Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

As a small business owner, it's essential to set up key financial tools that can help you run your business, and one of those is a business checking account. Depending on the type of company you operate, this account might be just the first of many banking solutions you need. To help you figure out what you need, below is an overview of several types of small business banking accounts you might want to consider.

Small Business Bank Account

One of the first steps to take when you open a new business is to establish a separate business bank account. It's important to keep personal and business finances separate for tax purposes. And if you own more than one company, you will want to keep the finances for each company separate as well.

At a minimum, you should open a small business checking account for your new company. It may also be wise to open a business savings account—providing you with a place to store savings for business emergencies and future growth opportunities. Plus, if you shop around, you may be able to find new business bank bonuses that might help your business earn extra cash when it opens its new bank accounts.

Related Article

Related Article

5 Best Business Bank Account Bonuses and Promotions (2024)

How to Open a Business Bank Account

Depending on the type of business entity you establish, you may have to provide different documentation when you open a new business bank account. Each financial institution may have its own requirements as well.

Here's a general overview of the documents you might need to open a business bank account:

- Driver's license

- Passport

- Mailing address

- Social Security number

- Employer Identification Number (EIN)

You'll also need to provide organizing documents, which vary depending on what type of business you are launching but could include:

- Articles of organization

- Articles of incorporation

- Partnership agreement

- Business license

Also be prepared to share your business address, phone number and any assumed business names (also called DBAs).

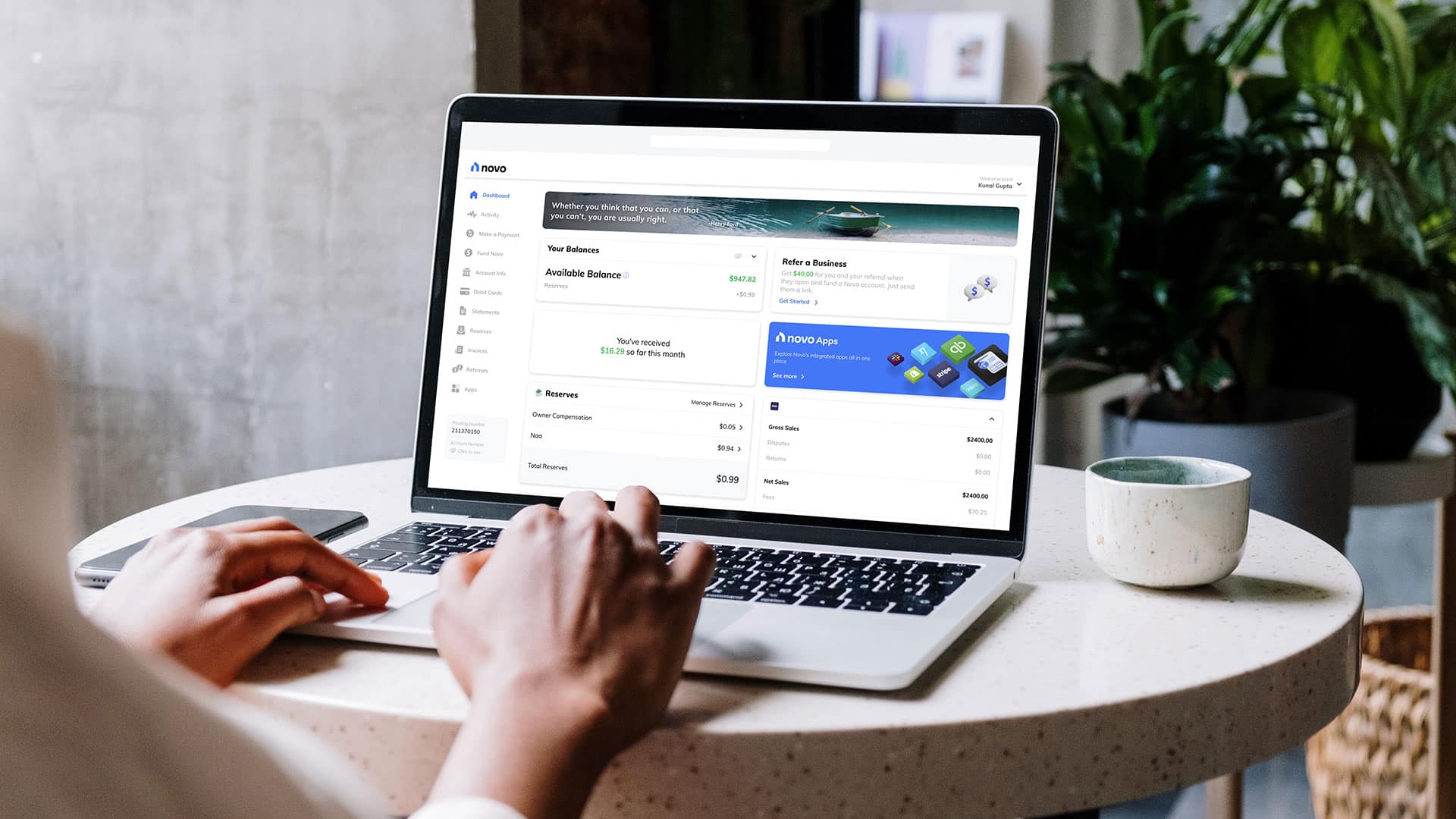

Recommended Business Account

Chase Business Complete Checking®

- Our Rating 5/5 How our ratings work

- APYN/A

- Minimum

Deposit RequiredN/A -

Intro Bonus

$300Expires October 17, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities.

