Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

For those who are new to the world of personal finance and banking, making a decision on what type of bank account to open can be overwhelming. To start, some of the most common types of accounts you can open are checking accounts or savings accounts, and you can open those at either a traditional bank or a credit union. In this guide, we walk through what to consider when opening an account and the steps required to create one.

Banking 101 How to Open a Bank Account

Steps to take and what to consider when you are opening a new bank account.

-

1

Decide if You Want a Bank or Credit Union

Before opening your bank account, you'll need to choose the bank or credit union where you want to open your bank.

-

2

Determine the Banking Services You Want

Think about the type of services the bank you're interested in provides—and the features that come with the account you want.

-

3

Visit the Bank Branch or Website

Visit your local branch to get more information or check out the bank's website, especially if you're considering an online-only bank.

-

4

Pick an Account That Suits Your Needs

Shop around for accounts and ask yourself what features are most important to you. For example, do you need a free checking account to deposit your monthly paycheck? Or maybe you want a high-yield savings account with a higher interest rate to park your emergency funds.

Getting Started: How to Open a Bank Account

1. Decide if You Want a Bank or Credit Union

Banks and credit unions are both financial institutions, but they have some slight differences:

- A bank is a for-profit institution where almost anyone can open an account.

- A credit union is a type of non-bank financial institution that is nonprofit, but may only be available to a certain group of people.

While some credit unions are limited to people in certain geographic locations or employees of certain companies, many credit unions open up membership to anyone for a nominal fee. The choice between a bank or credit union essentially comes down to what you prefer in terms of convenience, locations, banking technology, fees, community and more.

Recommended Bank Bonuses

| Bank Account | Intro Bonus | Minimum Deposit | Learn More |

|---|---|---|---|

|

Member FDIC |

$50-$300Expires December 31, 2024

See full terms and disclosures at sofi.com/banking. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/24. SoFi members with Direct Deposit can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the 4.60% APY for savings (including Vaults). Members without Direct Deposit will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

N/A | Open Account |

|

|

$300Expires October 16, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

N/A | Open Account |

Axos Rewards Checking Account |

Up to $500Expires July 31, 2024

Cash in on up to a $500 bonus† and up to 3.30% APY* with a new Rewards Checking account. Just use promo code RC500 before July 31. |

N/A |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

|

$300Expires October 17, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

N/A | Open Account |

2. Determine the Banking Services You Want

For example, here are some features to consider:

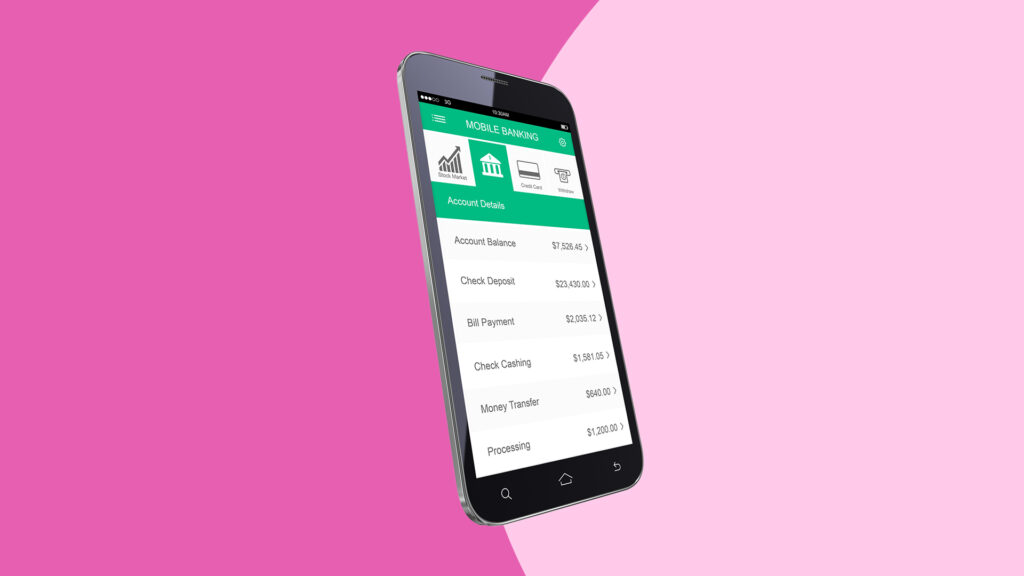

- Online and mobile banking: Most banks offer online banking services so you won't even need to visit a branch to handle your transactions, including deposits and transfers. But if you prefer banking in a physical branch, consider a traditional bank that has retail locations near where you live.

