Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

In March 2023, Silicon Valley Bank and Signature Bank® failed, causing panic among investors and consumers alike. While these banks were largely impacted by company-specific risks, it's natural to wonder whether your money is safe and if you should switch to a different financial institution.

Here's what to know about whether your money is safe, along with a list of safe banks to consider if you're still concern

10 Safest Banks in the U.S.

If you're shopping around for a new bank, there are some key features to watch out for. First and foremost, make sure the bank you're considering is an FDIC member—most banks are, but it still doesn't hurt to check.

Additionally, larger banks tend to be safer because their assets are more diversified, and they're more heavily regulated to prevent failure. With that in mind, here are some banks to consider.

| Bank | Assets | FDIC Insured? |

|---|---|---|

|

JP Morgan Chase |

$3.40 trillion |

Yes |

|

Bank of America |

$2.54 trillion |

Yes |

|

Wells Fargo |

$1.73 trillion |

Yes |

|

Citi |

$1.68 trillion |

Yes |

|

U.S. Bank |

$651 billion |

Yes |

|

PNC Bank |

$557 billion |

Yes |

|

Truist |

$528 billion |

Yes |

|

Goldman Sachs |

$521 billion |

Yes |

|

Capital One |

$476 billion |

Yes |

|

TD Bank |

$367 billion |

Yes |

Source: Federal Reserve, December 2023

If you're in the market for a new bank, check out the current best bank sign-up bonuses.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

1. Chase

With approximately $3.40 trillion in assets, JPMorgan Chase is the largest bank in the U.S. and the fifth-largest bank in the world. The bank was founded as Chase National Bank in 1877 but can trace its roots as far back as 1799 when the Bank of the Manhattan Company was founded—the two banks merged in 1955.

In a recent earnings report, Chase listed a net income of around $9.3 billion for the fourth quarter of 2023.

The bank offers a wide range of financial products and services, including both consumer and business bank accounts, credit cards, auto loans, home loans and an investment platform. The bank is FDIC insured.

Security features:

- Customizable account alerts

- Two-factor authentication

- Fraud support

- Credit Journey® identity monitoring

- 128-bit encryption for account access and transactions

FDIC insured? Yes

Chase Accounts to Consider

| Account | Monthly maintenance fee | Minimum deposit required | Bonus Offer | Learn More |

|---|---|---|---|---|

|

|

$12 with options to waive

Chase Total Checking customers can have their monthly maintenance fee waived by receiving direct deposits totaling $500 or more in new money each monthly statement period, maintaining a daily balance of at least $1,500 at the beginning of each day, or maintaining an average beginning day balance of $5,000 or more in any combination of linked qualifying Chase checking, savings and other accounts |

N/A |

$300Expires October 16, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

Open Account |

|

|

$4.95 with options to waive

$4.95 or $0; Avoid the monthly service fee when you have electronic deposits made into the account totaling $250 or more during each monthly statement period. |

N/A |

$100Expires October 16, 2024

New Chase checking customers enjoy a $100 checking account bonus when you open a Chase Secure BankingSM account with qualifying transactions. Qualifying transactions include debit card purchases, Zelle®, ACH credits, Chase QuickDepositSM or online bill payments. Your bonus will appear in your account within 15 days after completing the qualifying transactions. |

Open Account |

|

|

Up to $15 with options to waive

Customers who keep a minimum daily account balance of $2,000 or more, make $2,000 or more in monthly purchases on a Chase Ink® Business credit card, receive $2,000 or more in monthly deposits through QuickAccept℠ or other Chase merchant service solutions, link their Chase Private Client Checking account with their Business Checking account or have qualifying active-duty or veteran military status will have their monthly service fee waived in full. |

N/A |

$300Expires October 17, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

Open Account |

2. Bank of America

Bank of America, which has roots that go back to 1784 when Massachusetts Bank was chartered, is the second-largest bank in the U.S. with $2.54 trillion in assets.

In the fourth quarter of 2023, Bank of America reported $3.1 billion in net income.

Bank of America offers a suite of financial products and services, including consumer and business bank accounts, credit cards, home loans, auto loans and an investing platform. The bank also rewards loyal customers with its Preferred Rewards program, which offers discounts, rewards and other perks to customers with $20,000 or more in eligible deposits. The bank is FDIC insured.

Security features:

- Two-factor authentication

- Account alerts for unusual activity

- Encryption

- Scam and fraud education resources

- Account security meter

FDIC insured? Yes

3. Wells Fargo

Like other banks on our list, Wells Fargo has a rich history that began in 1852. Now, the bank is the fourth largest in the U.S., with $1.73 trillion in assets.

