Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Liberty Tax®

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 3.5/5 How our ratings work

Liberty Tax is known for providing accessible, in-person services to users. With over 2,500 brick-and-mortar locations across the United States, it's a popular choice for those who prefer to receive face-to-face assistance with their taxes. While you can likely find a less expensive online alternatives for simple tax return filing (Liberty Tax doesn't offer a free option), its Premium online tier is a solid, affordable choice for self-employed workers.

Convenient In-Person Tax Services

Liberty Tax® is a popular option among DIY tax preparers despite no free option for simple returns. While its online service isn’t quite as streamlined as what you’ll find with some of its competitors–for example, its on-site help functionality is somewhat difficult to navigate–Liberty Tax is still a solid option for individuals looking for budget-friendly tax software.

And with an extensive network of retail locations spread across the country, it’s a popular option for those who prefer to have their taxes done in person with a tax professional.

Pros

- Lower prices than some competitors

- In-personal tax support at thousands of retail locations

- Multiple guarantees for online and in-person tax returns

Cons

- No free version for simple tax returns

- State returns are more expensive than many competitors

- On-site help functionality can be confusing

- Poor online ratings

Liberty Tax at a Glance

|

Price |

|

|

Guarantees |

|

|

W-2 + Prior Year Import |

|

|

Audit Support |

|

|

Access to Tax Experts |

|

Types of Returns and Pricing

Liberty Tax offers three versions of its o

Pricing varies per version and is subject to change.

Liberty Tax Products & Pricing

| Tier | SUMMARY | FEDERAL | STATE |

|---|---|---|---|

|

Basic Edition |

|

$45.95 |

$36.95 |

|

Deluxe Edition |

|

$65.95 |

$36.95 |

|

Premium Edition |

|

$85.95 |

$36.95 |

Basic Edition

D iscount price: $45.95 Federal | $36.95 State- Regular price: $55.95 Federal | $36.95 State

Unlike many of its competitors, Liberty Tax does

- Standard deduction

- Earned income credit

- Tuition and fees deduction

This version works for single or married filers but doesn't include kids or dependents.

Related Article

Related Article

9 Best and Cheapest Online Tax Services

Deluxe Edition

- Discount price: $

65.95 Federal | $36. 95 State - Regular price: $75.95 Federal | $36.95 State

Liberty Tax's Deluxe Edition covers more complicated tax scenarios. Along with all of the features included with the Basic Edition, th

- Family-based tax breaks

- Investments

- Retirement income

- Tax credit for retirement savings

- Educator expense deductions

- Alimony deductions

- Charitable donations

- Medical expenses

Premium Edition

- Discount

price: $85.95 Federal | $36.95 State - Regular price: $95.95 Federal | $36.95 State

Liberty Tax's Premium Edition is geared toward self-employed individuals. Premium is the option to pick for your tax return if you're a freelancer or independent contractor. It's also the best version if you have less common forms of income.

Along with what's included in other Liberty Tax editions, the Pr

- Self-employment income and related business deductions

- Rental income

- Farming income

- Schedule K-1

- Unreported tips

Filing In Person With Liberty Tax

If you prefer to work face-to-face with a tax professional, Liberty Tax also offers in-person tax preparation. Liberty Tax operates o

Features

Liberty Tax offers a handful of convenient tools to help you file your taxes this year, including:

- Rem

ote filin g: Snap photos of tax documents through Liberty Tax's mobile app and a tax pro will complete your return remotely. - Free tax import: Import your previous tax return from a competitor.

- Audit a

ssistance : Liberty Tax pros provide support on potential issues with your tax return with the IRS or your state. - Tax return downloads: Download a copy of any tax return prepared at a Liberty Tax location.

- Tax interview checklist: Liberty Tax provides a tax interview checklist to organize your tax documents before meeting with a tax pro.

- Tax calculators: Liberty Tax provides free calculators to help you estimate tax returns, refunds, mileage deductions and other W-4 withholding.

Refund Options

Liberty Tax customers can receive their tax refund in several ways. Choose from receiving a paper check or direct deposit from the IRS. You can also choose to have your tax refund loaded onto a Netspend® Liberty Tax® Prepaid Mastercard®.

Refund transfers are also available, which allow you to file your taxes through Liberty without upfront fees, which are later deducted from your federal tax return proceeds.

