Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Capital One 360 Performance Savings Account

- Our Rating 4/5 How our ratings work

- APY4.30%

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

Capital One 360 Performance Savings is a quality, entry-level account. While it doesn't offer the highest APY on the market right now, it's pretty close, and markedly better than the national average savings rate. This account keeps things simple with no monthly maintenance fees or minimum deposit requirements to earn interest.

Savings Made Easy

High-yield savings accounts are excellent for storing an emergency fund or funding short-term savings goals. They also offer annual percentage yields (APYs) that far surpass the national average. The Capital One® 360 Performance Savings™ account delivers an impressive 4.30% APY with no monthly fees or minimums.

Keep reading to learn more about this powerful savings device, other Capital One savings products, and how the account stacks up against other high-yield savings accounts.

Pros

- Competitive APY

- No minimum deposit requirement to open or earn interest

- FDIC insured

Cons

- No debit card included

- Limited physical branches for in-person banking

- Limited withdrawal options

Account Features

Capital One 360 Performance Savings is among the top high-yield savings accounts with its competitive APY, no monthly maintenance fees and no minimum deposit requirements. Here's a look at some of the account's best featur

Competitive Annual Percentage Yield

Capital One 360 Performance Savings earns 4.30% APY on all account balances. Interest earned on the account is compounded and credited on a monthly basis. It's among the highest APYs on the mar

No Monthly Fees

Some banks and credit unions charge monthly fees to manage your bank account. Like many online banks that don't charge monthly fees on savings accounts, Capital One doesn't charge a monthly maintenance fee on 360 Performance Savings. There's also no minimum deposit requirement to open an account or earn interest.

FDIC Insured

Deposits with Capital One accounts are FDIC insured up to $250,000 per depositor, per ownership type, in the event of a bank failur

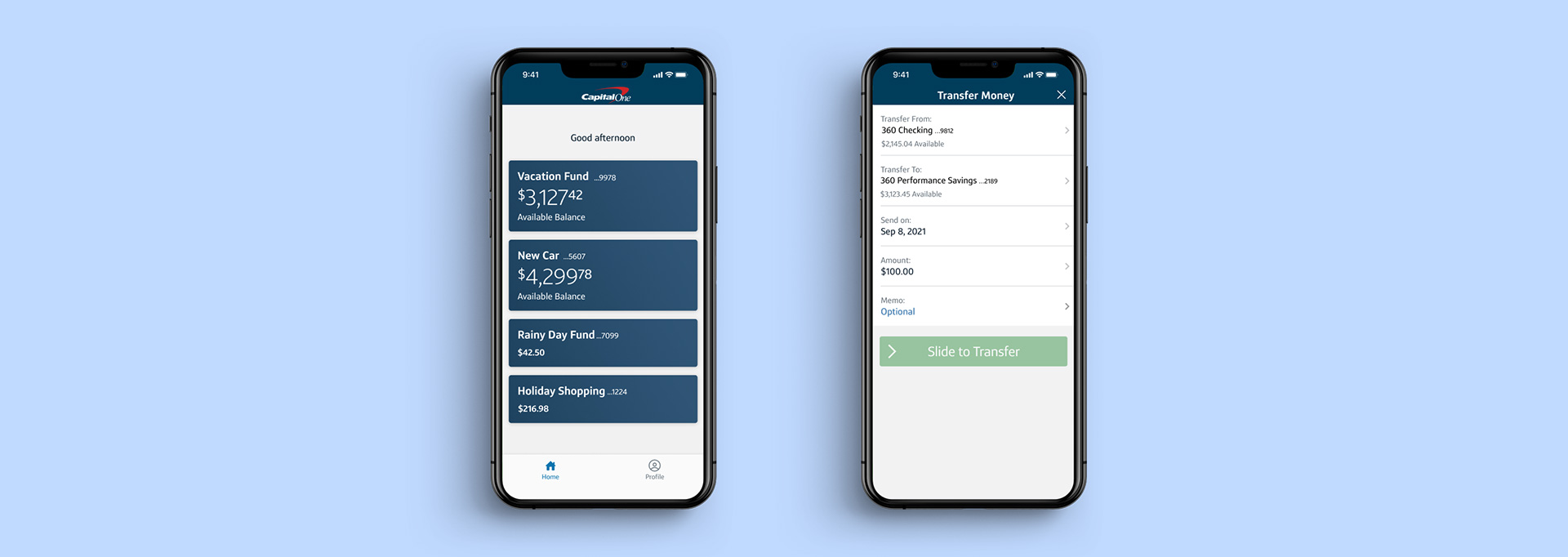

Highly Rated Mobile App

The Capital One mobile app is available for iOS and Android. The highly rated app allows Capital One customers to manage their accounts, pay bills, deposit checks digitally, monitor their credit score, send money via Zelle® and access Eno®, Capital One's virtual banking assi

Funding Your Account

Capital One offers customers a few ways to fund their accounts, including:

- Cash deposits

- Check

- Automated Clearing House (ACH) transfers

- Domestic wire transfers or other payment network transfers

- Transfers from an eligible Capital One deposit accou

nt

Accessing Your Funds

Capital One savings accounts do not come with a debit card. You can withdraw funds through electronic transfers through your online account, the Capital One mobile app or by calling the bank's customer service line. You can also make withdrawals in person at any Capital One br

Customer Service

Capital One offers banking support options 24/7 when you need help with your savings account.

