Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

If you're looking for a place to stash an emergency fund, save up for a down payment or manage another short-term savings goal, a high-yield savings account can keep your money safe and also reward you with a high interest rate. Marcus by Goldman Sachs® is one bank that offers a high yield—currently an impressive 4.40% APY APY—that's several times higher than the national average.

Here’s what you need to know about the Marcus by Goldman Sachs Online Savings Account, as well as its other savings products, and how they stack up against other options.

Marcus Online Savings Account

- Our Rating 4/5 How our ratings work

- APY4.40% APY

Annual percentage yield is accurate as of June 6, 2024. APY may change at any time before or after the account is open. Maximum balance limits apply.

- Minimum

Deposit RequiredN/A

With a decent interest rate, no minimum balance requirement and few fees, the Marcus Online Savings Account is easy to recommend to anyone who's comfortable banking exclusively online.

Marcus by Goldman Sachs Online Savings

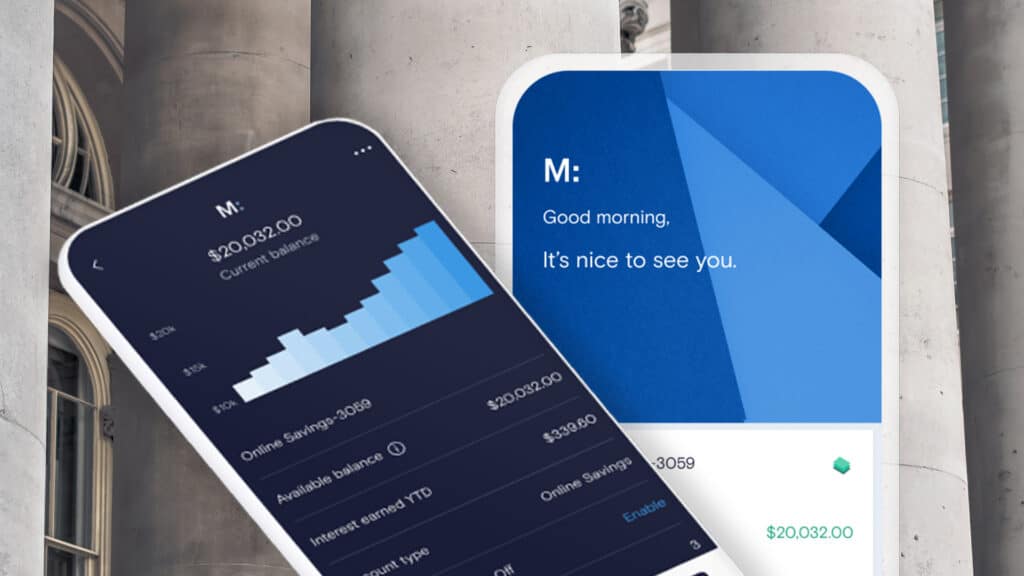

Marcus by Goldman Sachs is an online bank, which means it doesn't have any brick-and-mortar branches. However, that means the bank has fewer overhead costs and can afford to provide a higher yield on your deposits.

Related Article

Related Article

U.S. Bank Bonus Offers: Up to $800 for Opening New Accounts

FDIC Insurance

The Marcus Online Savings account is FDIC insured for up to $250,000 per depositor, per account, which is a must-have feature of a savings account.

Generous Annual Percentage Yield

This Marcus account offers 4.40% APY APY on your deposits, making it one of the top high-yield savings accounts on the market. Interest is compounded daily and added to your account monthly, which is standard for most high-yield savings accounts.

And unlike some other high-yield savings options, your APY won't go down as your balance grows. There is, however, a general deposit limit of $1 million per account and $3 million per customer. As with all bank accounts, the interest you earn is taxable income, and you'll receive a 1099-INT form each year, which you can use to report your earnings.

Referral Bonus

If you refer a friend who opens a Marcus account, both you and the new customer will receive a yield that's 1.00% higher than the stated APY for three months.

