Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

LendingClub

- Loan Amounts$1,000 – $40,000

- Loan Terms24 – 60 months

- APR Range9.57% – 35.99%

- Minimum

Credit Score600 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Borrowers in the fair credit range who need a small loan can appreciate LendingClub's quick funding and option for direct payments to creditors with debt consolidation loans.

Quick Personal Loans for Less Than-Ideal Credit Borrowers

LendingClub is an online lending marketplace that provides personal loans and other lending products, along with banking and investment services. While LendingClub charges origination fees on personal loans, it still offers competitive rates for qualified borrowers. The lender also allows you to apply for more than one loan and apply with a co-borrower.

Pros

- Low minimum loan amount

- Fast funding for personal loans (receive funds as little as 24 hours after approval)

- Joint loans allowed

- Direct payment to creditors

- Check rates without a hard credit inquiry

Cons

- Has origination fees

- No physical branches

- Lower maximum loan amount than some lenders

Loan Uses

LendingClub personal loans are best for borrowers with fair to good credit who want to consolidate existing debt, like high-interest credit cards, or finance large purchases. Its balance transfer loans allow you to send payments directly to a max of 12 creditors.

LendingClub personal loans provide upfront funds for a variety of needs. Possible uses for personal loans include:

- Debt consolidation

- Pay down credit card debts

- Home improvements

- Medical bills

- Funding a vacation or honeymoon

- Moving expenses

- Funding a wedding or other large events

- Financing major purchases

LendingClub Personal Loan Details

|

Loan Amounts |

$1,000 – $40,000 |

|

APR Range |

9.57% – 35.99% |

|

Loan Terms |

24 – 60 months |

|

Credit Score |

600 or above |

|

Funding Time |

As early as 24 hours after approval |

|

Prequalification? |

Yes |

|

Co-signer allowed? |

No |

|

Joint applicants allowed? |

Yes |

|

Income Requirements |

Not disclosed |

|

Origination Fees |

3% to 6% |

|

Late Fees |

Yes |

|

Prepayment Penalties |

None |

Highlights and Perks

LendingClub is competitive with other online lenders, but a few of its features make it stand out.

Multiple loans: First, LendingClub allows you to apply for and receive more than one personal loan at one time. There's a maximum limit of $50,000 that you can borrow total over multiple loans. If you need access to more than one loan, you may qualify through LendingClub. Remember that you can't consolidate or refinance multiple LendingClub loans later.

Apply with co-borrower: Another benefit to taking out a loan through LendingClub is that you can apply with a co-borrower. Joint personal loans allow you to split the financial obligations with another person. It's also a great way to qualify for a bigger loan or better rate than you may qualify for on your own.

Low loan minimum: LendingClub personal loans also feature a lower minimum loan amount than many other online lenders. You can take out a personal loan through LendingClub for as little as $1,000. LendingClub is an excellent option if you don't need to borrow much money.

Drawbacks and What To Look Out For

When choosing a LendingClub loan, watch out for a few things:

High maximum APR: You could qualify for a lower interest rate depending on your credit and other determining factors. Unfortunately, LendingClub has a wide range of rates, with its higher-end being extremely high. If you don't have at least good to excellent credit, there's a good chance you won't qualify for a low rate.

Origination fees: An origination fee is an upfront fee charged by lenders for processing loan applications. If approved for a personal loan through LendingClub, you could end up paying an origination fee of up to 6% on your loan amount. LendingClub deducts the fee amount from your loan payout, so borrowers should factor in the origination fee cost when determining the loan amount to request when applying.

No rate discount: Unlike many other online lenders, LendingClub doesn't offer a rate discount for signing up for automatic monthly loan payments. Autopay discounts typically range from 0.25% to 0.50%, so it's not a huge discount, but it adds up over time and could save you considerable money.

How to Qualify

LendingClub personal loans are available in all 50 states currently.

