Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Business Premium Savings Account

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

- APY4.01%

While the Business Premium Savings account features five balance tiers, all tiers currently earn the same interest rate.

- Minimum

Deposit Required$5,000 -

Intro Bonus

Up to $375Expires March 8, 2024

Choose smarter business banking by March 8 and enjoy up to 4.01% APY* and a bonus of up to $375 when you maintain a minimum average daily balance of $75,000. Just use promo code BPS375 on your application.

The Business Premium Savings account is a great option for businesses that have a lot of cash on hand. So long as you can meet the account's minimum opening deposit requirement of $5,000, you'll earn a competitive APY. While previously, this account required a high account balance to earn its top interest rate, Nationwide has since eased this requirement, and all balance tiers currently earn 4.01% APY. This change makes the account a lot more accessible to the average small business owner, which impressed us enough to raise this account's review score from its original rating of 4/5.

Strong Interest Rates for High Balances

Nationwide, a renowned insurance and financial services company, offers a Business Premium Savings account (in partnership with Axos Bank).

The Business Premium Savings account is a tiered interest rate savings account designed for businesses with a goal of earning interest on their savings. This account offers competitive interest rates on all balance tiers and a host of features to support your business’s financial needs.

Pros

- Competitive interest rates on all balance tiers

- No monthly maintenance fee

- No ongoing balance requirement

Cons

- Relatively high minimum opening deposit

$375 Bonus Offer

Right now, Axos Bank is offering up to $375 for opening a new Business Premium Savings account by March 8, 2024, using the promotional code BPS375 and meeting other requirements.*

To earn this bonus, open a new eligible account using the above promo code, then maintain an average daily balance of at least $30,000. For each statement cycle in which your balance is between $30,000 and $74,999.99, you'll earn $75; if your average daily balance is above $75,000, you'll earn $125 per statement cycle.

Note that a maximum of three payouts can be earned during four statement cycles. This means that in order to earn the maximum bonus, you'll need to maintain an average daily balance of $75,000 or more for three statement cycles, without letting it drop below this threshold for even one cycle.

APY Tiers

The Business Premium Savings account offers a tiered annual percentage yield (APY) system. While previously, an accountholder's interest rate increased alongside their account balance, Nationwide has since eased its requirements to earn APY, and as of September 2023, all balance tiers earn the same high interest rate.

This change really excited us, as previous requirements made the account less valuable to businesses that don't have lots of cash on hand. Now that this drawback has been dealt with, we chose to increase our overall score of this product from 4/5 to 4.5/5.

Here's how the different balance tiers break down:

| Tier | APY | Rate |

|---|---|---|

|

$0 – $23,999.99 |

4.01% |

3.93% |

|

$24,000 – $249,999.99 |

4.01% |

3.93% |

|

$250,000 – $499,999.99 |

4.01% |

3.93% |

|

$500,000 – $999,999.99 |

4.01% |

3.93% |

|

$1,000,000+ |

4.01% |

3.93% |

Related Article

Related Article

6 Best Business Bank Account Bonuses and Promotions (2024)

Features

Beyond the strong APY, this account offers a suite of useful tools designed to help your business grow its savings with ease.

No Daily Balance Requirement

There is no average daily balance requirement for this account. This offers additional flexibility and cost savings for your business.

However, keep in mind that there is a $5,000 minimum deposit requirement to open an account.

