Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

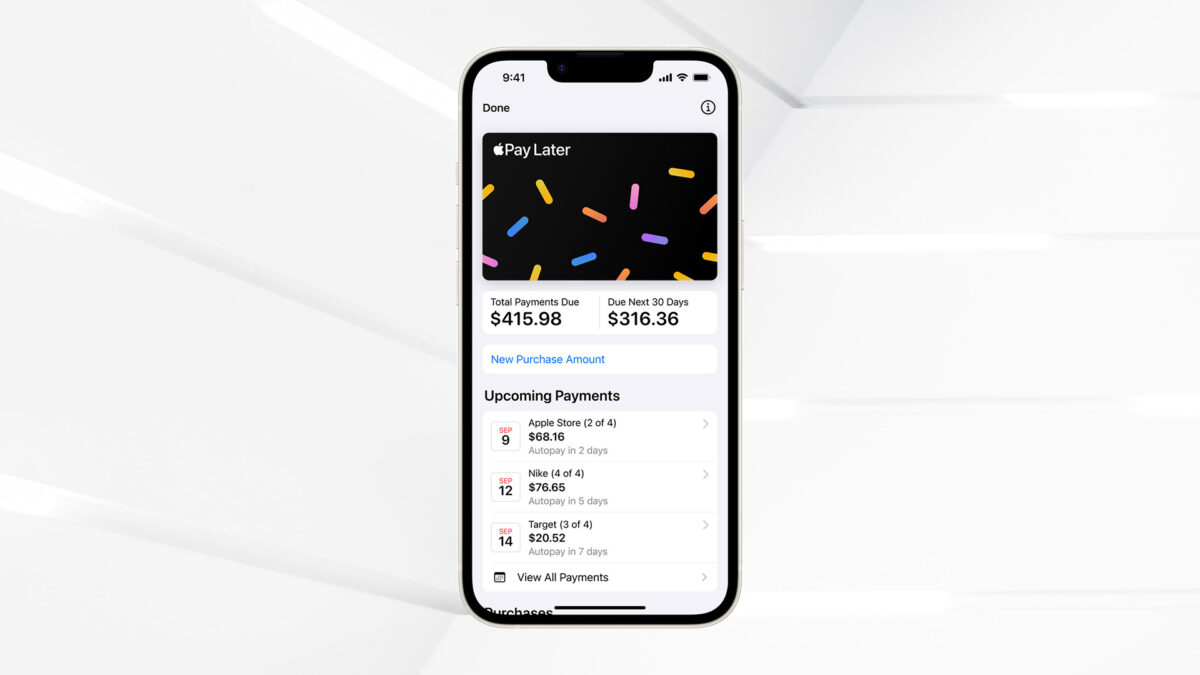

Apple Pay Later is an exciting new offering from Apple that allows U.S. users to split eligible purchases ranging from $75 to $1,000 into four equal payments over a span of six weeks, all without incurring any fees or interest charges. Here's a breakdown of how Apple Pay Later works, its main benefits and drawbacks and how it compares to similar services.

How Apple Pay Later Works

To access Apple Pay Later, users need to meet certain eligibility criteria. They must be 18 years of age or older and a U.S. citizen or lawful resident with a valid physical U.S. address. Users are required to enable two-factor authentication for their Apple ID and ensure their device is running the latest version of iOS. Additionally, they may be asked to verify their identity with a driver's license or state-issued photo ID.

Apple Pay Later exclusively accepts payments through eligible debit cards. Users will need to temporarily lift any credit freeze on their credit report before applying for an Apple Pay Later loan. Apple conducts a soft credit check to evaluate applications, with the assurance that this check won't impact the applicant's credit score.

There are specific reasons that might lead to an application rejection, including being currently or recently past due on debt obligations, having a recent bankruptcy or possessing a low credit score. Apple specifies that an application might be declined if the FICO score is less than 610 or the Lift Premium score falls below 580. However, Apple notes that rejected applicants may become eligible in the future, allowing them to reapply after a waiting period of 30 days.

What is Buy Now, Pay Later Financing?

Benefits

- Interest-Free: Apple Pay Later does not impose any interest or fees, making it a cost-effective alternative to traditional credit card financing.

- Transparency: Users can easily manage their payments and schedule, knowing the exact due dates and installment amounts, thereby helping them budget effectively.

- Convenience: The quick approval process and the ability to choose between autopay and manual payments offer flexibility in managing financial commitments.

Drawbacks

- Limited Eligibility: Users need to meet specific criteria to access the service, such as age, citizenship status, and having an eligible debit card.

- Credit Check: While it's a soft credit check, some users may prefer financial services without any credit evaluation.

- Limited Availability: As of now, Apple Pay Later is only available to U.S. customers.

How Apple Pay Later Stacks Up to Competitors

Apple Pay Later competes with similar "buy now, pay later" services like Afterpay and Klarna. These services allow users to split payments over time with clear installment plans and without interest or fees. However, Apple Pay Later's integration with the Apple Wallet app provides a seamless experience for Apple device users. Moreover, its focus on user privacy and security aligns with Apple's reputation.

In comparison, Afterpay and Klarna are third-party services that integrate with various retailers, offering broader merchant acceptance but potentially raising concerns about data sharing. The key advantage of Apple Pay Later is the convenience of staying within the Apple ecosystem, leveraging the familiarity and trust associated with the brand.

Bottom Line

Apple Pay Later offers an attractive and secure way for eligible users to manage their purchases, providing an excellent alternative to traditional credit financing, especially for Apple device owners who value convenience and transparency in their financial transactions.

Recommended Credit Cards

| Credit Card | Rewards Rate | Annual Fee | Bonus Offer | Learn More |

|---|---|---|---|---|

|

|

1x- 5xPoints

Enjoy benefits such as 5x on travel purchased through Chase TravelSM, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases |

$95 |

75,000Chase Ultimate Rewards Points

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $1,575 (75,000 Chase Ultimate Rewards Points * 0.021 base) |

Apply Now Rates and Fees |

|

|

1x - 2xPoints

Receive 3,000 anniversary points each year. Enjoy benefits including 2X points on local transit and commuting, including rideshare, 2X points on internet, cable, and phone services; select streaming, 2 EarlyBird Check-In® each year, 10,000 Companion Pass® qualifying points boost each year, and more. |

$69 |

50,000Southwest Rapid Rewards Points

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $600 (50,000 Southwest Rapid Rewards Points * 0.012 base) |

Apply Now Rates and Fees |

|

|

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

$0 |

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

Apply Now Rates & Fees |

|

|

2%Cashback

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel. |

$0 |

$200Cash Bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. |

Apply Now Rates & Fees |