Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Many of us remember our first kiss. Others fondly recall the first time they got behind the wheel. For a money nerd like myself, I remember the heydey of the Mint budgeting app. In 2007, it was one of the few—if only—money management apps that helped you create a budget, keep tabs on your cash flow, and, with handy charts, show where your money went each month.

Mint helped me escape budgeting spreadsheets and bank and credit card statements— it was a true budgeting app game-changer.

Here's the kicker: Mint recently announced they’ll be powering down for good in January 2024 and folding into Credit Karma. And they’re taking their budget tracking tool with them.

We've rounded up our favorite budgeting apps to help soften the blow and ensure you can stay on top of your money. By picking a budgeting app now, you can seamlessly export your data, learn how to use a new money management platform, and switch without a hitch. Let's look at our top Mint alternatives:

| App | Cost | Best For |

|---|---|---|

|

YNAB |

$14.99 per month or $85 per year |

Zero-sum budgeting |

|

Simplifi by Quicken |

$3.99 per month |

Customized spending plan |

|

Empower |

Free |

Investment and retirement planning |

|

Monarch Money |

$14.99 per month or $99.99 per year |

Shared budgeting and financial planning |

|

PocketSmith |

Free up to $39.99 per month |

International accounts and multi-currencies |

|

Tiller |

$79.99 per year |

Spreadsheet budgeting |

|

Rocket Money |

Sliding scale: $48 to $60 per year ($4 to $5 per month) or $6 to $12 per month |

Managing and negotiating bills |

|

Copilot Money |

$95 per year ($7.92 per month) |

Smart, data-driven spending tools and customizations |

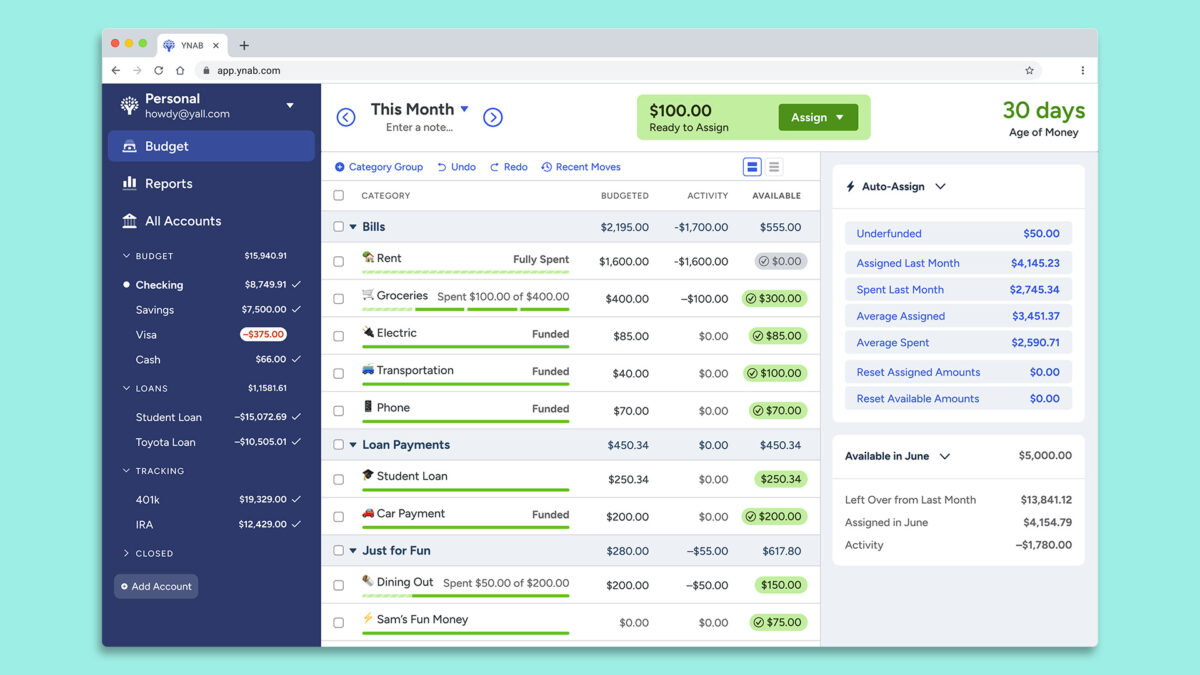

YNAB (You Need a Budget)

