Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

TurboTax

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

TurboTax shines when it comes to customers who have more complex tax returns. The Deluxe option helps maximize tax deductions and credits, while Premium covers investments—including cryptocurrency and and stock activity—and rental properties. Plus, you can easily import your investment income automatically with TurboTax.

Tax Filing Solutions for All Situations

Finding the right tax preparation service can be difficult. As you consider your options, TurboTax® may be at or close to the top of your list to research. The service, owned by Intuit®, is one of the most popular tax preparation softwares available. But biggest isn’t always the best, so take time to examine your options to determine the right fit for you.

Pros

- A product for every tax situation, both simple and more complex

- TurboTax Premium includes investments and rental properties

- A comprehensive review of your return, ensuring nothing gets missed

Cons

- Some products are more expensive than competitors

- Pricing for specific packages can be hard to find at a glance

TurboTax at a Glance

|

Price |

|

|

Guarantees |

|

|

W-2 + Prior Year Import |

|

|

Audit Support |

|

|

Access to Tax Experts |

|

Types of Returns and Pricing

TurboTax offers several pricing tiers, each one offering a different set of services, forms and features that can help you file your tax return with complete accuracy. Pricing varies for each tier and is subject to change.

TurboTax Products & Pricing

| Tier | SUMMARY | FEDERAL | STATE |

|---|---|---|---|

|

$0 |

$0 |

|

|

$69 |

$64 |

|

|

$129 |

$64 |

Turbo Tax Free Edition: $0 Federal, $0 State*

TurboTax Free Edition (*disclaimer: ~37% of taxpayers qualify for TurboTax Free Edition. Form 1040 + limited credits only) is available to taxpayers who only need to file Form 1040 with no additional forms or schedules. It includes the following, assuming there's no added complexity:

- W-2 income

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Hobby, personal property rental, or personal item sales income reported on Form 1099-K