The Chase Business Complete Checking® account is an attractive option. It offers the convenience of one of the largest financial institutions in the country, and it frequently offers bonuses that are relatively easy to earn. While it does not allow you to accrue interest on your funds like some other popular small business checking accounts, it's still very much worth considering if you can meet the requirements to waive its monthly fees.

Overview

The Chase Business Complete Checking® account comes loaded with a valuable sign-up bonus and an assortment of helpful perks, so long as you can meet the requirements to waive its monthly fees. It’s a good fit for many business checking customers, regardless of business size.

Pros

- Generous signup bonus

- Several options to waive monthly fee

- Same-day deposits using QuickAccept℠ service

- Huge network of in-person branches and ATMs

Cons

- Monthly maintenance fee

- Overdraft fees are relatively high

- Limit on fee-free cash deposits and physical transactions

Related Article

Related Article

How to Earn $400 With Chase Business Complete Checking

Merchant Account

You may want to consider opening a merchant account as well. A merchant account can enable your company to accept credit card and debit card payments from its customers, which is important since the majority of consumers use credit and debit cards to pay for purchases. If you have a brick-and-mortar location (especially a retail storefront), your business may also need a point-of-sale (POS) system that works with your merchant account. A POS system lets customers insert a chip card or swipe their credit cards or debit cards for payments.

One option to consider if your business needs to accept credit card payments is Chase Payment Solutions℠. This credit card processing system from Chase Bank (formerly called Chase Merchant Services) can enable your company to accept credit cards. The Chase merchant account even features the ability to turn your mobile device into a mobile point-of-sale solution.

Chase Payment Solutions Review: Credit Card Processing for Businesses of All Sizes

Small Business Credit Card

Another type of financial account you may want to open for your company is a small business credit card. Small business credit cards might help you:

- Establish business credit

- Keep business and personal purchases separate

- Manage cash flow

- Earn valuable rewards like points, miles or cash back

With most small business credit cards, the credit card issuer will check your personal credit when you apply for a new account. So it's wise to review your consumer credit reports (and possibly your personal credit scores) before you apply.

You typically don't need perfect credit to qualify for a small business credit card, but a good or excellent credit score may increase your odds of qualifying. If you're not happy with the condition of your credit when you review it, you might want to make a plan to try to improve your credit before you apply for financing.

Compare Chase Ink Business Credit Cards

| Credit Card | Intro Bonus | Annual Fee | Rewards Rate | Learn More |

|---|---|---|---|---|

|

|

$750Cash Bonus

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening |

$0 |

1.5%Cashback

Earn unlimited 1.5% cash back on every purchase made for your business. The advertised rewards type is cash back, but it’s important to note that you’re technically earning Chase Ultimate Rewards points (which can then be converted to cash back). |

Apply Now |

|

|

$750Cash Bonus

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening |

$0 |

1% - 5%Cashback

Earn 5% cash back on your first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. It also offers you 2% cash back on your first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. |

Apply Now |

|

|

120,000Chase Ultimate Rewards Points

Earn 120,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,760 (120,000 Chase Ultimate Rewards Points * 0.023 base) |

$95

This fee includes extra cards for authorized users, such as employees, at no additional charge. |

1x - 3xPoints

Earn 3x points on the first $150,000 of combined spending in a number of key business categories |

Apply Now |

|

|

$1,000Cash Bonus

Earn $1,000 bonus cash back after you spend $10,000 on purchases in the first 3 months from account opening. |

$195 |

Up to 2.5%Cashback

Earn unlimited 2.5% total cash back on purchases of $5,000 or more and unlimited 2% cash back on all other business purchases. |

Apply Now |

Quick Tip

Pay off your full credit card balance each month to avoid interest charges. This can also help you keep your credit utilization rate down, and some credit scoring models may reward you with extra points when you keep your utilization rate low.

Bottom Line

Setting up multiple accounts and credit cards for your new company might be time consuming, and as a business owner, you might not have a lot of extra time for additional tasks. Yet setting up the right bank accounts is essential for the long-term success of your business. The good news is that once you go through the initial effort, you shouldn't have to revisit these tasks too often.