For the fourth quarter of 2023, Wells Fargo reported $3.4 billion in net income.

Like other major banks, Wells Fargo offers a lot of products and services, including bank accounts for consumers and small businesses, credit cards, personal loans, auto loans, home loans, as well as investing and wealth management services. The bank is FDIC insured.

Security features:

- 24/7 fraud monitoring

- Encryption and browser requirements

- Automatic sign off

- Two-step verification process

- Account alerts

FDIC insured? Yes

4. Citi

Citi® first opened its doors in 1812 under the name First National City Bank. Now, the financial institution is the third-largest bank in the nation, with $1.68 trillion in assets.

Citi's net income for the year 2023 was reported at $9.2 billion after recording a loss for the fourth quarter of that year.

As a Citi customer, you can take advantage of a variety of financial products and services, including consumer and business bank accounts, credit cards, personal loans and lines of credit, home loans, business loans and an investment platform. The bank is FDIC insured.

Security features:

- Two-step authentication

- Fraud detection alerts

- 128-bit encryption

- Biometric sign on option

FDIC insured? Yes

5. U.S. Bank

U.S. Bank's predecessor, the First National Bank of Cincinnati, was chartered in 1863, remarkably making it the youngest bank on our list. While there's a big gap between Wells Fargo and U.S. Bank®, its assets are still sizable at $651 billion.

The bank reported a net income of $1.63 billion for the second quarter of 2023.

U.S. Bank offers several financial products and services to its customers, including personal and business bank accounts, credit cards, personal loans and lines of credit, home loans, auto loans, wealth management services and more. The bank is FDIC insured.

Security features:

- No liability for unauthorized digital transactions

- Range of identification authentication tools

- Automatic security alerts

- Data encryption

- Security rating tool

FDIC insured? Yes

Accounts to Consider

U.S. Bank Smartly® Checking Account (Member FDIC)

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4/5 How our ratings work

- Minimum

Deposit Required$25 -

Intro Bonus

Up to $450Expires September 26, 2024

Earn up to $450 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through September 26, 2024. Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm. Member FDIC.

U.S. Bank's Smartly® Checking Account is a pretty standard checking account; customers get access to handy features such as personalized financial insights, automated budgeting and and access to U.S. Bank Smart Rewards. While this account features a $6.95 monthly service fee, there are multiple ways to get it waived.

Overview

The U.S. Bank Smartly® Checking Account is a pretty standard checking account; customers get access to handy features such as personalized financial insights, automated budgeting and and access to U.S. Bank Smart Rewards. While this account features a $6.95 monthly service fee, there are multiple ways to get it waived.

Pros

- Valuable welcome offer

- No surcharge fees at MoneyPass® Network ATMs

- Monthly fee is waivable

Cons

- Monthly fee

- Account not available nationwide

Related Article

Related Article

U.S. Bank Review: All of Your Banking Needs in One Place

6. PNC Bank

Like other banks on our list, PNC Bank has a long history. It was established in 1983 when long-standing banks Pittsburgh National Corporation and Provident National Corporation merged, but its origins date back to 1852. Today, PNC is the sixth-largest bank in the U.S. and has around $557 billion in assets.

Security features:

- Two-step authentication

- Account alerts

- Fraud and suspicious activity support

- Encryption

FDIC insured? Yes

7. Truist

The Truist name might not be as familiar as many others we’ve mentioned, but you’ll likely remember its predecessors. This bank is the result of a 2019 merger between SunTrust and BB&T, which originated back in 1891 and 1872, respectively. With around $528 billion in assets, Truist has grown to become the seventh-largest bank in the country.

Truist reported an adjusted net income of around $1.09 billion in the fourth quarter of 2023.

As a Truist customer, you can access a range of banking products and services, including checking and savings accounts, credit cards, mortgages, other loans, investing and retirement solutions, and insurance products. It also has a wealth of educational content that can teach you about various aspects of money, such as saving for certain goals, managing debt, budgeting, and investing.

Security features:

- Data encryption

- Firewalls and activity monitoring

- Timeout and lock-out features

- Private information processes

FDIC insured? Yes

8. Goldman Sachs

Unlike Truist, Goldman Sachs is a household name. This financial firm has been in business since 1869, and it’s the eighth-largest bank in the U.S. It currently has around $521 billion in assets and reported a net income of $2.03 billion in the fourth quarter of 2023. The company’s net earnings for 2023 as a whole topped $8.5 billion.