- IRS standard deduction

- Earned Income Tax Credit

- Child tax credits

- Student loan interest deduction

If you want to itemize your

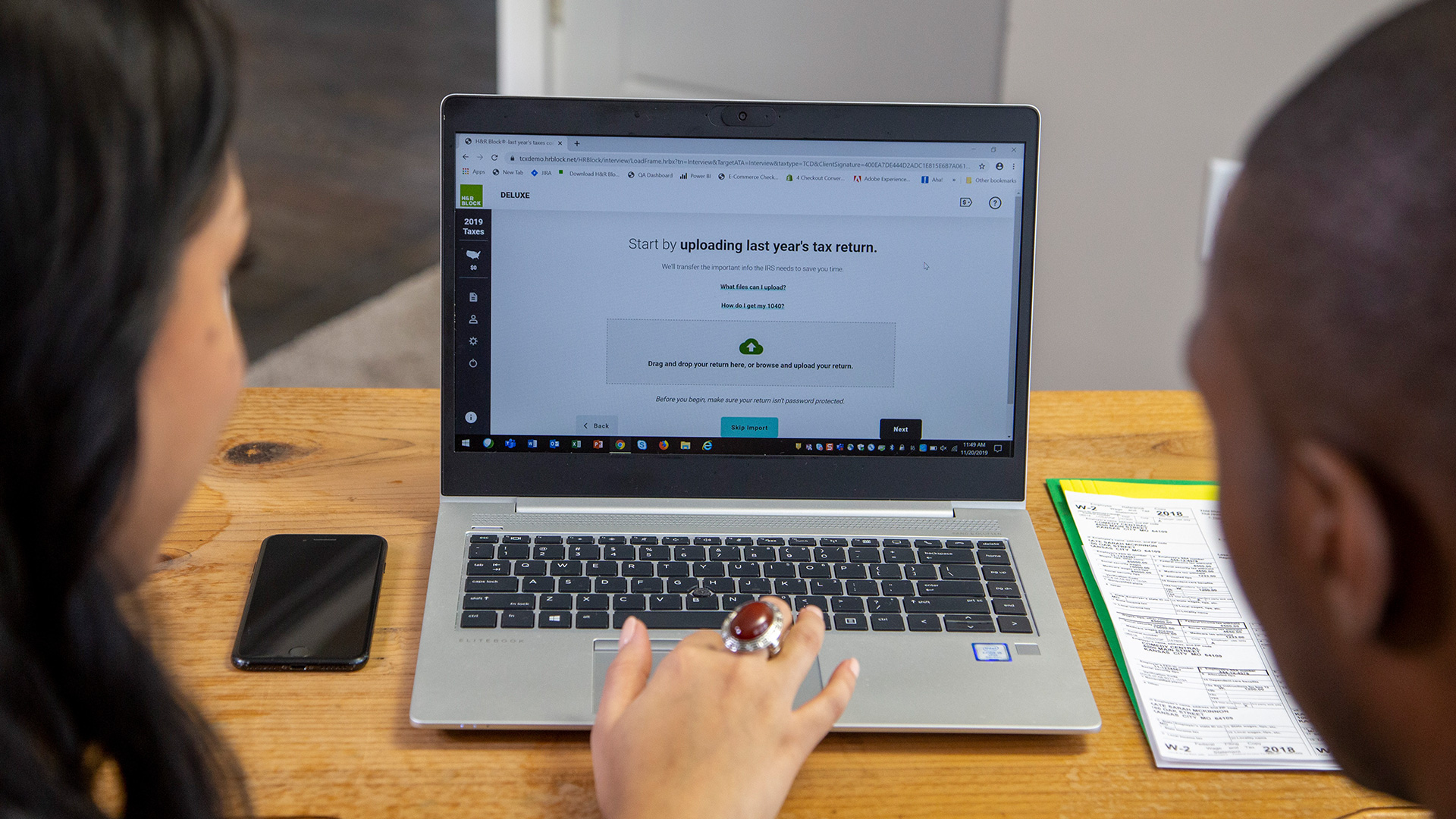

If you qualify for TurboTax Free Edition, you can import your W-2 and answer a few questions about your situation to complete the process. If your employer is a TurboTax Import Partner, importing is as simple as entering their EIN. If not, you can still import easily by taking photos of your documents in the TurboTax mobile app.

Anyone who used the service last year can get a jump start with pre-populated information. If you used another service, you may be able to upload a PDF of your return to get a similar effect, depending on which service you used.

Related Article

Related Article

9 Best and Cheapest Online Tax Services

TurboTax Deluxe: $69 Federal, $64 State

TurboTax Deluxe is designed for people who have more complex tax situations that aren't covered under TurboTax's free tier. In addition to the features of the free tier, TurboTax Deluxe will search and maximize more than

Mortgage and property taxes- Charitable donations

- Educational expenses

- Dependent tax credits

You'll also get access to one-on-one

TurboTax Premium: $129 Federal, $64 State

TurboTax previously offered two packages beyond its Deluxe tier—the Premier package, which was aimed at investors, as well as the Self-Employed package—but it has since consolidated these into the new "Premium" package.

While this change makes TurboTax's services more affordable for freelance and self-employed workers, investors who previously used the Premier package will likely end up paying more for the Premium package, especially if they aren't able to cash in on early season discounts.

Features for Investors

While the packages' names may have changed, most of the features are the same or similar. With this tier, investors gain access to:

Stocks , bonds, employee stock purchase plans, cryptocurrency, and other investments- Rental property income and tax deductions

You can

Features for Small Business Owners and Freelancers

If you're a freelancer, contractor, or small business owner, TurboTax Premium also offers features you need:

- A search of 500 tax deductions and credits

Importing from Quickbooks® Self-EmployedImporting from Uber, Lyft, and Uber EatsUploading and auto-filling of 1099-K and 1099-NEC formsCalculations for asset depreciationGuidance on industry-specific deductionsHome office expenses helpUnlimited W-2 and 1099 forms for employees and contractorsA personalized audit risk assessment