Pros

- Option to link accounts automatically or manually

- 34-day trial period

- Easy to track spending by categories

Cons

- Steep learning curve

- On the pricier side

- Customization features can become confusing

Why We Like It: YNAB is a well-loved, popular app for a reason. If you prefer zero-sum budgeting—a budgeting method that gives all the money you earn from a job until your expenses reach zero—you’ll enjoy using YNAB to create custom spending categories to track your spending. Plus, YNAB allows you to link your accounts automatically to get a full picture of your finances, from credit cards, checking and savings accounts, investments, and retirement funds.

Features:

- Important transactions automatically

- Access platform across multiple devices: phone, computer, tablet, both online and offline

- Set and easily track spending and savings goals

- Split transactions

- Loan planner and calculator tool

- Spending reports

- Net worth reports

Drawbacks: YNAB isn't as intuitive as others on this list, so you’ll need to play around in the platform to configure your spending categories. There is a learning curve.

Cost: $14.99 a month or $8.25 per month (if paid annually)

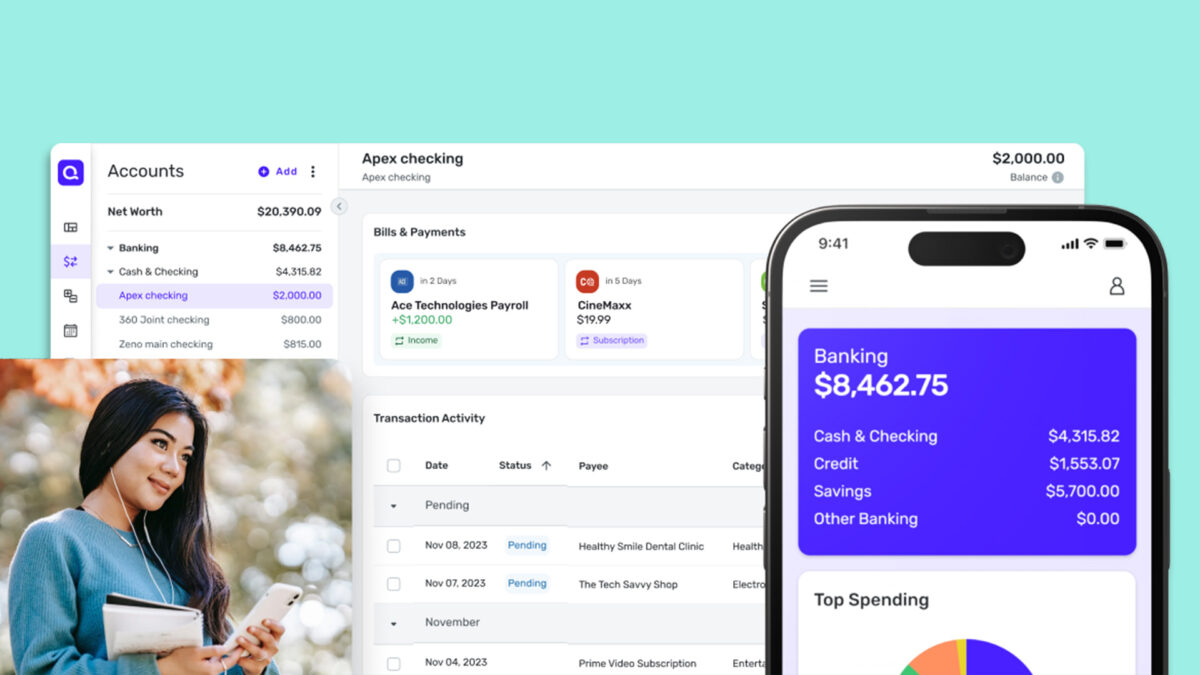

Simplifi by Quicken

Pros

- Robust reporting tools and features

- Clear, easy-to-navigate dashboard

- Personalized spending plan

Cons

- Limited options for setting due dates for bills

- No credit score included

- Small subscription fee

Why We Like It: Simplifi by Quicken makes it easy to create custom savings goals, create a personalized spending plan, and track your progress. The dashboard is intuitive, easy to use, and has no extra clutter that some find intimidating. Simplifi can also project future cash flow, which can help you adjust your spending.

Features:

- Custom savings goals

- Tracks progress toward savings goals

- Personalized spending plans

- Tracks net worth

- Projected cash flows

- Performance charts and balance updates

- Option to share an account with partner, friend, or accountant

Drawbacks: Unlike some money management apps, Simplifi doesn't offer a free credit score. Plus, when adding recurring transactions to your spending plan, you can include only a few types of due dates, such as weekly, biweekly, monthly, etc.

Cost: $3.99 per month

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.55%

*Annual Percentage Yield (APY) is variable and is accurate as of 2/26/2025. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.86%

Earn up to 4.86% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi Plus members are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

4.10%

Earn 4.10% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of March 19, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

