Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Happy Money

- Loan Amounts$5,000 – $40,000

- Loan Terms24 – 60 months

- APR Range11.72% – 17.99%

- Minimum

Credit Score640 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Happy Money can help pay off and consolidate credit card debt into one fixed monthly payment.

Convenient, Low-Fee Credit Card Debt Consolidation Loans

If you’re looking to take out a credit card consolidation loan, Happy Money is one of the better options. It features excellent customer service and, new in 2023, a built-in hardship protection program included with all loans. In some cases, Happy Money can even deposit loan funds to pay off your credit cards directly for you. However, rates are high, and you might find lower rates elsewhere if you have good credit.

Pros

- No late fees

- Direct payment to creditors

- Prequalification with no hard credit check

- All loans come with a hardship payment protection plan

Cons

- Most loans can only be used to pay off credit card debt

- Has origination fees

- High loan minimum

- No joint or co-signed loans

- Not available in all states

- Funding slower than other lenders

Who is Happy Money Best For?

Happy Money is a personal loan, but unlike other personal loans, you can only use it for one purpose: consolidating credit card debt. The company states that it is possible to use their loans for another purpose, but doesn’t provide any additional details about how that would work or how you can apply. Compared with other debt consolidation loans, Happy Money offers reasonable rates (although they’re not the lowest) and a good support network.

Happy Money Loan Details

|

Loan Amounts |

$5,000 – $40,000 |

|

APR Range |

24 – 60 months |

|

Loan Terms |

11.72% – 17.99% |

|

Credit Score |

640 or above |

|

Funding Time |

6 – 13 business days |

|

Prequalification? |

Yes |

|

Co-Signer Allowed? |

No |

|

Joint Applicant Allowed? |

No |

|

Income Requirements? |

Debt-to-income ratio under 50% |

|

Origination Fees |

0% - 5% |

|

Late Fees |

None |

|

Prepayment Fees |

None |

|

Other Fees |

None |

|

Loan Usage |

Credit card debt consolidation |

|

Discounts |

None |

Highlights and Perks

Happy Money has a few advantages that can help you repay your credit card debt faster, save money and grow your credit at the same time:

- Direct payment to your creditors: Happy Money can pay out your loan funds in one of two ways: as a deposit into your bank account or it can send the loan funds to pay off your old credit cards directly. Having Happy Money pay your creditors directly is a convenient option.

- Hardship payment protection: All Happy Money loans are insured through its partner TruStage Payment Guard, which makes up to three payments for you if you get sick or lose your job through no fault of your own. This differs from regular forbearance plans because it pays your loan down and prevents interest from accruing in the meantime.

- Comes with a credit union savings account: Happy Money doesn’t provide the funds for these loans itself, but instead works with partner lenders — most of whom are credit unions. Since credit unions require you to open a savings account to establish membership, your Happy Money loan will also come with a savings account you can use or ignore.

Drawbacks and What to Look Out For

While Happy Money can help a lot of folks, it’s not right for everyone and there are some drawbacks you should be aware of:

- There are cheaper loans available: Happy Money doesn’t charge very high rates for its loans, but you will find lower rates on a general-purpose personal loan. This is especially true if you have excellent credit.

- Funding times can be slow: Some lenders can approve you and get the money into your hands within a day. But Happy Money takes three to seven business days to approve or deny your application and then another three to six business days to send the money.

- Can dig yourself a deeper hole if you have spending issues: If you have unresolved spending problems, you can easily rack up a bunch of credit card debt with debt consolidation loans.

How to Qualify

Happy Money is very transparent about its approval requirements than other lenders, but it still doesn’t disclose everything. Here’s what we know:

- Age: 18 years or older

- Delinquent debt: None

- Credit score: 640 or above

- Debt-to-income ratio: Less than 50%

- Checking account: You must have a checking account

- Residency: Available to people with Social Security Numbers in all states except for Massachusetts and Nevada

Unfortunately, if you don’t meet these requirements or are denied for a loan, Happy Money doesn’t allow you to apply with a co-signer or a co-borrower. However, you can reapply after 30 days.

