Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Debit cards are a convenient tool for managing your day-to-day spending, and you typically receive one in the mail when you open a new checking account. In the United States, you can’t open an individual bank account until you’re 18 or the age of majority in your state. But despite this, kids’ debit cards are becoming very popular among parents. With these debit cards, a parent or legal guardian opens an account on their child’s behalf, and the child gets debit card access and even ATM access.

In this guide, we’ll look at how kids’ debit cards work, explore the pros and cons of these tools, and review some of the best kids’ debit cards available.

What Is a Kids’ Debit Card?

A kids’ debit card is similar to the adult version of a debit card, though most cards for children have special controls and give parents visibility into how the card is being used. Many also have other features, like budgeting tools designed to teach kids about money and the ability to set spending limits.

Debit cards for teens and kids come in a few different forms:

- Traditional debit card: This is a regular debit card that is linked to a bank or checking account. It's possible to spend more than what's in the account, which can lead to overdraft fees.

- Prepaid debit card: You load money onto a card and can only spend the amount loaded.

- Digital debit card: These cards are digital versions of a regular debit card and are stored in an app or on your mobile device. You can make purchases through your phone.

Parents can decide which type of debit card is right for their child by looking at the child's habits.

Best Debit Cards for Teens & Kids

To help you compare options, we’ve rounded up five of the best debit cards for teens and kids. These cards are no- or low-cost, have robust parental controls, and come with an array of features to help kids learn about money and stay on track with their finances.

| Account | Age Requirements | Monthly Fees | ATM Access |

|---|---|---|---|

|

None |

$4.99 – $14.98/month |

Yes |

|

|

6-18 years old |

$4.99 per child |

Yes |

|

|

6 years or older |

$4.95 – $7.95/month |

Yes |

|

|

6-17 years old |

None |

Yes |

Greenlight

Greenlight is one of the original debit cards for kids, offering a companion mobile app and a range of valuable features. Parents can limit ATM withdrawals, set store-specific spending controls, get real-time spending notifications, and more.

Type of Card: Traditional debit card linked to mobile app

Age Requirements: None

Features:

- Can add up to five kids

- Robust parental controls

- Savings and investing tools

- 1% cash back to savings for Core, higher savings rewards for Max and Infinity

- Optional purchase round-ups to boost savings

- Games designed to help kids level up their money skills

- Customizable cards

- Parents can set up allowances for chores as well as direct deposits

- Greenlight connects to Google Pay and Apple Pay for mobile payments

- Infinity plan has safety features like location sharing and crash detection

- Parents can apply for a Greenlight credit card and add their kids as authorized users

- FDIC insured

Monthly Fees:

- Greenlight Core: $4.99/month

- Greenlight Max: $9.98/month

- Greenlight Infinity: $14.98/month

ATM Access: Yes, card can be used at ATMs with Mastercard, Visa Interlink, or Maestro logo. Regular ATM fees may apply.

APY: N/A

GoHenry

GoHenry is a kids’ debit card that offers a full range of parental controls and a mobile app available for iOS and Android devices. You can set up spending controls for your child, receive alerts each time they use their card, track purchase history, and more.

Type of Card: Traditional debit card linked to mobile app

Age Requirements: 6-18 years old

Features:

- Can add up to four kids

- Robust parental controls

- Customizable cards

- Automated allowance feature

- Ability to set up chores and tasks within app

- Direct deposit option for teens with jobs

- Parent-paid interest option of up to help kids boost their savings

- Option to donate to charity

- FDIC insured

Monthly Fees: $4.99 per child/month

ATM Access: Yes, card can be used at ATMs. Regular ATM fees may apply.

