Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

Opening a new bank account or credit card can be a great way to score valuable welcome bonuses and promotions. Yet before long, you could find yourself trying to keep up with several bank accounts and credit cards each month. With a few strategies in place, however, you can manage your accounts like a boss, keep your budget in check and maybe even earn some lucrative rewards in the process. Here are three tips to get you started.

Managing Your Credit How to Manage Multiple Bank Accounts and Credit Cards

Managing multiple bank accounts and credit cards can be simple with the right plan. Here are some tips to get started.

-

1

Start With a Budget

No matter how many bank accounts or credit cards you use, it's important to have a plan for how you want to spend your money—aka a budget.

-

2

Track Your Spending

Once you have a financial plan in place, you'll need a system to stay on track. You can track spending on an excel worksheet, a notepad, or use a personal finance app.

-

3

Set Up Account Alerts and Automatic Drafts

Automate your recurring payments and set up account alerts for payment reminders, deadlines and overdrafts. Get alerted when you overspend or miss a payment.

Recommended Credit Cards

| Credit Card | Intro Bonus | Annual Fee | Rewards Rate | Learn More |

|---|---|---|---|---|

|

| 60,000

Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip. | $95 | 1x - 5xPoints

Earn unlimited 5X points with hotels, 4X points with airlines, 3X points on restaurants and other travel, and 1X points on other purchases. | Apply Now Rates & Fees |

|

| $200Cash Bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. | $0 | 2%Cashback

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel. | Apply Now Rates & Fees |

|

| $200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. | $0 | 2%Cashback

Earn unlimited 2% cash rewards on purchases. | Apply Now Rates & Fees |

|

| 75,000Chase Ultimate Rewards Points

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $1,500 (75,000 Chase Ultimate Rewards Points * 0.020 base) | $95 | 1x- 5xPoints

Enjoy benefits such as 5x on travel purchased through Chase TravelSM, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases | Apply Now |

1. Start With a Budget

A budget isn't about depriving yourself. Rather, it's a step-by-step guide for applying your hard-earned cash toward the goals that matter most to you. A budget is a system to help you avoid financial regrets.

Before creating your budget, write down the goals you want to achieve with you money. You'll need a plan to take care of your bills. Getting out of debt might also be high on your to-do list, but you should also add in big picture goals (like retirement) along with some fun (such as travel or entertainment) if you can.

If you can be frugal and save money in some areas, it could pay off. When you find extra money in your budget you can use it to reach more important financial goals faster. For example, years ago my husband and I cut our dining out and entertainment budget (among other expenses) and used the savings to pay off our credit card debt.

2. Track Your Spending

Track your spending with a spreadsheet or even a notepad (digital or physical). But you might also want to consider using one of the personal finance apps below.

- Simplifi by Quicken: For a small subscription fee of $3.99 per month, you can create a custom spending plan, track your progress and create savings goals that work for you. Simplifi by Quicken can also help you project future cash flow and show you your current net worth.