Recommended Bank Bonuses

| Bank Account | Intro Bonus | Minimum Deposit | Learn More |

|---|---|---|---|

|

Member FDIC |

$50-$300Expires December 31, 2024

See full terms and disclosures at sofi.com/banking. Direct Deposit Promotion begins on 12/7/2023 and will be available through 12/31/24. SoFi members with Direct Deposit can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the 4.60% APY for savings (including Vaults). Members without Direct Deposit will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

N/A | Open Account |

|

|

$300Expires October 16, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

N/A | Open Account |

Axos Rewards Checking Account |

Up to $500Expires July 31, 2024

Cash in on up to a $500 bonus† and up to 3.30% APY* with a new Rewards Checking account. Just use promo code RC500 before July 31. |

N/A |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

|

$300Expires October 17, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

N/A | Open Account |

No Monthly Fees or Deposit Requirements

It's common for high-yield savings accounts to have no monthly fees, and the Marcus Online Savings account is no different. Plus, there's no minimum deposit requirement when you open the account, and your balance doesn't need to meet a requirement to start earning interest.

There doesn't appear to be an overdraft fee associated with the account, but if your account remains negative for 60 days, Goldman Sachs may close it.

Funding Your Account

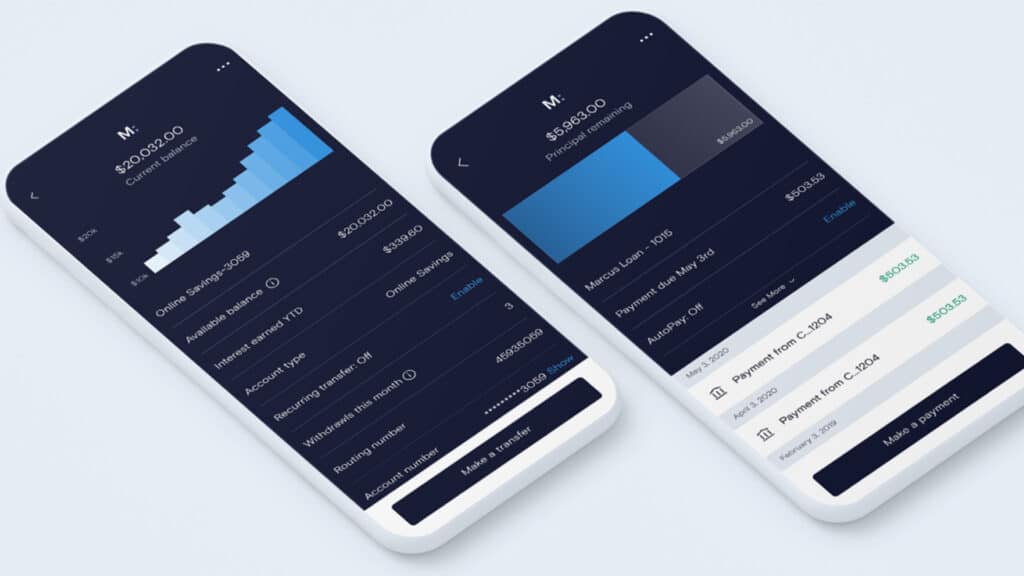

Unlike other bank accounts, the Marcus account doesn't offer check deposits via the mobile app. However, there are four other ways you can fund your account, including:

- ACH transfers, with the option for same-day transfers of $100,000 or less, depending on when you submit your request

- Direct deposit from your employer

- Mail a check (cash deposits are not allowed)