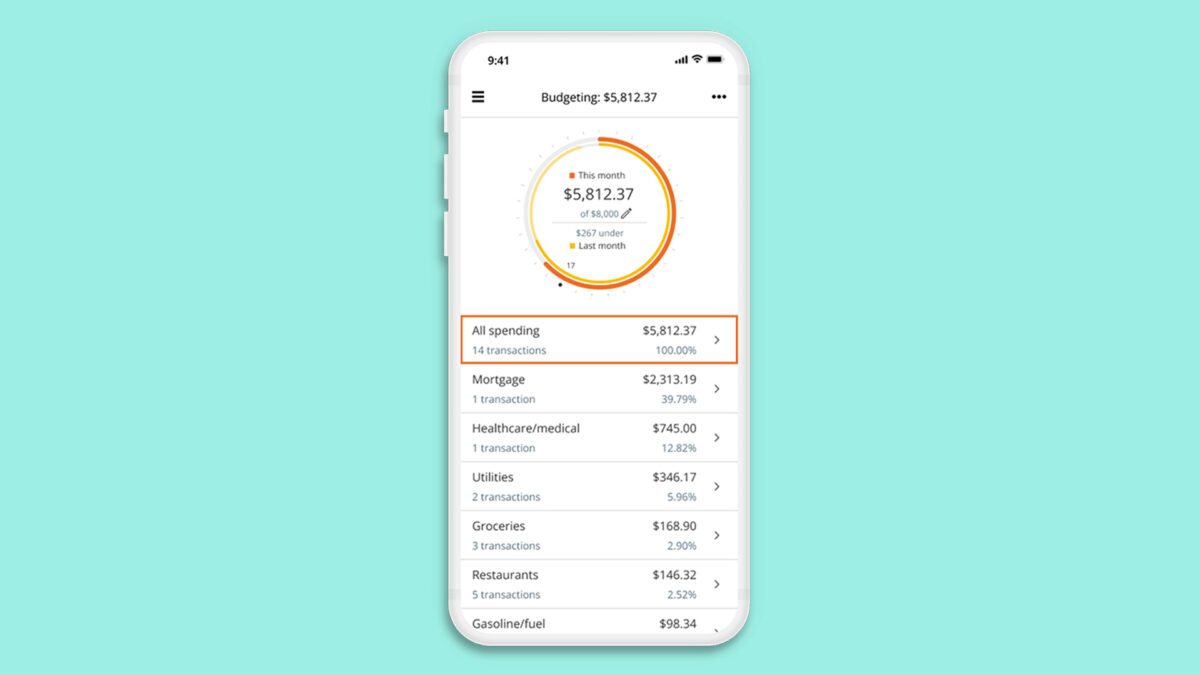

Empower

Pros

- Robust free features

- Retirement planner

- Investment fee analyzer

Cons

- Access to free tools may trigger an influx of emails

- Budgeting features are limited

- Cannot enter transactions manually

Why We Like It: Empower, most known for its investment and retirement planning, also has savings goals and spending tracker features. With it, you can experiment with different scenarios and changes in your retirement savings to see how they might impact your retirement goals and timelines. You can also create a spending plan for retirement and add "income events" outside of your retirement savings, such as pension and Social Security, for a fuller picture.

Features:

- Syncs outside accounts and cards

- Savings, retirement, and investment goals

- Tracks debt payoff progress

- Retirement spending and savings plans