To qualify for a LendingClub personal loan, you must be:

- A U.S. citizen or permanent resident or living in the U.S. on a valid visa

- At least 18 years old

- Able to provide a verifiable bank account

The online lender relies on information provided by borrowers on the loan application and other information to determine eligibility for a personal loan. Factors that play a role in determining eligibility and what rates you'll receive include:

- Your credit score

- Your credit history

- Debt-to-income ratio

- Employment and income information

- Information about you from credit bureaus

- Other pertinent financial information

You'll need an excellent credit score, a low debt-to-income ratio, and a lengthy credit history to qualify for the lowest rates.

LendingClub allows you to apply for a joint personal loan using a co-borrower but not a co-signer. A co-signer meets lending requirements and takes on financial responsibility for your loan balance if you cannot make payments. A co-borrower is someone who applies for a loan with you and shares the financial obligation to pay off the loan. LendingClub considers the creditworthiness of both applicants when determining eligibility for a joint personal loan.

Application Process

You can apply for a LendingClub personal loan online. Below are the steps you need to take to apply for a loan through LendingClub.

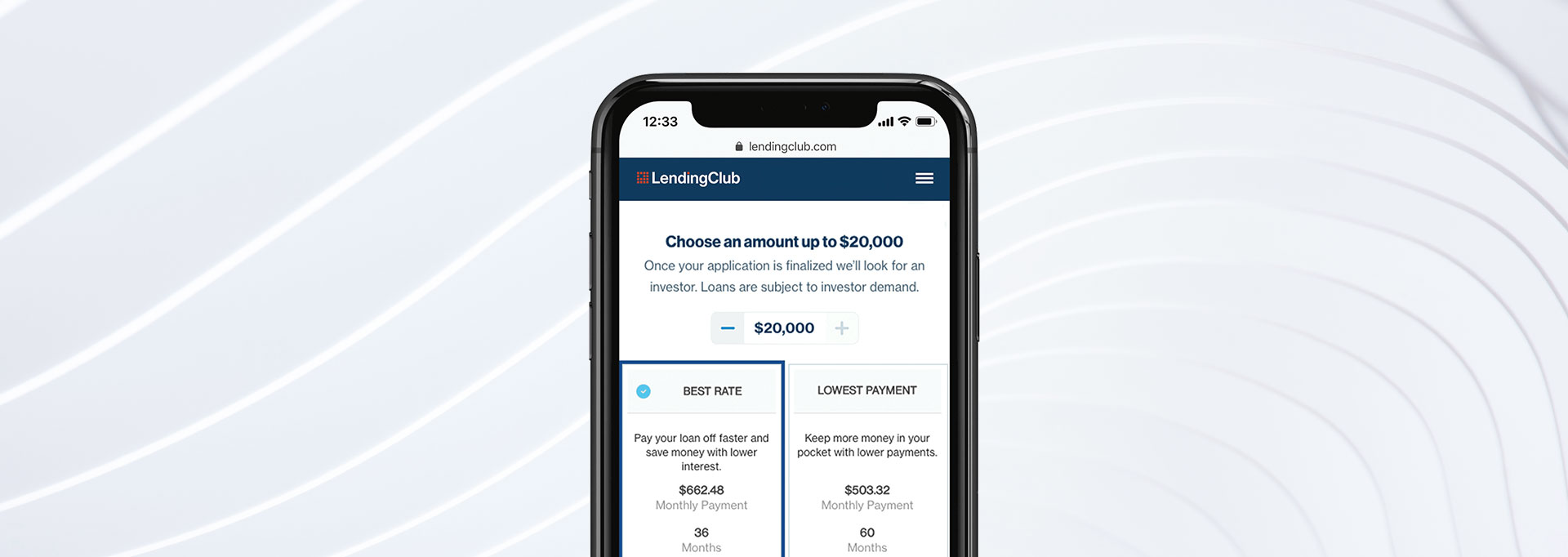

- Check rates: Start by prequalifying for a loan on the lender's website. When checking rates, LendingClub asks you to provide personal and financial information, including your name, contact information, total annual income, desired loan amount, and the reason for taking out a loan. In addition, lenders perform soft credit inquiries during the prequalifying process, which won't negatively affect your credit score.