- Customer service: Many banks offer customer service support on evenings and on the weekends. Some even have online chat features and the ability to email customer support.

- Fees and rates: Do your research on the rates and fees associated with an account. For example, some banks offer waived ATM fees for withdrawals while other banks offer competitive interest rates.

- Sign-up bonuses: Banks occasionally offer bonuses for new customers who sign up for an account. Check out our list of bank bonuses to check out banks offering incentives for opening an account.

3. Visit the Bank Branch or Website

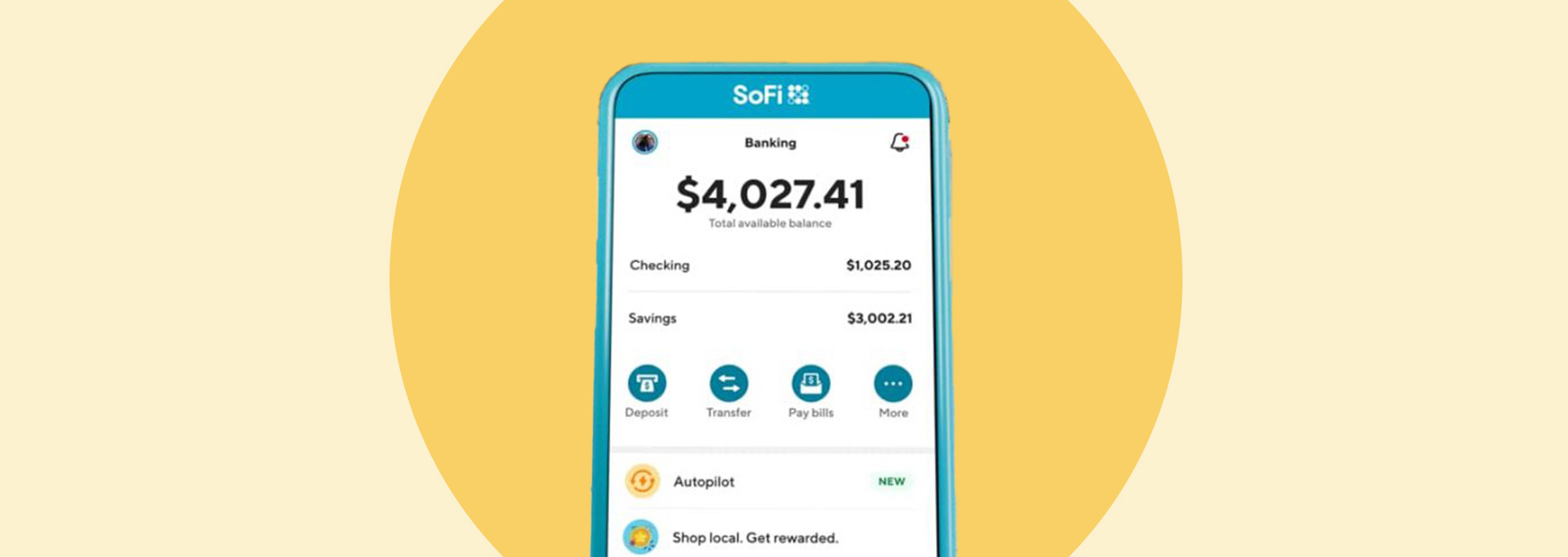

Most financial institutions offer mobile banking either through their mobile website or through a mobile app. So if you prefer to open an account from your phone, most institutions will allow you to do most if not all of the opening process online.

