Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Bal

For savers looking for a safe place to stash funds for sho

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Highlights

- CD accounts earn

up to 5.25% APY, depending on your chosen term. - CD terms range from

12 to 60 mon ths. - The bank offers up to

5.25% APY on its online money market account. - The money market account carries a $

10 monthly maintena nce fee, waivable by maintain ing a minimum daily balance of $1,000 - Online mon

ey market accounts do not come with an ATM card or check-writin g privileges.

Who Is CFG Bank Best for?

CFG Bank offers hig

- You're comforta

ble banking online or from your mobi le device. - You want to earn h

igh-yield interest and can meet acco unt minimums. - You do

n't need a checkbook or AT M card. - You can m

eet minimum balance requirements to waive month ly fees.

Explore the Best Checking Accounts

Visit the Marketplace

CFG Bank Certificates of Deposit

- Our Rating 4/5 How our ratings work

- Minimum

Deposit Required$500 - 1 Year APY5.25%

- 3 Year APY4.35%

- 18-Month APY APY4.95%

While CFG Bank doesn't offer the largest variety of CDs we've ever seen, pretty much all of its offered term lengths are at the top of their class in terms of interest rates. So long as you're interested in a CD with terms of 12-60 months, and are confident you won't need to withdraw your funds early, you'll likely earn one of the top rates available by choosing CFG.

CFG Bank CDs offers guaranteed earnings through a fix

Below are details on CFG Bank's CD offerings:

| Term | APY |

|---|---|

|

12 Months |

5.25% |

|

18 Months |

4.95% |

|

36 Months |

4.35% |

|

60 Months |

4.05% |

CFG Bank do

4 Best No-Penalty CD Rates in July 2024: Earn Up to 4.70% APY

CFG Bank High Yield Money Market Account

- Our Rating 3.5/5 How our ratings work

- APY5.25%

To earn interest on this account, you must maintain a minimum daily balance of at least $1,000.

- Minimum

Deposit Required$1,000 - Intro Bonus N/A

If you have a long-term savings goal—as well as at least $1,000 in funds that you won't need for a while—CFG Bank's High Yield Money Market Account is a great option. Offering customers an impressive 5.25% APY, you'd be hard-pressed to find an account that will net you more interest on your savings balance. However, it's worth noting that you need to maintain a minimum daily balance of at least $1,000 to earn interest, and you'll be charged a $10 monthly maintenance fee if your account balance drops below $1,000. If you don't think you can easily meet this requirement, you're likely better off looking elsewhere.

The CFG Bank High Yield Money Market Account earns on

CFG money market accounts require a $1,0

The on

Explore the Best Money Market Accounts

Visit the Marketplace

How Does CFG Bank Compare?

| Account | APY | Minimum Deposit | Learn More |

|---|---|---|---|

|

|

5.25%

To earn interest on this account, you must maintain a minimum daily balance of at least $1,000. |

$1,000 | Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

N/A | Open Account |

|

|

1.55%

Annual Percentage Yield is accurate as of March 31, 2023. Interest rates for the CIT Bank Money Market account are variable and subject to change at any time without notice. |

$100 | Open Account |

Other CFG Bank Accounts

In addition to its money market account and CDs, CFG offers the following accounts:

- A stand

ard saving s account - YouthSaver a

ccoun t (for young adults under 18) - Ba

sic Chec king - Check

ing Plus Interest C hecking - Stud

ent Check ing

CFG Bank is also known for its com

Explore the Best Bank Bonuses Currently Available

Visit the Marketplace

Banking Experience

If you decide to open an account with CFG Bank, here's what you can expect:

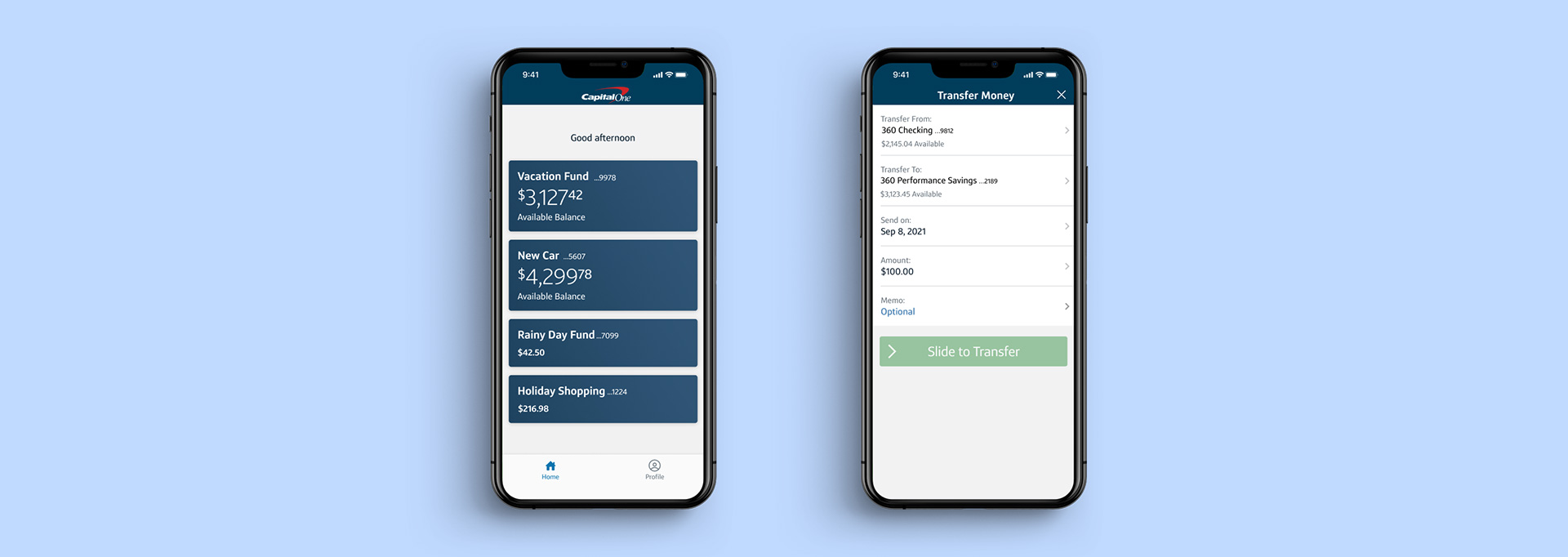

- How to withdraw and deposit funds: CFG allows you to withdraw fund

s through a transfer to a linked external b ank account. You can deposit money to your CFG account with bank transfers, mobile deposits, by mail and at its two branch locations in Maryland. - Mobile app: CFG Bank's mobile app has a 4.3-s

tar rating on the App Store, while its Google Play rating is lower at 3. 3 stars. Customers can manage accounts, check balances, transfer money, view statements and set up account alerts through th e app. - Customer service: Customers ha

ve 24/7 access to automated bank support and live phone support Monday through Friday during business hours, plus email support . CFG Bank operates two bank branches for in-person support for customers in the greater Baltimore area.

Drawbacks

While CFG money ma

- Monthly fee: The bank's money market account hhas

a $10 monthly fee unless you can m eet the daily minimum balance requirement to waive it. Paying bank fees undermines savings growth from earned interest on deposits. - Relatively high minimum deposit: Money market accounts require a $1,

000 minimum deposit to open, while CDs have a $500 minimum opening de posit. Neither is the highest we've seen, but many banks offer similar account offerings with lower entry barri ers. - Limited access to funds: Accessing your funds requires transferr

ing money to an external bank account, which can take several days to co mplete.

How to Open an Account

You can ope

- Name

- Contact information

- Mailing address

- Date of birth

- Social Security number

- Government-issued photo ID

- Bank account information to fund your new account

About CFG Bank

CFG B

Is CFG Bank Worth It?

CFG Bank certainly offers so

Still, CFG offers high-yield ra

FAQs

-

CFG Bank is headquartered in Baltimore, Maryland. The bank operates primarily online but has two local bank branches in Maryland for in-person banking.

-

Yes, money kept at CFG Bank is FDIC insured up to $250,000 per depositor, per insured bank, for each account ownership category.

-

CFG allows you to add funds to a money market account via ACH transfer, mobile deposit, in person at a branch, or by mailing a check.