Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

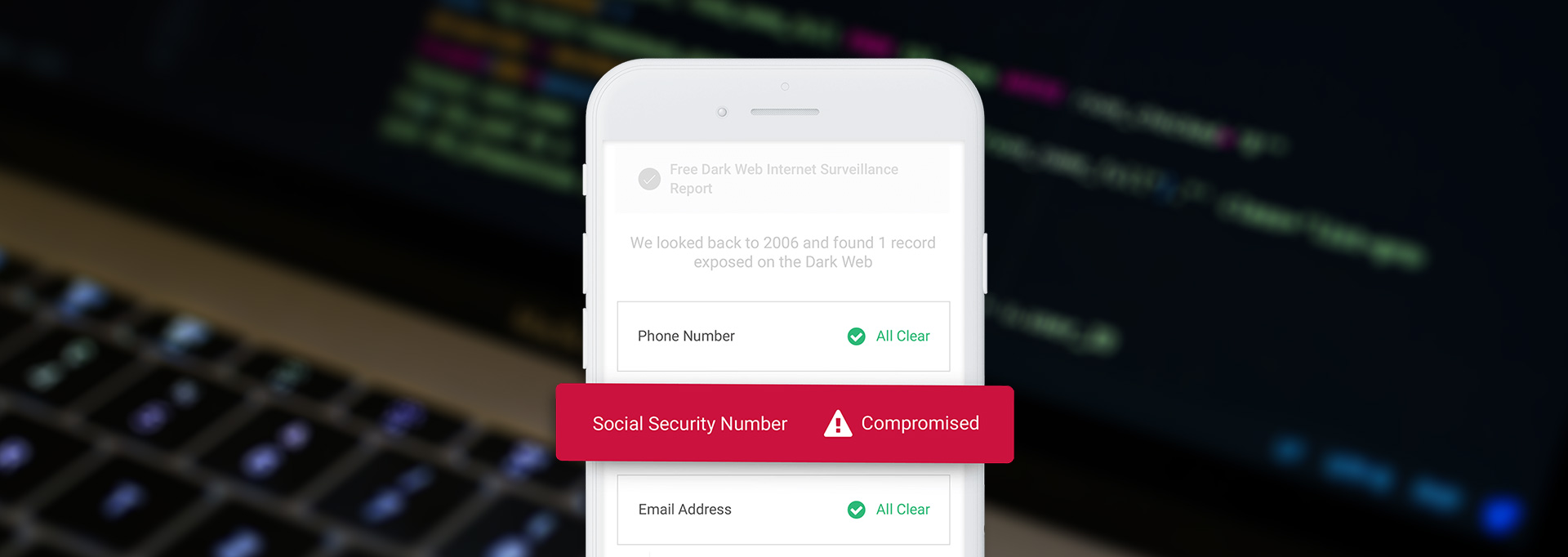

With data breeches at major retailers and social media sites in the news cycle, many people are looking for affordable ways to protect and monitor online data for themselves and their families. The good news is that one the best identity theft protection services is completely free. So if you're not sure that you're ready to pay for identity theft monitoring, then Credit Karma has you covered with its completely free service.

Credit Karma's coverage is minimal compared to paid plans through other providers. So if you're interested in more robust protection and monitoring, see our guide to affordable and effective identity theft protection. However, Credit Karma's free identity monitoring service is sufficient for both people who are at minimal risk and people are on a tight budget.

Credit Karma Free Identity Monitoring Details

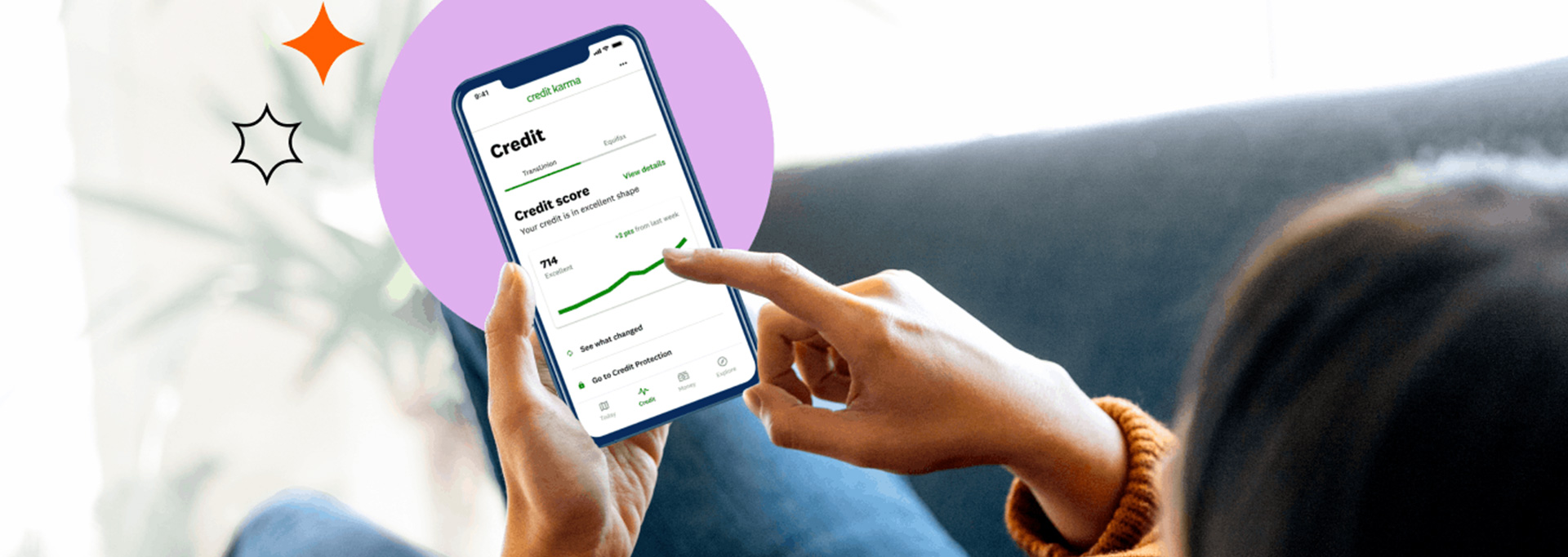

So what is offered with Credit Karma’s free identity monitoring service? You’ll get credit reports and scores from two of the three major credit bureaus (not Experian), credit monitoring, ID monitoring and an unclaimed property feature. Credit Karma also provides tons of resources to educate yourself on identity theft and how to protect yourself and your family better.

You must be 18 years of age or older to sign up for the free service, and there are no family plan options currently. Credit Karma protection doesn’t include any insurance coverage if your identity is stolen, making it more of an informational service than actual protection.

Why would Credit Karma give away this service for free? Like many companies, they are hoping if you like this service, you’ll explore other paid services they offer. As a leader in credit education and resources, it makes sense for them to provide identity monitoring.

Although it's a bare-bones service, Credit Karma gives people a way to stay safe without paying every month for identity protection.