Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Opening a business bank account is a must for small business owners. It's important to keep your business and personal finances separate, but if you're just starting your journey as an entrepreneur, you might not know which features to look for in a business bank account. This guide covers five features seasoned business owners look for when choosing a bank to help you narrow down the best bank for your business.

1. Convenience

A business bank account should make your job as a small business owner easier. Here are some of the features you might want your bank or credit union to offer:

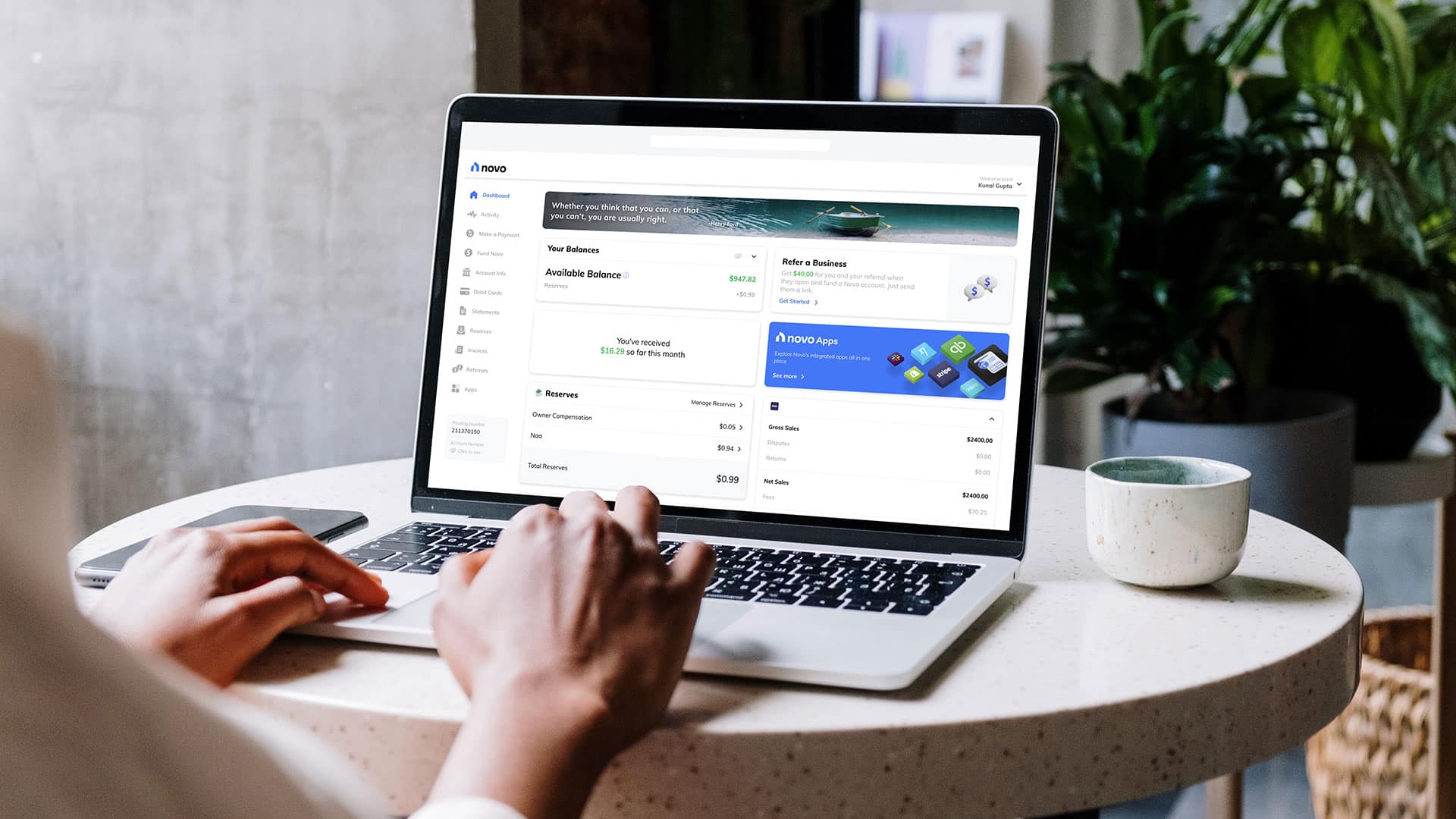

- Online banking: The ability to access your business bank account online 24/7 is important for a busy business owner. The best banks for small businesses provide online tools and user-friendly mobile apps to review your account history, transfer funds, make mobile deposits and more.

