Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

The average savings account currently pays an interest rate of 0.45% APY (as of September 2023). Earning any interest on your savings is better than nothing, but you’ll be waiting a long time before you see some notable growth. Investing can be a good alternative to savings accounts, but it’s risky for shorter-term savings goals — unless there’s a better in-between solution: a brokerage cash management account.

Brokerage firms offer these accounts as a sort of default catch-all bucket for the various bits and pieces of cash left over from your investment moves or for cash waiting to be invested. Lately, however, banks have been offering extra-juicy rates on these accounts that rival most high-yield savings accounts — and they can come with enough extra features to make them a viable alternative to your current bank.

Here are a few noteworthy brokerage accounts that can earn you interest on uninvested cash.

| Brokerage | Account | APY* | Account Minimum | Monthly Fee |

|---|---|---|---|---|

|

Brokerage Cash Sweep |

4.90% APY for Gold members; 1.50% APY for others |

No minimum balance |

$5 for Gold members; $0 for others |

|

|

Cash Management |

2.72% APY |

No minimum balance |

No monthly fees |

|

|

Cash Deposit |

3.70% APY |

No minimum balance |

No monthly fees |

|

|

Cash Reserve |

4.75% APY |

No minimum balance |

No monthly fees |

|

|

Cash Account |

4.80% APY |

$1 |

No monthly fees |

*Note: Rates often change frequently. These rates are current as of October 4, 2023.

