Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

First Citizens Bank is the largest family-controlled bank in the United States. Fans of in-person banking may enjoy taking advantage of the services that First Citizens Bank offers, including four different checking and savings accounts — several of which feature no monthly fees.

In addition to the bank's wide variety of checking and savings accounts, eligible customers can open money market accounts, certificates of deposit (CDs) and investment accounts. The bank also offers financing such as credit cards, auto loans, mortgages, home equity lines of credit and more.

First Citizens Bank Accounts: Discovering Your Options

First Citizens Bank offers three different types of consumer checking accounts, an online savings account, money market account and certificates of deposit.

Here's an overview of each type of account to help you figure out which First Citizens Bank accounts might work well for your needs.

Free Checking

Monthly Fees: None Paperless statements are required to avoid account fees. To be eligible for Free Checking, you must sign up to receive First Citizens paperless statements within 60 days of account opening. If you do not sign up and receive paperless statements, your account will be automatically converted to a Select Checking account and will be subject to the fees and charges applicable to a Select Checking account.

Minimum Opening Balance: $50

Features:

- No ongoing minimum balance requirements

- Included Visa debit card

- FDIC insured

- Mobile banking services

The Free Checking Account by First Citizens Bank is a simple, free banking solution that is easy to understand. There’s only one requirement you have to meet to avoid the monthly fee on this checking account: Sign up for paperless statements within 60 days of account opening.

You'll need to make a minimum deposit of $50 to open the account. However, after the initial deposit, there are no minimum balance requirements to keep your Free Checking Account open and active.

