Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Figuring out the savviest ways to take advantage of credit card perks can be complicated, and if you struggle to figure out how to maximize your rewards, you’re not alone. Luckily, mobile apps can simplify the world of credit card points and miles. Whether it's tracking point expiration dates, ensuring you earn bonus points on grocery spending or even providing guidance on award redemptions, credit card tracker apps can help you maximize credit card rewards.

Best mobile apps to maximize and track credit card rewards:

- Best for Diverse Rewards Types: AwardWallet

- Best for No Cost Commitment and Simplicity: UThrive

- Best for Maximizing Travel Rewards: The Points Guy App

- Best for Additional Features: MaxRewards

- Best for Robust Credit Card Database: CardPointers

- Best for Keeping It Simple: Waly

Recommended Credit Cards

| Credit Card | Rewards Rate | Annual Fee | Bonus Offer | Learn More |

|---|---|---|---|---|

|

|

1x- 5xPoints

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. |

$95 |

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base) |

Apply Now |

|

|

1x - 2xPoints

Earn 2X points on Southwest® purchases. Earn 2X points on Rapid Rewards® hotel and car rental partners. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services; select streaming. Earn 1X points on all other purchases. |

$69 |

50,000Southwest Rapid Rewards Points

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $700 (50,000 Southwest Rapid Rewards Points * 0.014 base) |

Apply Now |

|

|

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

$0 |

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

Apply Now Rates & Fees |

|

|

1% - 5%Cashback

Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. |

$0 |

$200Cash Bonus

Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back. |

Apply Now Rates & Fees |

Why You Should Use a Credit Card Rewards Tracking App

Keeping track of your credit card and travel rewards can be challenging, especially when you use multiple cards and travel loyalty programs. Not only do you need to remember how many points and miles you have when it comes time to redeem, but to truly maximize your rewards—you need to understand the features of each card.

Here are a few key ways credit card reward tracking apps can help you manage your card perks:

- Understand your cards' bonus categories. Knowing when to use each card is essential. Some earn a flat rewards rate for all eligible purchases, usually 1.5X-2X points per dollar. Others award extra points when you spend money in certain categories. For example, your cards may earn 2X-3X points per dollar for online shopping, travel purchases or grocery and gas rewards. Other cards offer higher rates in rotating quarterly categories or categories you choose.

- Know the type of rewards your credit cards offer. Some cards earn airline miles or hotel rewards you can redeem with specific merchants. Others earn general travel rewards, which are flexible and can typically be redeemed for various travel expenses including commuting, parking, rental cars, flights and hotel stays. Apps can help you figure out the smartest way to use them.

- Keep track of expiration dates. These days, most credit card and travel rewards don’t have expiration dates, but that's not true for all programs. Knowing which travel rewards expire and when will help you make informed decisions when redeeming.

