Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

According to recent data from The Aesthetic Society, U.S. adults spent $14.6 billion on aesthetic p

Here’s what you need to know about personal loans for cosmetic and plastic surgery, when these loans make sense, the cost of different procedures, alternative financing options and more.

Should You Use a Personal Loan to Pay for Plastic Surgery?

There’s no right or wrong answer when deciding whether to use personal loans to pay for plastic surgery, but there are some general factors to consider. The most important thing is likely your financial situation.

Can you afford more debt? Think about whether taking on additional debt would be manageable for you or not. If it isn’t, you might consider delaying your procedure until your financial situation improves.

What is your credit score? Other considerations could include your credit score, the amount you can get approved for and the interest rate you might receive. The average interest rate for a 24-month personal loan sits at 11.21% according to the Board of Governors of the Federal Reserve System. Borrowers with excellent credit typically get lower interest rates, which means lower borrowing costs.

Before shopping for a personal loan, look at your finances and credit score to determine if this type of financing could make sense.

What You Can Use a Plastic Surgery Loan for

You can typically use a personal loan for just about anything you want, but you may want to check with lenders to see if they have any restrictions. That said, people often use plastic surgery loans for things like:

- Breast augmentation or reduction

- Facelift

- Chemical peel

- Gender-affirmation surgeries

- Cleft lip or palette surgeries

- Botox

- Tummy tuck

Elective procedures are rarely covered by insurance and are a common reason why someone might take out a personal loan. Many reconstructive surgeries are covered by some insurance, but people sometimes choose to use a loan to pay for the portion that isn't covered (or if their insurance simply doesn't cover it.)

Average Cost of Cosmetic Procedures and Plastic Surgeries

The other thing you’ll want to understand before shopping for personal loans is how much your cosmetic procedure or plastic surgery will likely cost. While prices will likely vary based on the procedure, doctor and practice you choose, here are some cost estimates based on 2021 data from The Aesthetic Society, an organization for plastic surgeons:

- Breast augmentation: $4,235

- Breast reduction: $5,806

- Liposuction: $2,736

- Facelift: $9,127

- Rhinoplasty: $5,443

- Tummy tuck: $6,764

- Neurotoxins: $409

- Fillers: $766

- Facelift: $9,127

- Chemical peel: $196

Best Loans for Cosmetic and Plastic Surgery

- Best for Limited Credit: Upstart

- Best for Bad Credit: Avant

- Best for Small Loans: Navy Federal Credit Union

- Best for Competitive Rates: LightStream

Loan results will vary based on creditworthiness, loan purpose, loan amount, and other factors.

Best for Limited Credit: Upstart

While other lenders rely heavily on credit scores in lending decisions, Upstart uses AI technology to evaluate the likelihood that a borrower will repay their loan based on factors such as income and education. This makes Upstart a suitable option for those with limited credit history.

Upstart

- Loan Amounts$1,000 – $50,000

- Loan Terms36 or 60 months

- APR Range7.8% - 35.99%

- Minimum

Credit Score300 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Using artificial intelligence to help evaluate borrowers, Upstart is a unique lending platform that looks beyond your credit score for personal loan approval.

Overview

Upstart is a first-of-its-kind online lending platform that uses artificial intelligence to help make smarter lending decisions. This means the company considers factors beyond a borrower’s credit score to help determine creditworthiness. Upstart indicates its model has resulted in 43% lower rates for borrowers than traditional credit score models.

Beyond your credit score, Upstart will also look at your employment history, income and level of education when deciding whether to approve you for a loan. The company states that borrowers with credit scores as low as 300 might be able to get approved for a personal loan, though that loan may come with a relatively high APR.

Upstart’s rates are fairly competitive and loan funds are disbursed as soon as one business day after approval. This lender charges origination fees, so it’s important to read the fine print before applying.

