Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Apple announced a high-yield savings account through a continued partnership with Goldman Sachs, the card issuer for the Apple Card. The savings account has no fees and earns a robust 4.15% APY up to account balance limits. Apple's Savings account could be a welcome addition for current Apple Card holders and iPhone users, but is it good enough to compete with other high-yield savings options? Keep reading to learn more about Apple's high-yield savings account, how it works and whether it's right for you.

Pros

- Offers a highly competitive APY

- No monthly fee

- No amount limits on Daily Cash transfers to savings

Cons

- Requires having an Apple Card to open an account

- Requires electronic transfer to access funds

- Not available for Android users

Apple Savings Account Highlights

- Earns an impressive 4.15% APY

- No monthly maintenance fee

- No minimum deposit requirements

- Maximum balance limit of $250,000

- Requires an Apple Card account

- Must use iPhone with iOS 16.4 or later

- FDIC insured through Goldman Sachs

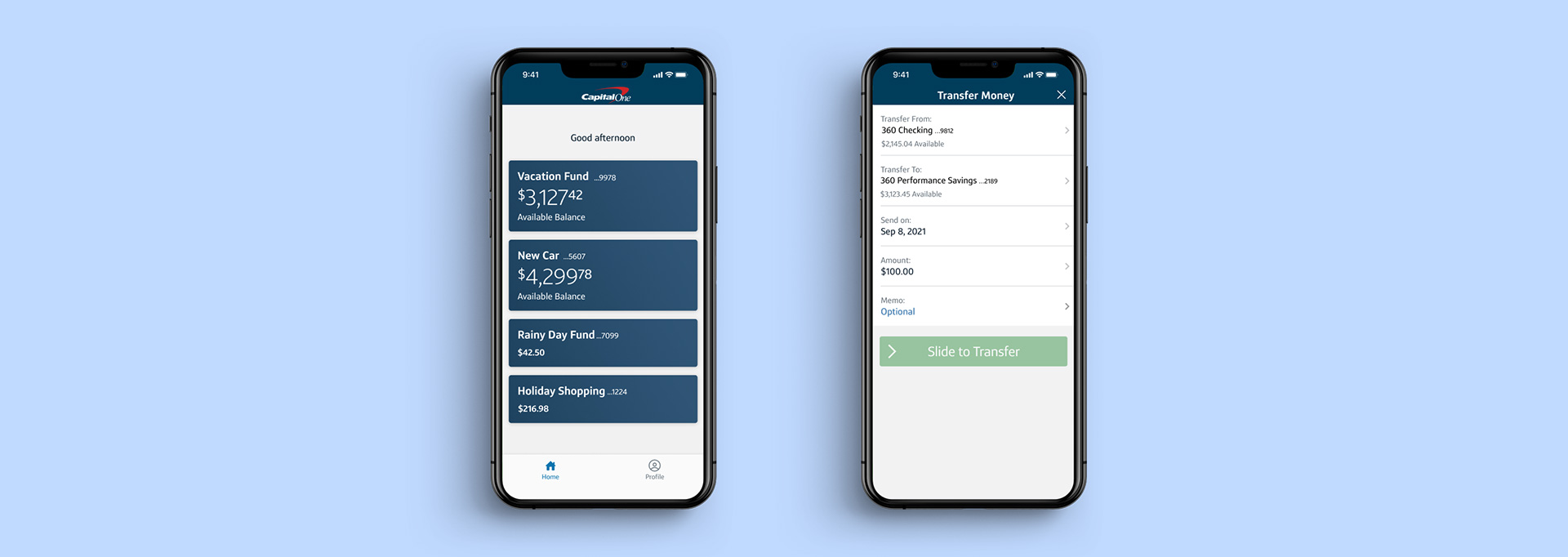

- Savings account access through Apple Wallet

- Deposits and withdrawals occur through ACH transfers with a linked external bank account

- Daily Cash earned via Apple Card is automatically deposited into Savings

What You Need to Open an Apple Savings Account

There are a few requirements to open an Apple Savings account—you must:

- Use an iPhone running iOS 16.4 or later

- Have an Apple Card in good standing (this is Apple’s credit card)

- Be 18 years of age or older

- Have a Social Security number or Individual Taxpayer Identification Number

- Have a valid U.S. street address (Puerto Rico, Virgin Islands military and embassy addresses also count)

Apple may request other personal information to verify your identity during the application process.