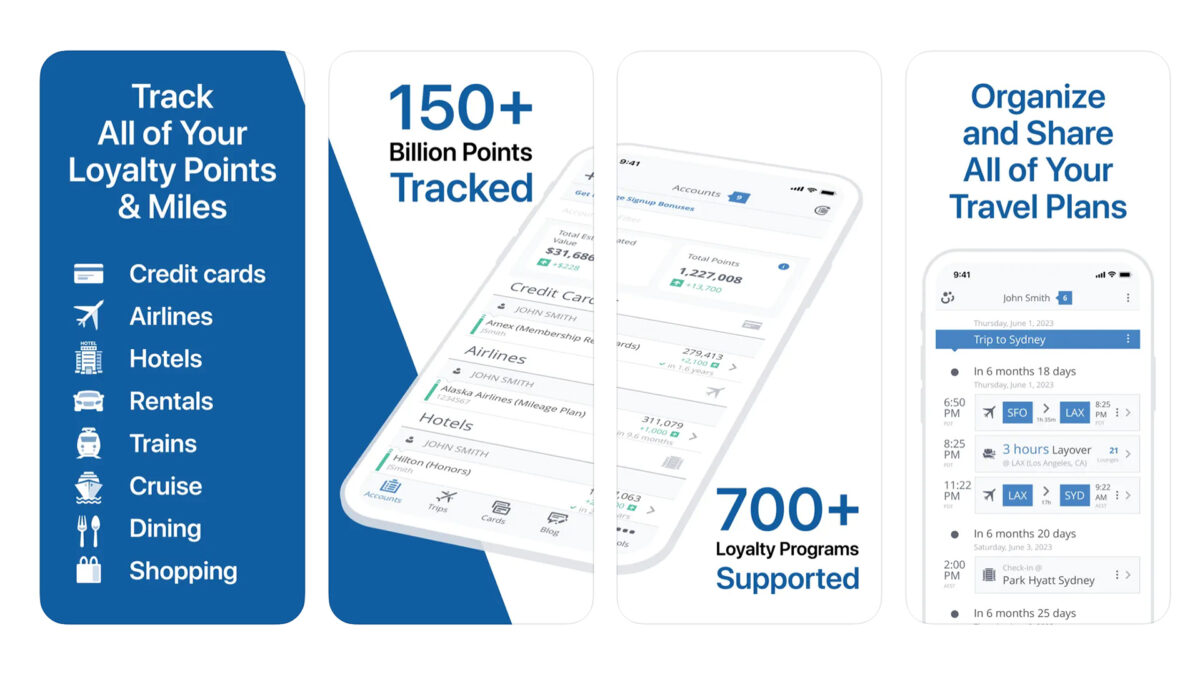

AwardWallet: Best for Diverse Rewards Types

AwardWallet partners with over 600 rewards programs, allowing you to track your hotel, airline and credit card rewards. It is also compatible with all of the major credit card issuers. If you want to maximize your credit card rewards fully, AwardWallet offers several tools to help you do just that.

Features

In addition to tracking your points, AwardWallet tracks your elite status progress and notifies you before points or free night awards expire. You can even use AwardWallet to track your credit card spending, travel plans and credit card travel and dining credits.

Pros

- Tracks wide variety of rewards, including hotel loyalty programs

- Mobile app and desktop version

- Trusted by many users due to company’s long history

Cons

- Free version offers very few features

- Desktop interface design is a little out of date

Cost

AwardWallet Plus costs $30 per year, and you'll get unlimited account balance updates and expiration tracking.

The free version has very limited features, but you’ll be able to view up to three expiration dates for miles or points.

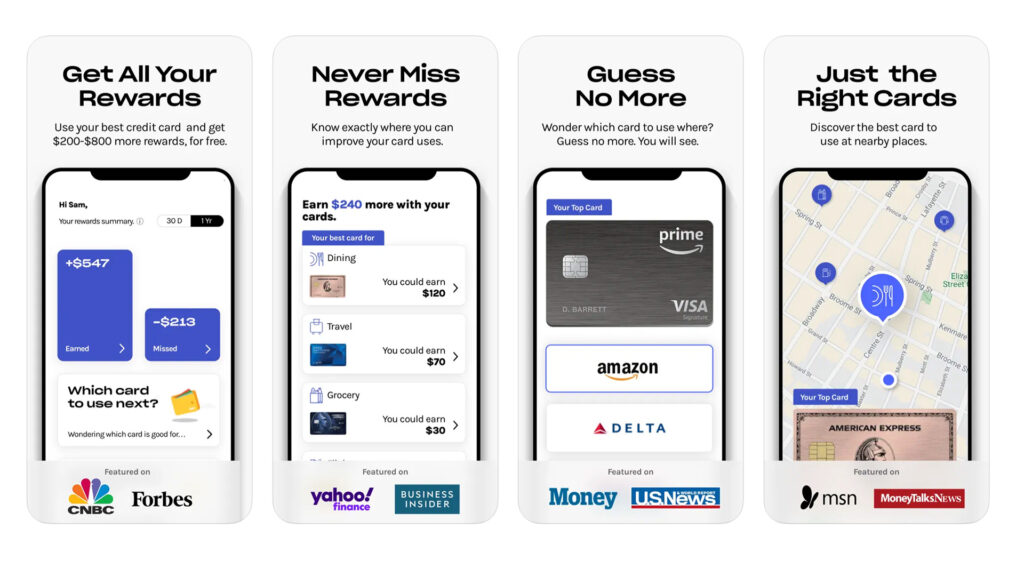

UThrive: Best for No Cost Commitment and Simplicity

Knowing which credit card to use on specific purchases is key to maximizing rewards well beyond the initial credit card sign-up bonus. The UThrive app offers personalized credit card advice based on users' spending habits.

Pros

- Free

- User-friendly interface

Cons

- Few features outside maximizing rewards

Features

Not only does the app keep track of your spending, but it also provides recommendations on which cards to use on current and future purchases. This helps users earn the most rewards possible and make better decisions about which credit cards to cancel or keep.

UThrive is a good option for those who want a simple app that helps them optimize their credit card spending for maximum rewards. Plus, the app is partnered with all of the major credit card issuers and travel loyalty programs in the U.S.

Cost

UThrive is free to download and use.