- Add income to help with retirement goals

Drawbacks: While Empower does offer budgeting tools, it lacks flexibility, and you can't manually enter transactions. Plus, as a free user, Empower sends me a lot of emails advertising its wealth management services.

Cost: Free

Related Article

Related Article

11 Savings Accounts That Make It Easier to Reach Your Savings Goals

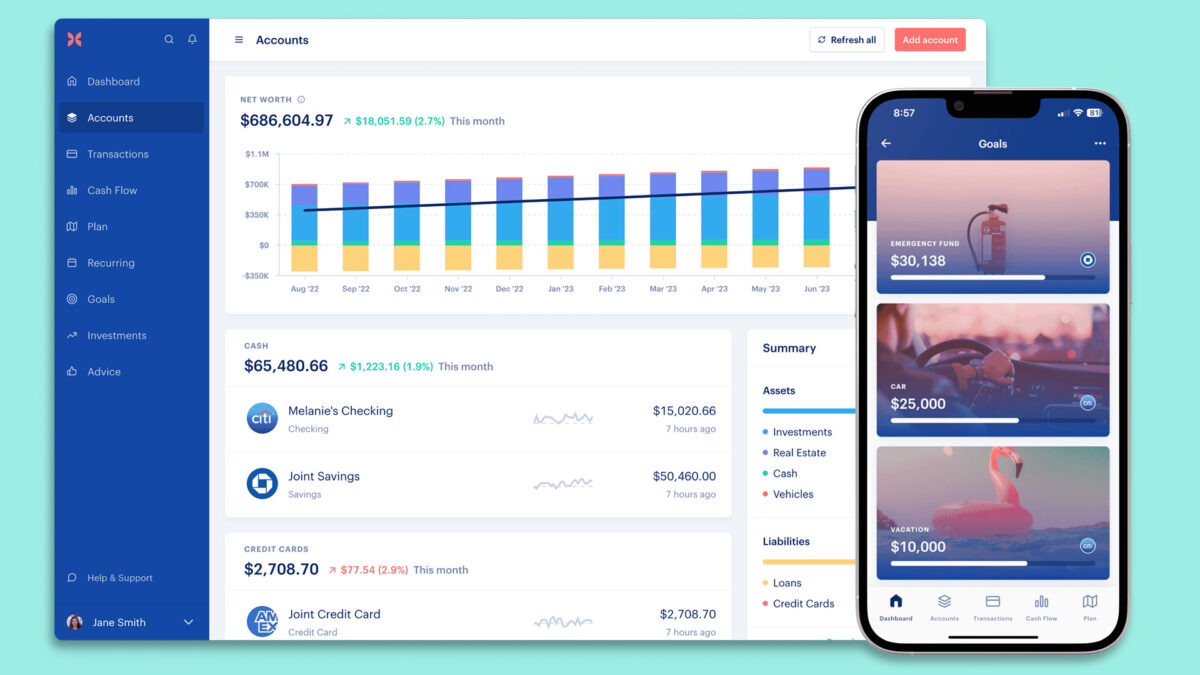

Monarch Money

Pros

- Free 7-day trial

- Can share account with family

- Flexible budgeting features

Cons

- Higher priced than other budgeting apps

- Small learning curve to using the service

Why We Like It: Monarch Money is a robust, powerful tracking tool that is best for creating a budget that aligns with your defined savings goals. Its standout feature is that you can share your account with unlimited users, making it easy to involve your partner, family, and finance professionals in your planning.