Application Process

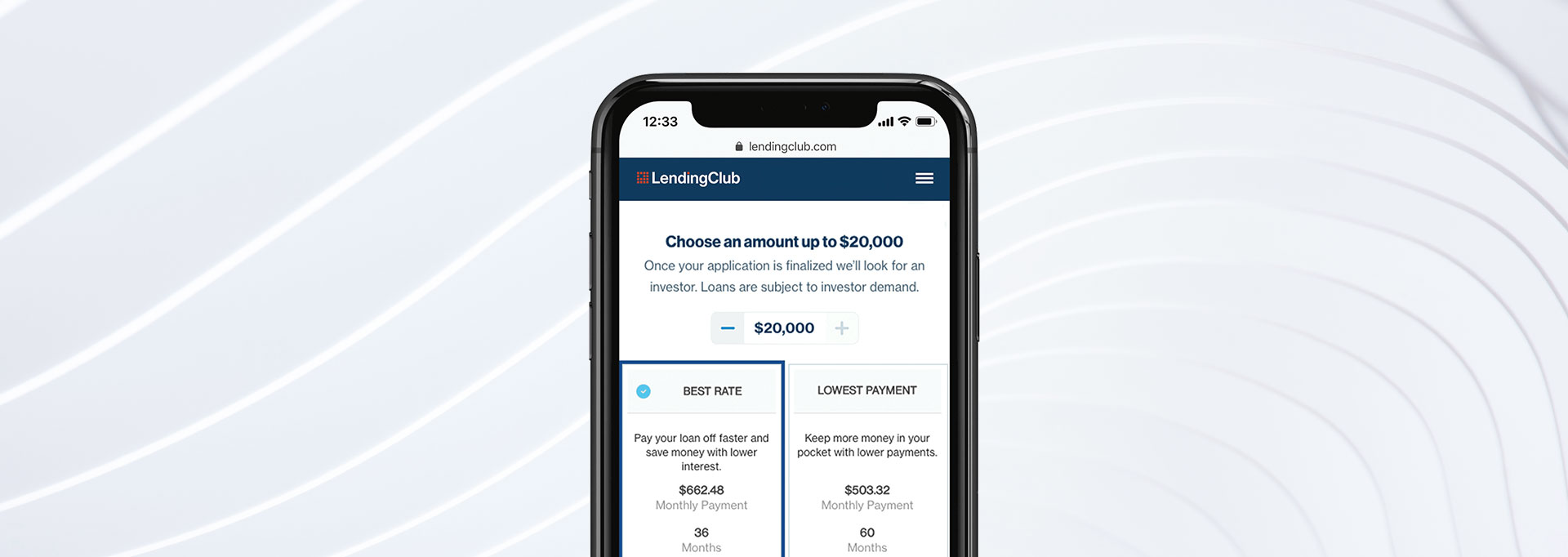

We always recommend shopping around for loans before making a decision. If you can find cheaper rates elsewhere, that’ll only accelerate your journey to becoming debt-free. But if you decide that Happy Money is the right debt consolidation loan choice for you, here’s what the application process will entail:

- Get prequalified: You can check your eligibility and loan options by using the “Check my rate” option on its website. Happy Money will do a quick soft credit check, which won’t impact your credit score.

- Make a loan decision: Compare your rates and loan options with a few other lenders. If you decide to move forward with Happy Money, you can submit a formal loan application. You’ll need to show proof of identity, income and a current bank statement.

- Respond quickly to any further requests: In some cases, Happy Money might need more information to approve or deny your application. If they reach out to you, make sure you respond quickly so you can speed up your loan decision.

- Get your funds: If you’re approved, Happy Money can deposit the loan funds to your bank account or it can pay off your credit cards directly for you, saving you a step.

- Set up automatic loan payments: You can make all of your payments manually if you want, but it’s always best to use an autopay feature so you don’t miss any payments. Remember, a history of on-time payments helps build your credit.

Example of Loan Payments

Happy Money loan payments will vary depending on how much you borrow, the interest rate you’re approved for, the origination fee, and your repayment term length.

We’ve included two loan payment examples to help you understand what you’re loan might look like with Happy Money:

- If you borrow $5,000 with a five-year term, 10.50% APR, and no origination fee:

- Your monthly payments will be $107.

- Your total interest paid would be $1,448 over the life of the loan.

- If you borrow $40,000 with a three-year term, 29.99% APR, and a 5% origination fee:

- Your monthly payments will be $1,697.

- You’ll pay $23,122 in interest and fees.

- The total cost of your 3-year loan is $61,122.

Reputation

Happy Money has a mixed reputation online. Despite having an A+ accreditation with the Better Business Bureau the company doesn't have the best reputation, with an average rating of 1.4 out of five stars, based on 59 reviews. Reviewers complain of long approval timelines of 30 days or more. On Trustpilot, the company has much better ratings of 4.2 out of five stars, based on 339 reviews. However, among the positive reviews, users liked their transparent rates and easy application process.

How Happy Money Compares

Happy Money is not the only lender that offers solutions for paying off credit card debt. You can actually use any personal loan to consolidate credit card debt, which opens you up to many more possibilities.

Happy Money vs. Upstart

Upstart is another lender that offers competitive rates. It has more lenient credit score requirements and in some cases, it will approve applicants who don’t even have a credit score as long as they’re a strong loan applicant otherwise. Upstart's approval and funding times are much faster than Happy Money, too. You can receive your loan funds within one business day, if approved.

FAQs

-

It can, if you miss any payments. You’ll also see a small drop in your credit score after you open the loan, but this generally happens with any new inquiry on your credit report. Happy Money reports that most people see an increase, though. The average customer showed a 40-point bump to their credit scores based on its 2021 survey.

-

Happy Money is generally meant to be a single-use loan to consolidate credit card debt. The company states that it “may be able to assist” with loans for other purposes, but it doesn’t specify any further details. We recommend applying with another lender if you need a loan for something else.

-

Unfortunately, no. You’ll need a credit score of at least 640 to be approved for a Happy Money loan.

-

Happy Money used to be called Payoff, but changed its name in 2017. Both names stick around today, though, because Happy Money also calls its loan the “Payoff Loan™”