It's a good idea to scope out the mobile tools to make sure they are a fit for your tech skills and banking needs, however. And if you plan to bank in person, you could even stop by your local branch and chat with customer service.

4. Pick an Account That Suits Your Needs

Bank on a budgetExplore the Best Free Checking Accounts

Visit the Marketplace

Review the account features and check what is required to open one. Some banks require a specific initial deposit, minimum opening deposit or minimum balance that you have to keep in your account to avoid bank fees.

If you need checks, a debit card or access to direct deposits, pick a product that offers those features.

What Types of Bank Accounts Can You Open?

Here is a breakdown of some of the most common types of bank accounts to choose from:

- Cash management accounts: This is an umbrella term for checking accounts and savings accounts, which are some of the most common accounts out there.

- Money market accounts: A money market account blends some features of a savings and checking account. So if you're looking to earn some interest but move money somewhat frequently, these could be worth looking into.

- Credit cards: Credit cards allow you to purchase items and pay for them later. To avoid paying interest on balances, pay back any negative balance on the credit cards in full, each and every month. Here are some credit cards with the best bonuses.

- Investment products: Investment products include retirement accounts like IRAs as well as taxable investment accounts. Investment products may have minimum balance requirements that you would need to satisfy.

- College student accounts: Many banks and credit unions have specific types of accounts designed for college students. If this is your first time applying for a credit card, learn more about how to apply for a credit card as a student.

Best Student & College Checking Accounts: Earn Up to $300 in Bonuses

What You Need to Open a Bank Account

1. Personal Information and Financial History

Banks and credit unions are legally required to verify the identity of anyone who is opening an account with them. As such, you will need to enter in identifying information about yourself. This might include:

- Name and email address

- Address and phone number

- Social Security number or Alien Identification Card Number

- Basic financial information such as employment history, salary or net worth

2. Signed Agreement of the Terms and Conditions

When you open a bank account, you'll also likely be required to agree to the terms and conditions of the bank. This could include security policies, transaction limitations or other additional terms. It's common for certain savings accounts to have a maximum number of withdrawals per month, as an example. Many bank accounts have fairly flexible terms, but you'll want to review these policies and make sure you understand them before opening your account.

Can I Open a Bank Account If I'm Under 18?

Different banks have a different minimum age for opening a bank account, but people younger 18 can be eligible for a bank account. Accounts designed for children and young adults can include special features such as overdraft protection and low or no-minimum deposits.

Parents also have the option of opening a joint or custodial deposit account for their child, using the parent as the primary account holder.

What Is a Joint Account?

A joint checking or savings account is one where two people are listed as accountholders on the account. Usually, there will be one person who is listed as the primary account holder and has the primary banking relationship. With a joint account, both people have equal access to the money in the account, so individuals should only open one if there is complete trust in the other person, such as in a spousal relationship.

To open a joint account, both parties need to provide the bank with the required personal and financial information, including Social Security numbers, addresses, and dates of birth.

FAQs

-

The amount you need to open a bank account varies per financial institution. Some banks allow you to open a bank account without any money up front as long as you make an initial deposit within 30-60 days, for example.

If a bank has a monthly minimum requirement, make sure to fulfill that minimum to avoid paying a monthly service fee or any overdraft fees.

-

Once the bank account is open, you should have immediate access to cash from your online account or ATM locations. You have the ability to transfer funds or open up a certificate of deposit. Keep a close eye on your account balance however, to ensure you don't overdraft. Also review the fee schedule for the account so you aren't hit with surprise charges.

-

Yes, many banks let you open a bank account online without having to visit a branch. You will need to visit the bank's website, go through the application process and provide information that confirms your identity.

-

To be mindful of your spending, review your transactions regularly to get an idea of your spending habits and to avoid overdrafting your account.

You can also create a budget that includes food, housing, entertainment, savings, retirement, and other spending, along with your income, and try to stick to that budget.

It's also helpful to set up an emergency savings fund. Set aside money every month for the emergency fund so you have a cushion to fall back on when unexpected but necessary expenses arise.