Related Article

Related Article

Tax Hack: How to Get a Cash Bonus With Your Tax Refund

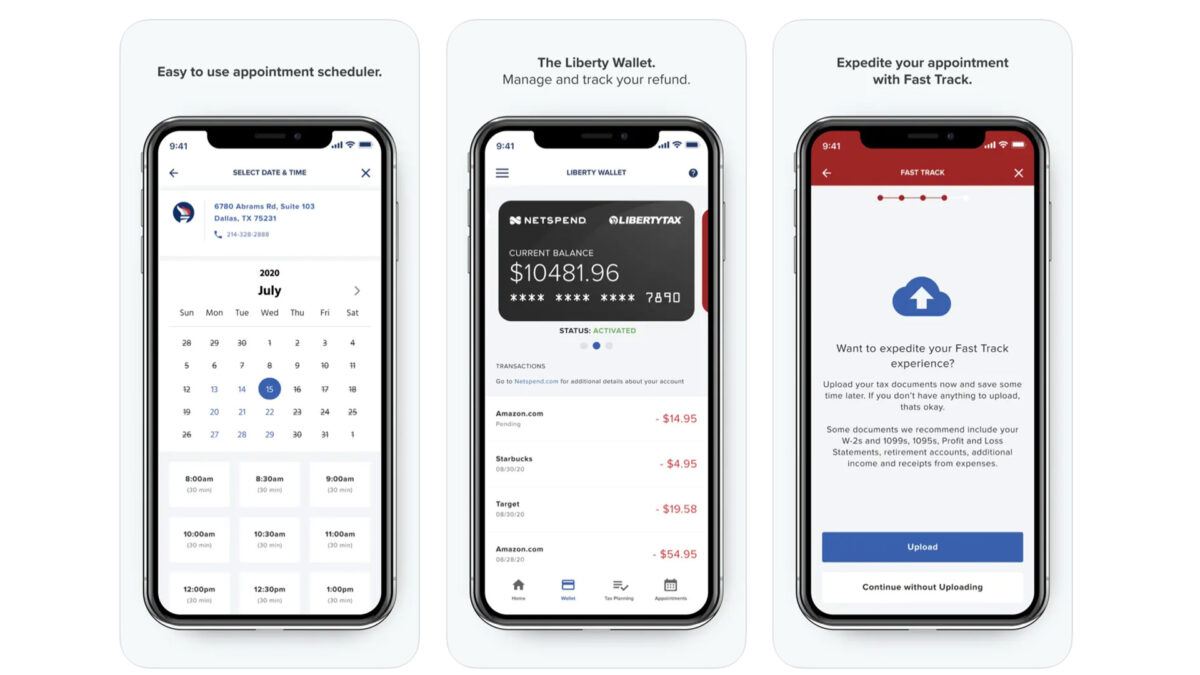

Mobile App

For tech-savvy customers, the Liberty Tax mo

Customers can also use the app to schedule appointments at Liberty Tax offices, track their tax refund and access money through Liberty Tax's digital wallet.

Liberty Tax Support

The Liberty Tax website features several tax tools to help customers as they do their taxes. Tools include a help s

You can always get in-person help from a tax professional at any Liberty Tax location. You can call

Other support options include email and phone support, with online support available M

You may be able to get a little more hands-on help as well. LibertyTax states on its website: "For free tax advice, please contact your local office by calling 1-866-871-1040." So that could be worth a try if you have a complex return or question while filing.

Is Liberty Tax Secure?

Knowing that your personal and financial information is secure when using an online tax preparation service is important. Liberty Tax employs several security measures to ensure customers' information and tax returns are secure. Security measures include:

- SSL encryption

- Account authentication

- Device verification

Audit Support

While nobody wants to deal with an audit, it can occur after filing a tax return. When comparing tax prep services, consider one that provides support if you face an audit.

Among Liberty Tax's guarantees is the promise of audit assistance should the IRS audit you based on a tax return prepared by your local Liberty Tax office. If that occurs, Liberty Tax will provide someo

For online returns, Liberty Tax professionals will advise you on potential audits or other inquiries from the IRS or state tax officials.

Other online tax prep companies may offer more free and paid audit support options, including payment of software fees and financial implications related to an audit.

Liberty Tax Guarantees

Liberty Tax stands by the quality of its tax preparation services by offering several guarantees to its customers.

Online returns feature two gu

- Accuracy guarantee: Liberty Tax guarantees its offices will give you the most accurate tax return and will reimburse you for penalties and other costs that are the result of an error on your return.

- Maximum refund guarantee: Liberty Tax will reimburse you for preparation fees if you can get a bigger tax refund through a competitor.

Liberty Tax also offers several guarantees for tax returns prepared by tax pros at one of its local branch locations, including accuracy, year-long support and audit assistance guarantees. In-person returns also come with correspondence assistance for all IRS and state return correspondence received.

Bottom Line

Liberty Tax isn't the cheapest tax preparation solution, especially for simple returns, nor is it the most comprehensive. However, it's a good option for individuals with more complex tax situations looking for budget-conscious tax services. It's also suitable for people who prefer to get their taxes done in person with the added convenience of digital support tools like Liberty Tax's mobile app.

Ready to File Your Taxes? Start Here