Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

While there’s no such thing as a risk-free investment, United States government bonds, or I Bonds, are about the closest to risk-free as you’ll find. In an environment with high inflation, Series I savings bonds are arguably one of the best investments you can make.

Here’s a closer look at how Series I Bonds work, how to buy them, and other important details about this unique investment asset.

What Are I Bonds?

Series I Savings Bonds are a fixed-income investment available through the United States Treasury. The bonds are effectively a loan to the government, which pays interest in return for your loan. This works much like any savings bond, Treasury bond, or Treasury bill.

What makes Series I Savings Bonds unique is the method used to calculate and pay interest to U.S. citizens who buy Series I Bonds. Interest rates for I Bonds are tied to the current inflation rate. That means you earn higher interest rates when inflation goes up and lower rates when interest goes down.

If interest rates are high and on the way up for what you believe to be a long period, Series I Savings Bonds could be a great investment choice.

Are I Bonds Still a Good Investment in 2023?

Series I savings bonds are not a perfect investment, but they make sense for many Americans looking to capitalize on high inflation. When you can earn 4% or more from risk-free savings bonds, going elsewhere to earn less with higher risk hardly makes sense. When you find the right balance, Series I bonds may be great for your investment needs.

If you're considering other low-risk investments, high-yield savings accounts and CDs are also safe options to store your funds. Check out the current best bank account sign-up bonuses that can help you get the most out of your new account.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.85%

*Annual Percentage Yield (APY) is variable and is accurate as of 11/15/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.86%

Earn up to 4.86% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

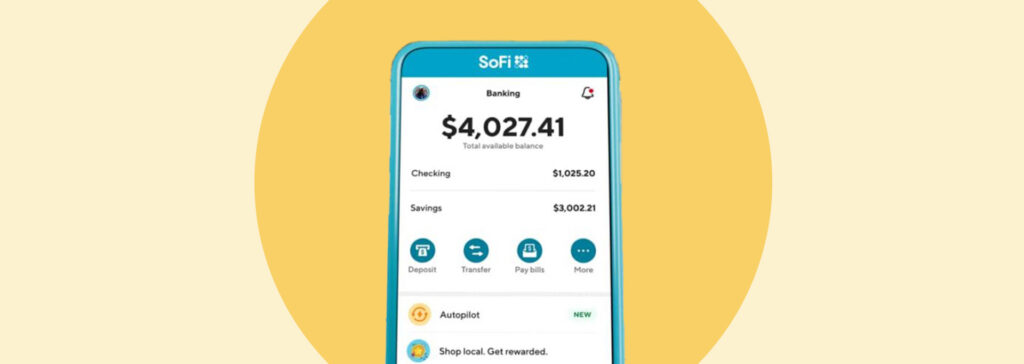

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi Plus members are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

4.35%

Earn 4.35% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of December 20, 2024. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

How I Bonds Work

Series I Bonds are created and administered by the United States Department of the Treasury. Here’s a closer look at how these bonds function.

- How to buy them: Series I savings bonds are issued by the Treasury Department through online sales or as part of your tax refund.

- How interest rates are determined: Interest rates are determined by a combination of a fixed interest rate and a variable interest rate.

- The fixed portion of your interest rate is locked in when the bond is issued. The variable interest portion comes from the inflation rate, measured by the Consumer Price Index (CPI). CPI data is collected and published on a monthly basis.

- With I Bonds, the rate you earn is locked in for the first six months, then adjusts to the current savings bond rate based on the most recent CPI data. New rates take effect based on the month you bought the bonds.

- How long you need to hold them: You must hold bonds for at least one year before redeeming them. You'll have to pay an interest penalty if you redeem in less than five years. Series I Bonds earn interest for up to 30 years.

The interest rate for Series I Bonds is unimpressive in some economic environments. But during the high inflation period of 2022-2023, however, these bonds are extremely attractive. Bonds issued in the six months leading up to October 2022 paid an impressive 9.62% interest rate. That’s almost as good as the average return from the stock market but with far less risk.