Robinhood Brokerage Cash Sweep: Up to 4.9% APY

Pros

- 24/7 phone and chat support

- $2,000,000 in FDIC coverage through partner banks

- 30 days free Gold membership

Cons

- No spending capabilities

- Below-average customer satisfaction ratings

- Requires $5 monthly subscription for the best APY

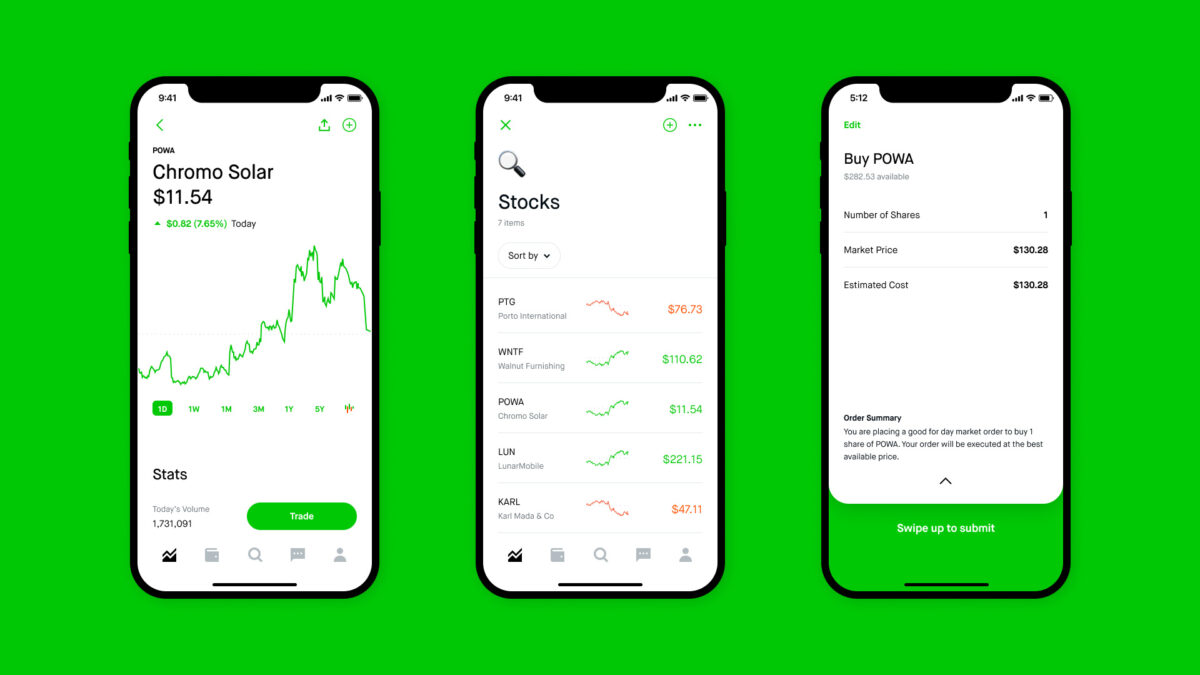

Robinhood offers a brokerage cash sweep program offering an ultra-appealing APY of 4.9%, but it doesn’t come free. Instead, you’ll need to pay a $5 monthly subscription fee for Robinhood Gold membership, which also unlocks better margin investing rates and research from Nasdaq and Morningstar. Without the membership, that shiny balloon deflates to a much more demure 1.5%.

While Robinhood's cash sweep program doesn't have spending capabilities like a checking account, they do offer a Cash Card option for everyday spending that includes nifty features like auto-investing options to help you save more. However, that’s a separate program from its brokerage sweep account and doesn’t offer any interest at all. In addition, Robinhood came in slightly below average in terms of customer happiness among DIY investors, according to a 2023 J.D. Power survey.

- Account requirements: $5/month Gold membership required to earn the higher APY

- Fees:

- No commission fees

- No fees for deposits or withdrawals

- 1.5% on withdrawals to an external debit card

- Best for: Investors looking for crypto, options and margins trading

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Fidelity Cash Management Account: Up to 2.72% APY

Pros

- Free checks and a debit card

- $1,250,000 in FDIC coverage

- Highly-rated investment platform

- Unlimited worldwide ATM fee reimbursements

Cons

- Lower APY than other options

- Requires margin, cash or money market shares for overdraft protection

Many Americans have their workplace 401(k)s with Fidelity, and its familiarity makes their brokerage accounts so attractive. The institution has even reported a “double-digit increase” in cash management account openings over the past three years.

Opting for this account means you can combine the high APY from a high-yield savings account with the spending abilities of a checking account, all while being able to access investing options. You’ll get access to an account feature called Cash Manager that lets you set up a series of if-then statements to maintain a minimum account balance while investing excess funds above a cap you set up. You’ll get to choose which accounts it pulls money from and puts them into. You can sell money market funds or use margin or extra cash to cover shortfalls as part of its overdraft protection program, but you can’t link your outside bank for this purpose.

- Fees: No account fees

- Account requirements: No account minimums

- Best for: People who want automated systems to maximize investments

Vanguard Cash Deposit: Up to 3.7% APY

Pros

- $1,250,000 in FDIC coverage

- Highly rated for customer satisfaction

Cons

- No spending capabilities

- Only available for existing brokerage customers

Traditional Vanguard brokerage accounts come with the Vanguard Federal Money Market Fund as a default settlement account for all the leftover cash bits from your investments. But you also have the option to choose its Cash Deposit account if you’d prefer FDIC insurance coverage.

If you’d prefer a cash account with the ability to spend from it, Vangaurd’s Cash Plus Account may be a better choice. However, the Cash Plus Account is even more exclusive than the Cash Deposit account since only certain Vanguard clients are eligible (Vanguard doesn’t say which clients, though). It’s also unable to be used as a settlement account for your investments.

- Fees: None

- Account requirements: Must already be an existing brokerage customer

- Best for: Bogleheads (i.e., low-cost mutual fund and ETF investors)