Phone support is available by calling 1-800-655-BANK (2265). Customers can access automated bank phone support 24 hours a day, seven days a week. Live phone support is available daily from 8 a.m. to 11 p.m. (EST). You can also receive general support via Twitter at @AskCapit

Other Financial Products

Capital One offers a variety of other banking products, including options for kids and teens. If you prefer to do all your banking in one spot, here are some other Capital One products to consider.

Capital One 360 Certificates of Deposit

- Our Rating 5/5 How our ratings work

- Minimum

Deposit Required$0 - 1 Year APY4.00%

- 3 Year APY4.00%

Capital One offers some of the strongest interest rates currently available; with terms ranging from six months to five years, few other banks can compete with its CD rates. What's more, Captial One CDs are more accessible than many of its competitors' offerings. There's no minimum opening balance requirement for any of its CDs, and its early withdrawal penalties are relatively lenient, especially for longer term lengths.

A Capital One 360 CD® is great for short-term savings with funds you don't need to access soon. The bank offers nine CD terms ranging from six months to 60 months. Unlike CDs at some banks, no minimum balance is required to open a Capital One 36

| Term | APY |

|---|---|

|

6 Months |

4.25% |

|

9 Months |

4.25% |

|

10 Months |

5.10% |

|

12 Months |

4.80% |

|

18 Months |

4.45% |

|

24 Months |

4.00% |

|

30 Months |

4.00% |

|

36 Months |

4.00% |

|

48 Months |

3.95% |

|

60 Months |

3.90% |

Capital One CDs are FDIC insured up to legal limits. Customers can receive interest payouts monthly, annually or at the end of the CD

Capital One 360 Checking

Capital One offers an interest-bearing checking account called 360 Checking®. The account has no monthly fee or minimum deposit requirements, although the bank will close your account if you fail to make a deposit within 60 days of account opening. The account earns 0.10% APY on all balances.

360 Checking comes with a debit card and access to over 70,000 fee-free ATMs across the U.S. Checkbooks are available by request for an additional f

MONEY Teen Checking

The online bank also offers a checking account geared towards teens called MONEY Teen Checking. The account has no monthly fees or balance requirements and comes with a debit card and fee-free ATM access. MONEY Teen Checking acts as a joint account between parents and teens, offering access to select features for teens and parental controls via the mobile app. MONEY Teen Checking accounts earn 0.10% APY on all balan

Kids Savings Account

Capital One's Kids Savings Accounts are a great introduction to banking and money management for children. The interest-bearing account earns a respectable 0.30% APY with no minimum balance requirements or monthly fees.

You can link your bank account to a Kids Savings Account for easy transfers. You can also set up automatic savings plans to make regular deposits for allowance and other nee

How the Capital One 360 Performance Savings Account Stacks Up

Choosing a bank can be challenging, especially with many offering high-yield savings accounts. Shop around to compare all of your options before deciding. Here are some other banks to consider.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.85%

*Annual Percentage Yield (APY) is variable and is accurate as of 11/15/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.86%

Earn up to 4.86% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.00%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 12/3/24. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

4.35%

Earn 4.35% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of December 20, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Is the Capital One 360 Savings Right for You?

Capital One 360 Performance Savings sits among the top high-yield savings accounts because of its impressive interest rates. Other accounts offer higher APYs, though, so shop around to find the best account to maximize your savings efforts.

With no fees or minimum deposit requirements, it's a great savings option for nearly everyone. Plus, you get access to one of the top-rated mobile apps and its modern banking features.

The bank offers 24/7 banking support, although live support is only available during specific hours.

If you prefer to bank in person, the primarily online bank operates a limited network of bank branches and Capital One Cafes. Individuals residing near a Capital One location can take advantage of in-person banking or digital account access.

Capital One offers other banking products for those who prefer to maintain all of their accounts through the same ban

Related Article

Related Article

Best High-Yield Savings Accounts (December 2024)

Bottom Line

Compare the rates, fees, features and customer service options to find the best choice for your banking. Capital One 360 Performance Savings offers high-yield APY, but it's important to consider all your options before sticking wit