Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

While I’ve been familiar with The Motley Fool for years, I’ve recently dug into the service to learn more about how it works, and I have to admit that I’m impressed by the long-term performance of The Motley Fool Stock Advisor service. Read on to learn more about how Stock Advisor works, how it has performed compared to the market overall and whether or not the service might make sense for you.

Pros

- Strong track record of beating the markets

- Admits some stocks will go down and helps readers manage risk

- Well-reasoned investment guidance from a team of experts

- Cost may be tax-deductible

Cons

- Subscription cost takes away from investment gains

- Thousands of other investors get the same advice at the same time, which can reduce your market gains

- Picking single stocks is considered riskier than broad index-fund investing

- Sales tactics reminds us of used car lots, and the service tries to upsell current subscribers on new subscriptions

Motley Fool Stock Advisor Review

Some people view the stock market as a risky Wild West where fortunes are quickly made and lost. But if you invest with a strategic, long-term outlook, the stock market is an ideal place to put your funds for a wide variety of goals, such as saving for retirement or your child’s college education.

If you invest in mutual funds or ETFs, the fund managers are judged on whether or not they can beat the market. Because the numbers show that most actively managed funds fall short of market benchmarks, index funds, which mimic major market indices like the S&P 500, have become increasingly popular. After all, as the saying goes: if you can’t beat ‘em, join ‘em.

What Is The Motley Fool Stock Advisor?

Stock Advisor is a paid subscription service from The Motley Fool, an investment and personal finance website that offers a range of paid and free content to help you learn more about investing and improving your money.

Stock Advisor is the flagship subscription from The Motley Fool. It features regular stock picks from Motley Fool founders Tom and David Gardner (they’re brothers) with a suggested portfolio of about 10 stocks they like right now.

New stocks are announced on Thursdays. I have noticed a “Motley Fool Effect” on newly announced stocks, as they tend to quickly spike in price after the announcements as thousands of investors rush to buy shares. But if the prices go up in the long run, that short-term volatility may not be a major factor. In the next section, we’ll look at the strategy the Gardners use to beat the market and how it could fit into your portfolio.

How Stock Advisor Beats The Markets

Over long periods of time, the S&P 500 has tended to offer a roughly 10% annual return to investors. Beating that consistently is a tough goal. In fact, according to the SPIVA report, which tracks fund performance against the market, about 80% of large-cap funds have underperformed compared to the S&P 500 over the last five years.

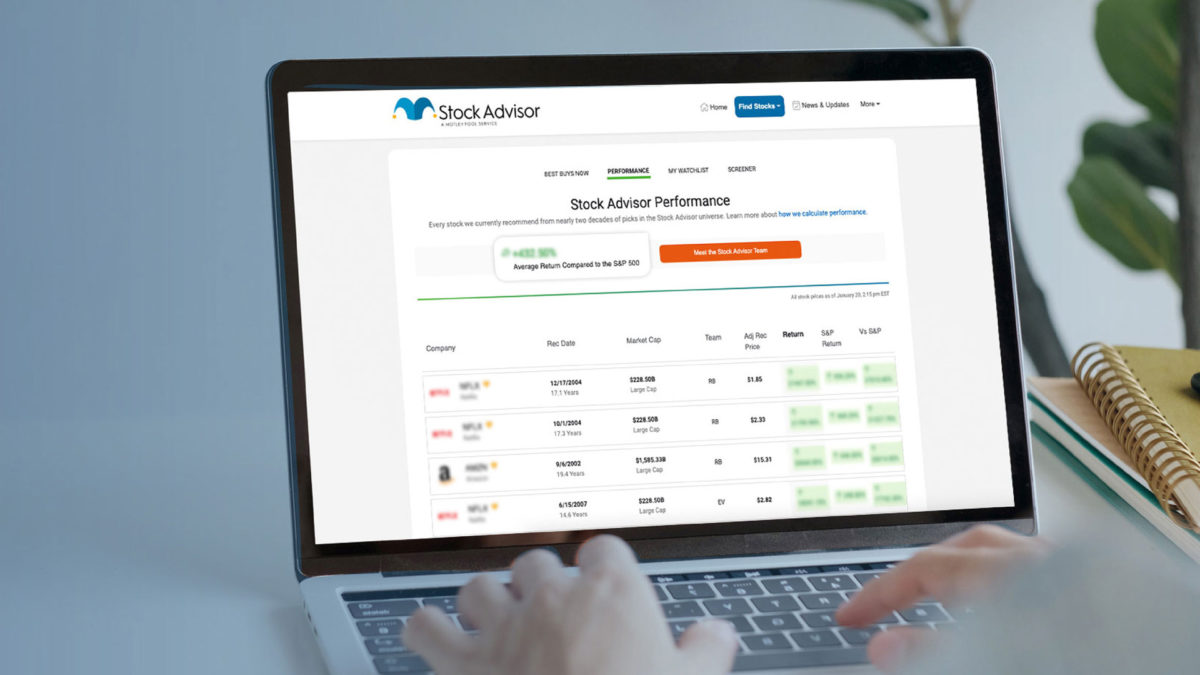

If Wall Street professionals with fancy degrees can’t consistently beat the market, why do we think we could do so consistently? Well, Tom and David seem to have done it, according to reporting you see when logged into Stock Advisor:

A screenshot of Stock Advisor performance compared to the S&P 500 since the service’s inception — as of August 2020.

According to the emails and articles sent to subscribers, a portfolio of at least 10 well-chosen stocks can beat the market. You’ll go in knowing some will lose money, but if a couple of them offer outsized returns, it can make up for the losses and then some.

Why This Strategy Makes Sense

Without realizing it, I followed a similar strategy in my own portfolio and picked a few stocks in common with The Motley Fool. My portfolio is up overall. A few stocks have lost a little. But a couple of stocks, I’ve picked, such as Amazon, have done so well that they’ve significantly lifted my entire portfolio.

If you pick a portfolio of the 500 stocks in the S&P 500, your risk is very diversified, but it would take an incredible market performance to do better than the roughly 10% you could expect here. If you have a portfolio of about a dozen stocks and one or two offer you 10x to 20x returns, that can make up for lackluster performance from other stocks.

The stocks in The Motley Fool Stock Advisor portfolio are generally written about with a combination of value investing metrics (looking at the numbers behind the company) and behavioral investing insights (focusing on how companies are competing and attracting new customers).

This has led to huge winners like Bookings Holdings, Netflix and Amazon that have offered between 7,500% and 12,000% returns to Motley Fool followers. Yes, you could have (and may have) picked these on your own. But The Motley Fool does a good job of weeding through the markets to pick interesting companies that offer great prospects for big future growth.

Is Motley Fool Stock Advisor Worth It?

I signed up for The Motley Fool Stock Advisor for a review and enjoyed it enough that I’ve stuck around and even made a few purchases based on the service’s guidance. Just be sure to put your own research into your portfolio and follow diversification guidelines to avoid too much risk in a small portfolio.

Otherwise, I have to give this service a positive review. If you are interested in getting started with investing in single stocks, The Motley Fool Stock Advisor is a great way to learn more about picking stocks with well-written guidance and a long track record.

The past is no guarantees of future performance, but they have done very well so far.