Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Capital One Financial Corporation's recent announcement of its acquisition of Discover Financial Services has sent shockwaves through the financial industry.

The blockbuster deal, valued at around a stagg

Capital One/Discover Deal Overview: Terms and Implications

Under the terms of the agreement, Capital One will assume control of Discover Financial Services. Capital One has stated, "Through this combination, we're creating a company that is exceptionally well-positioned to create significant value for consumers, small businesses, merchants, and shareholders as technology continues to transform the payments and banking marketplace."

At this time, it's unclear whether a wholly new entity will be created as a result of this acquisition. However, shareholders from both sides stand to benefit, with Capital One shareholders expected to o

The acquisition

Potential Impact on Consumers

The announcement of the acquisition has sparked speculation about its implications for consumers' wallets. While some experts express concerns about potential limitations on competition and the possibility of higher fees and interest rates, others speculate about potential benefits, such as enhanced credit card rewards and improved service offerings.

Consumer advocates, including Sen. Elizabeth Warren (D-MASS), have voiced concerns about the merger's potential to limit co

Best Rewards Credit Cards

Visit the Marketplace

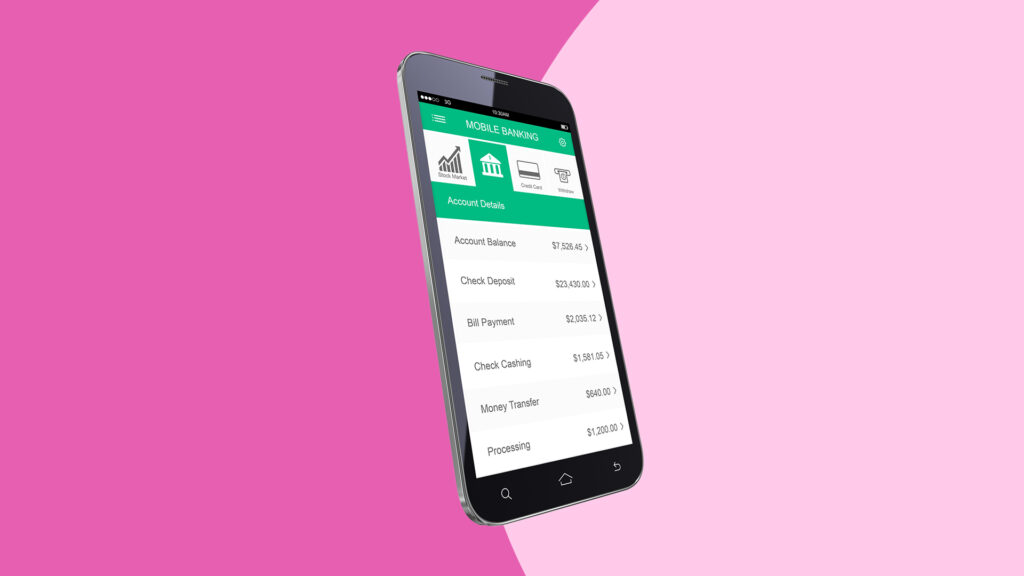

Utilizing Discover's Payment Network

A key aspect of the deal is Capital One's interest in leveraging Discover's payment network. By combining Capital One's credit card expertise with Discover's established network, it aims to offer

Capital One's CEO Richard Fairbank emphasized the importance of integrating Discover's payment network into opera

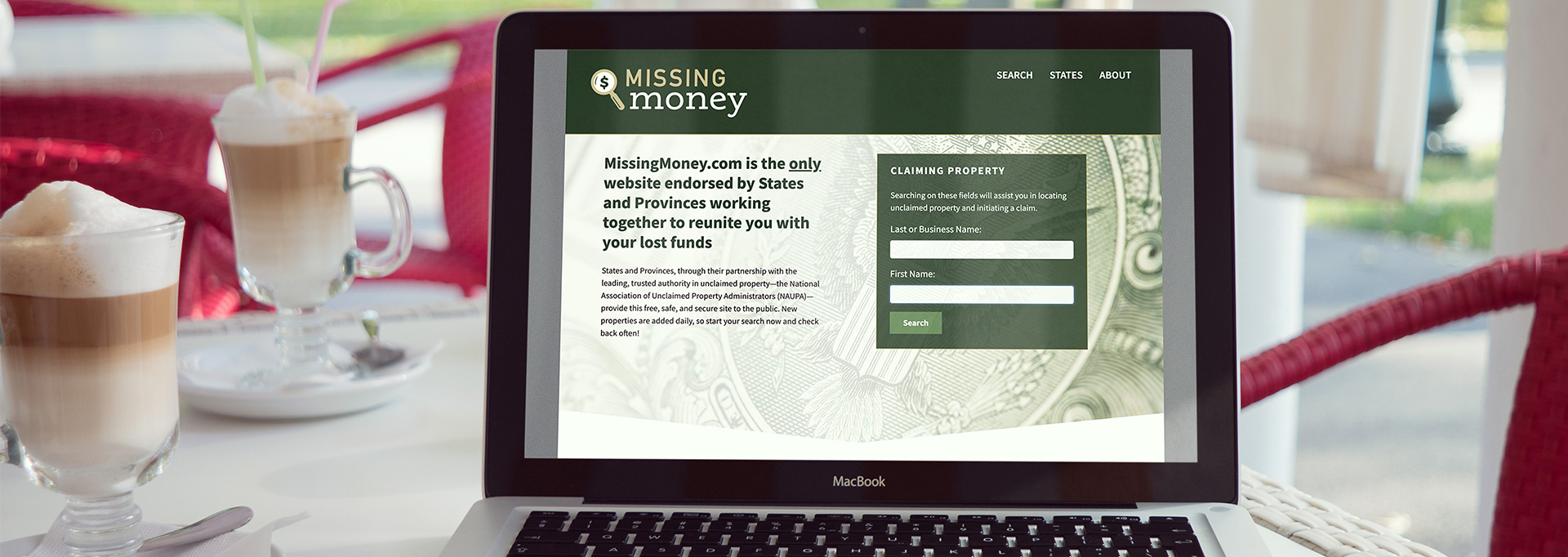

Regulatory Scrutiny and Consumer Protection

Regulators are expected to subject the merger to thorough scrutiny to ensure that it does not undermine competition or harm consumers' interests. The FTC

Consumer advocacy groups are calling for a comprehensive review of the merger's potential impact on consumers' financial well-being. They argue that increased consolidation in t

Explore the Best Free Checking Accounts

Visit the Marketplace

Consumer Considerations

In the midst of regulatory reviews and speculation, consumers are advised to stay informed about the developments surrounding the acquisition and its potential impact on their financial interests. While the full effects of the merger may not be immediately apparent, its approval could herald a new era in the credit card industry, with far-reaching implications for consumers and businesses alike.

Bottom Line

As the regulatory review process unfolds, stakeholders will be closely watching for updates and insights into the future of the Capital One-Discover merger and its implications for the broader financial landscape. The acquisition represents a transformative moment in the industry, with the potential to reshape the dynamics of credit card companies and redefine consumer experiences in the years to come.

The outcome of the regulatory review will have profound implications for consumers, businesses, and the financial industry as a whole. It is a pivotal moment that will shape the future of finance and set the course for the evolving relationship between credit card companies and consumers.