APY: N/A

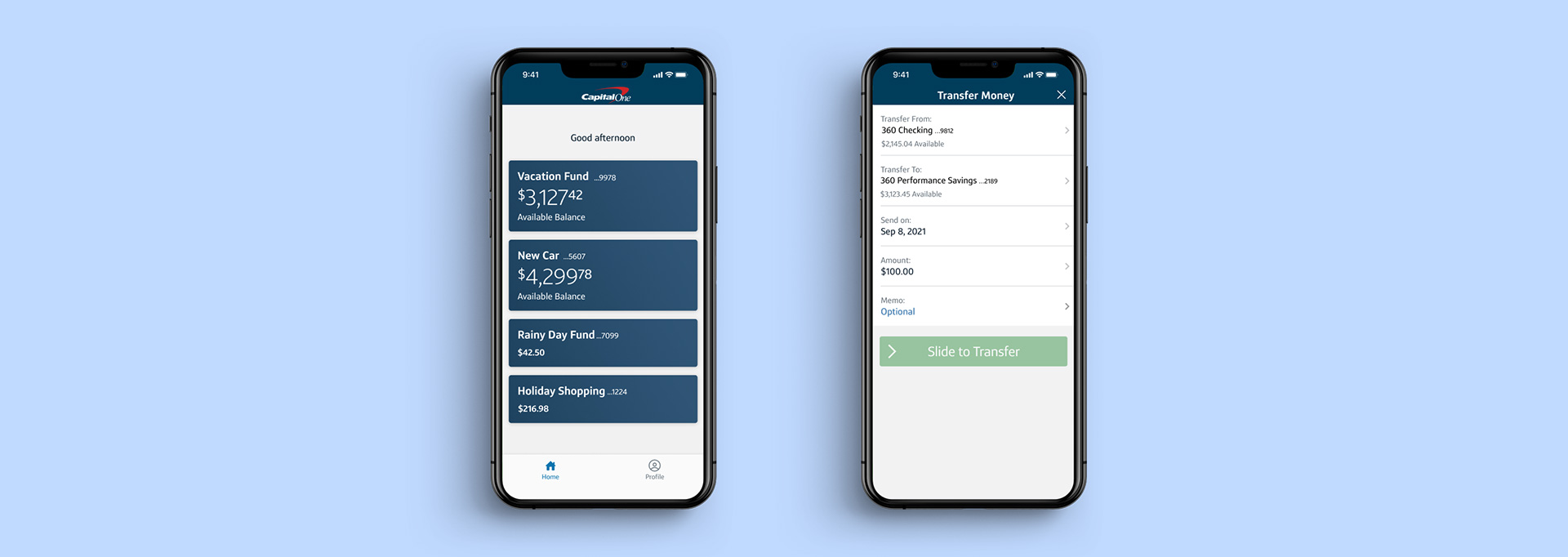

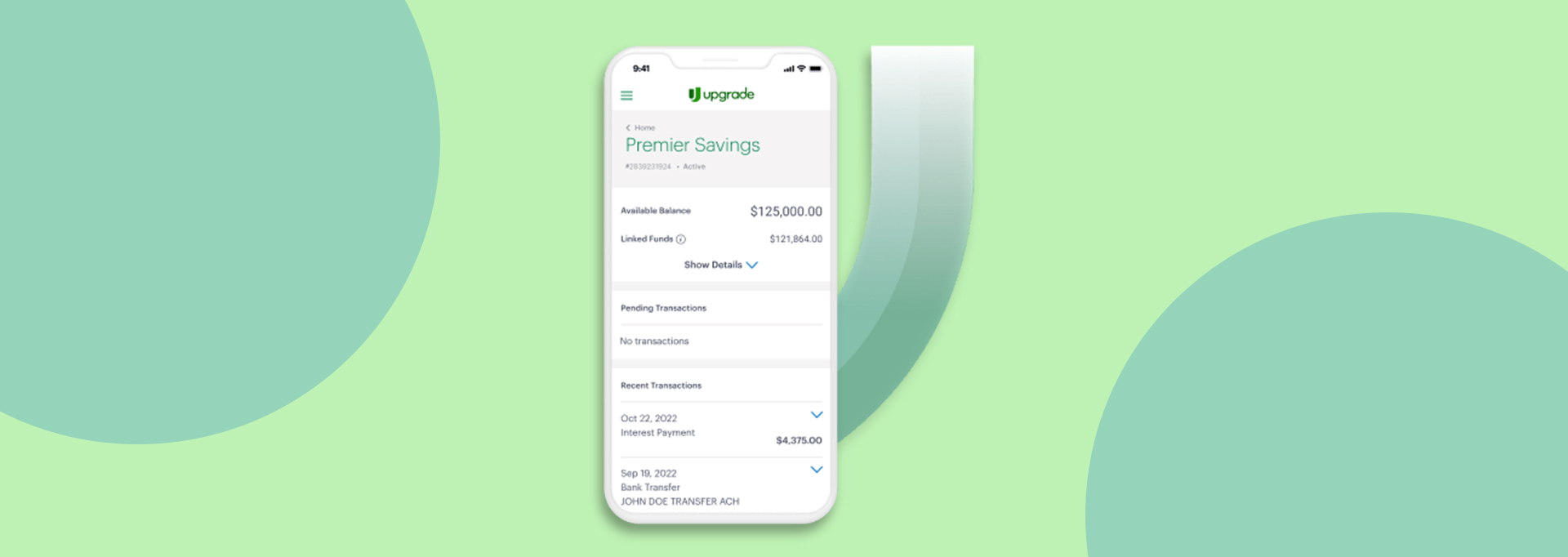

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.50%

*Annual Percentage Yield (APY) is variable and is accurate as of 4/02/2025. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.66%

Earn up to 4.66% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi Plus members are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

4.10%

Earn 4.10% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of March 19, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Copper

Copper offers a traditional debit card, a companion mobile app, and a feature that lets kids and teens learn about investing. Parents benefit from full visibility into their child’s spending and real-time purchase notifications.