Remote Deposit From Anywhere

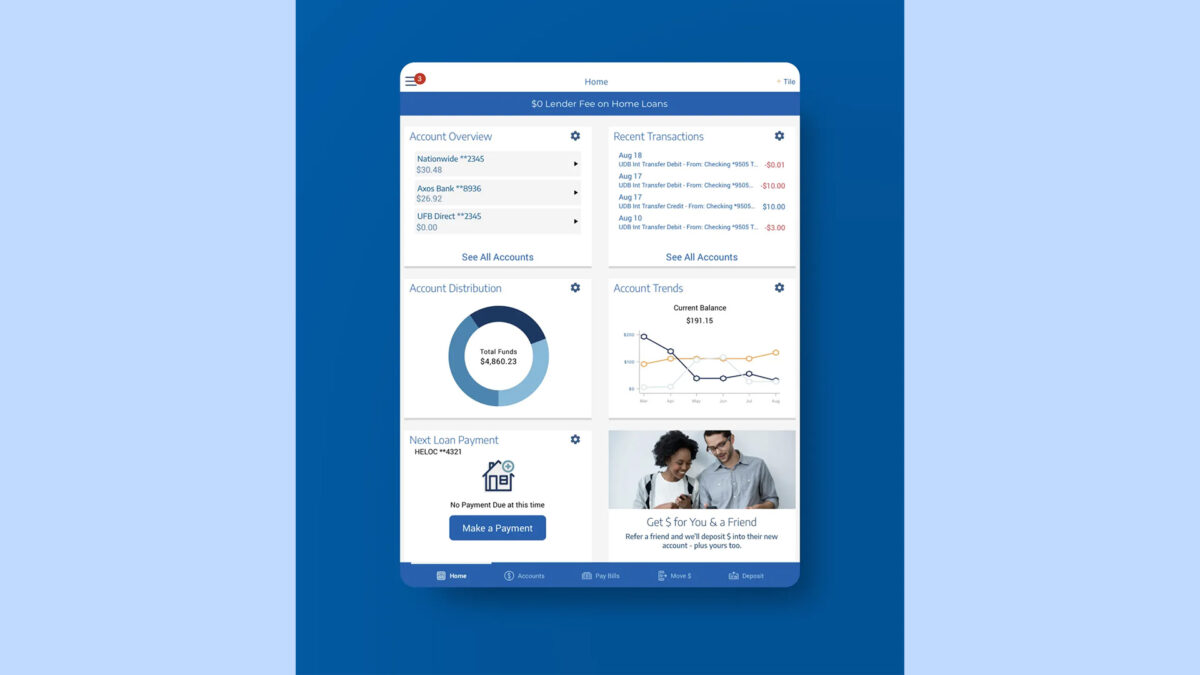

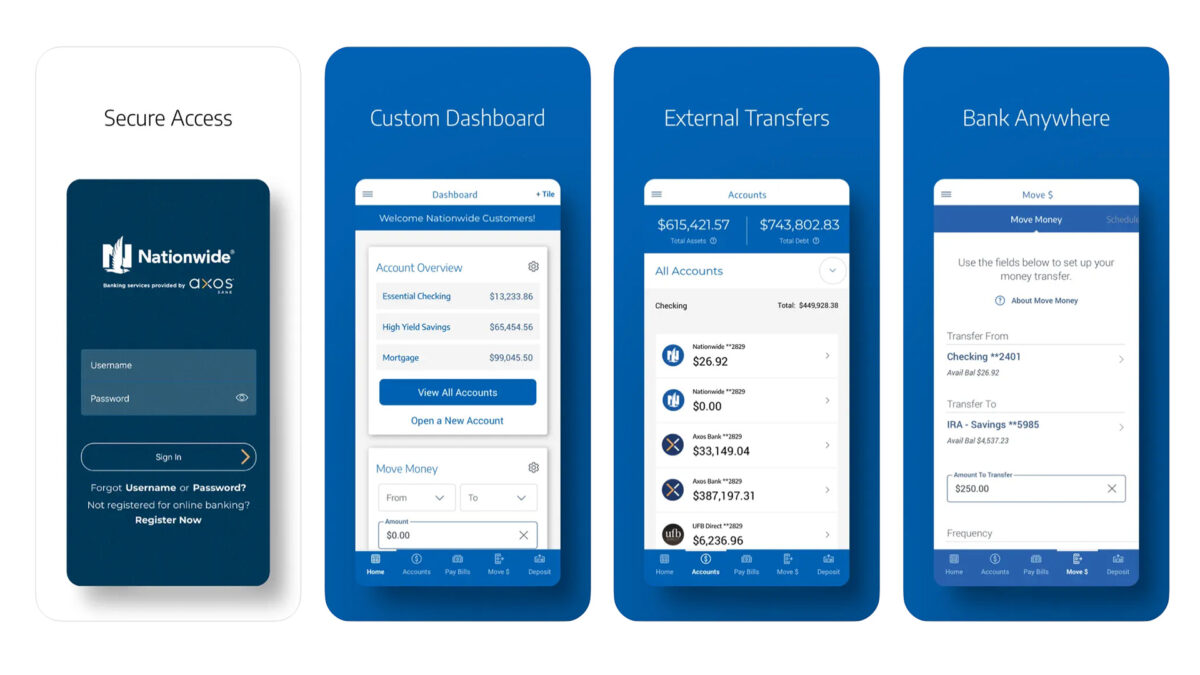

With the Business Premium Savings account, you can conveniently deposit checks remotely from anywhere with the Axos Bank for Nationwide app, streamlining your banking experience and saving time.