Related Article

Related Article

Best Bank Accounts That Reimburse or Waive ATM Fees

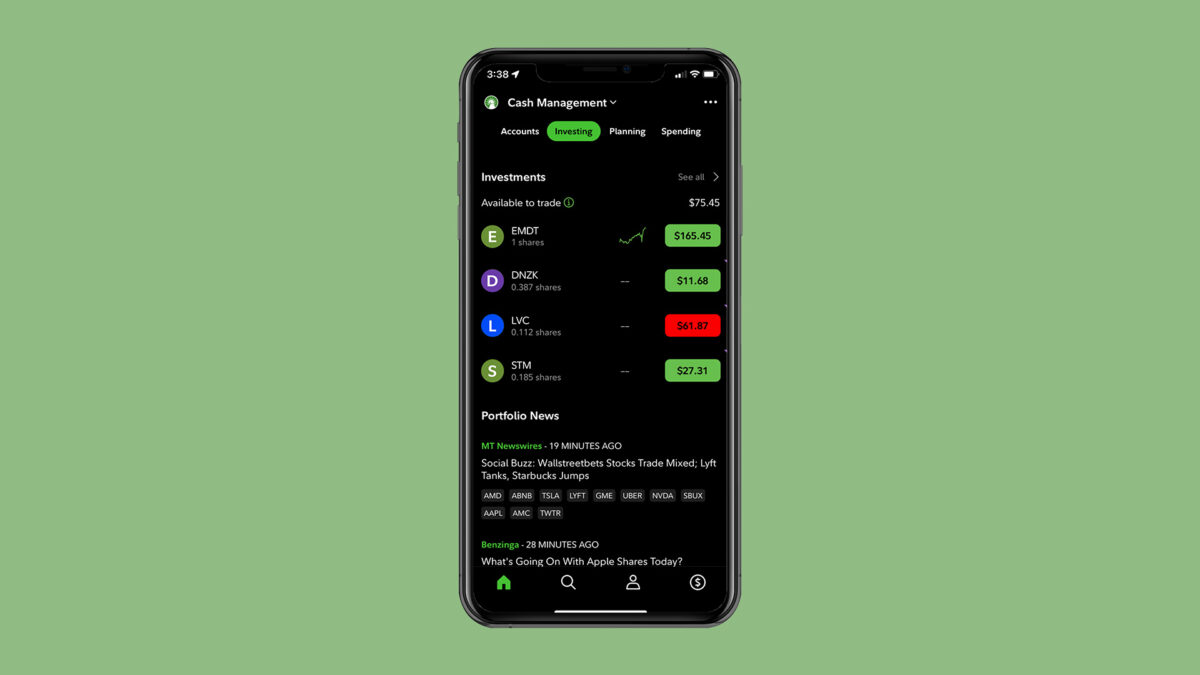

Betterment Cash Reserve: Up to 4.75% APY

Pros

- No fees

- High APY

- Goal-based savings

- $2,000,000 in FDIC coverage

Cons

- No spending ability

- At least $10 minimum deposits into account each transaction

Betterment made waves in 2010 when it launched the first big robo-advisor firm, now commonplace today with many brokerages. Now, it offers a Cash Reserve account; the only hitch is that you must have an existing Betterment account to access it.

You can’t spend from the Cash Reserve account (Betterment’s Checking Account would be better for that), but you can use it to partition some of your financial goals into different buckets. This can be a particularly good option for money you don’t want to invest or will use shortly, such as your emergency fund or upcoming vacation savings.

- Fees: None

- Account requirements: Must be a current Betterment client, a full-time U.S. resident and at least 18 years or older