Features:

- Syncs multiple accounts

- Net worth tracker

- Option to create and track financial goals

- Monitor allocation and performance of investments

- Customizable reports

- Budgeting tools

- View transactions

- Manage bills, subscriptions, and recurring expenses

- Customize dashboard

- Collaborate with a partner

Drawbacks: Monarch doesn't support bill payments or include credit score monitoring. Plus, users transitioning from Mint will need to find another way to monitor their cryptocurrency investments, like Stash or Copilot Money.

Cost: $9.99 per month or $89.99 per year

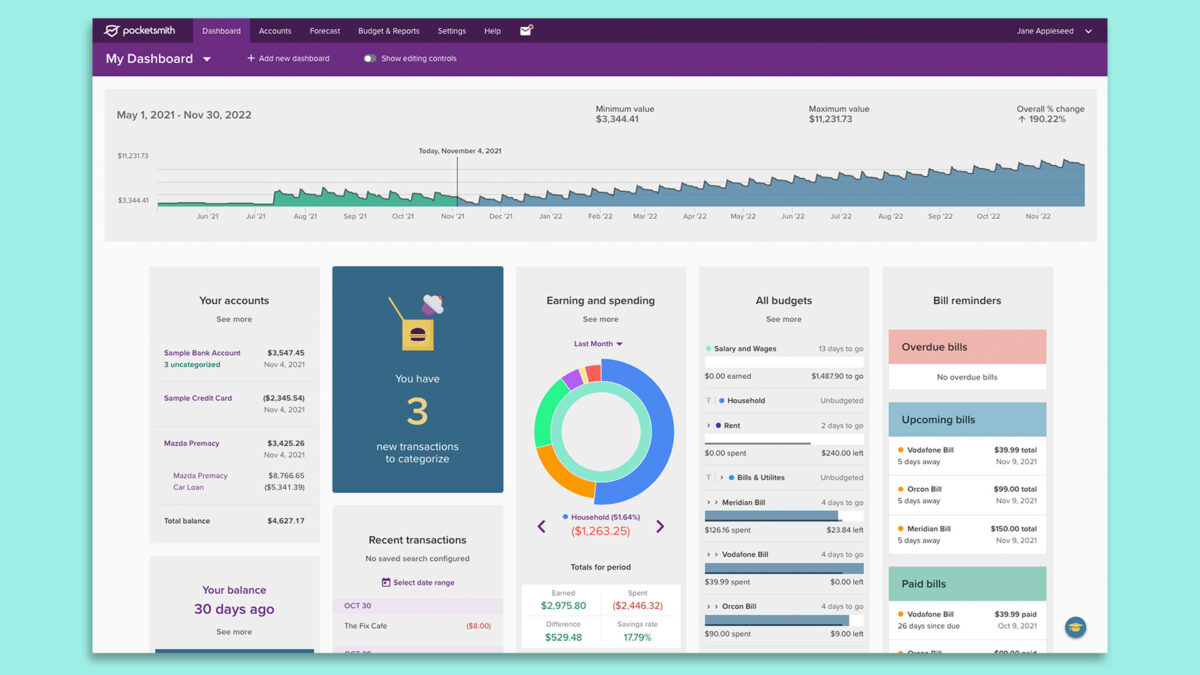

PocketSmith

Pros

- Connect bank accounts from different countries and currencies

- Budgeting calendar and customized expenses

- Cash flow forecasting

Cons

- Free plan has very limited features

- Limited net worth tracker, investing, and retirement planning tools

Why We Like It: If you have accounts in different countries or need to track expenses and income in different currencies, PocketSmith is a great choice. Plus, PocketSmith has many customizable features to manage your monthly budget.