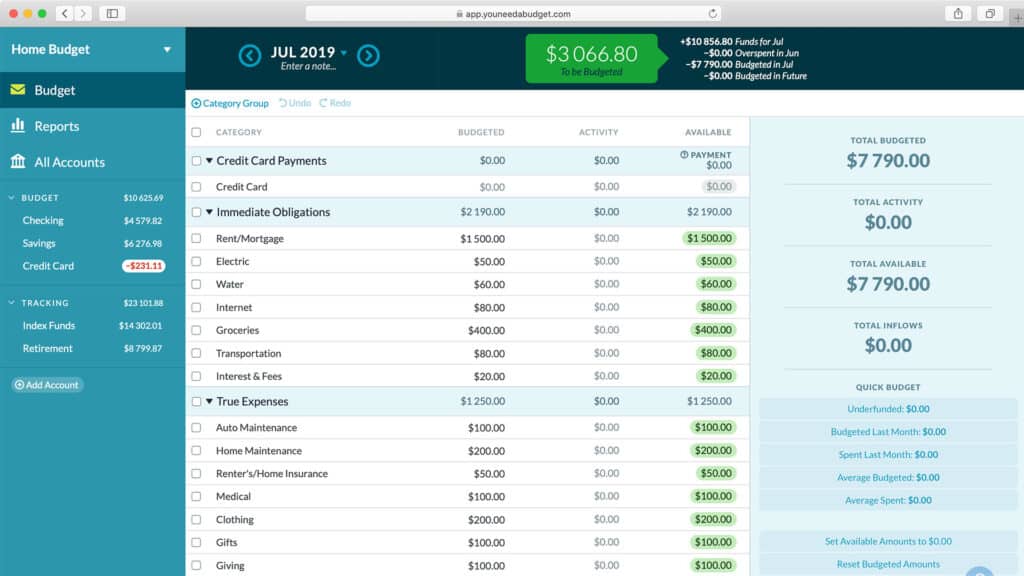

- YNAB: You Need a Budget, or YNAB, lets you use a zero-based budgeting system in which you give all of the money you earn a job (e.g.,pay recurring bills, grocery fund, savings or debt elimination). Best of all, you can set up your bank accounts and credit cards to automatically sync with your YNAB account—providing an overview of your balances and debts in one convenient location. YNAB is free for 34 days then $14.99 per month or $99 annually.

- Qube Money: Qube Money is a bank account that lets you set up spending categories (aka Qubes) and divide your money among them. You must unlock a Qube before you spend money from it on the debit card that comes with your account. Or you can use the workaround I prefer and transfer money to a "credit card spent fund" when you swipe your credit card for a purchase (like groceries or gas). A Qube Money account is $8 per month or $6.58 per month if you pay annually.

3. Set Up Account Alerts and Automatic Drafts

Account Alerts

Many bank accounts (checking and savings) and credit cards have automatic alert features you can customize to keep you in the loop when activity happens on your account. For example, your bank might let you schedule email and text alerts in response to:

- A large transaction hitting your account (e.g., debit, ATM withdrawal or check).

- The receipt of a direct deposit.

- Your account balance falling below a certain amount.

- The creation of a new monthly statement.

Credit card companies may let you set up certain types of account alerts too, such as:

- Payment reminders

- Payment overdue notices

- Transactions over a certain amount

- Approaching credit limit

- Unusual account activity

Automatic Drafts

Automatic payments can also provide a good failsafe on credit card accounts. Here are a few ways it can help:

- Minimum payments: Say you schedule automatic drafts for the minimum payment on your credit cards. If you acidentally forget a due date, your account won't incur a late fee and your credit history will be protected.

- Statement balance: It's best to pay your credit card bill in full each month. Paying the full statement balance due helps you avoid interest fees. Your credit score could improve as well when you keep your credit utilization rate low.

- Savings: If you know how much you plan to put toward a savings goal each month (like a down payment or vacation fund), you could schedule automatic transfers from your checking account to your high-yield savings account.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Minimum Deposit | Learn More |

|---|---|---|---|

|

| 3.75%

*Annual Percentage Yield (APY) is variable and is accurate as of 01/06/2025. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. | $5,000 | Open Account |

|

| Up to 4.21%

Earn up to 4.21% APY* on savings, and 0.51%* APY on checking when you meet requirements. *Note - A customer with $1,000,000 would earn 4.21% APY on their first $499,999.99 and 4.01% APY on the rest of their balance for a blended rate of 4.11% APY. | N/A | Open Account |

|

Member FDIC | 0.50% - 3.30%

SoFi members with Eligible Direct Deposit can earn 3.30% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.30% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet | N/A | Open Account |

Quick Tip

Consider opening a high-yield savings account with a separate bank to remove the temptation to spend.

Bottom Line

Having multiple credit cards and bank accounts could offer some unique benefits. From cash bonuses to credit card rewards you can redeem for free travel, there are several reasons you might want to consider a new bank account or credit card from time to time. Plus, financial needs change over time, so if you need to switch banks or get a new credit card, it often makes sense to do just that. Just be sure to put a good financial management strategy in place to avoid potential headaches.

See Which Credit Cards Offer BonusesBest Credit Card Bonuses

Visit the Marketplace