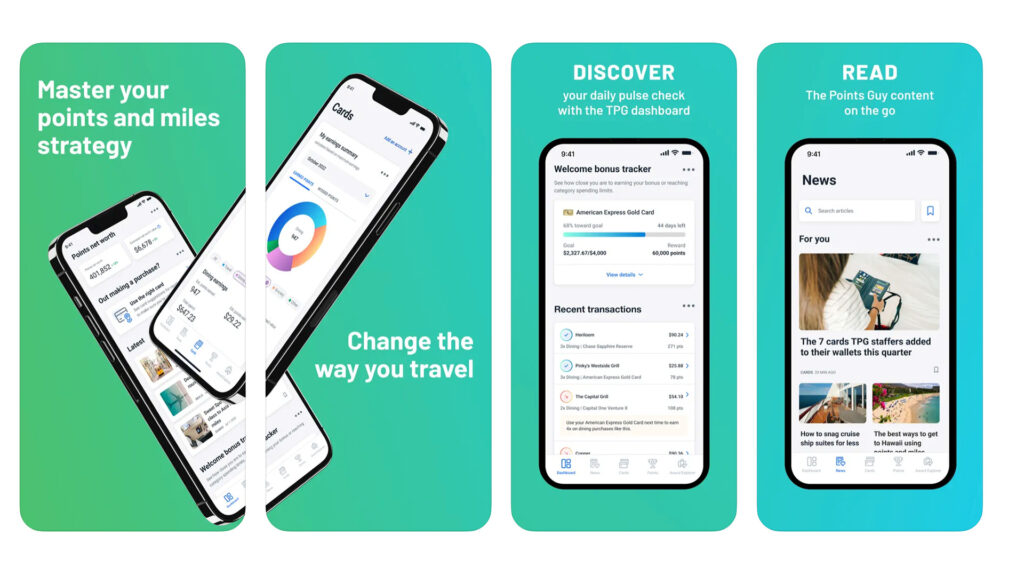

The Points Guy App: Best for Maximizing Travel Rewards

The Points Guy launched its credit card rewards app in September 2021 as a competitor to AwardWallet. The app lets users track loyalty account balances, check progress on credit card spending requirements and receive tips on which cards to use for the most rewards possible. It's a great tool for newbies who want a more comprehensive guide in their credit card rewards journey, from start to finish.

Features

The TPG app can help you maximize your credit card rewards by telling you which card is best for different types of purchases. It can also help you figure out where you can travel based on your points and miles balances. The app also gives you insights into card sign-up offers and your existing credit card perks.

Pros

- Free

- Helps you see where you can travel based on points balances

Cons

- Not yet available for Android

- No desktop version

Cost

The TPG app is free to download and use.