Features:

- Cash flow statements and forecasts

- Transactions categorization and labeling

- Budget calendar to track bills and recurring expenses

- Share account with partner, financial coach or advisor, or accountant

- Budgeting features such as "safe to spend" or "rollover budgeting"

Drawbacks: While PocketSmith has a lot of great tools and features for monthly budgeting, it isn't our top choice for net worth tracking, investment, or retirement goals. Plus, its free plan is sparse, so you'll need to upgrade to a paid plan to get the most out of the platform.

Cost: Free plan available; Paid plans range from $14.95 to $39.99 per month

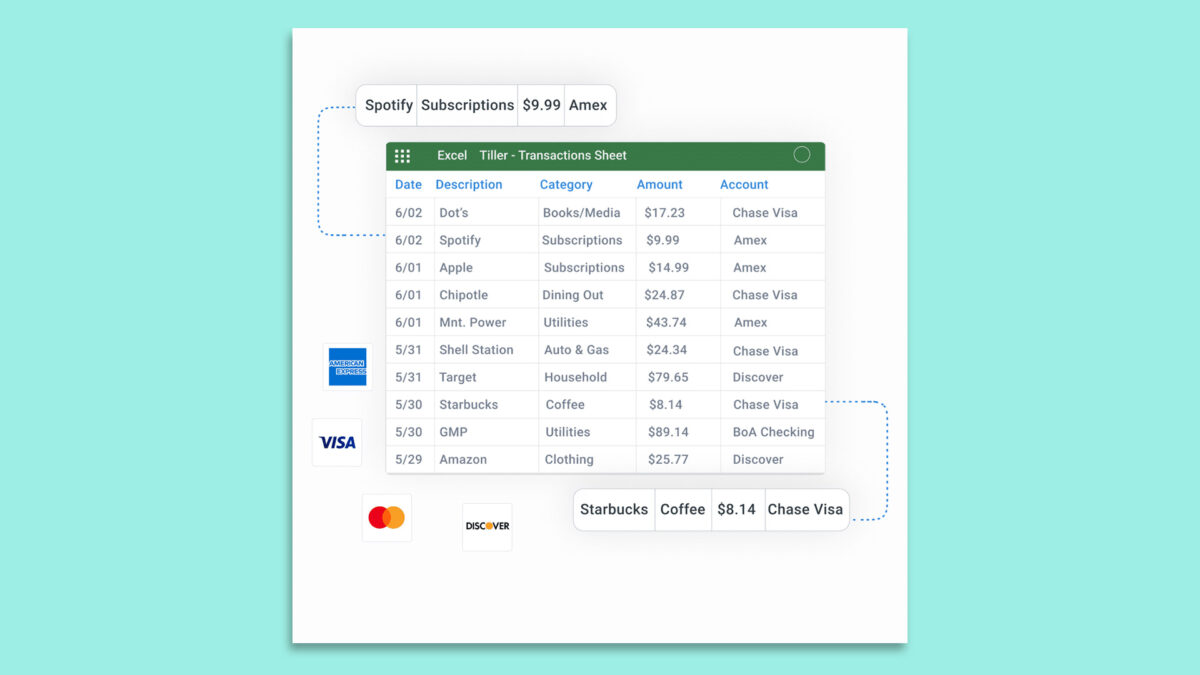

Tiller

Pros

- Free 30-day trial

- Many ways to customize budgets

- Templates available

Cons

- Must pay annually (no monthly subscription available)

- Need to access spreadsheets via Google or Microsoft

- No mobile app

Why We Like It: If you live and breathe spreadsheets, then Tiller's money management system is for you. If you don’t have your own to import, you can use one of Tiller's prebuilt spreadsheet templates for creating budgets, tracking expenses, and viewing your net worth. From there, you can make tweaks for your particular preferences and needs.