While Goldman Sachs is widely known for its investment products and services, it also offers several banking products. Its Marcus by Goldman Sachs high-yield savings account is a popular choice, but you can also take advantage of its range of certificate of deposit (CD) accounts and credit cards. All Marcus deposit accounts are insured by the FDIC.

Security features:

- Multifactor authentication

- Web browser requirements

- Encrypted network

- Firewalls

FDIC insured? Yes

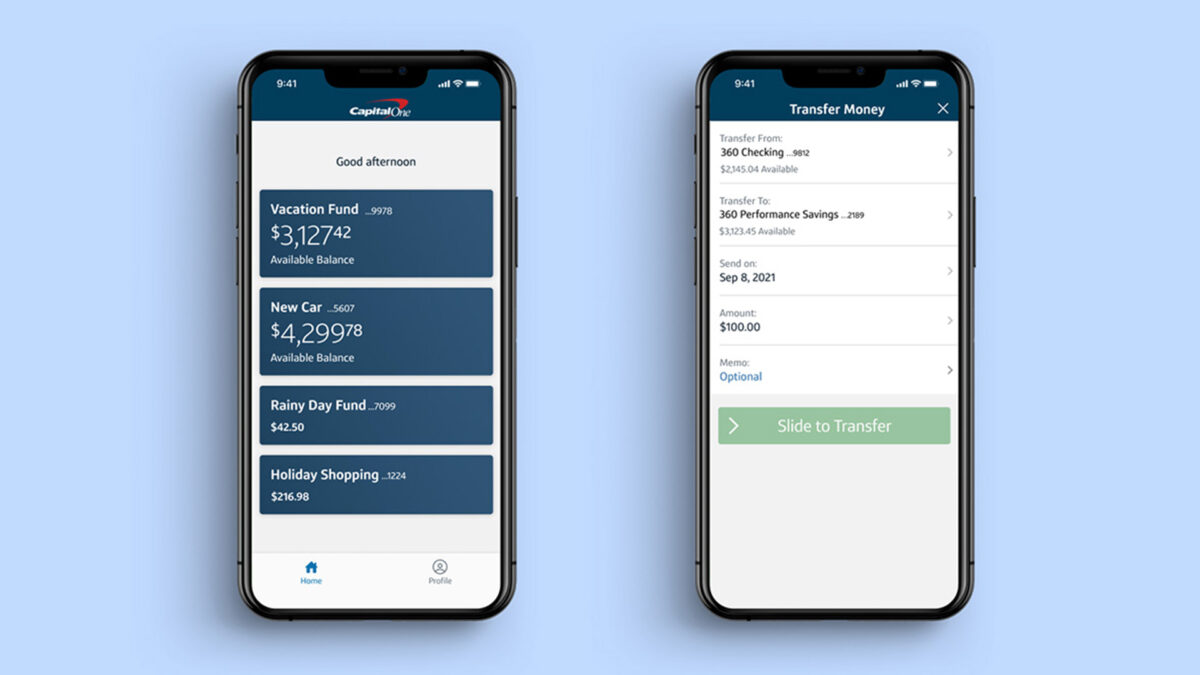

9. Capital One

Founded in 1988, Capital One is the youngest financial firm on our list. But don’t confuse its newness with a lack of stability. In a relatively short time, it’s grown to become the ninth-largest bank in the country. Capital One reported a net income of $706 million in the fourth quarter of 2023.

While it’s widely known for its many credit cards, Capital One also has a wide variety of banking products and services. You can open a checking, savings, or CD accounts, deposit accounts for kids, or take out new car loans or refinance an existing auto loan. All of Capital One’s deposit accounts have FDIC insurance.

Security features:

- Secure login

- Account alerts

- Card lock/unlock

- Fraud reporting

- No liability if card is stolen

FDIC insured? Yes

10. TD Bank

TD Bank adopted its namesake in 1955, but its roots trace back to 1855. Originally established as the Bank of Toronto, this North American bank has grown considerably since its beginnings. TD Bank rounds out our list, with a national rank of tenth largest bank in the nation.

This bank reported a net income of $2.89 billion in the fourth quarter of 2023, and a total net income of $10.79 billion for 2023 as a whole.

TD Bank offers a full suite of banking products for consumers, including bank accounts, credit cards, loans, insurance, and investment accounts. Its deposit accounts are backed by FDIC insurance.