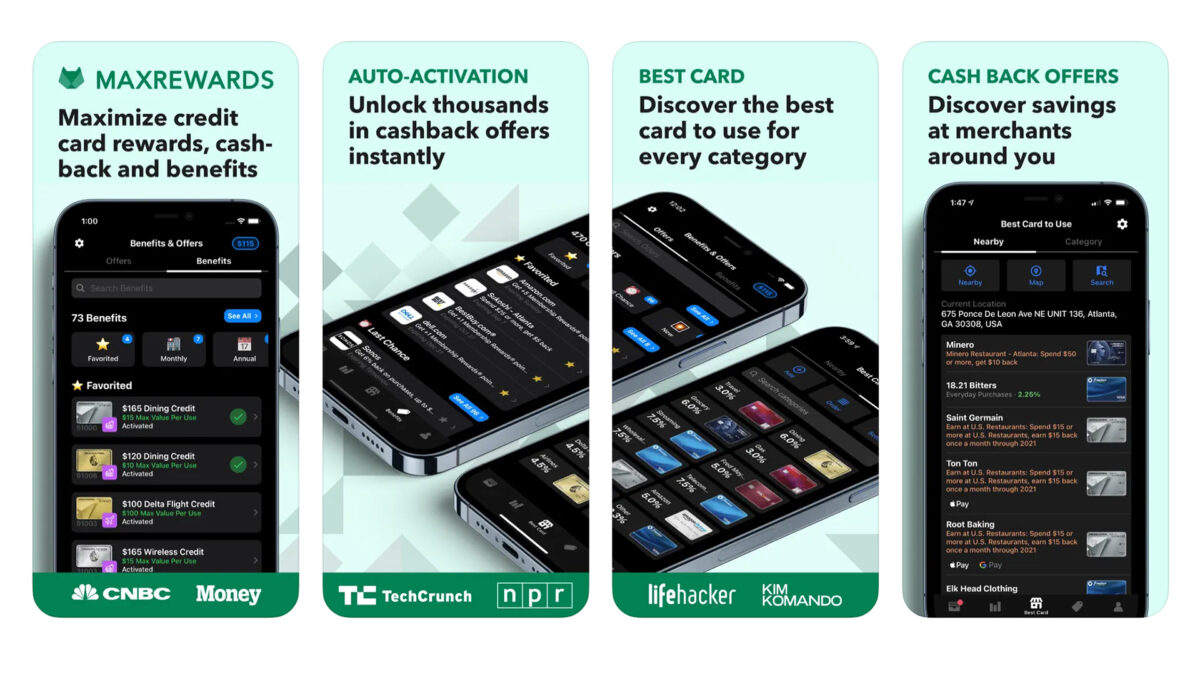

MaxRewards: Best for Additional Features

Unlike some other rewards trackers that monitor travel loyalty programs, MaxRewards is integrated with credit card issuers and banks. It supports over 800 credit cards from more than 80 card issuers. So if you're more concerned with maximizing credit card rewards, this platform may be for you. However, if hotel and airline loyalty programs are a significant part of your rewards strategy, you may be better off with another service.

Features

MaxRewards’ paid features include automatic activation of quarterly bonus categories and auto activation of deals from major credit card issuers. The app also manages your card issuer deals and sends notifications about new and expiring offers. Unlike many similar apps, you can also monitor your FICO credit score with MaxRewards.

Pros

- Good credit card integration

- Cheaper than some competitors

- Credit score monitoring

Cons

- Not a fit for hotel and airline loyalty programs

- Mobile only (no desktop version)

Cost

The app is free to use, but fans can unlock premium features with the paid version, MaxRewards Gold, for $3 a month.

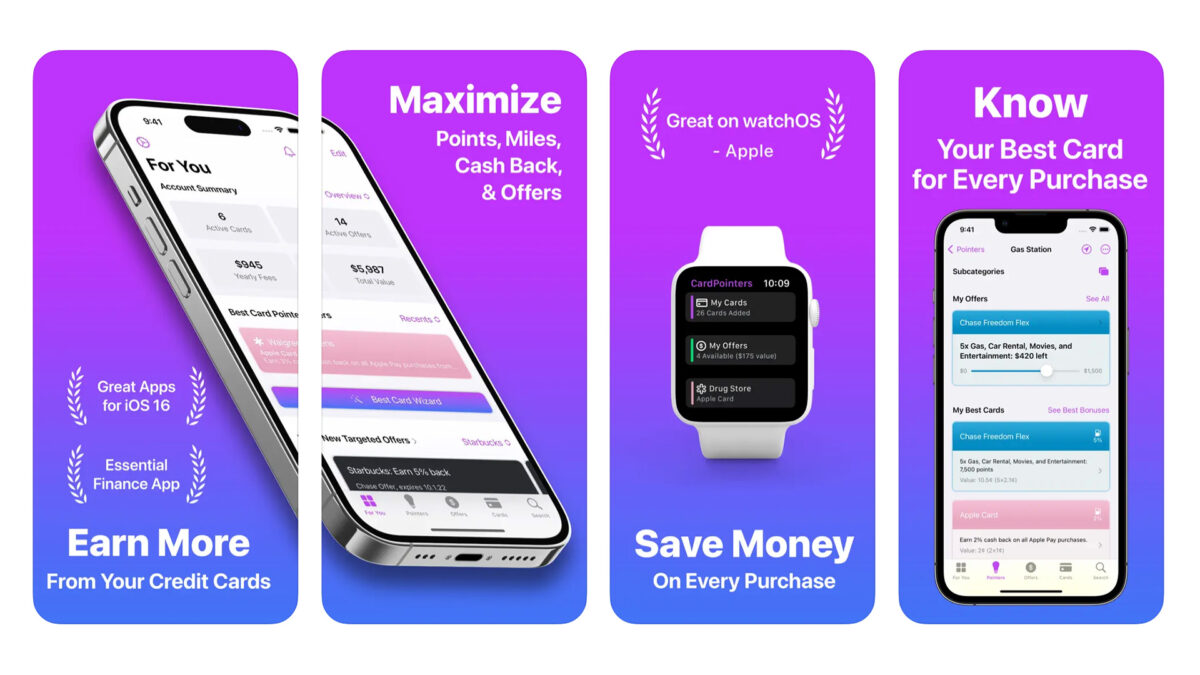

CardPointers: Best for Robust Credit Card Database

CardPointers is designed to help users save money and streamline how they earn points and miles. The company says it supports 5,000 credit cards and 900 banks, which would make it have one of the largest databases available in this type of app. If you’re looking for an app that can help you optimize your rewards while also tracking offers from your credit cards, CardPointers could be a good fit.