Other Benefits and Tools

The Business Premium Savings account provides a range of useful benefits and tools designed to help businesses manage their finances effectively:

- Free image statements: Account holders can access image statements online, which allows for easy organization and record-keeping. This feature eliminates the need for physical copies of your statements and deposited checks, saving both time and resources.

- Free online banking: With online banking, you can manage your account from anywhere, at any time. You can monito

r your balance, transfer funds and view transact ion history, making it simple to keep track of your business's finances. Online banking also includes security feat ures, ensuring that your financial information remains safe. - Remote deposit from anywhere: The remote deposit feature enables you to deposit checks from your smartphone or tablet via the Axos Bank for Nationwide app.

- Tiered interest rate structure: The tiered interest rate system rewards businesses with higher balances, offering higher APYs for larger account balances. This encourages businesses to save more and allows them to ea

rn more interest as their savin gs grow.

No Monthly Maintenance Fee or Average Daily Balance Requirement

The Business Premium Savings account does not c

As previously mentioned, this account also doesn't charge a fee tied to an average daily balance requirement, despite requiring a $5,000 minimum opening deposit. This is a welcome perk, as it means you won't be penalized if your balance temporarily falls below a certain threshold (outside of not earning interest).

How to Access Your Money

Accessing your money in the Business Premium Savings account is a simple and convenient process that can be done through the mobile app or online.

Mobile App:

- Download the Axos Bank for Nationwide app on your smartphone or tablet, available for iOS and Android.

- Log in using your account credentials (username and password). If you haven't set up your online access yet, you'll need to register and create a username and password.

- Once logged in, you can view your account

balance, transactio n history, make deposits and transfer funds between your accounts.

Online Banking:

- Visit the Nationwide online banking website (hosted by Axos).

- Log in using your account credentials (username and password). If you haven't set up your online access yet, you'll need to register and create a username and password.

- After logging in, you can view your account balance, transaction history, transfer funds, view statements and more.

Nationwide Interest Checking: Earn Interest With No Monthly Fees

Business Premium Savings Drawbacks

While the Business Premium Savings account offers many advantages, it isn't perfect:

- Relatively high minimum opening deposit of $5,000: While Nationwide has lowered this account's minimum opening deposit requirement considerably since its launch, it's still a bit s

teep in compariso n with other business savings accounts. Since not every business has that type of cash to stash away, this isn't ideal for everyone.

Explore the Best Small Business Savings Accounts

Visit the Marketplace

About Nationwide

Nationwide is a well-established insurance and financial services company with a solid reputation. In partnership with Axos, an innovative online bank, Nationwi

The Bottom Line

The Business Premium Savings account is an excellent choice for businesses with a substantial amount of savings, as it offers competitive interest rates, no fees and convenient tools for managing your account.

Ready to open a Business Premium Savings account? Start here.

*Disclosure

To be eligible to earn all or a portion of the cash incentive as part of the promotional offer "BPS375," a Business Premium Savings (BPS) account must be submitted between 09/13/2023 at 12:00 am PT and 3/8/2024 at 11:59 pm PT. Axos Bank reserves the right to limit each primary account holder or business title to one (1) savings account promotional offer per year. Businesses that have held an Axos Bank or UFB or Axos Bank for Nationwide checking or savings account past 12 months under the same title are not eligible for this offer. Promotional terms and conditions are subject to change or removal without notice. Incentive may be taxable and reported on IRS Form 1099-MISC. Consult your tax advisor. After initial requirements above are met, the amount of incentive earned will depend on meeting the additional requirements outlined below:

Business Premium Savings bonus of up to $375 You must be approved for your new Business Premium Savings account and fund it within 30 days of account opening. A incentive of up to $375 can be earned during the first four (4) statement cycles. A statement cycle is a calendar month consisting of at least one day your account was open during that month. $75 will be earned for each statement cycle during which the average daily balance in your Business Premium Savings account is between $30,000 and $74,999.99. $125 will be earned for each statement cycle during which the average daily balance in your Business Premium Savings account is a minimum of $75,000 or greater. You can earn a maximum of three (3) payouts during the four (4) statement cycles, and the incentive will be deposited into your Business Premium Savings account within 10 business days following the end of the statement cycle in which the balance requirement was met. Your Business Premium Savings account must remain open and in good standing at the time the incentive is paid to be eligible. Furthermore, your Business Premium Savings account must remain open for 120 days, or an early closure fee of up to $375 may apply.