Quick Tip

There is no minimum opening deposit requirement to open an Apple Savings Account.

How to Set Up an Apple Savings Account

To set up an Apple Savings account, follow these steps:

- First, you'll need to have an active Apple Card in your iPhone Wallet.

- Open Wallet and tap on your Apple Card.

- Tap on "More" and then "Daily Cash."

- Tap "Set Up," which is next to "Savings."

- Follow the instructions from there to finish the set up process.

- Any Daily Cash statement credits you have will be automatically moved to Savings.

- You can also add funds from your Apple Cash balance or an external bank account.

Apple Savings Account Features

Here’s a look at the best features of Apple Savings:

- APY: Apple Savings has a strong APY of 4.15%, which isn’t the highest rate you can find, but it beats a lot of other savings accounts out there.

- No fees: Savings has no monthly service fees or other bank fees.

- Minimum deposit: The account also has no minimum balance or opening deposit requirements.

- FDIC insured: Apple Savings is FDIC insured through Goldman Sachs, up to $250,000.

- Automatic savings: If you earn cash back with your Apple Card (called Daily Cash), it will be automatically deposited into your Savings account.

Apple Savings Account Drawbacks

It's hard to argue with a savings account that has impressive APY and no fees. Still, here are some drawbacks to consider before opening an Apple Savings account:

- Requires an Apple Card: You must have an Apple Card—which is a credit card—in good standing to apply for Savings. You also need to meet credit and other requirements to qualify for an Apple Card.

- Limited access to funds: The only withdrawal options from Savings are electronic transfers to a linked external bank account or transferring funds to your virtual Apple Cash card in your Apple Wallet.

- No Android: Savings is not available to Android users. You'll need an iPhone with iOS 16.4 or later to access Apple's Savings account.

- Daily Cash restrictions: Previously, cardholders could direct Daily Cash earnings to an Apple Cash card in their wallet to spend as they wanted. When you open a Savings account, Daily Cash is automatically deposited into that account.

One interesting detail we noticed in the Deposit Account Agreement is a clause that states, "We reserve the right to require you to notify us in writing seven days before a withdrawal is made from your Account." While it's unclear how strictly this rule is enforced, it's certainly an unusual stipulation to include with a bank account.

Best Online Banks of 2024

Alternatives to the Apple Savings Account

Apple's Savings account stands among the top high-yield savings accounts with its competitive APY, but it may not be available or a good fit for everyone. Here are some other high-yield savings accounts to consider to maximize your savings.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.30%

*Annual Percentage Yield (APY) is accurate as of 6/4/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

5.15%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 4.60%

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. |

No minimum deposit |

Open Account |

|

|

5.00%

Earn 5.00% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of May 6, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

Is the Apple Savings Account Right for You?

The Apple Savings account could be right for you if you’re already an Apple user and either have or are willing to get Apple’s credit card. If you like the idea of having a little bit of cash back automatically transferred to a savings account, don’t need in-person banking support and don’t want the hassle of monthly fees, then Apple Savings might also be a great fit.

However, if you’re an Android user or just don’t want to add another credit card to your wallet, you’re probably better off with a different high-yield savings account. This is especially true if your main goal is finding the highest APY out there—though Apple Savings has a respectable interest rate, it’s not the best we’ve found.

Want to earn some extra cash?Explore the Best Bank Bonuses Currently Available

Visit the Marketplace