Features

The app can help you figure out which of your cards is best to use for purchases in various spending categories, like dining, online shopping, airfare and many more. Plus, you can look at “pointers” to compare cards’ rewards. Other handy features include the ability to integrate your cards into your mobile wallet, set reminders for annual fees and set discount offer alerts based on preferences and location.

Pros

- On many device types, including Apple Watch

- Large database of credit cards

Cons

- A bit more expensive than its competitors

- Few features available with free version

Cost

The free version has limited features, and the paid version is $50 per year.

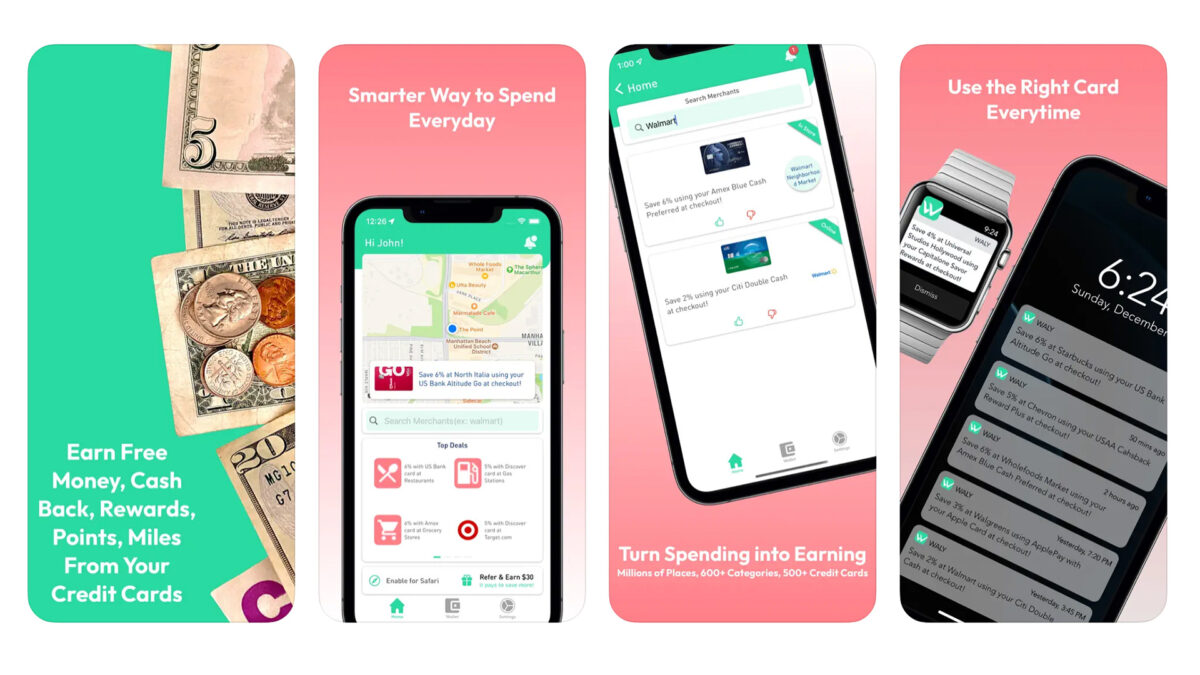

Waly: Best for Keeping It Simple

Waly is a very new app in the credit card rewards maximization space, but it’s worth a look. The app makes fairly straightforward recommendations as to which card you should use for online and retail shopping, and the Waly site mentions it may build out more personalized features down the road.

Features

The app provides a relatively simple service of recommending the right card for the type of shopping you’re doing based on the website you’re visiting or your location. This app doesn’t collect your card info, but for in-person retail shopping, you’ll need to enable location services for it to make recommendations.

Pros

- Free

- Don’t have to provide personal credit card info

Cons

- Very new to market

- Fairly simple feature set

Cost

Right now, Waly is free to download and use, though developers say they are working on a future paid version that could have more functionality.

Which App Is Best for Your Spending Habits?

Many tools and apps out there can help you maximize credit card rewards and get the most from your cash-back cards. The best one comes down to your personal needs.

If you're purely interested in tracking all of your rewards balances, AwardWallet is your best bet. If you want tracking capabilities with an educational component, the TPG app might be a better fit. And if you're just looking for a simplified tool for recommendations on which card to use, the UThrive app might be just what you need. Remember: A mile is a terrible thing to waste. These apps can help you avoid this scenario.

Related Article

Related Article