- Send a domestic wire transfer from your primary checking account

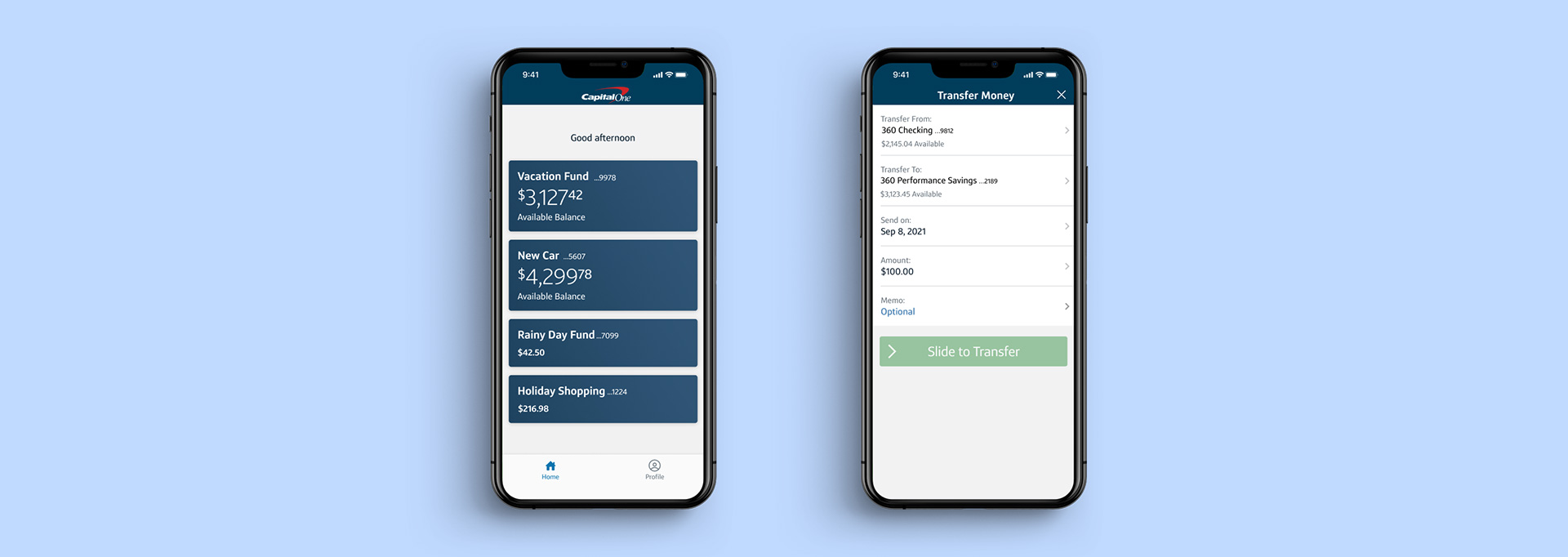

Accessing Your Funds

Unfortunately, you won't receive a debit or ATM card with your savings account. However, you can access the funds in your online bank account in the following ways:

- ACH transfers initiated with Marcus or your other bank account

- Wire transfer initiated through customer service

- Have a check sent to you

Additionally, Marcus by Goldman Sachs doesn't limit your withdrawals to six per month as many other banks do. You can make as many withdrawals as you'd like without worrying about an extra fee.

Customer Service

The Marcus customer service team is available 24/7, so you don't have to worry about being left high and dry outside of business hours with your Online Savings Account. You can reach customer service by calling 1-855-730-7283 or through a live chat function in your online account (not available in the Marcus app).

How the Marcus Online Savings Account Stacks Up

There are a lot of high-yield savings accounts out there, so it's important to shop around and compare all of your options before settling. Here are some other banks to consider.

| Bank AccountAccount | APY | Features | Learn More |

|---|---|---|---|

|

|

4.40% APY

Annual percentage yield is accurate as of June 6, 2024. APY may change at any time before or after the account is open. Maximum balance limits apply. |

No minimum deposit |

Open Account |

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Other Financial Products

Goldman Sachs offers a handful of other financial products. One notable absence is a checking account, which you can't get alongside your Online Savings account with the bank.

With that said, here's what else you might consider for long-term savings, borrowing or investing.