Related Article

Related Article

5 Low-Risk Ways to Earn More Money On Savings

I Bonds: Pros and Cons

Pros

- Earn high interest during high inflation periods

- Very low risk of losses

- Easy to manage online

- Can buy using tax refund

Cons

- Interest rates can drop

- Funds are locked up and come with penalties if withdrawn before five years

- Interest is taxable

Pros

- Earn High Interest in High Inflation: High interest rates are always attractive. When inflation is high, you may find savings bond rates beat what you’ll get from savings accounts, CDs, and even the stock market. The higher inflation goes, the more interest you’ll earn from Series I savings bonds.

- Very Low Risk of Losses: U.S. government bonds are among the safest investments in the world. Finance professionals use U.S. Treasury rates as a “risk-free rate” when comparing investments. As long as the government doesn’t default on its debt, these are unlikely to lose value (other than through inflation).

- Easy to Manage Online: Any U.S. citizen or legal permanent resident should be able to create a TreasuryDirect account and buy savings bonds online easily. The annual limit is more than enough for most savers.

- Can Buy with Tax Refund: You’re already used to living without your tax refund. If you don’t need the lump sum of cash for additional investments, debt payoffs, or other needs, rolling that cash directly into I bonds makes it painless to budget for this investment.

Cons

- Interest Rates Can Drop: High interest rates mean high yields, but low inflation periods lower the rates for these bonds. The Federal Reserve actively works to avoid high inflation rates, so they are pushing to keep rates here from getting too high simultaneously.

- Funds Locked Away: Funds are locked in for at least one year and at least five years if you don’t want to pay an interest penalty.

- Interest Is Taxed: The interest you earn from I bonds is subject to federal income tax, which can often be higher than the capital gains tax rate.

How to Buy I Bonds

Note: This material has been prepared for informational purposes only. Consult with a financial advisor before making any investments.

You have two main options if you want to buy Series I Savings Bonds: online directly through the TreasuryDirect website or using your tax refund.

There’s a $10,000 annual limit for buying electronic I savings bonds online and a $5,000 limit for buying paper bonds with your tax refund. That’s a $15,000 annual limit between the two.

Using Your Tax Refund When Filing Taxes

When filing your annual tax return, you can opt to receive a portion of your refund as Series I Savings Bonds. Check your tax return software or talk to your accountant if you want to buy with a tax refund.

Online Using the TreasuryDirect Website

For general Series I purchases throughout the year, here's how to buy them through the TreasuryDirect website:

- Go to TreasuryDirect.gov: If you have an account, you can log in to proceed. If you don’t have a TreasuryDirect® account, follow the prompts to create one and sign in. This is a government financial account, so use a unique, secure password to keep your assets as safe as possible.

- Choose how to buy: You can enroll in a direct deposit program to buy bonds on a regular schedule or use the BuyDirect® feature to buy right away, anywhere from $25 to the $10,000 annual limit.

- Confirm and fund your purchase: Depending on how you decided to buy, your transaction should execute right away or as scheduled. You can log into TreasuryDirect anytime to view your current electronic bond holdings and manage your account.

The TreasuryDirect website is very dated, much like most other government websites. However, the process is fairly simple and straightforward if you’re comfortable with computers and patiently read every page.

Should You Buy Series I Bonds?

Regarding financial decisions like where to invest your money, you are in the best position to decide what makes sense for your unique needs. For many households, Series I Bonds are a good way to lower risk while earning a competitive interest rate. However, as rates vary over time, the 30-year horizon means no one should put all their money in I Bonds.

Savvy investors will likely find Series I Bonds can earn a spot in their portfolio during this high inflation period; even so, it's still best to consult with a financial planner before making any investment decisions.

If you need help with your investments, consider a fee-only financial planner who acts as a fiduciary. A fiduciary is an industry term meaning they have to put your best interests ahead of their own.