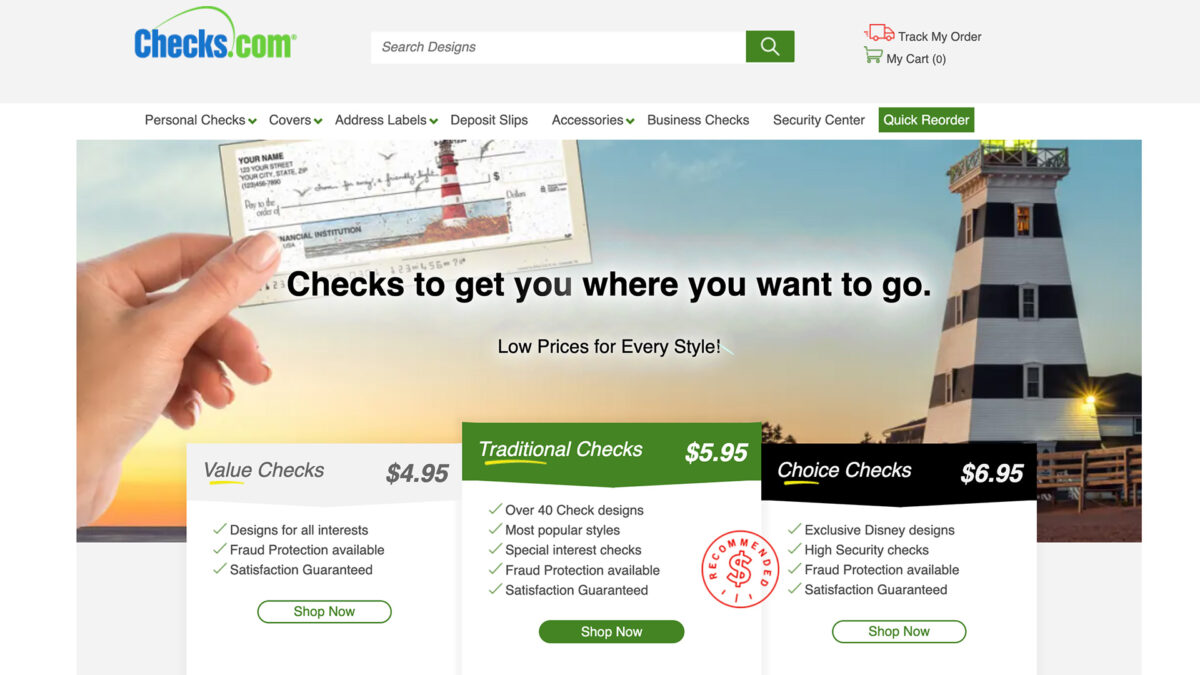

Checks.com

Most discount check suppliers offer standard “Blue Security Checks” as their cheapest option. But if you’re looking for something with a bit more flair, Checks.com is a good option for affordable custom checks. The company offers over 70 designs for just $4.95 per 100 single checks. You can buy duplicate checks for just $1 more at $5.95 per 100 checks.

Choose from designs like National Park scenes, popular Disney movies, fancy geometric patterns, and more.

Can You Print Your Own Checks?

Printing money is illegal — or is it? Believe it or not, it’s perfectly legal to print checks from home; you just need the right equipment. For starters, you’ll need magnetic ink and a printer capable of using it, such as a laserjet printer.

Next, you’ll need to download a MICR font (magnetic ink character recognition) online and stock up on blank check paper that will print your checks with the proper security features like watermarks.

Finally, with the proper equipment in hand, you’ll need to use a check-printing website like Checkeeper or purchase check-printing software that can correctly add in all of the bits required for a successful deposit at the bank.

Additional Tips to Help You Save on Checks

- Go digital: If you have the option, paying for purchases digitally using your debit card, ACH transfers, Venmo, or other cash-free methods is cheaper and safer because you aren’t handing out papers with your bank account number and personal details on it.

- Order early: Write a reminder on a Post-it note to order more checks and tuck it in your checkbook a few pages from the last check. This can help you avoid expedited delivery fees.

- Order singles: Most check sellers offer the option for single checks or duplicate checks, which have a sheet of carbon paper behind every check to offer a paper trail for the checks you’ve written. Single checks are cheaper than double checks.

- Vet your supplier: Before buying checks online or by mail, take a minute to vet the business. If a retailer looks “off” or “scammy,” don’t give them your most sensitive financial details.

- Prioritize security: If you’re going to spend extra, consider splurging on checks that offer more security features first rather than flashy designs. Enhanced security features include fraud-sensitive ink, watermarks, higher-quality paper, and certain secret microprint designs.

- Choose plain designs: Custom checks with interesting designs are fun, but they typically cost much more to do the same job.

Is It Time for a Switch?

Many banks lure you in with a starter pack of free checks and then charge you for each subsequent checkbook order. If your bank offers enough benefits and promotions, these added charges may be doable for you, but if you use checks a lot, you might consider switching banks or using one of the options above to snag free or cheap checks.

Frequently Asked Questions

-

Generally, yes. Business checks cost more because they’re physically larger than personal checks, and many offer additional security features.

-

Some banks offer a limited number of free over-the-counter checks designed to tide you over temporarily. You can also use expedited check printing services to ship your order in one business day. If you have access to a printer with magnetic ink, you may be able to print your own checks from home.

-

This depends on the bank. Some banks offer a certain amount of free checks after you first open your account, while other banks offer free or discount checks for life. There are banks out there that don’t offer any free checks at all.

SoFi Disclosures

1. Up to $300 Bonus Tiered Disclosure

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct

Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the

total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the

details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through

SoFi Bank, N.A., Member FDIC.

SoFi members with Eligible Direct Deposit can earn 3.30% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct

Deposit amount required to qualify for the 3.30% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on

checking balances. Interest rates are variable and subject to change at any time.

These rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

2. APY disclosures

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and

information can be found at https://www.sofi.com/legal/banking-rate-sheet

3. Fee Policy

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

4. Additional FDIC Insurance

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per depositor per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $3M through participation in the program. See full terms at SoFi.com/banking/fdic/sidpterms. See list of participating banks at SoFi.com/banking/fdic/participatingbanks.

5. ATM Access

We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third-party fees may be incurred when using out-of-network ATMs. SoFi’s ATM policies are subject to change at our discretion at any time.

6. Early Access to Direct Deposit Funds

Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

7. Overdraft Coverage

Overdraft Coverage is a feature automatically offered to SoFi Checking and Savings account holders who receive at least $1,000 or more in Eligible Direct Deposits within a rolling 31 calendar day period on a recurring basis. Eligible Direct Deposit is defined on the SoFi Bank Rate Sheet, available at https://www.sofi.com/legal/banking-rate-sheet. Members enrolled in Overdraft Coverage may be covered for up to $50 in negative balances on SoFi Bank debit card purchases only. Overdraft Coverage does not apply to P2P transfers, bill payments, checks, or other non-debit card transactions. Members with a prior history of unpaid negative balances are not eligible for Overdraft Coverage. Eligibility for Overdraft Coverage is determined by SoFi Bank in its sole discretion. Members can check their enrollment status, if eligible, at any time by logging into their account through the SoFi app or on the SoFi website.

8. 0.70% Savings APY Boost

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and

pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 3/30/2026. Rates variable, subject to change. Terms apply at

sofi.com/banking#2. SoFi Bank, N.A. Member FDIC.