Features:

- Sync up bank accounts

- Prebuilt spreadsheets for tracking net worth, expenses, and budgets

- Community templates for retirement planning

- Custom spending categories and “rules”

- Custom reporting

- Automatic transactions

Drawbacks: You can only access spreadsheets in one of two ways: via Google or Microsoft. And using Tiller as a budgeting app requires, at minimum, a basic understanding of spreadsheets.

Cost: $79 per year

4 Ways to Earn More Interest On Your Savings

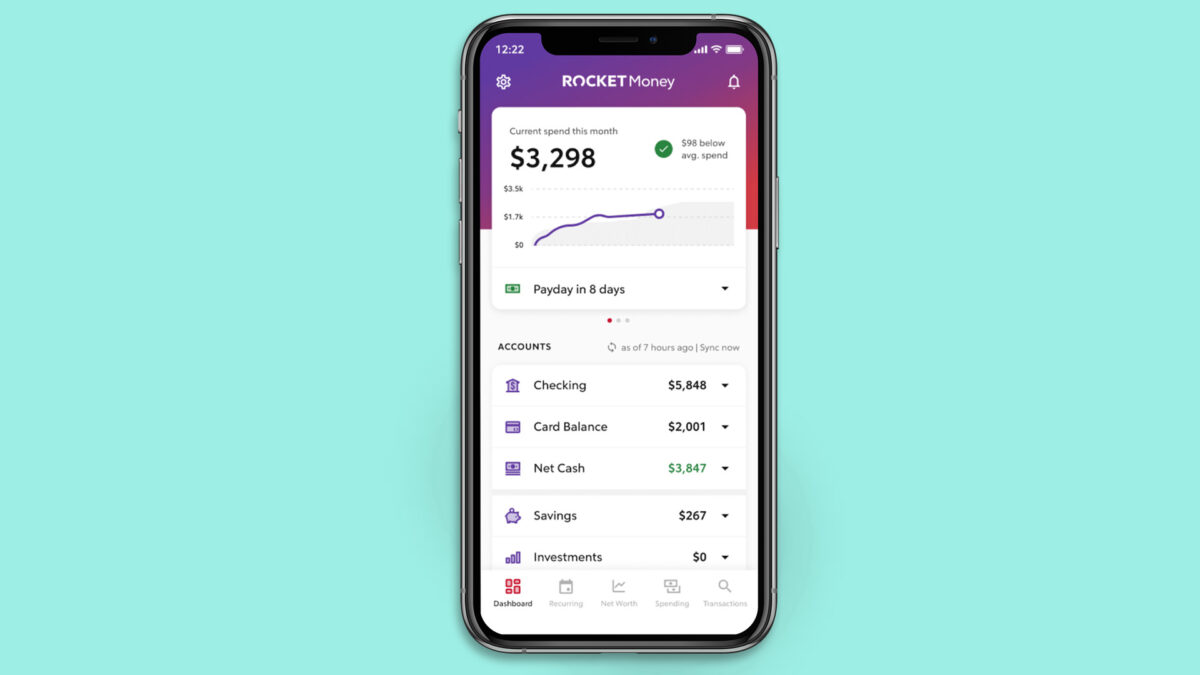

Rocket Money

Pros

- Clean, easy-to-use interface

- Sliding scale for premium plan

- Free credit score

- Bill negotiation

Cons

- Bill negotiation fees are steep (30% to 60% of amount saved, charged in first year)

- Limited features with free plan

- Light on investment and retirement tracking

Why We Like It: Rocket Money features robust budgeting and savings tools, but perhaps what's most notable is helping you manage bills, subscriptions, and other ongoing expenses. Plus, if you're willing to incur a fee, it can negotiate lower bills on your behalf—making it easier to abide by a budget.

Features:

- Bill negotiation

- Sync up accounts and track spending

- Bills, subscriptions, and other recurring expenses management

- Net worth tracker

- Custom spending categories

- Free credit score

- Unlimited budgets

- Savings accounts and automatic savings plans

Drawbacks: The free plan offers limited features—subscription management, spend tracking, balance alerts, and account linking. And while someone from Rocket can help you negotiate fees, expect to pay a hefty fee.