You can also get a year-over-year

Recommended Business Credit Cards

| Credit Card | Rewards Rate | Annual Fee | Intro Bonus | Learn More |

|---|---|---|---|---|

|

|

1.5%Cashback

Earn unlimited 1.5% cash back on every purchase made for your business. The advertised rewards type is cash back, but it’s important to note that you’re technically earning Chase Ultimate Rewards points (which can then be converted to cash back). |

$0 |

$750Cash Bonus

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. |

Apply Now Rates and Fees |

|

|

1% - 5%Cashback

Earn 5% cash back on your first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. It also offers you 2% cash back on your first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. |

$0 |

$750Cash Bonus

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening |

Apply Now Rates and Fees |

|

|

1x - 3xPoints

Earn 3 points per $1 spent on Southwest® purchases. Earn 2 points per $1 spent on Rapid Rewards® hotel and car rental partners. Earn 2 points per $1 spent on local transit and commuting, including rideshare. Earn 1 point per $1 spent on all other purchases. |

$99 |

60,000Southwest Rapid Rewards Points

Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open. Dollar Equivalent: $840 (60,000 Southwest Rapid Rewards Points * 0.014 base) |

Apply Now Rates and Fees |

|

|

1x - 3xPoints

Earn 3x points on the first $150,000 of combined spending in a number of key business categories |

$95

This fee includes extra cards for authorized users, such as employees, at no additional charge. |

90,000Chase Ultimate Rewards Points

Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,070 (90,000 Chase Ultimate Rewards Points * 0.023 base) |

Apply Now Rates and Fees |

TurboTax Live Full Service**

TurboTax provides a simple approach to filling out your tax return, but if you're concerned about making a mistake, you can opt for the company's full-service program. Available in both English and Spanish, this option connects you with a

This program is available for all tiers, with cost varying based on the type of services you require. Luckily, TurboTax offers several price estimates on its website based on common tax situations. If you feel your situation is unusual, you can also have a Full Service expert review your information and provide you with the price you'll pay before you commit.

**Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price.

Features

TurboTax offers a variety of features that can make the preparation and filing process go more smoothly and give you some peace of mind. Some of the standard features available with most tiers include:

Access to an online community of specialists and customers- Import of last year's return, including from other tax preparation services

- Tax calculators

- The latest updates on tax law

Additionally, you'll get the following features, though the exact benefits vary based on the tier you choose:

- Maximum refund

guarantee : TurboTax commits to searching for every tax deduction and credit that you qualify for based on the tier you choose. - 100%

accurate calculations guarantee: The company will pay your IRS penalties if the federal agency finds an error that can be attributed to TurboTax's calculations. - Audit

support : If the IRS sends you an audit letter based on your TurboTax individual, TurboTax Live Assisted Business or TurboTax Full Service Business return, the company will offer one-on-one, question-and-answer support with one of its professionals. Note, however, that this does not include representation or legal advice.

Refund Options

If you qualify for a tax refund, you can receive the money in the form of a

TurboTax is willing to advance up to 50% of qualifying users' refunds,

Related Article

Related Article

Tax Hack: How to Get a Cash Bonus With Your Tax Refund

Mobile App

You can fill out your tax information and file your return online, or you can download TurboTax's mobile app to get the job done. The app is available for i

You can also use the app's

TurboTax Support

TurboTax offers a wealth of knowledge an

If you need assistance with TurboTax, you can call 1-800-446-8848 to leave a message for the TurboTax support team.

Is TurboTax Secure?

TurboTax uses two-factor authentication and Touch ID® to ensure that only you can access your tax information. The company also uses

TurboTax and Audits

If your tax return gets audited, TurboTax can provide some basic support to answer your questions, but that

However, you can sign up for a premium service called TurboTax MAX for an additional cost for full audit representation and identity protection. Note, however, that this is a preventative service, so this pricing isn't available if you've already received an audit notice. If that happens, though, you can still r

The Bottom Line

TurboTax offers services and features for most taxpayers, and compared to other online tax preparation services,

At the same time, some TurboTax tiers are notably more expensive than several of its top competitors' services. Don't be afraid to shop around and compare options, including online tax preparation services and tax professionals, to determine the best fit for you.