- Apply for a loan: If you receive a prequalifying offer you like, fill out and submit the online application. Fill out the loan application fully, providing all the required information and documentation. For example, you may need to provide recent paystubs and bank statements, income tax return information, a government-issued photo ID, mortgage statements and more. A lender representative may contact you if other information is required during the process.

- Hard credit pull: It's during the loan application process when lenders take a more serious look at your credit history. As a result, lenders perform a hard credit pull during the application process, which can temporarily cause your credit score to drop several points.

- Approval: If approved, LendingClub will present you with a loan offer or offers to choose from. If you're ready to move forward, sign the necessary paperwork. Read the loan contract's fine print to ensure it's accurate and there are no surprises later.

- Receive funds: Once LendingClub approves and processes your loan application, it will disburse loan funds to your bank account or directly to your creditors if you are consolidating debt.

Example of Loan Payments

If you take out a 5-year loan of $10,000 at a 15% APR, you would have monthly payments of $237.90 and pay $4,273.96 in interest during the life of the loan.

Reputation

LendingClub has a good reputation among its customers. It currently holds an A- rating with the Better Business Bureau. The lender also received good marks from borrowers on TrustPilot, where it rated 4.8 out of five stars.

LendingClub appeared in the J.D. Power 2022 U.S. Consumer Lending Satisfaction Study, ranking 10th among personal loan lenders in overall customer satisfaction.

How LendingClub Compares

LendingClub isn't the only lender to consider if you need a personal loan. It's always a good idea to shop around and check rates with multiple lenders to find the best deal.

LightStream and Upstart are online lenders that provide personal loans and other lending products for various financial needs. Depending on your situation, one of these alternatives may be better for your needs.

LightStream provides personal loans up to $100,000, a much higher limit than many of its competitors. However, you'll need at least good to excellent credit to qualify for a personal loan through the lender. LightStream doesn't charge prepayment penalties or origination fees.

With low credit score requirements, Upstart is a great option for borrowers with limited, poor or fair credit. The lender considers education and nontraditional underwriting factors beyond credit scores. Upstart doesn't charge prepayment penalties on personal loans but carries an origination fee of 0% to 10% of the loan amount.

Here's a look at how these lenders stack up to LendingClub.

| LendingClub | LightStream | Upstart | |

|---|---|---|---|

|

Best For |

Debt consolidation Joint loans |

Higher loan limits Good to excellent credit |

Fast funding Poor to fair credit Limited credit |

|

Loan Amount |

$1,000 – $40,000 | $5,000 – $100,000 | $1,000 – $50,000 |

|

APR |

9.57% – 35.99% | 7.49% – 25.49% (with autopay) | 7.8% - 35.99% |

|

Loan Terms |

24 – 60 months | 24 – 144 months | 36 or 60 months |

|

Credit Score |

600 or above | 660 or above | 300 or above |

FAQs

-

Your credit score may drop temporarily when you apply for a personal loan when LendingClub performs a hard credit inquiry. Your credit could also take a hit if you fail to make payments on time. Late payments can remain on your credit report for up to seven years. On the flip side, consistent on-time payments and paying down your loan could positively impact your credit.

-

LendingClub is one of the largest online lenders for unsecured personal loans, providing over $70 billion in loans to millions of borrowers since the company launched in 2007.

-

LendingClub doesn’t disclose its credit and other requirements publicly like most lenders. However, those with bad to fair credit may be able to qualify, including through its joint loan option.

When determing borrower eligibility, LendingClub looks at your credit score along with other factors to determine eligibility for a personal loan, including debt-to-income ratio, credit and financial history, and more.

-

LendingClub provides personal loans between $1,000 and $40,000. If taking out multiple loans, the total amount borrowed cannot exceed $50,000.