High-Yield Certificate of Deposit

With a high-yield CD from Goldman Sachs, you'll get some of the best CD rates on the market. The bank offers maturities ranging from six months to six years:

| CD Term | APY |

|---|---|

|

7-month No-Penalty CD |

4.70% |

|

11-month No-Penalty CD |

4.70% |

|

13-month No-Penalty CD |

4.70% |

|

6 months |

5.10% |

|

9 months |

5.00% |

|

12 months |

5.00% |

|

18 months |

4.60% |

|

24 months |

4.20% |

|

36 months |

4.15% |

|

48 months |

4.05% |

|

60 months |

4.00% |

|

72 months |

3.90% |

What's more, Goldman Sachs offers a 10-day rate guarantee, which means that if the yield increases within 10 days of opening your account, you'll get the higher rate.

There is, however, a $500 minimum balance when you open the account. The account is insured by the FDIC.

No-Penalty Certificate of Deposit

With the Goldman Sachs No-Penalty CD, you can withdraw your money at any time (beginning seven days after funding the account) without incurring a penalty. You can choose between a 7-, 11- or 13-month term.

The only limitation is that you have to wait at least seven days after funding the account to access your money. As with the high-yield CD, the minimum deposit requirement is $500. The account is insured by the FDIC.

Rate Bump Certificate of Deposit

This specialized CD allows you to take advantage of increasing interest rates, even after you open your account. If Goldman Sachs raises the interest rate on the account, you can bump your APY up to the new rate once during your term.

The Rate Bump CD has a 20-month maturity and a 4.40% APY. There is a penalty if you withdraw your money before the account matures, and there's a $500 minimum balance. The account is insured by the FDIC.

Build your savings fasterExplore the Best CD Rates

Visit the Marketplace

Borrowing

Goldman Sachs Bank USA offers no-fee personal loans from $3,500 to $40,000, which you can use for debt consolidation or home improvements. The bank also offers a Buy Now, Pay Later service called Marcus Pay®, which allows you to make point-of-sale purchases from $300 to $10,000, and pay them off over six, 12 or 18 months with interest.

However, Marcus is now only offering personal loans to applications with a personal invitation code, which will limit this option for most people.

Marcus by Goldman Sachs

- Loan Amounts$3,500 – $40,000

- Loan Terms36 - 72 months

- APR Range6.99% – 24.99%

- Minimum

Credit ScoreNot disclosedA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Personal loans offered through Marcus by Goldman Sachs come with unique features, such as no fees, rewards for on-time payments, rate discounts, and the ability to change your due date.

Investments

With Marcus Invest, you can take advantage of investment portfolios built by the experts at Goldman Sachs. The robo-advisor platform uses algorithms to manage your portfolio for a light 0.25% annual fee.

Marcus by Goldman Sachs Online Savings Account Pros and Cons

This savings account offers solid value, but there are some notable drawbacks to keep in mind if you're thinking about opening one.

Pros

- The APY is much higher than the national average

- Can transfer up to $100,000 to another account on the same day

- Don't have to maintain a certain balance to earn interest or to avoid monthly fees

Cons

- No ATM network

- No checking account

- No cash deposits

Is the Marcus Online Savings Account Right for You?

The online high-yield savings account offers a decent interest rate, but it's not the best on the market. So, if you're looking to maximize your savings, shop around and compare accounts to determine the right one for you. The account does skip the fees and doesn't have a minimum balance requirement, but you can find those features among other accounts as well.

One feature that sets Goldman Sachs apart from the competition is the ability to make same-day transfers from your external accounts. Because this is one of the only ways to fund your account, it's a great benefit, particularly if you need to transfer money out of savings for an emergency or other immediate need.

Ready to open an account? Start here.

With that said, the account likely isn't a good fit for someone who prefers in-person service or wants to maintain their checking and savings accounts with the same financial institution. And if you use cash often and want the option to deposit cash into your savings account or withdraw cash from your account with an ATM, the Marcus account can't help you with either of those.