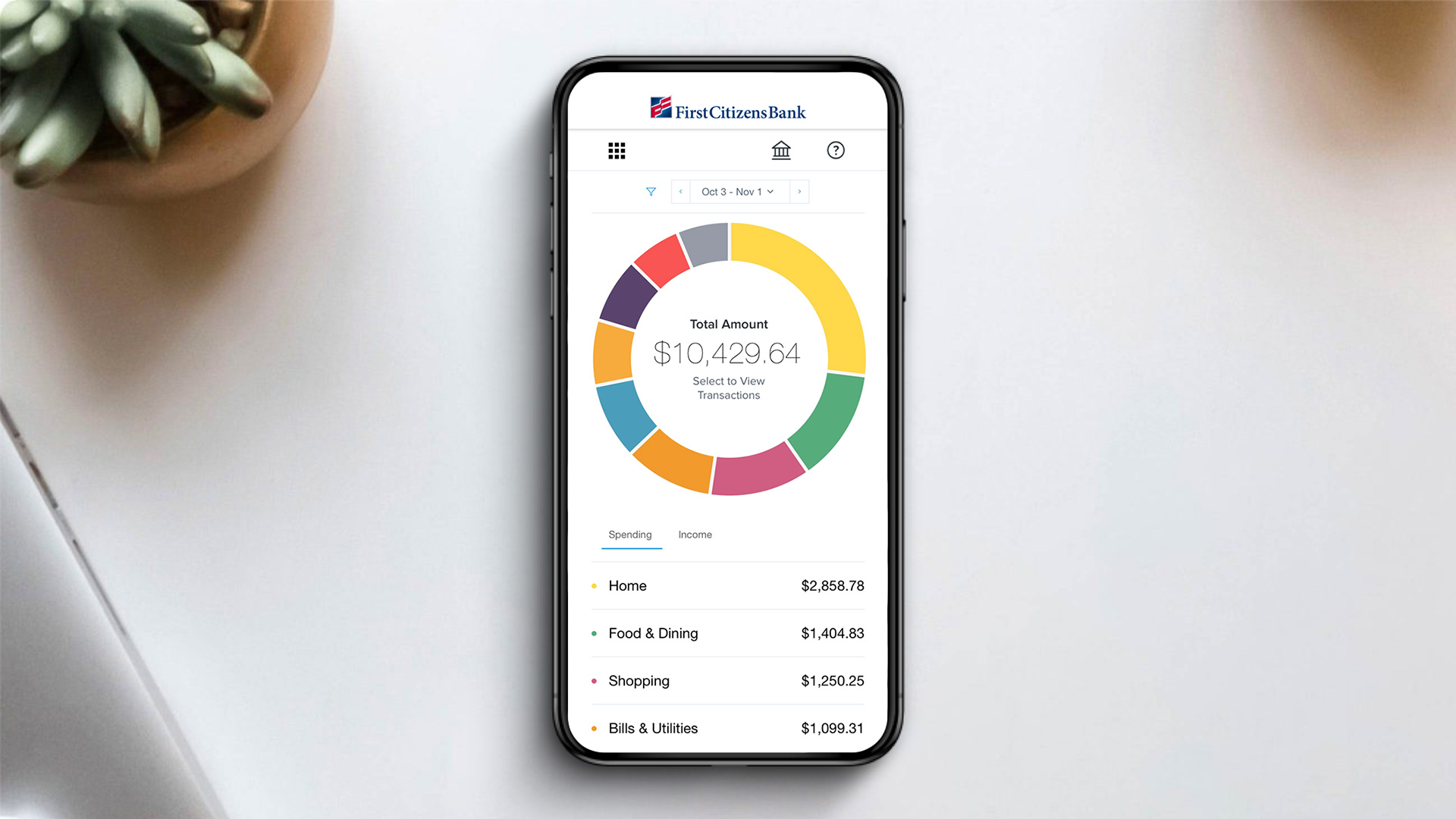

The account also comes with a Visa debit card, access to free digital banking tools (like Zelle® and mobile deposits) and optional overdraft protection. You can even link the account (and others) to the bank's money management tool — Manage My Money — to take advantage of budgeting solutions, net worth tracking, financial alerts and more.

Premier Checking

First Citizen Bank's Premier Checking Account may be a better option for people who want to earn interest on their deposits. In addition to being an interest-bearing account, customers who open a Premier Checking account may also be eligible for better rates on the bank's CDs and home equity lines of credit (HELOCs).

The checking account does feature an $18 monthly fee. However, you may qualify for a waiver if you have any of the following:

- $5,000 combined daily balance on eligible accounts (e.g., Premier Checking, Together Card, Regular Savings, Bonus Savings, Online Savings, Tiered Money Market Savings, Premium Tiered Money Market Savings, CDs, IRAs or an Investor Services Account)

- $4,000 or more in direct deposits per month.

- Equity line of $25,000 or more.

- Consumer loan from the bank of $10,000 or more.

Prestige Checking

The Prestige Checking Account is First Citizen Bank's highest-tier checking account option. According to the bank, customers who open this account can expect the VIP treatment with:

- The best rates the bank offers on HELOCs and CDs.

- Free cashier's checks, travelers checks and money orders.

- Unlimited ATM fee reimbursement. (Note: Third-party fees charged by the ATM owner may still apply; foreign withdrawals are subject to a 3% fee.)

The annual percentage yield (APY) that you earn with the Prestige Checking is the same as the APY the bank offers its Premier customers — 0.05% at the time of writing.

The monthly fee for Prestige Checking is $25. You can qualify for a waiver for the monthly fee, but the qualification criteria is a bit harder to satisfy:

- $25,000 combined daily balance on any First Citizens deposit account.

- $6,500 or more in direct deposits per month.

- Equity line of $100,000 or more.

- Consumer loan from the bank of $25,000 or more.

Online Savings Account

APY: 0.03%

Monthly Fees: None

Minimum Opening Balance: $50

Features:

- No monthly service fees

- No ongoing minimum balance requirements

- FDIC insured

First Citizens Bank offers a convenient, free online savings account that's easy to open and use anywhere. The minimum deposit to open an account is a low $50.

There are no monthly fees to use the accounts, and no hoops to jump through to qualify for a waiver. That being said, you only get two withdrawals or transfers per month for free. After that, you'll pay $3 per transfer or withdrawal thereafter.

Additionally, the account does earn interest. But the APY on the account as of writing is just 0.03%. That's lower than the APY bank offers on some of its checking accounts, and lower than the national average interest rate of 0.21% on savings accounts per the FDIC (October 2022 data).

Money Market Account

A money market account with First Citizens Bank offers customers the chance to earn a higher APY. Plus it features some of the benefits of both a savings and a checking account combined.

First, you have a chance to earn 0.05% to 0.15% APY (at time of writing) depending on your balance. Here are the different balance tiers where you could qualify for higher earnings:

- $0-$24,999: 0.05% APY

- $25,000-$99,999: 0.07% APY

- $100,000-$499,999: 0.10% APY

- $500,000+: 0.15% APY

The account has a $10 monthly maintenance fee. However, if you maintain a daily balance of $1,000, the bank will waive that extra expense for you.

You do have to make an initial deposit of $500 to open a Money Market Account with First Citizens Bank. So keep that in mind if you're considering one of these accounts.