- In-person banking: If your company makes frequent cash deposits or you prefer to visit a branch in person, look for a financial institution that offers this capability.

- Services: Depending on your business, you may need to write checks, link a savings account, use bill pay services, send or receive wire transfers, use a debit card and more. You might also want to open a business credit card from the same bank (although it's wise to shop around).

- Accounting software: If you use accounting tools to manage your business finances, finding a bank that can integrate with that software can be a huge time saver.

Compare Chase Ink Business Credit Cards

| Credit Card | Intro Bonus | Annual Fee | Rewards Rate | Learn More |

|---|---|---|---|---|

|

|

$750Cash Bonus

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening |

$0 |

1.5%Cashback

Earn unlimited 1.5% cash back on every purchase made for your business. The advertised rewards type is cash back, but it’s important to note that you’re technically earning Chase Ultimate Rewards points (which can then be converted to cash back). |

Apply Now |

|

|

$750Cash Bonus

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening |

$0 |

1% - 5%Cashback

Earn 5% cash back on your first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. It also offers you 2% cash back on your first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. |

Apply Now |

|

|

100,000Chase Ultimate Rewards Points

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,300 (100,000 Chase Ultimate Rewards Points * 0.023 base) |

$95

This fee includes extra cards for authorized users, such as employees, at no additional charge. |

1x - 3xPoints

Earn 3x points on the first $150,000 of combined spending in a number of key business categories |

Apply Now |

|

|

$1,000Cash Bonus

Earn $1,000 bonus cash back after you spend $10,000 on purchases in the first 3 months from account opening. |

$195 |

Up to 2.5%Cashback

Earn unlimited 2.5% total cash back on purchases of $5,000 or more and unlimited 2% cash back on all other business purchases. |

Apply Now |

2. Low Fees

Be sure to pay attention to the monthly fees financial institutions charge as you'll probably want to avoid banks with higher fees. And if you can find banks with no fees, low fees or an easy way to qualify for fee waivers, you may want to add those names to your shortlist.

Don't forget the other costs associated with business bank accounts. Some banks offer ATM fee refunds, for example, which could save you money if you need to access cash frequently for your business. Meanwhile, minimum balance and overdraft fees are two types of expenses to watch out for when comparing your options.

Related Article

Related Article

How to Earn $400 With Chase Business Complete Checking

3. Competitive Interest Rates

Some banks pay interest on the funds you store in your business deposit accounts. The higher the annual percentage yield (APY) a bank offers, the more money your business has the potential to earn.

Here are a few of the best interest-bearing business checking and business savings accounts currently available:

Standout Interest-Bearing Business Account

Axos Business Interest Checking

- Our Rating 4/5 How our ratings work

- APYUp to 1.01%

Customers earn 1.01% APY on balances between $0 and $49,999.99; balances between $50,000 and $249,999.99 earn 0.20% APY; balances of $250,000 or more earn 0.10% APY.

- Minimum

Deposit Required$100 -

Intro Bonus

Up to $400Expires June 30, 2024

Open a business checking account by June 30 and get up to $400 when you use promo code NEW400 on your application and maintain a minimum average daily balance of $50,000.

Axos Business Interest Checking is our favorite small business checking account for newly incorporated businesses. We’ve seen them offer up to 1.01% APY on your funds, which is great for a checking account, typically has a solid sign-up bonus, 50 free monthly transactions, and it’s relatively simple to waive the $10 monthly maintenance fee. But keep in mind Axos is an online bank, so cash-heavy businesses are not a good fit.

Overview

Axos Bank’s Business Interest Checking Account is a great option for newly incorporated businesses eager to earn interest on deposits. It offers up to 1.01% interest, as well as a sign-up bonus worth up to $400.

Pros

- Earn interest on deposits

- Monthly maintenance fee can be waived

- Unlimited reimbursements from any domestic ATM

Cons

- APY decreases with higher balances

- Limited fee-free transactions every month

- Monthly maintenance fee

*Disclosure

To be eligible to earn all or a portion of the cash incentive as part of the promotional offer "NEW400," an application for a Basic Business Checking account or a Business Interest Checking account must be submitted between 09/30/2023 at 12:00 am PT and 6/30/2024 at 11:59 pm PT. Axos Bank reserves the right to limit each primary account holder or business title to one (1) checking account promotional offer per year. Axos Bank or Axos Bank for Nationwide checking customers or Businesses that have held an Axos Bank or UFB or Axos Bank for Nationwide checking or savings account in the past 12 months under the same title are not eligible for this offer. Promotional terms and conditions are subject to change or removal without notice. Incentive may be taxable and reported on IRS Form 1099-MISC. Consult your tax advisor. After initial requirements above are met, the amount of incentive earned will depend on meeting the additional requirements outlined below:

Small Business Checking bonus up to $400: You must be approved for your new Basic Business Checking or Business Interest Checking account and fund it within 30 days of account opening. An incentive of up to $400 can be earned during the first five (5) statement cycles. A statement cycle is a calendar month consisting of at least one day your account was open during that month. You can earn a maximum of four (4) payouts during the five (5) statement cycles, and the incentive will be deposited into the qualifying account within 10 business days following the end of the statement cycle in which the balance requirement was met.