Type of Card: Traditional debit card linked to mobile app

Age Requirements: 6 years old or older

Features:

- Parental controls

- Automated allowance feature

- Option to set up chores and tasks within the app

- 2% savings rewards with basic plan, and 5% savings rewards with higher-tier plan

- Purchase round-ups for added savings

- Direct deposit option for teens with jobs

- Free AllPoint ATM access

- FDIC insured

Monthly Fees:

- Copper: $4.95/month

- Copper + Invest: $7.95/month

ATM Access: Yes, card can be used at ATMs. Fee-free access to 55,000 Allpoint ATMs, but out-of-network ATM fees may apply.

APY: N/A

Chase First Banking

Unlike some other kids’ debit cards on our list, Chase First Banking is more like a traditional bank account with a companion debit card. That said, there is a digital component, and parents and teens can access the First account through the Chase mobile app.

Parents can also set spending limits in the Chase app and receive real-time purchase notifications. You need to have an existing Chase checking account to be eligible for Chase First Banking.

Type of Card: Traditional debit card linked to mobile app

Age Requirements: 6-17 years old

Features:

- Parental controls

- Automatic allowance feature

- Ability to assign chores within the Chase mobile app

- Option to set spending parameters that only allow kids to spend with certain retailers, up to specific limits

- Mobile payments to friends and family through Zelle

- Savings goals to help kids track their progress

- FDIC insured

Monthly Fees: None

ATM Access: Yes, card can be used at ATMs. Fee-free access to 15,000 Chase ATMs, but out-of-network ATM fees may apply.

APY: N/A

Pros and Cons of Kids’ Debit Cards

Pros

- Can teach kids about spending and financial responsibility, if used wisely

- More accessible to kids than credit cards

- No potential interest charges, as you’d see with a credit card

- Parental controls are available with most kids’ debit cards

- Account balances may be FDIC insured up to the standard $250,000 limit

Cons

- Frivolous spending can happen if the card isn’t used wisely

- No opportunity to build credit

- May have monthly fees, depending on the card

- Fewer purchase protections than credit cards

- Parents must monitor activity closely to ensure kids are being financially responsible

Things to Look Out for When Choosing an Account for Kids

While a debit card may seem like a pretty standard spending tool, debit cards designed for kids will include unique features and controls. If you’re thinking about getting your child started with their own debit card, here’s what to look out for when choosing an account.

- Fees: Some kids’ debit cards, or the checking accounts they’re attached to, come with monthly fees. Other fees may also apply, including ATM fees or overdraft fees. As you compare options, make note of the fees to ensure you’re aware of potential costs.

- Requirements: Certain cards are designed for kids as young as 6, while others are tailored to teens 13-17. As mentioned, parents or legal guardians must open an account on their child’s behalf before they can get a debit card.

- Parental controls: Different cards have varying parental controls, though most offer the option to set spending limits, receive purchase alerts, and turn off the card remotely. Despite this, it’s essential to research parental controls to find the best possible option for your family.

- Type of card: Different companies also offer different types of cards. One may provide a standard, plastic debit card, while another offers a digital card or prepaid debit card. Many come with a companion mobile app to simplify the process of setting up controls and tracking spending.

- Features: You’ll want to compare features across cards as well. Many kids’ debit cards have budgeting tools and allowance features, but others offer additional perks like automated savings, cash back on purchases, optional purchase round-ups for additional savings, and more.

- Protections: Certain debit cards may have fewer protections than credit cards. Look for a kids’ debit card with fraud protections, FDIC insurance on account balances, and the option to turn off the card remotely if it’s ever lost or stolen.

Related Article

Related Article

5 High-Yield Savings Accounts With Over 5.00% APY

Should Your Kids Have Access to a Debit Card?

Unfortunately, there’s no right answer when it comes to whether a child should have a debit card or not. The bottom line is that it depends on your child and if you feel they can use the card wisely.

There are benefits and drawbacks to kids’ debit cards. While they can be a great tool to teach kids about money, they are also an added responsibility for both children and parents. Parents must commit to helping their children learn to manage their money, or kids could end up overspending or making frivolous purchases.

Ensure you consider the pros and cons, and compare kids’ debit cards to find the best option for your family.

Frequently Asked Questions

-

You’ll need to be 18 years old to open a bank account on your own in the United States. That said, parents and legal guardians can open accounts with debit cards on their children’s behalf. Age requirements vary by company, with some having no minimum age requirement at all.

-

There isn’t necessarily an age requirement to use an ATM, but financial companies will have different age requirements for debit card access. If you’re considering a debit card for your child, compare options to find one that aligns with your family’s unique needs.

-

There’s no one right age when it comes to introducing your child to a debit card. It depends on the child and your own comfort level with them having access to this financial tool. If you think your child is ready for a debit card, it’s essential to teach them how to use one and provide ongoing guidance as they learn to manage their money.