Certificates of Deposit

First Citizens Bank offers a variety of fixed-rate CDs with terms that range from six months to five years. The rates on these FDIC-insured certificates of deposit range from 0.01% APY (6-Month CD) to 0.15% APY (5-Year CD). All of the CD options, regardless of duration, require a $500 minimum opening deposit.

First Citizens Bank Features and Benefits

Based on the type of account you open, you may be able to take advantage of the following benefits and features that First Citizens Bank has to offer its customers.

- Digital Banking: The online tool lets you see all of your accounts in one location, including accounts with other banks. You can take advantage of the program's budgeting apps, review statements, order checks, transfer funds and set up account alerts.

- Zelle: Conveniently send money to anyone with a U.S. bank account. You can access Zelle through your First Citizens Bank Digital Banking app or online account.

- Bill Pay: Customers can take advantage of the bank's Bill Pay service. You can make unlimited bill payments using the service at no charge. However, additional fees may apply for certain types of transactions or rush payments.

- Mobile Deposits: Customers enjoy 24/7 access to mobile deposit capabilities. The first 10 mobile deposits you make each month are free. Afterwards, there's a $0.50 fee per check.

- No Minimum Balance: With several of First Citizen's accounts, you don't have to worry about maintaining a minimum balance after you open your account.

- Overdraft Protection: You can set your checking account up for three different types of overdraft protection. However, the bank may charge you a $10 fee each day (or for each overdraft over $5) depending on the type of coverage you choose. With Checkline Reserve overdraft protection, you'll also pay interest for using this revolving line of credit.

First Citizens Bank Fees

On top of the monthly account fees mentioned above, you might encounter additional fees as a First Citizens Bank customer.

- Wire Transfer: $15.00

- External Fund Transfer Fee (Bank to Bank): $2.99

- Next-Day Rush Bill Payment: $34.95

- Two-Day Rush Bill Payment: $29.95

- Gift Payments: $2.99

- Charitable Donation Payments: $1.99

- Express Mail Notification Letter: $15.00

- Bill Pay Payment Cancellation (Before Disbursement): $7.50

- Payee-Returned ACH Payment (Customer Error): $10.00

- Payee-Returned Check Payment (Customer Error): $5.00

- Proof of Payment for Bill Payment (Not Disputed): $10.00

- Research from Offline Files: $25.00/Hr.

- Multiple Users: $7.50 per month (In Addition to Primary User)

- Mobile Deposit: $0.50 (After First 10 Free Checks)

First Citizens Bank Pros and Cons

If you're considering doing business with a new bank or credit union, it's wise to shop around and see what the best banks have to offer in terms of services, products, rates and bonuses. You should also take the time to look at the benefits and drawbacks of each individual bank you're considering.

Here are some pros and cons of opening an account with First Citizens Bank.

Pros

- Free Checking and Savings Options: If you're looking for a free checking and/or savings account, First Citizens Bank offers both options.

- In-Person and Digital Banking: Some people prefer the option to visit a bank branch in person. Others like to do their banking online. First Citizens offers customers the opportunity to manage their accounts both ways.

- Full-Service Banking: Enjoy managing all of your finances with the same financial institution? In addition to deposit accounts, the bank also offers insurance, credit cards, loans and other financial products.

- Good Reputation: First Citizens Bank is the largest family-controlled bank in the U.S. It has a 120-year history of providing reliable financial services to its customers. The bank offers FDIC-insured deposit accounts and has a decent track record when it comes to customer service.

Cons

- Low Earnings: The annual percentage yields (APYs) that First Citizens Bank offers on its checking, savings, money market accounts and CDs are much lower than you may find elsewhere. In some cases, the bank's interest rates are lower than the national averages for such accounts. You can almost certainly find higher interest rates on high-yield savings accounts, money market accounts and CDs with other online banks.

- Fees: Although the bank offers a free checking and savings account options, some other accounts feature fees. You may be able to qualify for a fee waiver, but you'll have to jump through hoops to do so.

- Limited Footprint: Fans of in-person banking should verify that First Citizens Bank has locations in their area. The bank only has branches in 19 states.

Is a First Citizens Bank Account Right for You?

If you're a fan of in-person banking and keeping all of your accounts under the same roof, banking with First Citizens Bank might appeal to you. However, if earning the most money possible on your savings is a bigger priority to you, you may want to continue your search. Keep in mind that it's wise to compare multiple options upfront no matter which banks you're considering. When you take the time to shop around first (including shopping for the best bank bonuses and promotions) you can feel confident that you've chosen the best bank for your situation.

Featured photo courtesy of First Citizens Bank