Pros

- Considers factors beyond your credit score in lending decisions

- Loans up to $50,000

- Fast funding time

- Check rate without affecting credit score

- Low minimum credit score requirement

Cons

- No physical locations

- Limited repayment terms

- Has origination fees

- High maximum APR

- Not available in Iowa or West Virginia

Best for Bad Credit: Avant

If you have less-than-stellar credit, you may find Avant's personal loans accessible to fair to bad credit borrowers. Keep in mind you may face higher rates, though.

Avant

- Loan Amounts$2,000 – $35,000

- Loan Terms12 – 60 months

- APR Range9.95% – 35.99%

- Minimum

Credit Score580 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Avant offers small personal loans that are accessible to borrowers with fair credit, with funding available as soon as the next day.

Overview

Avant is known for its personal loans that can be used for a wide range of purposes and are accessible for those with fair credit. Funding can be completed as soon as the next business day once approved. The minimum APRs tend to be higher than competitors, but the maximum APR is comparable to other online lenders. A unique feature offered by Avant is their flexible payment due date, which allows a 10-day grace period without incurring a late fee.

Pros

- Loan terms up to 60 months

- Low minimum credit score requirement

- Flexible payment due date

- Next day funding available

Cons

- No physical locations

- Origination fee of up to 4.75%

- Relatively low maximum loan amount ($35,000)

- High minimum APR

- No joint applicant or co-signer

Best for Small Loans: Navy Federal Credit Union

Some lenders have high minimum loan amounts of $2,000 or $5,000, which can be too high for those financing smaller procedures. Navy Federal Credit Union’s minimum loan amount is just $250, making it a good option for small loans.

Navy Federal Credit Union

- Loan Amounts$250 – $50,000

- Loan TermsUp to 180 months

- APR Range8.99% – 18.00%

- Minimum

Credit ScoreNoneA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Personal loans from Navy Federal Credit Union come with no origination fees, quick funding, and can be a good fit for borrowers with less-than-ideal credit.

Overview

To qualify for Navy Federal Credit Union loans, you’ll need to be a member: you need to be a veteran, active-duty service member, Department of Defense personnel, or eligible military family member. In addition to offering co-signed personal loans for borrowers with less-than-perfect credit, Navy Federal Credit Union also offers secured personal loans. Borrowers won’t pay an origination or prepayment fee, and funding can be available as quickly as the same day. It’s worth putting this lender on your shortlist if your credit isn’t great and you’re looking to compare loan options.