Cost: Sliding scale: $48 to $60 per year ($4 to $5 per month) or $6 to $12 per month ($72 to $144 per year)

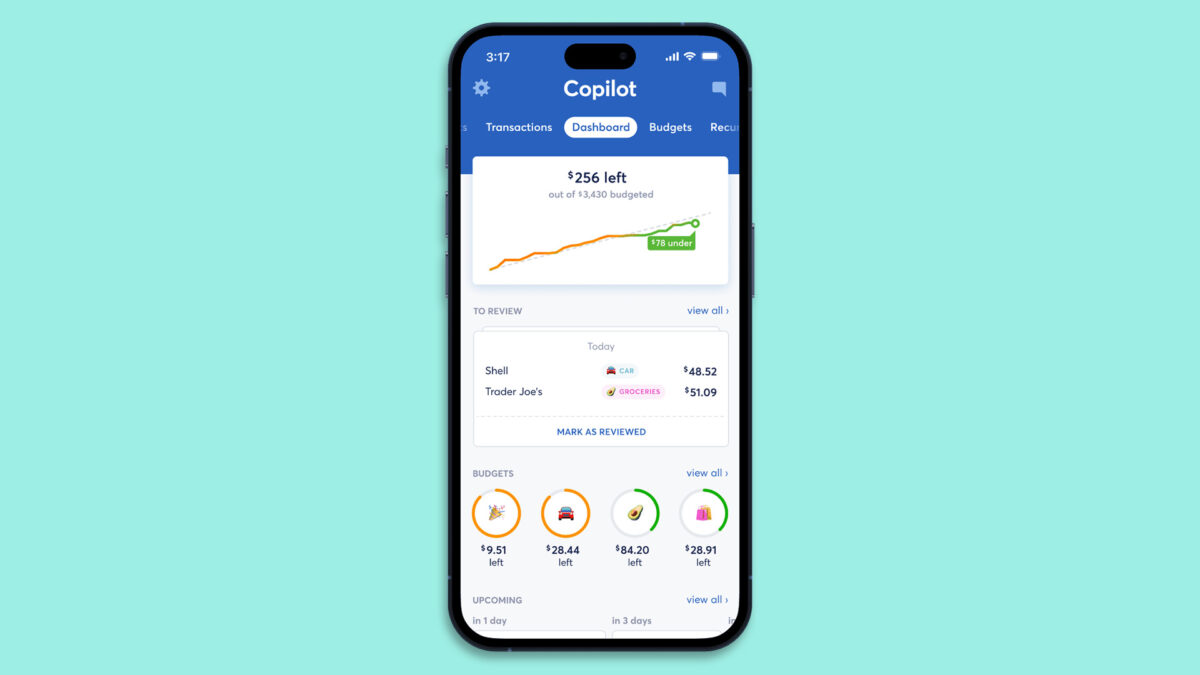

Copilot Money

Pros

- Free trial

- Clean design, an intuitive interface

- Can link to crypto wallets

- Can track multiple investment accounts

Cons

- Limited budget features and functionality

- No mobile app for Android

Why We Like It: In many ways, Copilot Money feels like a money management app for the future: boosted by machine learning to help you best categorize expenses, budget rebalancing, and the option to link to your crypto wallet. Plus, the platform is developing a tool to help former Mint users easily import their data to Copilot; interested customers can join their waitlist.

Features:

- Detect recurring expenses

- Split expenses and other transactions

- Net worth tracker

- Links up to retirement, savings, and investment accounts

- Track your home's estimated property value

- Budget rebalancing suggestions

- AI-powered spending categorization

- Daily spending snapshots

Drawbacks: If you want to go hard on your budgeting, Copilot's limited budgeting features probably won't serve your needs. Plus, Copilot Money currently doesn't support Android mobile operating systems.

Cost: $7.92 per month ($95 per year)