Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Capital One 360 Certificates of Deposit

- Our Rating 5/5 How our ratings work

- Minimum

Deposit Required$0 - 1 Year APY4.00%

- 3 Year APY4.00%

Capital One offers some of the strongest interest rates currently available; with terms ranging from six months to five years, few other banks can compete with its CD rates. What's more, Captial One CDs are more accessible than many of its competitors' offerings. There's no minimum opening balance requirement for any of its CDs, and its early withdrawal penalties are relatively lenient, especially for longer term lengths.

Accessible Rates With Mild Penalties

A certificate of deposits (CD) is a unique type of savings account where you can earn favorable interest rates if you agree to lock your money away for a certain period of time. Here’s a closer look at CD accounts from Capital One, which term has the highest interest rate and how Capital One compares to competitors.

Pros

- Strong interest rates

- No minimum balance requirement

- Relatively lenient early withdrawal penalties

Cons

- Lacks no-penalty CD option

Overview of Capital One 360 CDs

Capital One 360 CD accounts are available for online banking customers or through the in-person Capital One café and branch network. Here is a quick overview of their CDs:

- Minimum deposit: There is no minimum deposit required to open a Capital One CD.

- Interest: Interest accrues daily and compounds monthly

- APYs: Rates are fairly competitive

- Early withdrawal penalty: Early withdrawal penalties range from three to six months of interest

CDs here work like CD accounts at other financial institutions in most ways. Accounts are time-bound and you’ll get higher interest rates for longer CD terms.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.85%

*Annual Percentage Yield (APY) is variable and is accurate as of 11/15/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.86%

Earn up to 4.86% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

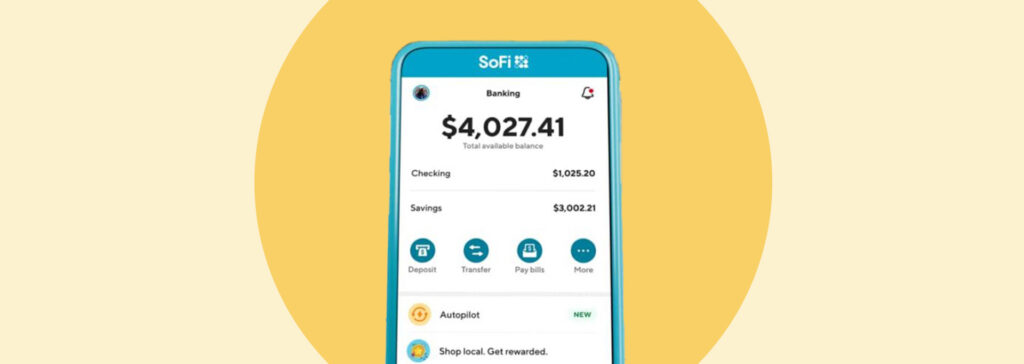

0.50% - 3.80%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

4.35%

Earn 4.35% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of December 20, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Capital One 360 CD Interest Rates

Capital One tends to offer competitive interest rates for most of its accounts. Some of the biggest banks in the United States offer the worst rates around, while more innovative banks like Capital One bring higher interest rates to savers.

As with other banks, rates here are likely to fluctuate with market conditions. When the Federal Reserve raises or lowers its target interest rate, most banks follow suit. In the current environment of rising interest rates, this could mean locking up funds for a period of time at a lower rate than would be available from a new account.

If you think interest rates are on the way up, you may want to consider Capital One 360 savings accounts or a high-yield savings account, as the rates on those accounts are flexible.

Rates are current at the time of last publishing. Rates can change at any time with no warning.

Perks of Capital One CD Accounts

Capital One CDs have a lot going for them. Here are some of the best features:

- No minimum deposit

- Competitive APYs

- Rates stay the same through CD term so there’s no market risk

- Easy and fast to open an account online

- Can have interest paid out, monthly, annually or at the end of the CD term

Eligibility and Other Requirements

There aren’t a lot of barriers to opening a Capital One CD. You don’t need to already be a Capital One customer, and there’s no minimum deposit required to get started.

If you already bank with Capital One, opening a CD is quick and easy, and you can fund from a linked Capital One account instantly. New customers must go through a brief sign-up process that takes less than 10 minutes if you have your information handy and are comfortable with computers.

Early Withdrawal Penalty

The main fee to know about with Capital One CDs is the early withdrawal penalty fee. If you withdraw funds at any point before the term of the CD is up, you’ll have to pay a penalty:

- CDs 12-month or shorter: You’ll pay three months of interest

- CDs longer than 12 months: You’ll pay six months of interest

Keep these time frames in mind because it’s possible to redeem your CD so early in the term that you’ll end up paying more in penalty fees than you’ve earned in interest. (Note that you won’t incur penalties if the owner of the CD dies or is declared legally incompetent.)

4 Best No-Penalty CD Rates in January 2025: Earn Up to 4.70% APY

Are Capital One 360 CDs FDIC Insured?

Yes, Capital One 360 CDs are FDIC insured up to up to $250,000 per depositor, per ownership type. With insurance, you are guaranteed to get your money back even in the extremely unlikely event that Capital One goes bust.

Capital One CDs vs. Competitors

Capital One CDs hold their own against many other CDs out there, with high interest rates and a variety of term lengths to chose from. But if you prioritize sky-high APYs, you might be better off with one of our other picks for the best CDs.

And if you’re looking for a little more flexibility, consider a no-penalty CD. In many cases, you’ll find lower APYs on those products, but there are a few out there that can compete with the rates at Capital One.

Is a Capital One CD Worth It?

A Capital One CD is worth it if you are able to lock up some funds for a set period of time and like the current APYs. There's no minimum deposit to worry about and you can set up your account online in a few minutes. If you already use and love Capital One, that could be the icing on the cake.

On the other hand, if you think you’ll need access to that money before the CD term ends, consider stashing your cash in a high-yield savings account or a no-penalty CD instead.

Ready to open a Capital One 360 CD? Start here.