- Best for: Tax-efficient automated investing

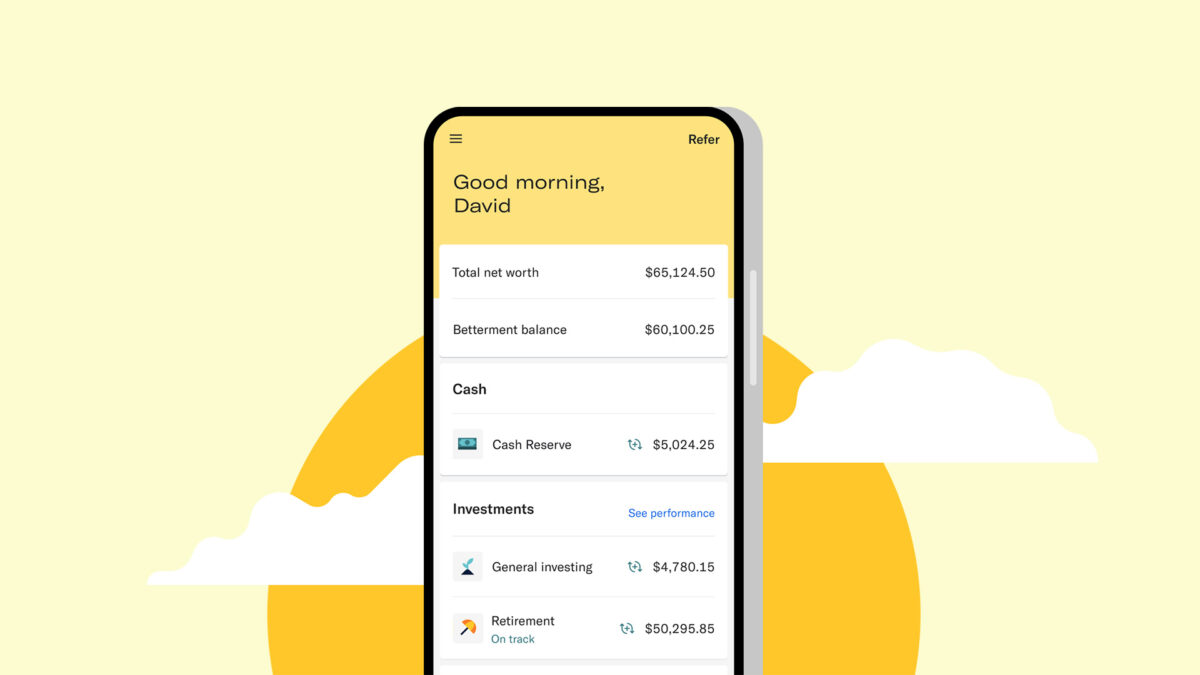

Wealthfront: Up to 4.80% APY

Pros

- Excellent APY

- No monthly fee

- Use with cash transfer apps

- Instant transfers for investing

- $8,000,000 in FDIC coverage

- Paychecks available two days earlier

Cons

- Small ATM network

- Depositing cash costs money

- Check-writing system is limited and clunky

Wealthfront is popular with many people because it offers a robust set of planning tools that anyone can use to project their future net worth and track progress toward retirement and homeownership goals and more. Its Cash Account offers just as many tools, combining a checking account and savings account all into one package that works for most things.

For example, you can write checks from your account, but you’ll need to schedule the payment online. This account also comes with a debit card and access to a free ATM network, but it’s relatively small (19,000 nationwide) compared to more popular ATM networks like MoneyPass, which features 40,000 machines. You can deposit cash with certain retailers, but you’ll incur a $5.95 fee, which somewhat defeats the purpose.

- Fees:

- No monthly fee

- $2.50 out-of-network ATM fee

- 2.75% international transaction fee

- $5.95 retailer cash deposit

- $10 outgoing wire transfer

- Account requirements: Must be a full-time U.S. resident at least 18 years old and have a smartphone

