Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

You can also use

T

If you haven’t used PayPal in a while, or if you’ve only used it to s

Pros

- High Savings Interest Rate

- No Minimum Account Balance Requirement

- No Monthly Service Fees

- Check Cashing Option

- Receive Direct Deposit

- Access Paychecks and Government Payments Up to 2 Days Early (If Eligible)

- Rewards-Earning Potential

Cons

- No Checking Account, Money Market Account, or CD Options

- No Joint Account Option

- No In-Person Branches

- Can Take Up to 6 Business Days to Transfer Funds From a Bank Account

- Savings Account Is Not Available to Business PayPal Account Holders

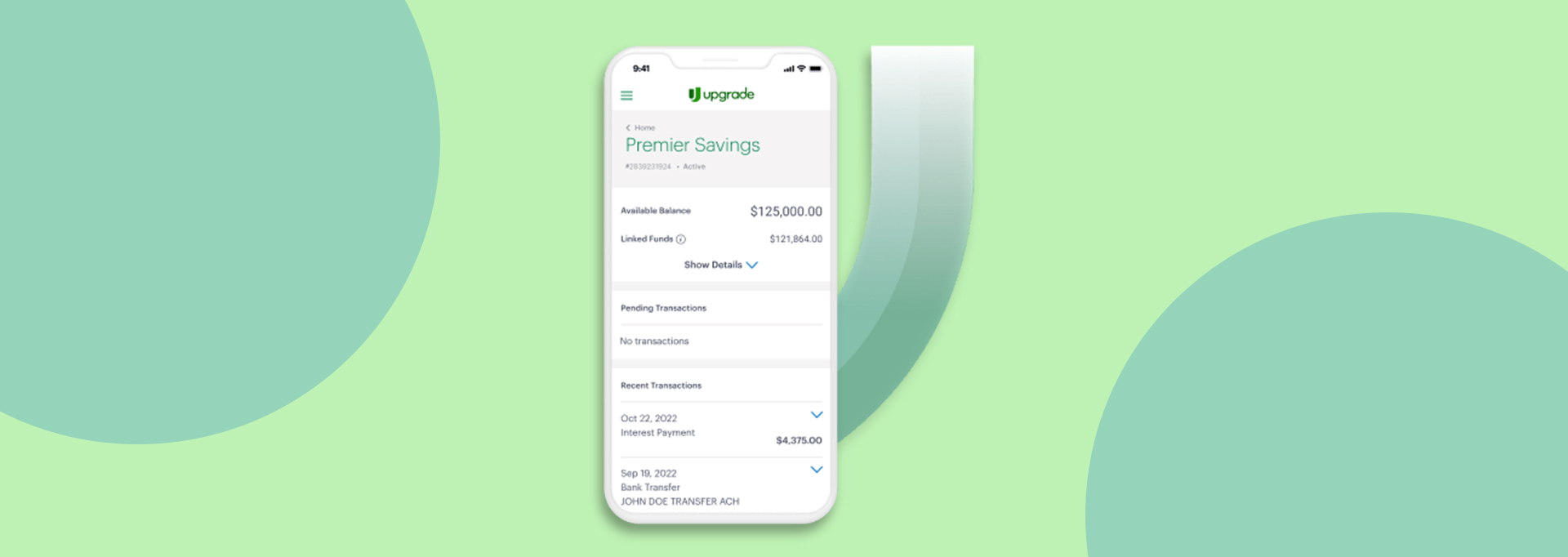

PayPal Savings

PayPal Savings is an offering that’s available through the PayPal platform in partnership with

APY

PayPal Savings essentially functions as a high

According to the Federal Deposit Insurance Corporation (FDIC), the average interest rate financial institutions paid on savings accounts as

Explore the Best High-Yield Savings Accounts

Visit the Marketplace

Fees

Of course, the interest rate isn't the only factor to consider when you choose the best savings account for your situation. Another perk PayPal Savings users can enjoy is the

Minimum Deposit Requirement

Another benefit of the PayPal Savings account is its

Benefits

On top of a higher-than-average interest rate and no monthly service fees, PayPal Savings account holders can enjoy several other benefits.

Savings Go als: Create custom goals to save for specific purposes (likesinking funds ) and track your progress.- Auto

matic Tran sfers: Schedule automatic savings transfers from a linked bank account orPayPal balance into your PayPal Savings account (and cancel any time). - U

nlimited Withd rawals: Withdraw funds from your savings account as often as you like without limitations.

How to Open a PayPal Savings Account

You can open a PayPal Savings account through the mobile app or on the PayPal website. In the app, visit the “Finances” tab and click the "PayPal Savings" page to get

To be eligible for a PayPal Savings account, you’ll

To add funds to your PayPal Savings account, you have

- Transfer money from your

PayPal balance . - Transfer funds from a linked

bank account . - Add m

oney from a linked Vis a® or Mastercard® debit card.

When moving funds from a linked bank account, be prepared to wait approximately

PayPal Digital Wallet

- Our Rating 4/5 How our ratings work

- Minimum

Deposit RequiredN/A

PayPal is a trusted household name that is widely accepted by many retailers. Its digital wallet makes it easy to securely organize your preferred payment methods, and even earn some extra rewards on your purchases.

One of the many ways you can use the PayPal app is to set up a

It’s worth noting, however, that you may not want to cash in your credit card rewards on purchases with retailers. Often the points and miles you earn may be worth more if you redeem them in a different way (like redeeming them for free travel).

Earn Up to 10% Cash Back on Purchases

Through August 31, 2023, you can earn up to 10% cash back by using PayPal to make a purchase. Here's how it works:

- Click the invitation link

- Make at least one eligible purchase with your valid PayPal account by August 31

- Receive PayPal Rewards Points for the

purchase(s ), redeemable for up to 10% cash back, for a maximum of $30 (equal to 3,000 Points)

Your PayPal Rewards Points should appear in your account within 14 days but may arrive sooner.

There are some restrictions on how you can use your cash back reward. For example, you can't use it for send/receive money transactions, including for goods and services,or for any transaction made in a foreign currency.

You must be a U.S. resident age 18 or older and have a U.S. personal account with PayPal in good standing to be eligible for this offer.

Other PayPal Features

In addition to PayPal Savings and digital wallet, you can use PayPal to simplify your financial life in other ways.

Cash a Check Service

PayPal doesn't have a full

However, the app does include some limited features that might appeal to consumers who lack a traditional checking account. The PayPal

Expedited Funding

Receive

Delayed Funding

Receive free check cashing for no fee with a

If you’re looking for a digital check cashing option, you might want to research what some of the best online banks have available. There are

Direct Deposit

Consumers who lack a traditional bank account may also use PayPal as a means

When you use PayPal for Direct Deposit, the funds you receive appear in your

Rewards-Earning Debit Card

The PayPal Debit Card includes free access to MoneyPass® ATMs to withdraw cash, has no monthly fee or minimum balance requirement, and does not require a credit check to get.

If you have a PayPal Savings account, you can transfer money from it to your PayPal Balance and use the debit card to make purchases in stores and online or withdraw the money at an ATM.

Is PayPal Right for You?

PayPal has long been recognized as a convenient, safe way to pay

If you’re looking for a convenient way to earn more interest on your savings and stay on track with multiple savings goals,

However, it’s also important to understand that PayPal comes with li