Pros

- Fast funding available

- Minimum loan amounts as small as $250

- Lengthy repayment terms up to 180 months for home improvement loans

- Co-signer option available

- No origination fee

- Secured loan options available

Cons

- High minimum loan amounts for longer-term loans

- Need to be a member to get a loan

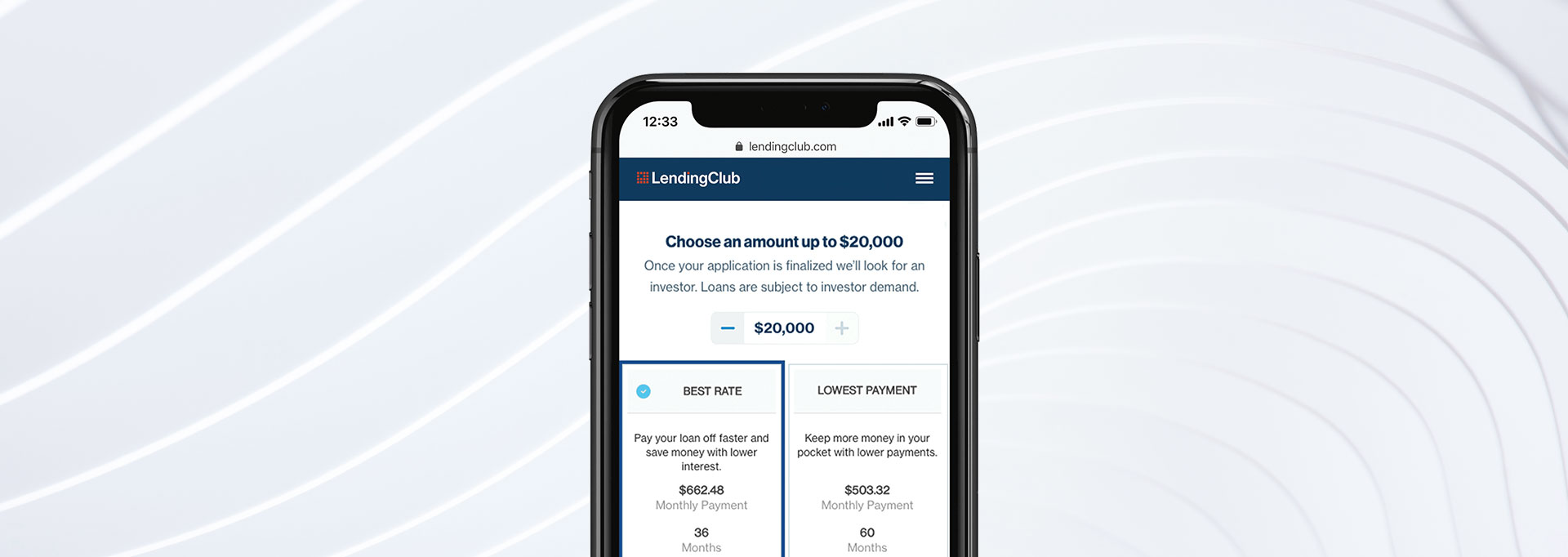

Best for Competitive Rates: LightStream

LightStream is known for offering some of the lowest rates for qualified borrowers compared to other lenders. You'll also pay no origination fees or late fees with personal loans from LightStream.

LightStream

- Loan Amounts$5,000 – $100,000

- Loan Terms24 – 144 months

- APR Range7.49% – 25.49% (with autopay)

- Minimum

Credit Score660 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

LightStream is a solid online lender offering no fees, high loan maximums and low-rate personal loans for several purposes.

Overview

LightStream offers personal loans for several purposes, including debt consolidation, medical expenses, home improvement, weddings, car purchases and more, making this worth considering for those seeking flexibility. The lender offers relatively low rates compared to competitors, including autopay discounts. Its personal loans also have no origination fees or late fees, which can help keep borrowing costs low. However, borrowers will likely need to have good-to-excellent credit in order to be approved for a LightStream personal loan. Overall, it’s a good lender to add to your shortlist if you’re looking for flexible funding, no fees and a low APR. Lightstream may also disburse loans as soon as the same day you’re approved, making this lender a worthy choice if you need fast funding.

Pros

- Low minimum APR

- No origination fees, no late fees

- High loan maximum of $100,000

- Autopay discount

- Joint applications allowed

Cons

- Rates and terms vary by loan purpose

- No soft pull prequalification

- Must have good-to-excellent credit

- No physical branches

How to Choose a Loan for Plastic Surgery

If you decide a personal loan is your best option for financing plastic surgery, there are a few things to look into as you compare loans. Consider the following factors:

- Loan restrictions: Most lenders don’t have restrictions about using a personal loan for a cosmetic procedure or plastic surgery, but it’s always a good idea to double-check. Ask your lender if these are permitted purposes before you sign on the dotted line.

- Interest rate: You could end up with a lower or higher rate depending on the lender you choose and other factors, like your credit score and existing debts. A lower rate generally means lower borrowing costs.

- Fees: Some lenders charge an origination fee, prepayment penalty and more. Check with prospective lenders about their personal loan fees before applying for a loan.

- Loan amount: Personal loans typically have minimum and maximum amounts you can borrow. For instance, a lender may have a minimum of $5,000 or maximum of $50,000. Knowing these numbers can help you avoid any surprises and avoid under- or overborrowing.