Security features:

- Two-step authentication

- Firewalls

- System monitoring

- Fraud reporting

FDIC insured? Yes

Is Your Money Safe in 2023?

Generally speaking, if your money is in an FDIC-insured account, it is safe. This typically includes checking, savings and some other account types (but not investment accounts).

According to experts, regional banks are the most at risk of the potential ripple effects caused by previous bank failures. Unless you have deposits totaling more than the maximum insurance amount, however, your money is safe in your bank. But if you'd feel comfortable switching to another bank that can provide more stability, here are our top choices.

Since 2001, 566 banks have failed, and the FDIC has paid out insurance proceeds to bank customers in every instance, usually the next business day in the form of a new account with another bank or a check.

After the bank runs that caused the Great Depression, Congress created the Federal Deposit Insurance Corporation (FDIC). Banks pay into the agency's Deposit Insurance Fund, which protects consumers when a bank fails. The FDIC provides up to $250,000 in insurance per depositor, per insured bank, for each account ownership category. The National Credit Union Share Insurance Fund provides the same protection for credit union members.

How to Choose a Safe Bank

During times of economic uncertainty, making sure that your bank account deposits are insured is a top priority. Fortunately, most banks offer this benefit, so you don't necessarily need to go with a big bank to avoid risking your money.

With that said, it's still a good idea to consider a bank's history and financial standing as you shop around and compare your options. Even if you have insurance, a bank failure may force you to look for another bank anyway.

These are the top factors you should look at when shopping around for a safe bank:

- FDIC-insured accounts

- Large banks with a large number of assets

- Bank takes security of deposits and online accounts seriously

FDIC Insurance

Arguably, the most important factor to look for is FDIC insurance. The good thing is that most banks have at least $250,000 of insurance per account, but it’s always smart to check. You can ask the bank or check its website, as banks usually display their FDIC information online.

You can also look up the insurance on your existing bank account using the FDIC’s online tool or by calling the FDIC at 1-877-275-3342. (For the hearing impaired, call 1-800-877-8339.)

Bank Size and History

Larger banks are often safer. As we saw from the recent bank failures, regional banks are in a more precarious position than the massive national banks. Those big institutions hold more assets, so withdrawals typically have less impact. Similarly, banks that have been around for a long time may be more likely to have grown over time, have a long history of FDIC insurance and deeper experience.

If you prefer credit unions for their smaller size, you probably don’t have to worry. Just check that your organization is insured by the National Credit Union Administration, which insures similarly to the FDIC.

Security

Security didn’t play a role in the recent bank failures, but it’s something to keep in mind when searching for a safe bank. Look for one that takes the online security of your account seriously, with tools like two-factor authentication and encryption.

Bottom Line

As with any financial decision, take your time to shop around and compare multiple banks to determine the best fit for you. In some cases, it may be worth it to use accounts from multiple banks to take advantage of the benefits each may provi

Explore the Best Savings Accounts

Visit the Marketplace

FAQs

-

If a credit union has insurance through the National Credit Union Administration, it is just as safe as a bank that has FDIC insurance. These two organizations offer very similar protections for deposits, typically $250,000 per depositor, per account type.

Some people feel safer at credit unions because they tend to be smaller and members have a stake in ownership, but others feel safer at large banks with a long history and big footprint. The most important thing is to check if the financial institution and account type you want are insured—either by the Federal Deposit Insurance Corporation (for banks) or the National Credit Union Administration (for credit unions).

-

Credit unions can fail, like banks, during a bank collapse or financial crisis, but it is extremely rare. Credit unions may be less likely to make riskier investments, but any edge they have over a traditional bank with FDIC insurance is debatable. If you have deposits in a credit union that are backed by NCUA insurance, your money is safe from credit union failure up to the limit provided by that credit union.

-

If an online bank has FDIC insurance, it is typically as safe as a brick-and-mortar bank. The big difference between these two types of financial institutions is that online banks have a much smaller footprint with no branches, so they tend to have more online services and less fees for consumers. Always check if any bank you’re considering has FDIC insurance.

-

Yes, it is very rare, but some banks are not FDIC insured. Always check if a bank has FDIC insurance before you deposit your funds. You can typically find this information prominently displayed on a bank’s website or check via the FDIC search tool.

-

Investment products that aren’t deposits, such as stocks, bonds and mutual funds are not insured by the FDIC. Cryptocurrencies, safe deposit boxes and life insurance policies are also not FDIC insured.