- $75 will be earned for each statement cycle, up to $300 when you meet three requirements: 1) the average daily balance in your Basic Business Checking account or Business Interest Checking Account is between $25,000 and $49,999.99, 2) you have completed ten (10) point-of-sale transactions per month using your Small Business Checking Visa® Debit Card for signature-based purchases with a minimum of $3 per transaction, 3) You must also have bill pay set up and connected to your Basic Business Checking account or Business Interest Checking account. The bill pay transaction minimum is $10.

- $100 will be earned for each statement cycle, up to $400 when you meet three requirements : 1) the average daily balance in your Basic Business Checking account or Business Interest Checking Account is greater than $50,000, 2) you have completed ten (10) point-of-sale transactions per month using your Small Business Checking Visa® Debit Card for signature-based purchases with a minimum of $3 per transaction, 3) You must also have bill pay set up and connected to your Basic Business Checking account or Business Interest Checking account. The bill pay transaction minimum is $10.

Your Small Business Checking account must remain open and in good standing at the time the incentive is paid to be eligible. Furthermore, your Small Business Checking account must remain open for 150 days, or an early closure fee of up to $400 may apply.

Related Article

Related Article

6 Best Business Bank Account Bonuses and Promotions (2024)

4. Reasonable Transaction Limits

Some banks impose transaction limits that could hold your company back or make it more expensive to conduct business in a way that's most convenient for you. A bank might place limits on:

- Checks

- Mobile deposits

- Bill payments

- Electronic transfers

Take mobile deposits, for example. Depending on the bank, your company might face limits on the number of mobile deposits it can make per month. After reaching that limit, you might not be able to make more deposits that month or would have to pay a fee to do so. Plus, a bank may impose a cap on the maximum dollar amount of daily mobile deposits it will accept (for example, a maximum of $5,000 in mobile deposit funds per day).

If making a large number of mobile deposits (or depositing large amounts of money) is important to you, search for a business bank account with fewer restrictions. The same is true if you plan to write a lot of business checks, use the bill pay feature heavily or make a lot of electronic funds transfers.

5. Bonus and Promotional Offers

New bank account bonuses and promotions can be a great way to earn a little extra money for opening an account your business needed anyway. A new account bonus shouldn't be the only reason you choose a primary business bank account. But if a bank offers services that seem like a good fit for your business, earning some extra cash could be a nice added benefit.

Standout Business Account Bonus

Chase Business Complete Checking®

- Our Rating 5/5 How our ratings work Read the review

- APYN/A

- Minimum

Deposit RequiredN/A -

Intro Bonus

$300Expires July 22, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities.

The Chase Business Complete Checking® account is an attractive option. It offers the convenience of one of the largest financial institutions in the country, and it frequently offers bonuses that are relatively easy to earn. While it does not allow you to accrue interest on your funds like some other popular small business checking accounts, it's still very much worth considering if you can meet the requirements to waive its monthly fees.

Overview

The Chase Business Complete Checking® account comes loaded with a valuable sign-up bonus and an assortment of helpful perks, so long as you can meet the requirements to waive its monthly fees. It’s a good fit for many business checking customers, regardless of business size.

Read the reviewPros

- Generous signup bonus

- Several options to waive monthly fee

- Same-day deposits using QuickAccept℠ service

- Huge network of in-person branches and ATMs

Cons

- Monthly maintenance fee

- Overdraft fees are relatively high

- Limit on fee-free cash deposits and physical transactions

If you do sign up for a new business bank account to earn a new account bonus, be sure to read the fine print. Typically, you have to jump through a few hoops to satisfy a bank's criteria for an introductory bonus offer. And you don't want to miss out on a bonus opportunity because you forgot to complete a requirement.

Next Steps

Whether you're in the market for a new business bank account, credit card, loan or other type of financial product, it's always smart to shop around for the best deals. It does take a little extra time to compare offers from multiple financial institutions (or lenders or credit card issuers, depending on the financial product you need). The extra research can pay off in big savings over time.