- Loan terms: Your loan term is the number of months or years you’ll have to repay your loan. A longer repayment term sometimes means a higher interest rate, so be aware of this as you consider your monthly payments.

- Lender reputation: You want the lender you choose to be reputable and trustworthy. Research its reputation online and read customer reviews before you submit a loan application. Pay attention to application ease, funding time, customer service and more.

Related Article

Related Article

How to Prequalify for a Personal Loan, and Why It Can Be a Good Idea

Alternatives for Plastic Surgery Financing

While personal loans could be a good option to pay for a cosmetic procedure or plastic surgery, other financing options also exist. Researching all your options can help you find one ideal for your situation.

1. In-House Provider Surgery Financing

Some dermatologists and plastic surgeons offer payment plans, loans or special medical credit cards for patients. If you have a provider in mind, ask about financing options. They may offer favorable interest rates, or you might be better off looking for a third-party lender. Common in-house financing options include CareCredit, United Medical Credit, Alphaeon and PatientFi.

2. 0% Introductory APR Credit Card

Besides personal loans and payment plans, a credit card that offers a 0% introductory APR on new purchases could be an option for financing an elective procedure. These cards offer a 0% APR for a set time frame, typically 12-21 months, and you won’t pay interest on your balance during that time. Just be sure to pay it off before the interest-free period ends, though, or you'll end up paying the card's regular rate, which could be quite high.

Confirm that your doctor accepts credit card payments before applying for a card if you decide to go this route. Also, check your credit score to determine if you’re likely to get approved for a 0% intro APR card. Many credit card issuers require good to excellent credit for approval.

Pay No Interest for a Limited TimeHere Are the Best Balance Transfer Cards

Visit the Marketplace

3. Saving Up for Your Procedure

If another monthly payment will make your debt burden unmanageable, you may want to consider setting more aside from your paycheck and delaying your procedure until you’ve met your savings goal. Paying out-of-pocket for a procedure will likely mean you’ll part with a large sum up front, but you won’t need to worry about the potential stress of carrying more debt. You also won’t need to pay interest charges, which could save you a considerable amount in the long run. A high-yield savings account dedicated to building your procedure fund could help you put savings on autopilot and end up without extra debt.

FAQs

-

In general, it’s possible to use a personal loan for plastic or cosmetic surgery as long as your lender permits it. Most lenders don’t have restrictions about using loans to cover medical expenses, including plastic surgeries, but always research loans before applying to ensure your loan proceeds can be used to pay for an elective procedure.

-

You can typically use a plastic surgery loan for procedures like:

- Facelift

- Breast augmentation

- Tummy tuck

- Reconstructive surgery

- Nonsurgical procedures, like a chemical peel or Botox

You can generally use a personal loan for almost anything you want, but it's best to check with your lender ahead of time to make sure it doesn't have any restrictions on what you can use the loan for.

-

If you have a less-than-stellar credit history, getting a loan for any purpose will likely be more difficult, including cosmetic surgery. That said, some personal loans are available for borrowers with bad or fair credit. But before you take on any additional debt, make sure it’s manageable for you so you don’t overextend yourself financially.

-

The ideal cosmetic surgery financing option depends on your situation. For some, it may make sense to use their savings, while others may opt for a personal loan or a credit card with a lengthy 0% introductory APR. Research different options to decide which makes the most financial sense for you.

-

The amount you can borrow with a plastic surgery loan varies based on several factors, including your credit history, debt load, income and lender. For instance, someone with a very good or excellent credit score and a low debt-to-income (DTI) ratio can likely borrow more than someone with bad credit and a high DTI ratio. But lenders also offer different maximum loan amounts, income requirements and more.

Consider prequalifying for personal loans with multiple lenders to compare rates and amounts. Doing so will generally only result in a soft credit check, which won’t negatively impact your credit score. When you formally apply for a loan, you’ll be subject to a hard credit pull.