- Best for: Planning nerds

Explore the Best Bank Bonuses Currently Available

Visit the Marketplace

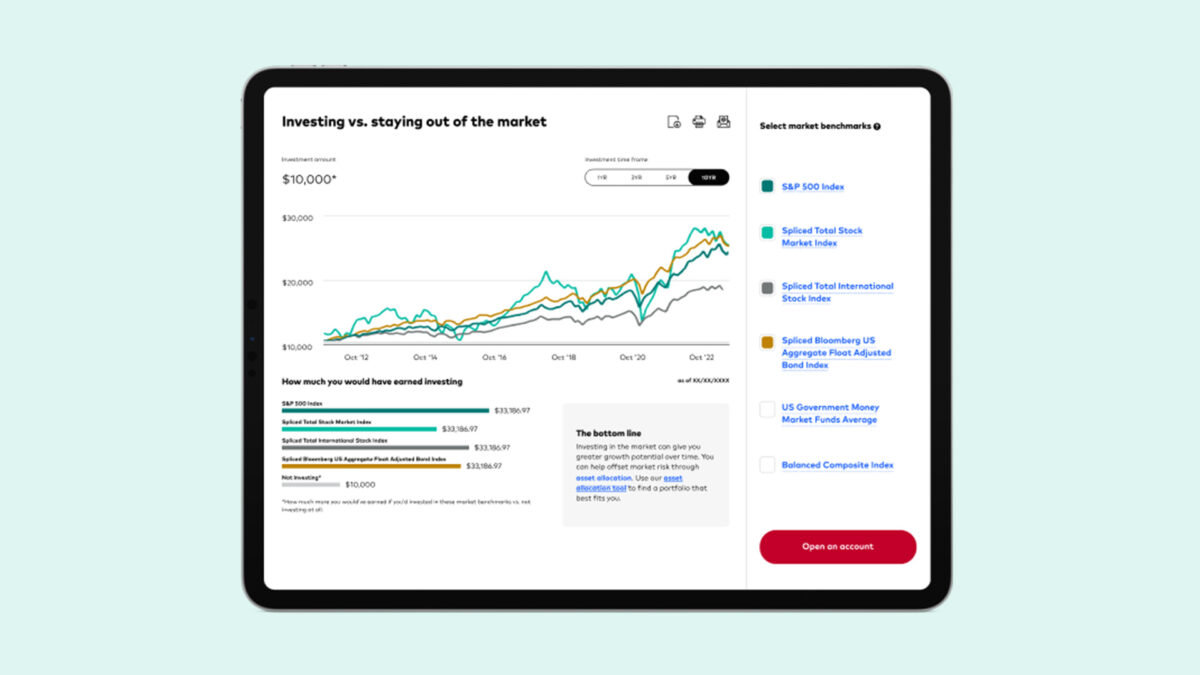

Should I Leave Cash In a Brokerage Account?

If you’re already an active investor, a cash management account at a brokerage firm can be a viable alternative to a bank savings account, particularly if you want your cash reserves parked closer to your investments in case of short-notice investing opportunities.

If you’re a more hands-off investor with a robo-advisory firm, cash management accounts can help you keep your extra money in one location.

Finally, brokerage accounts come with expanded FDIC coverage, which can be a great option for keeping really large cash savings safe. But if your primary concern is simply earning the highest rate possible, then you may have better luck with a traditional bank or credit union offering a high-yield savings account. It’s quite easy to find good options offering even higher rates than the cash management accounts most brokerage firms are offering.

Frequently Asked Questions

-

Not always. If your brokerage firm uses a cash management account at a bank or a money market fund, it’ll typically pay interest on your uninvested cash. Otherwise, some brokerages do not.

-

Brokerages often partner with banks to offer cash management accounts. If your brokerage keeps your cash deposits with a bank, then it’s the bank that will pay you interest (via your brokerage firm) for the privilege of using your money to make loans. If your bank uses a money market fund for its cash management account, then you’d simply be earning the dividends on the cash since it’s technically invested.

-

Generally speaking, yes — most publicly available brokerages are insured by the SIPC and must disclose this on marketing materials and their website. However, if your brokerage firm parks your cash with a bank (versus at the firm itself) — as is common with cash management accounts — then it would be covered by FDIC insurance, not SIPC.

-

It’s generally considered safe to keep more than $500,000 with a single brokerage account, which is the limit for SIPC insurance. You may have more coverage than you think because the $500,000 limit applies to several types of brokerage accounts you may own. Some brokerages also carry insurance of their own to repay people who aren’t covered by SIPC insurance. Only a few people have lost their investments over the SIPC limit; however, how much money you keep in your account depends on your comfort level.